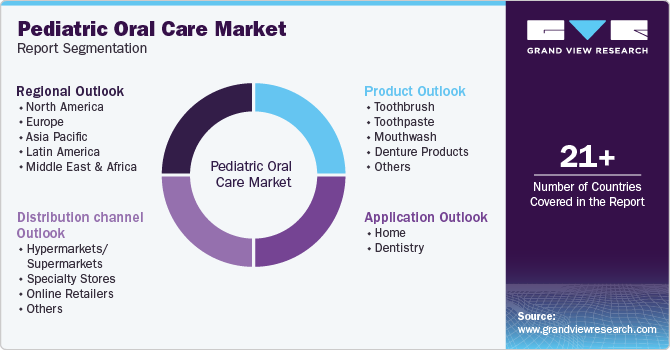

Pediatric Oral Care Market Size, Share & Trends Analysis Report By Product (Toothbrush, Toothpaste), By Application (Home, Dentistry), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-985-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pediatric Oral Care Market Size & Trends

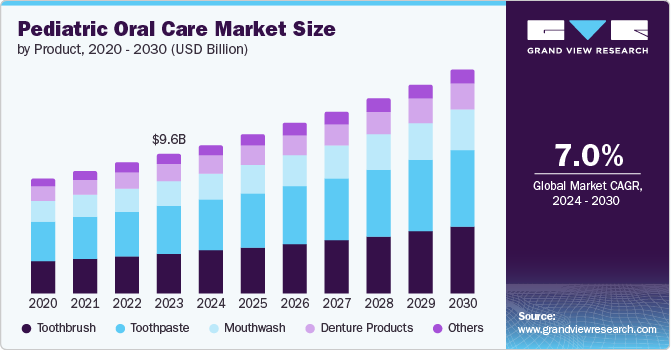

The global pediatric oral care market size estimated at USD 9.6 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. The market is driven by several key factors, such as the increasing prevalence of dental issues among children, growing awareness about the importance of oral hygiene from a young age, technological advancements in pediatric dental care, and the rising focus on preventive dental care. For instance, the American Dental Association organizes National Children's Dental Health Month every February to promote awareness among children and their parents about the importance of regular tooth brushing, flossing, and dental check-ups to prevent dental issues.

The rising prevalence of oral diseases among children is another primary driver of the market growth. According to the World Health Organization, an estimated 514 million children globally suffer from cavities in their primary teeth. Typical oral health issues affecting children include malocclusions, tooth sensitivity, thumb sucking, lip sucking, and tongue thrusting. Children with poor oral health tend to miss more school days and perform lower academically compared to their peers with better oral health.

The growing demand for innovative products drives the market growth. There is an increasing preference for flavored toothpaste, cavity-protection toothpaste, baby tongue cleaners, and cartoon-themed mouthwash, boosting market growth. In addition, the inclusion of dental health coverage for children up to 18 years old as an essential health benefit under the U.S. Affordable Care Act has further driven the demand for pediatric oral care products.

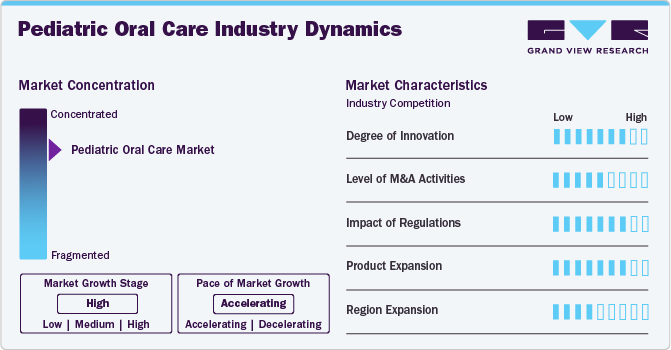

Industry Dynamics

The degree of innovation in the market is high. Companies launch various new products to cater to children's specific needs, including developing flavored toothpaste, cavity-protection toothpaste, baby tongue cleaners, and cartoon-themed mouthwashes, driving increased demand from parents. For instance, in February 2023, Stratasys introduced TrueDent, a breakthrough solution enabling dental labs to 3D print monolithic, full-color permanent dentures with natural-looking gums, accurate tooth structure, shade, and clarity in a single print.

The level of merger and acquisition (M&A) activities in the market is moderate. M&A activities were notable in the market, with various dental service providers looking to expand their reach and offerings through strategic partnerships. For instance, in January 2022, Spark Dental Management acquired Children's Dental Management, expanding its capabilities in the dental industry. The acquisition combines Spark's expertise with Children's specialized focus on pediatric dentistry, strengthening Spark's service offerings and market presence.

Regulations play a crucial role in shaping the pediatric oral care market by ensuring quality standards, patient safety, and ethical practices within the industry. For instance, regulatory bodies such as the American Academy of Pediatric Dentistry (AAPD) establish guidelines for pediatric dental practices to safeguard children’s oral health and promote evidence-based care. Compliance with HIPAA (Health Insurance Portability and Accountability Act) regulations also governs patient data protection and confidentiality in pediatric dentistry settings.

Product expansion within the market shows high growth, with companies launching various new and innovative products to cater to children's specific needs. For instance, Pigeon Corporation offers a wide range of oral care products for infants and toddlers, including toothbrushes, toothpaste, and training cups. The increasing demand for flavored toothpaste, cavity-protection toothpaste, baby tongue cleaners, and cartoon-themed mouthwashes drove companies to expand their product portfolios to meet the evolving preferences of parents and children.

Regional expansion within the market shows moderate growth. Companies focus on penetrating new markets and reaching a broader consumer base. For instance, in June 2024, Sage Dental expanded into Tennessee, marking a significant milestone. This strategic move allows Sage to broaden its reach and impact in the dental care industry, tap into a growing market, and gain a competitive advantage.

Product Insights

The toothpaste segment led the market in 2023 with a revenue share of more than 34.0%. The demand for toothpaste increases with age as this group is more vulnerable to oral diseases such as cavities, tooth decay, and gum problems. The increase in the number of toothpaste launches for kids also drove the market growth. For instance, Chicco, a prominent baby oral care brand, launched the "4-Week Brushing Champion Challenge" on World Oral Health Day '24. This initiative aims to help babies learn brushing and motivate them through a rewarding program, supporting parents in developing healthy oral care habits.

The toothbrush segment is expected to register the fastest growth rate in the market over the forecast period. Modifications and innovations in toothbrush design, such as the introduction of electric toothbrushes and improvements in the size and quality of bristles, further attracted consumers as they provided better oral care results. For instance, Oral-B launched specialized electric toothbrushes designed for children, featuring smaller brush heads, softer bristles, and engaging designs to make brushing more appealing and effective for young users.

Application Insights

The home segment held the largest revenue share of 73.5% in 2023. The increasing parental awareness of the significance of oral hygiene for children is fueling a rise in the demand for children’s at-home oral care products. This growth is propelled by the availability of specialized oral care items tailored for children, such as toothbrushes, toothpaste, and mouthwashes. In addition, the market is seeing a surge in engaging and educational products featuring beloved characters that resonate with parents and promote oral care practices at home.

The dentistry segment is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to the rising prevalence of oral diseases, which necessitate treatment in dental clinics. With the increasing population and healthcare awareness, the demand for dental services is expected to rise, driving the growth of the dentistry segment.

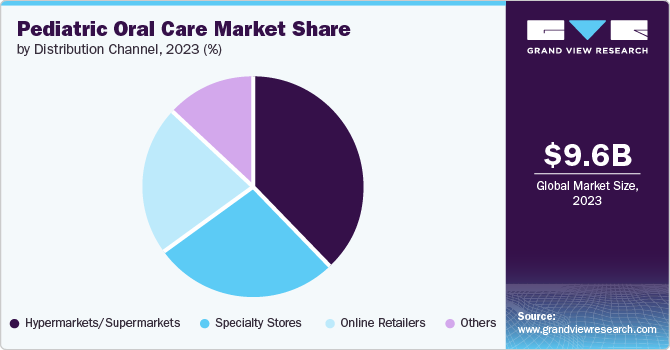

Distribution Channel Insights

The hypermarkets/supermarkets segment dominated the market and accounted for more than 38.5% of revenue share in 2023. These markets consist of a large variety of products and different brands in one place. Oral care products are readily available in hypermarkets/supermarkets. For instance, major retailers such as Walmart, Target, and Costco dedicated aisles and shelves for children's oral care products, making it convenient for parents to compare and purchase these items during regular grocery and household shopping trips.

The online retailer segment is expected to register the fastest CAGR of 7.5% in the market during the forecast period. This can be attributed to the increasing convenience and accessibility of online purchasing oral care products for children. Online shopping allows parents to compare prices, read reviews, and deliver products directly to their doorstep, saving time and effort. Major e-commerce platforms, including Amazon and Flipkart, have sections for pediatric oral care products, offering various options from leading brands.

Regional Insights

The pediatric oral care market in North America is witnessing a rise in demand for natural and organic oral care products, driven by increasing consumer awareness about the potential health risks associated with synthetic ingredients. Companies are launching innovative products catered to children's preferences, such as flavored toothpaste and electric toothbrushes with engaging designs. The market is also witnessing a shift towards natural and organic oral care products as consumers become more conscious of the ingredients used in their personal care products.

U.S. Pediatric Oral Care Market Trends

The US pediatric oral care market is experiencing notable growth driven by increasing awareness about the importance of early dental hygiene practices, the rising prevalence of pediatric dental issues, and advancements in pediatric dentistry. According to the Centers for Disease Control and Prevention, cavities are among the most common chronic diseases in childhood in the U.S. Product innovation plays a vital role in this market segment, with companies launching child-friendly oral care products such as flavored toothpaste, colorful toothbrushes, and interactive apps to make brushing fun for children.

Europe Pediatric Oral Care Market Trends

The Europe pediatric oral care market is shifting towards natural and organic products due to growing awareness about potential health risks associated with chemicals in traditional oral care products. Consumers are becoming more discerning about the ingredients used in children's oral care products, driving demand for natural and eco-friendly options. In addition, parents emphasized preventive dental care, leading to increased sales of products such as fluoride-free toothpaste, organic toothbrushes, and biodegradable floss picks.

The UK pediatric oral care market is experiencing a surge in product innovation and development, with companies focusing on creating fun and engaging oral care solutions for children. This includes toothbrushes featuring popular cartoon characters, flavored options, and interactive apps promoting good oral hygiene habits. The market is also witnessing increased awareness campaigns to educate parents about the importance of early dental care for children.

The pediatric oral care market in France is characterized by a growing demand for premium and specialized oral care products for children. There is a notable trend towards organic and natural formulations, with French consumers preferring products free from artificial colors, flavors, and preservatives. The market is seeing an influx of innovative toothbrush designs that cater to children's different age groups and dental needs. Furthermore, there is an increasing focus on sustainable practices within the industry, with companies launching eco-friendly packaging solutions and promoting recycling initiatives to reduce environmental impact.

Asia Pacific Pediatric Oral Care Market Trends

Asia Pacific pediatric oral care market dominated globally with a revenue share of over 39.8% in 2023. This growth is owing to the high adoption rate and awareness among parents regarding the kids' oral care products for maintaining oral hygiene. Factors such as an increase in the incidence of oral diseases such as tooth decay and cavities among children and the presence of major key players in the region are expected to boost the market's growth. For instance, in January 2024, Dr. Dento, a rising oral care brand, launched a new product range featuring natural ingredients that deliver professional-grade results while being gentle on teeth and gums, just in time for the festive season.

The pediatric oral care market in China is experiencing rapid expansion driven by several unique factors. The market is witnessing a surge in innovation, with companies introducing advanced technologies such as intelligent toothbrushes and interactive dental apps to make oral hygiene fun and engaging for children. Product launches tailored to specific age groups and preferences are also on the rise, catering to the diverse needs of Chinese consumers.

Latin America Pediatric Oral Care Market Trends

Latin America pediatric oral care market is witnessing a surge in demand for innovative and specialized products catered to children's preferences. Companies are launching flavored toothpaste, electric toothbrushes with engaging designs, and mouthwashes with fun flavors to make oral care more appealing for young consumers. For instance, the Pan American Health Organization (PAHO) worked with regional and national health authorities to implement school-based oral health programs, contributing to the market's expansion.

The pediatric oral care market in Brazil is among Latin America's largest markets for pediatric oral care products. The country witnessed a surge in product innovation and launches explicitly tailored for children, such as flavored toothpaste, interactive toothbrushes, and educational apps promoting oral hygiene. This focus on innovation increased consumer interest and drove competition among manufacturers to offer unique and effective solutions for pediatric oral health.

Middle East & Africa Pediatric Oral Care Market Trends

The pediatric oral care market in the Middle East & Africa is witnessing a surge in demand for innovative and specialized products catered to children's preferences. There is a growing emphasis on preventive dental care, with governments and healthcare organizations actively promoting awareness campaigns about the importance of maintaining good oral hygiene from an early age. For instance, in March 2024, the Gulf Cooperation Council (GCC) countries implemented regulations to improve oral health standards, such as mandatory dental check-ups for school-aged children, further propelling the market's expansion.

The South Africa pediatric oral care market is experiencing distinct trends that reflect the region's unique dynamics. Parents' growing preference for chemical-free alternatives drives the increasing adoption of natural and organic oral care products for children. This shift towards natural ingredients spurred innovation in the market, with companies launching new product lines that cater to this demand. Additionally, there is a heightened focus on promoting oral health awareness among children through educational campaigns and school programs aimed at instilling good dental habits early on.

Key Pediatric Oral Care Company Insights

Companies invest heavily in research and development to introduce new and improved products that cater to the unique requirements of children’s dental health. Regulatory bodies, such as the FDA, closely monitor the market to ensure product safety and efficacy. This drives companies to adhere to stringent regulations while launching new products or claiming benefits.

Key Pediatric Oral Care Companies:

The following are the leading companies in the pediatric oral care market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company

- Procter & Gamble

- GSK plc.

- Johnson & Johnson Services, Inc.

- Unilever

- Lion Corporation

- Sunstar Suisse S.A.

- Doctor Fresh

- Church & Dwight Co., Inc.

Recent Developments

-

In February 2024, Colgate partnered with IMPAct4Nutrition, a UNICEF India-incubated platform focusing on nutrition. This partnership merges Colgate's social responsibility with IMPAct4Nutrition's specialized knowledge to improve children's awareness of oral health and nutrition. The objective is to impact an additional 10 million children by 2025 positively.

-

In April 2024, Sage Dental, a dental service organization (DSO), opened two new practices in South Tampa and Viera, Florida, expanding its network to over 120 locations across Florida and Georgia. As a DSO, Sage Dental supports its affiliated practices with clinical and non-clinical services, allowing dentists to focus on patient care.

Pediatric Oral Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.3 billion |

|

Revenue forecast in 2030 |

USD 15.5 billion |

|

Growth Rate |

CAGR of 7.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait |

|

Key companies profiled |

Colgate-Palmolive Company, Procter & Gamble, GSK plc., Johnson & Johnson Services, Inc., Unilever, Lion Corporation, Sunstar Suisse S.A., Doctor Fresh, Church & Dwight Co., Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pediatric Oral Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric oral care market report based on product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Toothbrush

-

Toothpaste

-

Mouthwash

-

Denture Products

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Home

-

Dentistry

-

-

Distribution channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Online Retailers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pediatric oral care market size was estimated at USD 9.6 billion in 2023 and is expected to reach USD 10.3 billion in 2024.

b. The global pediatric oral care market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 15.5 billion by 2030.

b. The Asia Pacific dominated the pediatric oral care market with a share of 39.8% in 2023. This is attributable to an increase in the incidence of oral diseases such as tooth decay and cavities among children and a rise in awareness of the kid’s oral care products among the parents for maintaining oral hygiene.

b. Some of the players operating in this market are Unilever Plc, Johnson & Johnson, Church & Dwight Co. Inc., Pigeon Corporation, Procter & Gamble Company, Colgate-Palmolive Company, Anchor Group, Oriflame, Amway, Dr. Fresh., Chattem, Dabur, and Splat Baby

b. Key factors that are driving the pediatric oral care market growth include the rising awareness for pediatric oral hygiene, increasing prevalence of oral diseases in pediatrics, and increase in the number of launches of toothpaste for pediatrics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."