- Home

- »

- Pharmaceuticals

- »

-

Pediatric Diabetes Therapeutic Market Size Report, 2030GVR Report cover

![Pediatric Diabetes Therapeutic Market Size, Share & Trends Report]()

Pediatric Diabetes Therapeutic Market Size, Share & Trends Analysis Report By Type (Type 1, Type 2), By Treatment (Insulin, GLP-1, Biguanide, SGLT2), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-446-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

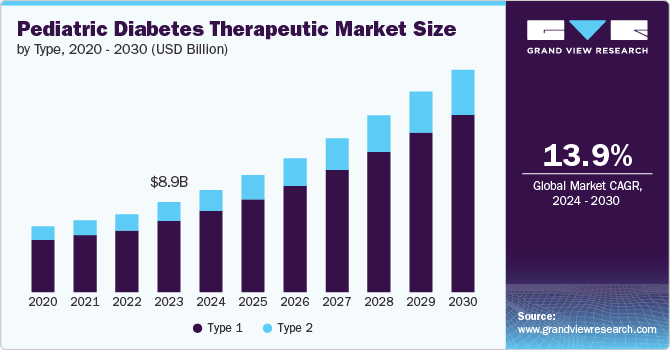

The global pediatric diabetes therapeutic market size was estimated at USD 8.92 billion in 2023 and is projected to grow at a CAGR of 13.9% from 2024 to 2030. This growth can be attributed to a combination of rising incidence rates of diabetes among children and adolescents, advancements in treatment technologies, and increasing awareness about early diagnosis and management of the disease. Type 1 diabetes (T1D) remains the most common form among children, with a growing prevalence in various regions worldwide.

According to the International Diabetes Federation (IDF), in 2022, there were 530,000 new cases of T1D diagnosed across all age groups, with 201,000 of these cases occurring in individuals under the age of 20 year. The increasing incidence of T1D is a primary driver for the market, as it requires lifelong management starting from a young age. Type 2 diabetes (T2D), traditionally an adult condition, is also emerging in the pediatric population, especially in regions with high obesity rates among children.

In addition, the prevalent cases of type 1 disease among children and adolescents under 20 years of age is highest in India, followed by the U.S., China, Brazil, Russia, Saudi Arabia, the UK, Algeria, Germany, Canada, Morocco, Ukraine, and Turkey. As these countries face a significant burden of young patients requiring lifelong disease management, there is an increasing demand for advanced treatment solutions tailored to pediatric needs. This demand fuels the development and adoption of innovative treatment technologies such as insulin pumps, continuous glucose monitoring systems, and drug therapy specifically designed for children. Thus, research and development of new treatment is expected to drive market growth during the forecast period.

Moreover, the Changing Diabetes in Children program is a significant driver in the market, particularly in low- and middle-income countries. In 2023, around 54,092 children reached to program and 46,260 children enrolled for program. Focused on improving diabetes care for children, the program provides essential tools like insulin and glucose monitoring devices. By enhancing local healthcare capacity, it ensures better management for pediatric patients. The program's emphasis on education and awareness further strengthens pediatric care, leading to increased demand for specialized treatments. As the program expands access to healthcare settings, it significantly contributes to the growth of the market in underserved regions.

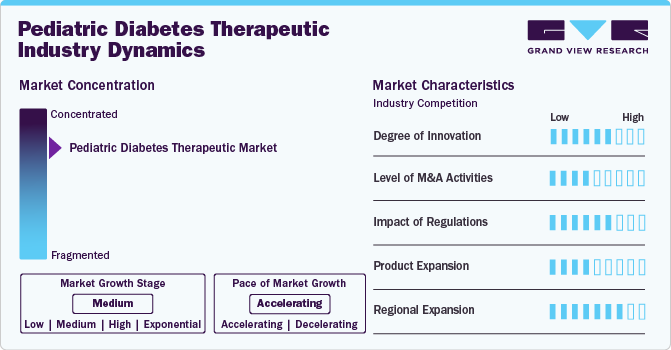

Market Concentration & Characteristics

There is high innovation particularly in insulin therapies, biguanides, GLP-1 receptor agonists, and SGLT2 inhibitors. Advanced insulin delivery systems, such as insulin pumps and continuous glucose monitors, are enhancing disease management. Innovations in biguanides, like extended-release formulations, and new GLP-1 receptor agonists and SGLT2 inhibitors are transforming therapeutic approaches, offering improved efficacy and convenience for managing pediatric diabetes.

The market experiences a moderate level of mergers and acquisitions. Leading pharmaceutical and biotechnology companies are acquiring businesses and technologies to expand their portfolios in pediatric care. Recent M&A activities focus on integrating new insulin formulations, advanced biguanides, and novel GLP-1 receptor agonists and SGLT2 inhibitors into existing treatment regimens, reflecting the strategic importance of these therapies in treatment.

The pediatric diabetes therapeutic market is heavily regulated to ensure the safety and efficacy of new therapies for children. Regulatory agencies, such as the FDA, enforce strict guidelines for insulin products, biguanides, GLP-1 receptor agonists, and SGLT2 inhibitors used in pediatric care. Compliance with these regulations is critical for market entry and continued innovation, as these treatments must meet rigorous standards tailored to pediatric patients' unique needs.

Despite the advancements in insulin therapies, biguanides, GLP-1 receptor agonists, and SGLT2 inhibitors, there remains a moderate threat of substitution. Traditional treatments, such as older insulin formulations and basic biguanide drugs, may be used as cost-effective alternatives. However, the improved efficacy and patient outcomes associated with newer therapies reduce the likelihood of substitution, keeping advanced treatments in high demand.

The pediatric diabetes therapeutic market is expanding rapidly in various regions due to increased access to healthcare services and growing awareness of diabetes management. Developing regions are seeing significant growth in the adoption of advanced insulin therapies, GLP-1 receptor agonists, biguanides, and SGLT2 inhibitors. This expansion is driven by rising healthcare expenditures, increasing diabetic prevalence among children, and the establishment of specialized pediatric diabetic care centers.

Type Insights

The type 1 segment dominated the market and accounted for 79.32% of the global revenue in 2023 and is anticipated to grow significantly over the forecast period. The increasing prevalence of type 1 diabetes among children and rising government support to curb disease burden is anticipated to positively impact market growth. Type 1 diabetes, a chronic condition where the pancreas produces little or no insulin, affects pediatric patients who require lifelong management. For instance, the ‘Mittayi’ scheme, launched by the Kerala Social Security Mission in 2018, drives growth in the market by providing free insulin therapy and glucose monitoring devices to children. Registrations under the scheme increased from 910 in 2018 to 1,710 in 2022, with 2,122 registered by August 2023. With an estimated 4,000 affected children in Kerala, including high numbers in Thiruvananthapuram and Kollam, the scheme underscores the rising demand for pediatric diabetic treatments.

The type 2 segment held significant market share in 2023. This can be attributed to the rising prevalence of type 2 diabetes (T2D) among children and high demand. Increased awareness, early diagnosis, and advancements in personalized treatments are fueling market growth. This surge in T2D cases underscores the need for innovative therapeutic solutions tailored to younger patients.

Treatment Insights

The insulin segment dominated the market with a revenue share of 35.88% in 2023. This can be attributed to the rising demand for insulin and rising support of companies in providing insulin to needy patient across worldwide. In March 2024, Minnesota Attorney General Keith Ellison announced Eli Lilly’s commitment to donate insulin to state clinics for five years and implement a USD 35 price cap, addressing allegations of deceptive pricing from a 2018 lawsuit. This move is expected to drive growth in the market by improving access to affordable insulin for children and enhancing the overall management of diabetes in younger populations.

The biguanide (metformin) segment held a significant revenue share in 2023. This can be attributed to the rising adoption of Biguanide (metformin) as a first-line treatment for type 2 diabetes in children. Metformin’s proven efficacy in lowering blood glucose levels, combined with its safety profile, is expanding its use in younger populations. This trend highlights the growing need for effective and well-tolerated therapeutics in managing pediatric diabetics, thereby fueling market growth.

Route of Administration Insights

The parenteral segment dominated the market with a revenue share of 62.50% in 2023. The parenteral administration of antidiabetic medications provides rapid and precise control of blood glucose levels, making it especially crucial in critical situations such as diabetic ketoacidosis or hyperglycemic emergencies. This swift regulation of glucose underscores the importance of intravenous treatments in managing acute diabetic complications. Additionally, advancements in drug formulations and delivery technologies have enhanced the efficacy and safety of this approach, reinforcing its market leadership.

The oral segment is projected to experience the fastest CAGR during the forecast period. This growth is largely attributed to the rising adoption of oral medications like Farxiga (dapagliflozin) for managing T2D in children. Some of the other factors driving oral drug adoption is its ease of administration and better patient compliance, particularly among children who may have difficulty with injections. Additionally, it offers effective blood glucose management with fewer invasive procedures, making them a preferred choice for both patients and caregivers.

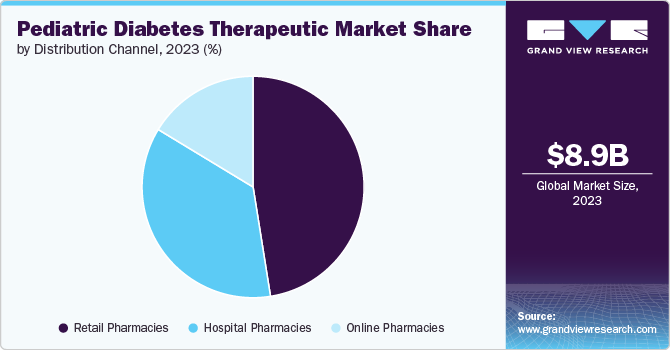

Distribution Channel Insights

The retail pharmacies segment held a considerable market share of 47.49% in 2023. Retail pharmacies play a critical role in refilling the prescriptions of diabetic patient by ensuring easy accessibility of medications for young patients. Their ability to provide diabetes medications, including insulin and other essential drugs, directly supports the treatment of pediatric diabetes. As retail pharmacies expand their services and improve medication delivery systems, they contribute significantly to market growth by meeting the unique needs of children with diabetes.

The online pharmacies segment is projected to witness a significant growth rate over the forecast period. Online pharmacies boost the adoption of pediatric diabetes treatment by increasing accessibility to essential medications, such as insulin and glucose monitors, particularly for families in remote or underserved areas. They offer convenience, discreet delivery, and often lower costs, making it easier for parents to consistently obtain and manage their child’s diabetes care. Additionally, online platforms can provide educational resources and personalized support, further enhancing treatment adherence and outcomes.

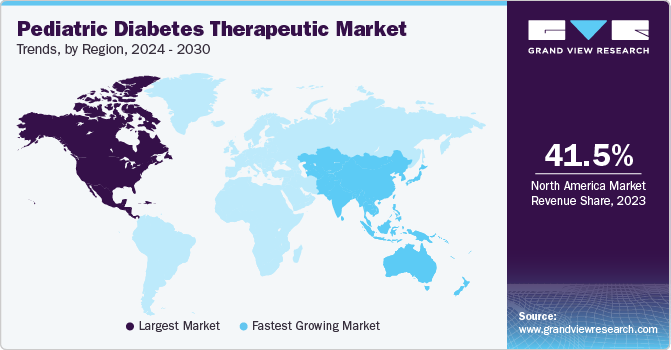

Regional Insights

The North America pediatric diabetes therapeutic market accounted for 41.49% share in 2023. The region's leadership is attributed to the widespread use of insulin therapy and the introduction of advanced treatment options like GLP-1 receptor agonists and SGLT2 inhibitors. These therapies, combined with the increasing prevalence of pediatric diabetes, are expected to drive market growth during the forecast period.

U.S. Pediatric Diabetes Therapeutic Market Trends

In 2023, U.S. dominated pediatric diabetes therapeutic market in North America. The high prevalence of pediatric diabetes and the extensive use of insulin and biguanide therapeutics are key growth factors. However, challenges such as supply chain disruptions, and a shortage of specialized healthcare professionals may hinder market expansion

Europe Pediatric Diabetes Therapeutic Market Trends

Europe pediatric diabetes therapeutic market was identified as a lucrative region in this industry. Growth is fueled by a rising number of healthcare facilities and an increase in the use of insulin and GLP-1 receptor agonists for managing pediatric diabetes. The demand for advanced treatment options continues to rise, driven by a growing pediatric patient population.

The UK pediatric diabetes therapeutic market is projected to grow due to advancements in treatment options, including the adoption of GLP-1 receptor agonists and SGLT2 inhibitors. These developments enhance therapeutic efficacy and provide new options for managing pediatric diabetes.

The pediatric diabetes therapeutic market in Germany accounted for the largest share of the Europe market in 2023. The growing incidence of chronic conditions like diabetes in children has led to increased demand for insulin and biguanides, which are essential in managing the disease

The France pediatric diabetes therapeutic market is expected to expand during the forecast period, driven by supportive government healthcare initiatives and investments in medical infrastructure. The increasing use of insulin and GLP-1 receptor agonists is also contributing to market growth.

Asia Pacific Pediatric Diabetes Therapeutic Market Trends

The Asia Pacific region is expected to experience the fastest growth in the pediatric diabetes therapeutic market. Increased awareness and rising investments in diabetic treatment, including insulin and SGLT2 inhibitors, are key factors driving this growth. Initiatives like the launch of specialized diabetic treatment centers further support market expansion.

The China pediatric diabetes therapeutic market is set to grow significantly. The increasing prevalence of T1D among children and the rising adoption of advanced therapies, including insulin and GLP-1 receptor agonists, are contributing to the market's expansion.

The pediatric diabetes therapeutic market in Japan held a notable revenue share in 2023, driven by the rising incidence of diabetes in children and the adoption of advanced therapeutics, such as insulin therapy and GLP-1 receptor agonists. The demand for effective diabetic management solutions continues to rise in the region.

Latin America Pediatric Diabetes Therapeutic Market Trends

Latin America's pediatric diabetes therapeutic market is identified as a lucrative region, with growth supported by recent advancements in diabetic therapies, including biguanides and SGLT2 inhibitors. These innovations enhance the therapeutics landscape for treatment of children with diabetes in the region.

The pediatric diabetes therapeutic market in Brazil led the Latin America region in 2023. Despite socioeconomic challenges, the adoption of insulin and GLP-1 receptor agonists is increasing, contributing to market growth. Efforts to improve access to diabetic treatment, especially in underserved areas, are crucial for continued expansion.

MEA Pediatric Diabetes Therapeutic Market Trends

The MEA region's pediatric diabetes therapeutic market is expected to grow due to government investments in healthcare infrastructure and research. The development and adoption of insulin, biguanides, and SGLT2 inhibitors are driving market growth, particularly in regions with rising disease rates.

Saudi Arabia pediatric diabetes therapeutic market is projected to be one of the fastest-growing markets in the coming years. The demand for effective pediatric diabetic treatments, including insulin and SGLT2 inhibitors, is increasing due to the rising incidence of diabetic among children. This growth is further supported by government initiatives to enhance healthcare services.

Key Pediatric Diabetes Therapeutic Company Insights

Some of the key players such as Boehringer Ingelheim International GmbH, Eli Lilly and Company, Sanofi, Vertex Pharmaceuticals Incorporated, Novo Nordisk A/S, AstraZeneca, MannKind Corporation, Xeris Pharmaceuticals, and Amphastar Pharmaceuticals, Inc. hold significant positions in the market. These companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Pediatric Diabetes Therapeutic Companies:

The following are the leading companies in the pediatric diabetes therapeutic market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Eli Lilly and Company

- Sanofi

- Vertex Pharmaceuticals Incorporated

- Novo Nordisk A/S

- AstraZeneca

- MannKind Corporation

- Xeris Pharmaceuticals

- Amphastar Pharmaceuticals, Inc.

Recent Developments

-

In March 2024, the U.S. FDA approved Farxiga (dapagliflozin) developed by AstraZeneca for the treatment of patient with type 2 aged 10 and older. Initially approved for adults with T2D in the U.S. as an addition to diet and exercise, the recent FDA approval is supported by positive outcomes from the pediatric T2NOW Phase III This approval is expected to drive market growth.

-

In August 2023, Amazon.com, Inc. pharmacy introduced a USD 35.0 automated insulin savings program, featuring manufacturer-sponsored coupons for over 15 brands, including Novo Nordisk A/S, Eli Lilly and Company, Dexcom, Sanofi, and Insulet. This program covers a range of products, such as insulin vials, pens, continuous glucose monitors, and pumps.

-

In September 2022, Novo Nordisk A/S revealed plans to introduce an unbranded biologic form of Tresiba (insulin degludec) injection, a long-acting basal insulin intended for once-daily use to control high blood sugar in patients aged 1 year and older with diabetes.

Pediatric Diabetes Therapeutic Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.16 billion

Revenue forecast in 2030

USD 22.14 billion

Growth rate

CAGR of 13.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; Eli Lilly and Company; Sanofi; Vertex Pharmaceuticals Incorporated; Novo Nordisk A/S; AstraZeneca; Mankind Corporation; Xeris Pharmaceuticals; Amphastar Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pediatric Diabetes Therapeutic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric diabetes therapeutic market report based on Type, treatment, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Type 1

-

Type 2

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin

-

GLP-1 Receptor Agonists

-

Biguanide

-

SGLT2 Inhibitors

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Diagnostic Centers

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pediatric diabetes treatment market size was estimated at USD 8.92 billion in 2023 and is expected to reach USD 10.16 billion in 2024.

b. The global pediatric diabetes treatment market is expected to grow at a compound annual growth rate of 13.9% from 2024 to 2030 to reach USD 22.14 billion by 2030.

b. Some key players operating in the pediatric diabetes treatment market include Boehringer Ingelheim International GmbH; Eli Lilly and Company; Sanofi; Vertex Pharmaceuticals Incorporated; Novo Nordisk A/S; AstraZeneca; Mankind Corporation; Xeris Pharmaceuticals; Amphastar Pharmaceuticals, Inc.

b. Key factors that are driving the pediatric diabetes treatment market growth include a combination of rising incidence rates of diabetes among children and adolescents, advancements in treatment technologies, and increasing awareness about early diagnosis and management of the disease.

b. The North America pediatric diabetes treatment market accounted for 41.49% share in 2023. The region's leadership is attributed to the widespread use of insulin therapy and the introduction of advanced treatment options like GLP-1 receptor agonists and SGLT2 inhibitors. These therapies, combined with the increasing prevalence of pediatric diabetes, are expected to drive market growth during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."