- Home

- »

- Consumer F&B

- »

-

Pea Flakes Market Size And Share, Industry Report, 2030GVR Report cover

![Pea Flakes Market Size, Share & Trends Report]()

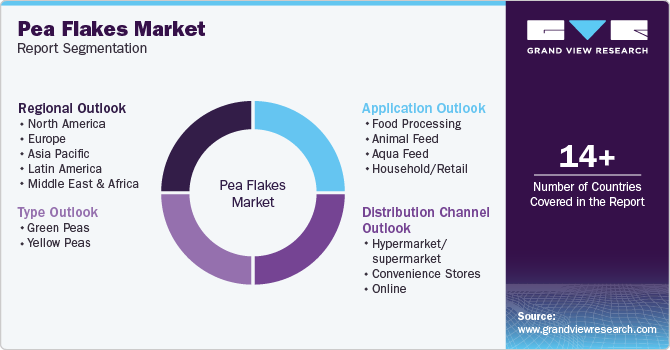

Pea Flakes Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Food Processing, Animal Feed, Aqua Feed, Household/Retail), By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-532-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pea Flakes Market Summary

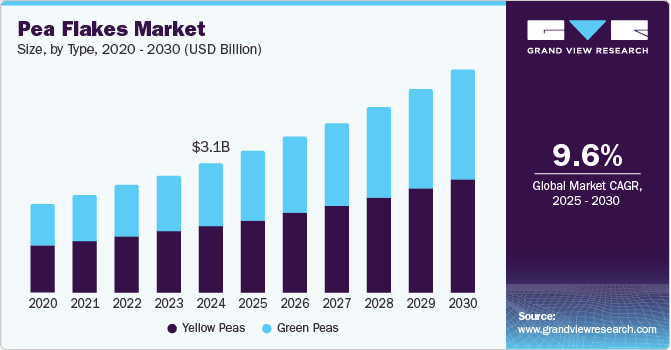

The global pea flakes market size was valued at USD 3.09 billion in 2024 and is projected to reach USD 5.36 billion by 2030, growing at a CAGR of 9.6% from 2025 to 2030. The growth of this market is primarily driven by the increasing demand from urban pet owners and growing expenditures on pet food and wellness. Pea flakes' comparatively high protein contents, minerals, and amino acids, combined with the product's natural sweetness, have resulted in the growing utilization of animal feed.

Key Market Trends & Insights

- North America dominated the global pea flakes industry with a revenue share of 34.6% in 2024.

- The U.S. pea flakes market dominated the regional market in 2024.

- The Middle East & Africa pea flakes market is projected to experience the fastest CAGR during the forecast period.

- Based on type, the yellow peas segment held the largest revenue share of the global pea flakes market in 2024.

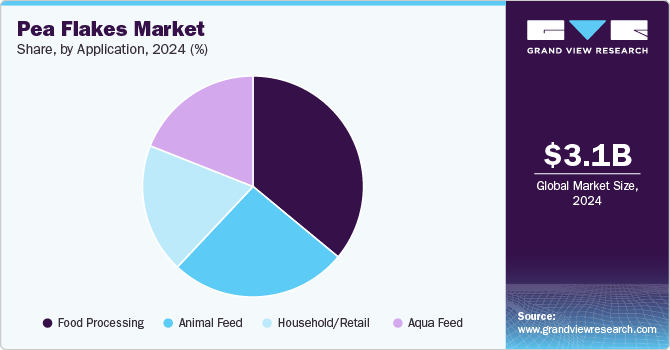

- In terms of type, the food processing segment dominated the pea flakes industry, with a revenue share of 35.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.09 billion

- 2030 Projected Market Size: USD 5.36 billion

- CAGR (2025-2030): 9.6%

- North America: Largest market in 2024

- Middle East & Africa: Fastest growing market

Over the last few years, pet food and treat spending has increased significantly, especially in urbanized areas across numerous regions. Multiple pet owners have included high-fiber, high-protein, and natural ingredients-based products in pet food stocks. Pea flakes are often offered to pets such as rodents, birds, dogs, horses, and more. Pea flakes are considered suitable food or treat alternatives for pets such as guinea pigs, rabbits, mice, hamsters, gerbils, degus, chinchillas, parrots, etc.

According to APPA (American Pet Products Association), total pet spending was recorded at USD 147 billion in 2023. Pet food & treats accounted for USD 64.4 billion. Growing pet ownership in developed countries such as the U.S., UK, and others, as well as significant growth in demand for pet treats from developing economies such as India, are expected to add lucrative growth opportunities for this market.

Pea flakes are also utilized in human food owing to the increasing popularity of plant-based foods and the inclination towards including high-protein food products in diet plans. Growing awareness regarding the role of food intake in overall health and wellness is expected to add lucrative growth opportunities for this market during the forecast period.

Pea flakes, a naturally gluten-free food product, are extensively used by professional chefs and households for a variety of dishes, including soups, salads, stews, baked goods, and others. The addition of texture and overall nutrition offered by the product stimulates its growing utilization. Pea flakes are increasingly utilized in preparations such as casseroles, veggie patties, dips, spreads, and other products.

Type Insights

The yellow peas segment held the largest revenue share of the global pea flakes market in 2024. The higher protein contents of the product, the large amount of fiber offered, and the increasing demand for plant-based foods by urban consumers are likely to add growth to this segment. Yellow pea flakes are also extensively used in soups, stews, and other food products as key ingredients.

The green pea flakes segment is expected to experience the fastest growth during the forecast period. The rich protein content in green pea flakes and the growing utilization of food products made for vegan customers are adding to this segment's growth. Increasing use by pet owners as treats and a rise in demand from health-conscious urban consumers for utilization in salads, dips, sauces, and others are anticipated to add novel growth opportunities.

Distribution Channel Insights

The hypermarket/supermarkets segment held the largest revenue share of the global pea flakes industry in 2024. This is attributed to increasing availability through hypermarkets/supermarkets, growing demand by urban pet owners, and ease of accessibility. Brands prefer effective distribution through hypermarkets/supermarkets as it enhances brand visibility. New store launches by popular brands across developed countries such as the U.S. and others are expected to fuel the growth of this segment.

The online distribution segment is anticipated to experience the fastest growth from 2025 to 2030. This is attributed to factors such as increasing market penetration of e-commerce businesses, the emergence of quick commerce platforms in developing economies such as India, and the convenience offered by online portals through services. Customers prefer online shopping experiences owing to factors such as doorstep delivery, replacement or return services, detailed product descriptions shared by sellers, and display of reviews mentioned by previous buyers.

Application Insights

The food processing segment dominated the pea flakes industry, with a revenue share of 35.9% in 2024. Pea flakes are extensively used to make processed food products such as cereals, baked goods, convenience snacks, etc. They are also commonly used as supplementary food for pets such as dogs, rodents, and birds. The product is also a key ingredient in soups, dips, sauces, and more. These aspects fuel the growth of this segment.

The animal feed segment is projected to experience the fastest growth during the forecast period. This is attributed to pet owners' increasing use of pea flakes as treats or supplementary food, growing demand for a variety of pet food products, and a rising number of pet owners worldwide. Increased pet food and wellness spending, enhanced accessibility facilitated by e-commerce websites, and a significant rise in demand from urban pet owners are anticipated to add growth opportunities.

Regional Insights

North America dominated the global pea flakes industry with a revenue share of 34.6% in 2024. This is attributed to many pet owners in the region, growing demand for convenience pet food products, and multiple pet food manufacturers and marketers in North America. Demand for pea flakes is primarily influenced by the pet owners who use them as treats for pets such as rabbits, birds, dogs, horses, and others.

U.S. Pea Flakes Market Trends

The U.S. pea flakes market dominated the regional market in 2024. The increased spending on pet food and wellness by pet owners in the U.S. mainly drives this market. According to APPA (American Pet Products Association), the U.S. pet industry spending was estimated at USD 150.6 billion in 2024. Ease of accessibility facilitated by the effective distribution through hypermarkets and supermarkets and growing availability through e-commerce websites also add to the growth.

Europe Pea Flakes Market Trends

Europe held a significant revenue share of the global pea flakes market in 2024. This is attributed to increasing awareness regarding the benefits associated with the product, growing utilization by pet owners, and a rise in utilization for soups, sauces, dips, and other food products. According to AnimalhealthEurope, nearly 91 million European households own a pet, which accounts for approximately 46.0% of the total households.

Germany dominated the regional market for pea flakes in 2024. According to the International Trade Administration and the U.S. Department of Commerce, 45.0% of German households had pets in 2023. Additionally, 14.0% of the households had two or more pets. The total number of pets was recorded at nearly 34.3 million. Increasing demand for pea flakes by pet owners and ease of availability through effective offline distribution accomplished by the key market participants are expected to drive growth over the forecast period.

Middle East & Africa Pea Flakes Market Trends

The Middle East & Africa pea flakes market is projected to experience the fastest CAGR during the forecast period. Growth of this market is mainly driven by aspects such as increasing demand from the pet food industry, growing popularity of plant-based food offerings, and significant growth in utilization as an ingredient in foods such as soups, sauces, and others. Increasing demand for plant-based proteins in countries such as Saudi Arabia, Qatar, UAE, and others is expected to influence the growth of this regional market.

South Africa held a significant revenue share of the regional industry in 2024. The growing utilization of pea flakes as key supplementary food for pets such as rabbits, rodents, dogs, horses, and others is adding to the growth experienced by this market. Pea flakes are also extensively fed to Guinea pigs for amino acids that cannot be naturally produced by the pet. Pea flakes offer lysine, which has a rich nutritional content.

Key Pea Flakes Company Insights

Some of the key companies in the global pea flakes industry are Kessler Zoologiegroßhandel GmbH & Co. KG, BP Milling, Garden Valley Foods, GEMEF INDUSTRIES (SOTEXPRO), JR Farm, and others. To address increasing and growing competition, the major market participants have embraced strategies such as portfolio enhancements, effective offline distribution, and growth in digital footprint.

-

Inland Empire Foods Inc. provides an extensive portfolio of pea, bean, and lentil ingredients. Its portfolio includes yellow split pea flakes, garbanzo bean flakes, Black bean flakes, and Navy Bean flakes. Patented technology and in-house equipment design are key strengths of this company, which enable it to offer a wide variety of products.

-

Kessler Zoologiegroßhandel GmbH & Co. KG trades, refines, and manufactures a wide range of distinctive natural raw materials and animal products across various categories. Some of the product categories offered by the company include feeding oils, sticks, granulates, powder, flakes, tablets, insects, fish, shellfish, vegetables, fruits, berries, herbs, mixtures, seeds, grains, and others.

Key Pea Flakes Companies:

The following are the leading companies in the pea flakes market. These companies collectively hold the largest market share and dictate industry trends.

- B P Milling Ltd.

- Garden Valley Foods

- GEMEF INDUSTRIES (SOTEXPRO)

- JR Farm

- Exotic Nutrition Pet Supply

- Inland Empire Foods Inc.

- Wheeeky Pets

- Kessler Zoologiegroßhandel GmbH & Co. KG

- Mealberry

Pea flakes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.39 billion

Revenue forecast in 2030

USD 5.36 billion

Growth rate

CAGR of 9.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

B P Milling Ltd.; Garden Valley Foods; GEMEF INDUSTRIES (SOTEXPRO); JR Farm; Exotic Nutrition Pet Supply; Inland Empire Foods Inc.; Wheeeky Pets; Kessler Zoologiegroßhandel GmbH & Co. KG; Mealberry

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pea flakes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pea flakes market report based on application, type, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Processing

-

Animal Feed

-

Aqua Feed

-

Household/Retail

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Green Peas

-

Yellow Peas

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket/supermarket

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.