- Home

- »

- Clinical Diagnostics

- »

-

Pediatric Cardiac Tumor Diagnostic Market Size Report, 2030GVR Report cover

![Pediatric Cardiac Tumor Diagnostic Market Size, Share & Trend Report]()

Pediatric Cardiac Tumor Diagnostic Market Size, Share & Trend Analysis Report By Tumor (Primary Cardiac Tumors, Secondary Cardiac Tumors), By Type (Echocardiography, MRI), By End-use, By Region, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-434-5

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

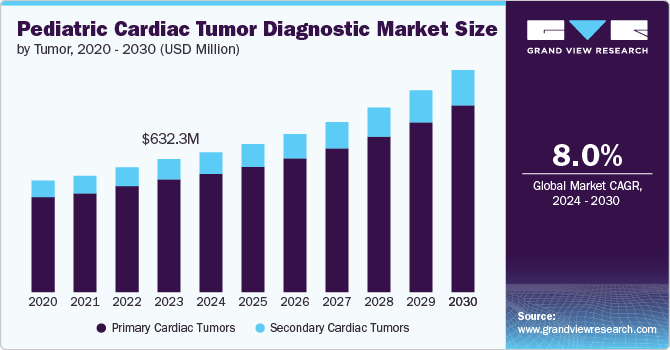

The global pediatric cardiac tumor diagnostic market size was estimated at USD 632.34 million in 2023 and is projected to grow at a CAGR of 8.03% from 2024 to 2030. The growth of the market is attributed to the growing awareness of pediatric cardiac tumors and the need for early disease diagnosis. According to a report published by the Society of Thoracic Surgeons in January 2024, pediatric cardiac tumors (both primary and metastatic) were found in 0.027% of 11,000 pediatric autopsies. Integrating artificial intelligence and machine learning in diagnostic tools has further enhanced the accuracy and efficiency of identifying cardiac tumors in children.

Continuous technological advancement is one of the most significant growth factors for the market. High-resolution imaging techniques, such as echocardiography, magnetic resonance imaging (MRI), and computed tomography (CT) scans, have become more sophisticated, allowing for better visualization of cardiac tumors in children. These technologies have improved the ability to detect tumors at an earlier stage, which is critical for improving patient outcomes. In addition, the development of non-invasive diagnostic methods has made it easier for healthcare providers to diagnose pediatric cardiac tumors without subjecting young patients to invasive procedures. These technological advancements enhance diagnostic accuracy and contribute to the broader adoption of these tools in clinical settings.

Funding for tumor research in children has significantly increased in recent years, driven by growing awareness of the unique challenges pediatric cancer patients face. Government grants, non-profit organizations, and private sector initiatives have all contributed to expanding research efforts to understand and treat children's tumors, including cardiac tumors. For instance, in June 2023, Children’s National Hospital announced a transformative USD 96 million investment from an anonymous donor family aimed at revolutionizing research and care for childhood tumors. This significant contribution will enable Children’s National to attract leading experts and accelerate the most promising research initiatives. Pediatric cancer research often receives less attention and funding compared to adult cancers, but the tide is shifting as advocacy groups and researchers push for more resources dedicated to this critical area. Increased funding has enabled the development of more targeted therapies and diagnostic tools, improving the outlook for children diagnosed with tumors.

Furthermore,awareness about pediatric cardiac tumors and the importance of early diagnosis has been growing due to initiatives by healthcare organizations and increased access to medical information. Early diagnosis is crucial in managing cardiac tumors, allowing for timely intervention and better prognosis. This growing awareness has led to more routine screenings and the use of advanced diagnostic tools in pediatric care settings.

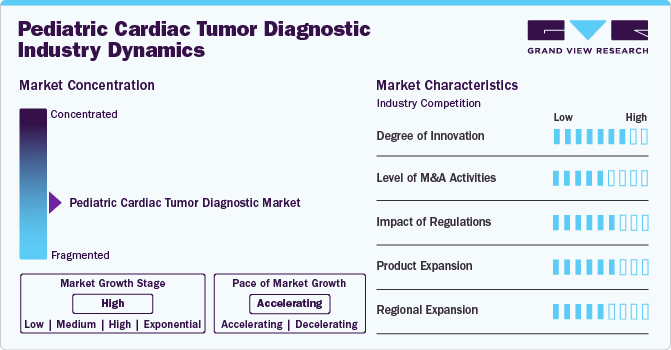

Market Concentration & Characteristics

The degree of innovation in the market for pediatric cardiac tumor diagnostic is high. This is driven by advancements in imaging technologies, such as high-resolution echocardiography and MRI, and the integration of artificial intelligence for more accurate and early diagnosis. These innovations significantly enhance the detection and management of pediatric cardiac tumors, positioning the market at the forefront of medical technology.

The level of M&A activities in the market is moderate. While there is ongoing consolidation among companies seeking to enhance their technological capabilities and expand market share, the niche nature of this market means that M&A activity is focused more on strategic partnerships and acquisitions rather than large-scale mergers.For instance, in February 2021, IARC and St. Jude announced a partnership to expand global pediatric cancer registries. This initiative aims to improve and broaden data collection in low- and middle-income countries, supporting global efforts to enhance childhood cancer survival rates.

Regulations in the market play a crucial role in ensuring the safety and efficacy of diagnostic tools. Stringent regulatory standards, particularly from agencies like the FDA and EMA, impact product development timelines and market entry. While these regulations ensure high-quality diagnostics, they also increase the cost and complexity of bringing new technologies to market.

Product expansion in the market is accelerating, with companies introducing advanced imaging technologies and AI-driven diagnostic tools. These innovations are designed to improve early detection and diagnostic accuracy. According to a UK Cancer Research report from June 2024, a new scanning technique allows for accurate medulloblastoma diagnosis in children within minutes. This innovative method works in conjunction with the MRI scans that doctors already use to locate tumors, providing quick and precise results. As demand for specialized pediatric care grows, manufacturers are expanding their portfolios to include more comprehensive and non-invasive diagnostic solutions tailored specifically for pediatric cardiac tumors.

Regional expansion in the market is growing rapidly as healthcare infrastructure improves globally. Emerging markets in Asia, Latin America, and Africa are increasingly adopting advanced diagnostic technologies due to rising healthcare investments and awareness. This expansion is driven by the need for better diagnostic tools and improved access to pediatric cardiac care in these regions.

Tumor Insights

The primary cardiac tumor segment held the largest share of 84.81% in 2023, driven notably by the prevalence of rhabdomyomas, which are the most common primary cardiac tumors in infants and children. Increased awareness about these tumors among healthcare providers and parents is a key driver of this growth. Advancements in imaging technologies, such as high-resolution echocardiography and MRI, have significantly improved diagnostic accuracy and early detection of rhabdomyomas. Moreover, rising investment in pediatric cardiac care and research is fueling market expansion by enabling the development of specialized diagnostic tools. Enhanced understanding of the clinical implications of rhabdomyoma and better access to healthcare services are also contributing to the growing demand for advanced diagnostic solutions in this niche market.

The secondary cardiac tumors segment is expected to grow at the fastest CAGR over the forecast period due to their higher prevalence compared to primary malignant tumors. Secondary malignant cardiac tumors, which are 10–20 times more common, can be either carcinomatous or sarcomatous, with carcinomas being more frequent. These tumors often appear as multiple small, firm nodules in imaging studies. Melanoma is known for its ability to spread to the heart and affect all four chambers equally. The rise in diagnostic market growth is driven by advances in imaging technologies and increasing awareness of metastatic cardiac tumors, leading to improved detection and management.

Type Insights

Echocardiograph segments held the largest share of 60.76% in 2023.According to a report by IMR Press published in January 2024,echocardiography offers a comprehensive, non-invasive assessment throughout all stages of cancer, making it particularly valuable for monitoring cardiovascular disease resulting from oncology treatments. This capability has garnered significant attention for its role in studying cardiac tumors and evaluating treatment-induced cardiac changes. The technique's ability to provide detailed imaging and ongoing monitoring without invasive procedures is driving its increased adoption. As a result, the echocardiography market is expanding rapidly, fueled by technological advancements and improved recognition of its importance in pediatric cardiac care.

Magnetic Resonance Imaging (MRI) segment is expected to grow at the fastest CAGR over the forecast period.According to a Springer report published in May 2023, the Magnetic Resonance Imaging (MRI) market is seeing significant growth in the pediatric cardiac tumor diagnostic sector due to advancements such as real-time MRI (rt-MRI). This innovative technique merges the high frame rates of ultrasound, up to 50 images per second, with the superior quality and detailed features of MRI. Real-time MRI has proven highly effective in imaging children, dramatically reducing both examination time and the need for sedation. This efficiency and improved patient experience are driving increased adoption and growth of MRI in pediatric tumor diagnostics.

End-use Insights

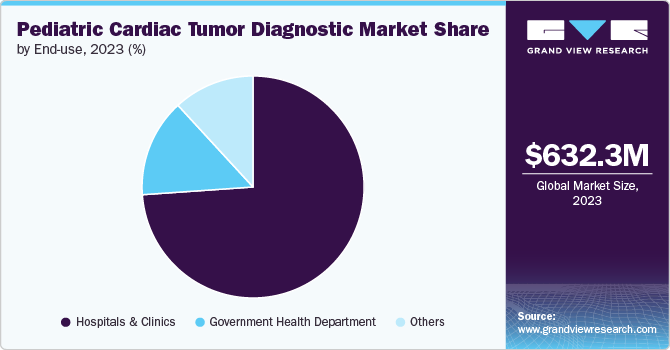

The hospitals and clinics segment held the largest share of 73.89% in 2023,driven by increased awareness and advancements in hospital infrastructure. Enhanced knowledge about pediatric cardiac tumors has led to more proactive diagnostic practices and early detection efforts. Concurrently, investments in upgrading hospital infrastructure are enabling the integration of advanced diagnostic technologies, such as high-resolution imaging and AI-driven tools. These improvements are facilitating better diagnostic capabilities and patient care, contributing to the expansion of the market. As hospitals and clinics continue to evolve and adopt cutting-edge technologies, the demand for specialized pediatric cardiac diagnostic services is expected to grow.

The government health department segment is growing at the fastest growth over the forecast period. The growth is primarily driven by increased investment and funding. Government support is enhancing research and development, leading to advancements in diagnostic technologies and improved patient care. Initiatives include funding for innovative diagnostic tools and supporting awareness programs that educate healthcare providers and the public about pediatric cardiac tumors. These efforts are crucial for early detection and effective management. As governments prioritize pediatric health and invest in specialized diagnostic services, the market for pediatric cardiac tumor diagnostics is expanding, supported by both financial resources and educational outreach.

Regional Insights

North America pediatric cardiac tumor diagnostic market dominated the overall global market and accounted for 36.44% revenue share in 2023, driven by key market players and strategic partnerships. Leading companies are collaborating with research institutions and healthcare providers to develop advanced diagnostic tools and improve patient outcomes. For instance, in November 2020, GE Healthcare and GenesisCare partnered to address two major global health challenges: cancer and cardiovascular disease. This collaboration aims to enhance patient access to advanced technology, with plans to explore further joint efforts to improve cancer diagnosis, treatment, and cardiovascular care worldwide. This partnership underscores a commitment to elevating global healthcare standards. These partnerships are fostering innovation in imaging technologies and enhancing early detection capabilities.

U.S. Pediatric Cardiac Tumor Diagnostic Market Trends

The pediatric cardiac tumor diagnostic market in the U.S. held a significant share of the North American market in 2023, driven by the adoption of advanced technologies. Innovations in imaging, such as high-resolution MRI and AI-enhanced echocardiography, are improving the early detection and diagnosis of cardiac tumors in children. In addition, strong investments in healthcare infrastructure and research further propel the market growth, making the U.S. a leader in pediatric cardiac diagnostics.

Europe Pediatric Cardiac Tumor Diagnostic Market Trends

Europe pediatric cardiac tumor diagnostic market is experiencing significant growth and is driven by increased investment and funding for new technological advancements. Governments and private sectors channel resources into research and development, fostering innovation in diagnostic tools. Key market players are also expanding their presence in the region, capitalizing on Europe's robust healthcare infrastructure and rising demand for advanced pediatric cardiac diagnostics, further boosting market growth. For instance, in May 2024 , Siemens Healthineers announced a USD 314 million investment in a new Oxford facility, marking the UK’s first major production site for advanced MRI cooling technology. The facility will design and manufacture MRI superconducting magnets and will feature a dedicated R&D hub focused on innovative and sustainable MRI technology. Construction has commenced on this significant project.

The UK pediatric cardiac tumor diagnostic market is experiencing significant growth, fueled by technological advancements, particularly in CT and MRI imaging. These innovations are enhancing the precision and speed of tumor detection, leading to improved outcomes in pediatric care. Increased investment in these advanced diagnostics is driving market expansion.

Germany pediatric cardiac tumor diagnostic market is experiencing significant growth, driven by increased awareness in pediatric medicine and oncology. Efforts to educate healthcare providers and the public about early detection and management of pediatric tumors are boosting demand for advanced diagnostic tools. This heightened awareness, coupled with Germany's robust healthcare infrastructure, is contributing to the market's expansion.

Asia Pacific Pediatric Cardiac Tumor Diagnostic Market Trends

Asia Pacific pediatric cardiac tumor diagnostic market is experiencing the fastest growth,supported by government initiatives to advance medical technology. Increased funding and policy support are attracting global market players to expand their presence in the region. For instance, in April 2023, Siemens Healthineers expanded its manufacturing operations in India by inaugurating an MRI facility in Bengaluru under the PLI scheme. The company launched a new production line at the Bengaluru facility to manufacture Magnetic Resonance Imaging machines. This expansion is enhancing access to cutting-edge diagnostic tools, driving significant growth in the pediatric cardiac care sector across Asia Pacific.

China pediatric cardiac tumor diagnostic market is growing, driven by innovations from key market players like Fujitsu. These companies are introducing advanced diagnostic technologies, enhancing early detection and treatment. The growth is further supported by increased investment in healthcare infrastructure and technology advancements in the region.

Japan pediatric cardiac tumor diagnostic market is experiencing growth due to significant research in oncology technology and strategic partnerships. Collaborations between healthcare institutions and technology firms are driving advancements in diagnostic tools, enhancing early detection and treatment. For instance, in April 2023, Canon Medical Systems Corporation and the National Cancer Center Japan (NCC) commenced clinical research using a CT system featuring photon-counting computed tomography. These efforts are bolstering market expansion and improving pediatric cardiac care in Japan.

Latin America Pediatric Cardiac Tumor Diagnostic Market Trends

Latin America pediatric cardiac tumor diagnostic market is experiencing notable growth, due to increased awareness of oncology and robust government support. Enhanced public and healthcare provider education about early detection and management of pediatric tumors, coupled with government initiatives and funding, is driving advancements in diagnostic technologies and expanding market access across the region.

Middle East And Africa Pediatric Cardiac Tumor Diagnostic Market Trends

MEA pediatric cardiac tumor diagnostic market is expanding, driven by government funding and growing research into childhood cardiac tumors. Increased investment in healthcare infrastructure is enhancing access to advanced diagnostic technologies. These factors, combined with a focus on improving diagnostic capabilities for pediatric cardiac tumors, are fueling market growth and advancing care in the region.

Saudi Arabia pediatric cardiac tumor diagnostic market is expanding fueled by increased healthcare awareness in oncology and rising oncology research. Government funding for treatment and advancements in diagnostic technologies are enhancing early detection and care, driving market expansion, and improving outcomes for children with cardiac tumors.

Key Pediatric Cardiac Tumor Diagnostic Company Insights

The competitive scenario in the market for pediatric cardiac tumor diagnostic is high. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Pediatric Cardiac Tumor Diagnostic Companies:

The following are the leading companies in the pediatric cardiac tumor diagnostic market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- CANON MEDICAL SYSTEMS CORPORATION

- Boston Scientific Corporation

- Lantheus

- Bio-Rad Laboratories, Inc.

- Abbott

- F. Hoffmann-La Roche Ltd

- Medtronic

Recent Developments

-

In May 2024, GE HealthCare unveiled Revolution RT, a new CT solution for radiation therapy that features cutting-edge hardware and software designed to enhance imaging accuracy. This innovation aims to streamline the simulation workflow, providing a more personalized and seamless oncology care experience for both clinicians and patients.

-

In December 2023, GE Healthcare launched a new AI-enabled MRI system. This advanced system sets a new standard for patient comfort with its high-performance wide bore design and features AI and deep learning technologies that enhance the speed and precision of scans.

-

In October 2023, Philips' AI-powered MRI technology and Quibim's AI-driven image analysis software are designed to support clinicians in providing quicker and more accessible cancer care, addressing staff shortages and reducing healthcare costs.

Pediatric Cardiac Tumor Diagnostic Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 664.65 million

Revenue forecast in 2030

USD 1.06 billion

Growth Rate

CAGR of 8.03% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tumor, type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; Boston Scientific Corporation; Lantheus; Bio-Rad Laboratories, Inc.; Abbott; F. Hoffmann-La Roche Ltd; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

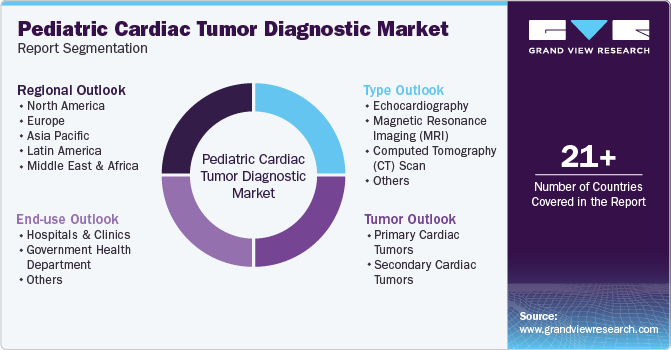

Global Pediatric Cardiac Tumor Diagnostic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric cardiac tumor diagnostic market report based on tumor, type, end-use, and region.

-

Tumor Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Cardiac Tumors

-

Secondary Cardiac Tumors

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Echocardiography

-

Magnetic Resonance Imaging (MRI)

-

Computed Tomography (CT) Scan

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals And Clinics

-

Government Health Department

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pediatric cardiac tumor diagnostic market size was estimated at USD 632.34 million in 2023 and is expected to reach USD 664.65 million in 2024.

b. The global pediatric cardiac tumor diagnostic market is expected to grow at a compound annual growth rate of 8.03% from 2024 to 2030 to reach USD 1.06 billion by 2030.

b. North America dominated the pediatric cardiac tumor diagnostic market with a share of 36.44% in 2023. This is attributable to presence of key market players and strategic partnerships among them. Leading companies are collaborating with research institutions and healthcare providers to develop advanced diagnostic tools and improve patient outcomes.

b. Some key players operating in the pediatric cardiac tumor diagnostic market include GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; CANON MEDICAL SYSTEMS CORPORATION; Boston Scientific Corporation; Lantheus; Bio-Rad Laboratories, Inc.; Abbott; F. Hoffmann-La Roche Ltd; Medtronic

b. Key factors that are driving the market growth include increasing awareness and advancements in medical technology. With the rise in the prevalence of congenital heart conditions and tumors among children, the demand for accurate and early diagnostic tools has surged.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."