PDC Drill Bits Market Size, Share & Trends Analysis Report By Product (Matrix body, Steel Body), By End-use (On Shore, Off Shore), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-352-4

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

PDC Drill Bits Market Size & Trends

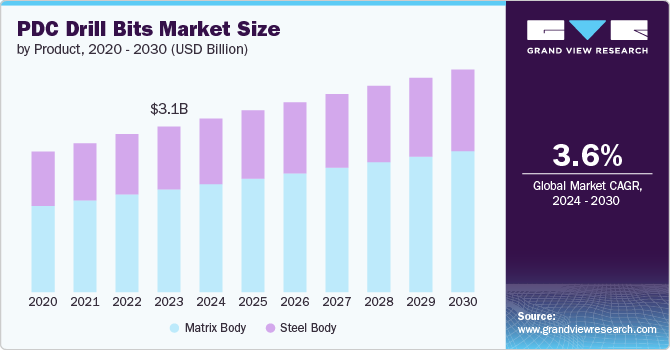

The global PDC drill bits market was estimated at USD 3.13 billion in 2023 and is forecasted to grow at a CAGR of 3.6% from 2024 to 2030. This growth is attributed to the rising need for cost-effective and efficient solutions in the oil & gas industry. As exploration and production activities expand to more challenging and deeper formations, PDC drill bits offer superior durability, faster drilling rates and longer lifespans compared to traditional methods.

There are advancements in PDC technology which are expected to enhance their performance and adaptability to various geological conditions, making them an ideal choice for operators looking to maximize productivity and reduce operational costs. The rising focus on energy security and the continuous search for new hydrocarbon reserves is further likely to drive the demand for advanced drilling tools like PDC bits.

Polycrystalline diamond (PDC) drill bits market is likely to be hampered by its high initial cost associated with these advanced drilling tools. Even though it offers long-term cost-efficiency and superior performance, the initial investment for PDC bits is considerably more compared to traditional products. This can be a substantial financial burden for smaller operators and manufacturers with limited budgets, potentially limiting their adoption.

Moreover, PDC bits can be less effective in certain extremely hard or abrasive formations, which may require more frequent replacement of cutters and increase operational costs. Market volatility, including fluctuations in oil and gas prices, can also impact investment in new drilling technologies, thereby restraining the growth of the market.

Product Insights

Matrix body PDC bit dominated the market and accounted for a revenue share of 62.0% in 2023. These are more preferable in comparison to steel body due to their superior durability and resistance to abrasive formations. They are made from tungsten carbide which helps them withstand high-impact drilling conditions and provide a longer operational lifespan. Their ability to retain the cutters more securely makes them ideal for drilling in hard and challenging geological formations, thereby increasing its demand over the forecast period.

The demand for steel body PDC drill bit is anticipated to grow especially in applications where flexibility and resilience are required. These bit are made from high-strength steel, allowing for easier customization to suit specific drilling conditions. Moreover, steel body bit typically offer higher impact resistance and can be more cost-effective compared to matrix body bits, making them suitable for less abrasive formations and applications requiring quicker drilling speed.

End-use Insights

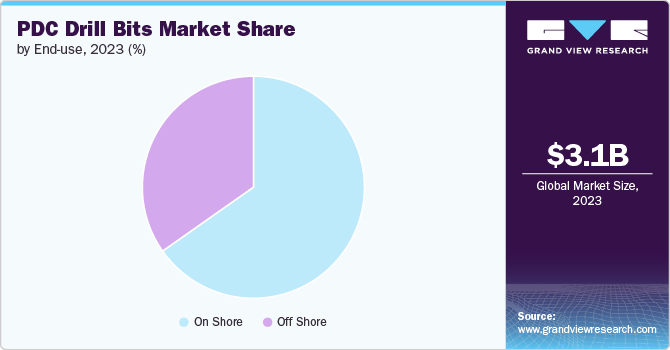

The onshore segment dominated the market with the revenue share of 65.3% in 2023 and is further expected to grow at a fastest rate over forecast period. As onshore drilling typically involves a varied range of geological formations, that includes hard and abrasive rocks including sandstone, shale, and limestone. These bits excel in such conditions due to their high rate of penetration, durability, and ability to maintain sharpness over long periods of drilling. Moreover, it is more cost-effective compared to traditional roller cone bits which makes them an ideal choice for onshore drilling operations where maximizing efficiency and reducing operational costs are critical concerns.

The demand for PDC drill bit is anticipated to grow in offshore locations owing to the expanding drilling activities into deeper waters and more challenging geological formations where traditional drill bits may struggle to maintain efficiency. PDC drill bits, with their advanced materials and design, offer superior durability and performance in these harsh environments, including high-pressure and high-temperature conditions encountered offshore. These factors are expected to boost the demand for the product for offshore locations.

Regional Insights

The market in North America is expected to grow at a CAGR of 3.6% over the forecast period. This growth is attributed to the region's significant shale gas and tight oil reserves, which requires durable and efficient drilling technologies. The widespread exploration and production activities in shale formations, particularly in areas like the Bakken Formation, Marcellus Shale, and Permian Basin, demand the usage of advanced drilling tools which can handle abrasive rock conditions typical of these reservoirs. PDC drill bits, known for their high rate of penetration and long lifespan, are ideal for these applications, thereby fueling its demand in coming years.

U.S. PDC Drill Bits Market Trends

The U.S. dominated the North America market with a revenue share of 77.7% in 2023. The demand is driven by country's increasing technological advancements and the rising investments in unconventional oil and gas resources are driving the need for more effective drilling solutions, thereby fueling the market’s demand in the U.S.

Europe PDC Drill Bits Market Trends

The market in Europe is expected to grow significantly over the forecast period. The inclination towards cleaner and more efficient energy extraction methods coupled with the advancements in PDC bits technology, that offer faster drilling rates and decrease overall operational costs. Furthermore, European regulations often highlight minimizing environmental impact, and the improve performance of PDC bits contributes to fewer drilling-related disruptions and lower carbon footprints, further driving their adoption in the region.

Asia Pacific PDC Drill Bits Market Trends

The demand for PDC drill bit in Asia Pacific is expected to grow at the fastest CAGR of 4.1% from 2024 to 2030. Several countries in the region including China, India, Australia, and Indonesia are heavily investing in the development of unconventional oil and gas resources, that includes coal bed methane and shale gas, that require advanced drilling technologies including PDC bits for efficient extraction. In addition, technological advancements and augmented focus on enhancing drilling efficiency and reducing operational costs are encouraging the usage of PDC drill bit in the region.

Key PDC Drill Bits Company Insights

Some of the key players operating in the market include Baker Hughes Company and Sandvik AB.

-

Baker Hughes Company is engaged in designing, manufacturing and service transformative technologies. The company has a broad product and service portfolio for oilfiled, turbomachinery and process solutions, software and analytics, and measurement, testing and control solutions. It provides its products and services under Bently Nevada, Druck, Panametrics, Reuter-Stokes, and Waygate Technologies.

-

Sandvik AB is Sweden based high-technology engineering solution provider for mining, manufacturing, and infrastructure industries. The company offers its products and services under mining & infrastructure equipment and tools and tools & software component manufacturing segments. The company has approximately 41,000 employees and sales in about 170 countries.

Archway Engineering (UK) Ltd and Infinity Tool Manufacturing are some of the emerging participants in market.

-

Archway Engineering (UK) Ltd is a stockiest as well as designer and manufacturer of special equipment for drilling industry. The company also offers various services including rig repair, rig servicing, safe working load testing, SPT hammer calibration, bespoke design, and equipment assessment & Repair.

-

Infinity Tool Manufacturing is involved in the manufacturing of PDC drill bits, horizontal directional drilling consumables, down-the-hole-bits, and drilling accessories. Its product portfolio includes PDC bits, PDC reamers, DTH bits, tricones, directional hammer bits, cable tool bits, drag bits, and DTH hole opener.

Key PDC Drill Bits Companies:

The following are the leading companies in the PDC drill bits market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Hughes Company

- Sandvik AB

- Archway Engineering (UK) Ltd

- Infinity Tool Manufacturing

- NOV (National Oilwell Varco)

- SLB

- Wuxi Geological Drilling Equipment Co.Ltd.

- Rockpecker Limited

- Cangzhou Great Drill Bits Co.Ltd.

- WUHAN SML TOOLS LIMITED

Recent Developments

- In July 2022, Halliburton Company introduced a new Hedron platform of fixed cutter polycrystalline diamond compact PDC drill bits. This is a mix of new technology with a leading customization process to deliver high-performance designs to its customers. With this innovation, drill bits can address the complicated drilling challenges.

PDC Drill Bit Market Report Scope

|

Attribute |

Details |

|

Market size value in 2024 |

USD 3.28 billion |

|

Revenue forecast in 2030 |

USD 4.21 billion |

|

Growth Rate |

CAGR of 3.6% from 2023 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina |

|

Key companies profiled |

Baker Hughes Company; Sandvik AB; Archway Engineering (UK) Ltd; Infinity Tool Manufacturing; NOV (National Oilwell Varco); SLB; Wuxi Geological Drilling Equipment Co., Ltd.; Rockpecker Limited; Cangzhou Great Drill Bits Co., Ltd.; WUHAN SML TOOLS LIMITED |

|

Customization scope |

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global PDC Drill Bits Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global PDC drill bits market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Matrix body

-

Steel Body

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

On Shore

-

Off Shore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global PDC drill bits market size was estimated at USD 3.13 billion in 2023 and is expected to reach USD 3.28 billion in 2024.

b. The global PDC drill bits market is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2024 to 2030 to reach USD 4.21 billion by 2030.

b. Matrix body PDC drill bits accounted for the largest revenue share of over 62.0% in 2023. These bits excel in such conditions due to their high rate of penetration, durability, and ability to maintain sharpness over long periods of drilling. Moreover, it is more cost-effective compared to traditional roller cone bits which makes them an ideal choice for onshore drilling operations.

b. Some key players operating in the PDC drill bits market include Baker Hughes Company, Sandvik AB, Archway Engineering (UK) Ltd, Infinity Tool Manufacturing, NOV (National Oilwell Varco), SLB, Wuxi Geological Drilling Equipment Co.,Ltd., Rockpecker Limited, Cangzhou Great Drill Bits Co.,Ltd., and WUHAN SML TOOLS LIMITED.

b. The key factors that are driving the market growth are the rising need for cost-effective and efficient solutions in the oil & gas industry. As exploration and production activities expand to more challenging and deeper formations, PDC drill bits offer superior durability, faster drilling rates and longer lifespans compared to traditional methods.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."