- Home

- »

- Healthcare IT

- »

-

Patient Support Technology Market Size, Share Report, 2030GVR Report cover

![Patient Support Technology Market Size, Share & Trends Report]()

Patient Support Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Standalone, Integrated), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-284-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Patient Support Technology Market Trends

The global patient support technology market size was estimated at USD 1.58 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030. The increasing demand for comprehensive patient-centric engagement solutions, technological advancements, and strategic initiatives undertaken by the market players are expected to drive market growth. For instance, in October 2023, ZS introduced the AI-based ZAIDYN Connected Health solution as part of the ZAIDYN ZS platform. The solution helps healthcare providers, pharmaceutical companies, and payers engage patients, understand unmet needs, and enhance health outcomes.

Pharmaceutical entities allocate approximately USD 5.0 billion each year towards patient support programs (PSPs), yet they face obstacles in maximizing their efficacy in enhancing patient value. Traditionally, PSPs have relied on conventional, human-centric engagement strategies, predominantly facilitated via interactions with nurses and case managers. Although this highlights the significance of human interaction within the PSP framework, expanding technological solutions presents an even larger opportunity to address patient requirements, enhance their experiences, and achieve superior results at reduced expenses.

Moreover, technological advancements have significantly altered how non-licensed personnel engages with patients, continuously enhancing the quality of care that healthcare organizations can deliver. For instance, ClearSource illustrates this transformation by employing healthcare technology to increase the efficacy of non-licensed staff within Healthcare Organization (HCO) call centers. The firm utilizes technology to increase the efficiency and quality of patient care for its healthcare partners. This is achieved by providing an AI-powered simulation training platform, equipping agents with a suite of resources, including extensive knowledge bases and the ability to consult experts using integrated chatbots. These tools collectively promote patient support and contribute to a more knowledgeable, empathetic, and efficient healthcare experience while improving call center efficiency through automation.

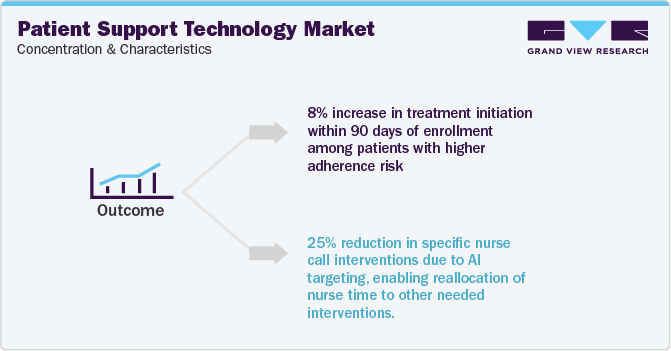

Furthermore, companies offer AI-powered patient support programs to enhance patient outcomes. For instance, AllazoHealth's AI-based patient support program improved initiation, one-to-one patient engagement, patient experience, health outcomes, and medication adherence while improving program performance, efficiencies, and costs. The company's clients who implemented its AI-driven patient support program observed a 7.8% growth in therapy initiation rate, a 13% gain in days on therapy, a 25% lower expense on pharmaceutical interventions, and a 5.5 times greater medication adherence program performance.

Case Study Insights

A biologic therapy manufacturer collaborated with AllazoHealth and Lash Group to transform therapy initiation through AI-driven patient support.

Challenge:

The manufacturer of a biologic therapy sought to enhance therapy initiation among targeted patient groups, specifically those who are at a greater risk of not starting therapy.

Solution:

Predictive analytics list the patients with a high probability of not initiating prescribed treatment and initiating AI-powered personalized interventions by message, channel, and timing. Lash Group, the manufacturer’s hub service partner, executes appropriate interventions, and the AllazoHealth AI platform analyzes the data from these follow-up actions. The platform continuously evolves as more patient data is gathered and analyzed.

Result:

The AI-driven adherence program helped the manufacturer’s objectives by accelerating first-fill rates and enhancing overall program efficiency.

Market Concentration & Characteristics

The degree of innovation in the patient support technology industry is high. Technological advancements are attributed to the growing utilization of artificial intelligence (AI) & machine learning (ML), increasing demand for digital health solutions and IT solutions. For instance, Phreesia's patient survey of 4,800 respondents showed that a significant number of patients are interested in tools supporting medication affordability (40%), knowledge resources (37%), and restocking medication (29%). Patients also mentioned the need for medication adherence support, emotional support tools, and new medications.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in May 2021, CloudMD Software & Services Inc. acquired Rxi, offering a patient support program and establishing specialty drug management to the employer market.

The impact of regulations is moderate to high in the industry. The industry involves several digital technologies, including AI and ML. It is regulated by different bodies in different countries. For instance, the WHO introduced a list of regulations to be considered while using AI in healthcare. Moreover, the companies are expected to adhere to the GDPR in Europe to ensure data safety.

Companies in the patient support technology industry undergo geographic expansion strategies to maintain their position in emerging markets and customer base from these regions. For instance, in November 2023, Docquity announced the expansion of its digitized patient access program (PAP), DocquityCare PAP, to Thailand. Docquity introduced five PAPs in Thailand, supporting around 250 authorized HCPs and 100 enrolled hospitals to enhance patient care for individuals with cancer and different life-threatening illnesses.

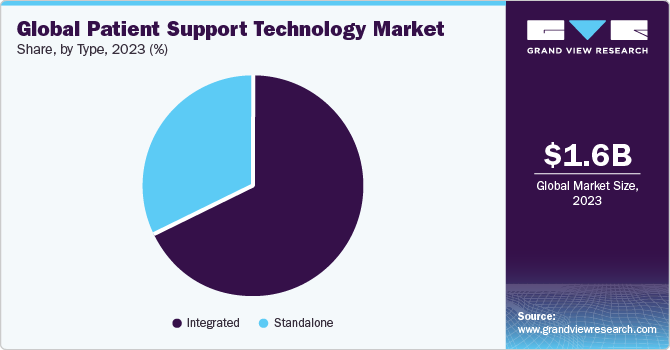

Type Insights

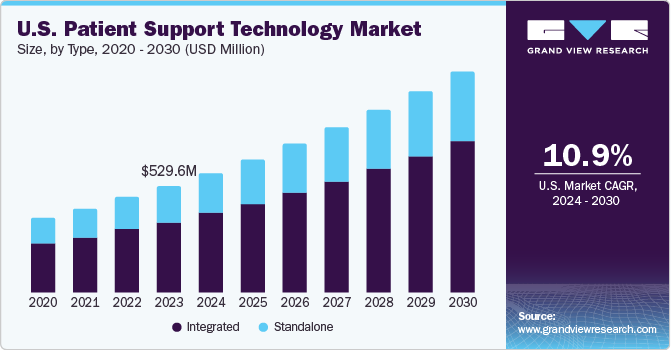

Based on the type, the market is segmented into standalone and integrated solutions. The integrated segment dominated the market in 2023 with a revenue share of 67.69%. The segment is also expected to grow at the fastest rate of 11.1%. Increasing focus on patient-centered care, technological advancements, and the need for streamlined & efficient healthcare processes is driving the segment growth.

An integrated patient support program combines diverse services like patient education, treatment access, care coordination, psychosocial support, health monitoring, lifestyle management, and more. This comprehensive approach aims to improve patient outcomes, quality of life, and overall healthcare experience by addressing various aspects of patient care and support. For instance, Accenture's INTIENT Patient platform, which comprises four integrated solutions and is supported by leading technology, assists Life Sciences companies in improving patient support from pre-diagnosis to ongoing treatment and wellness.

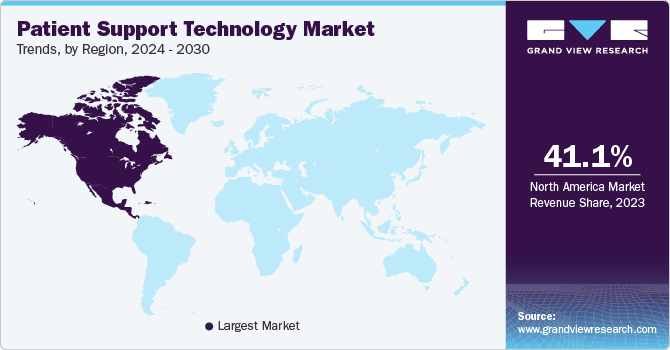

Regional Insights

North America dominated the patient support technology market, with a revenue share of 41.12% in 2023. A growing emphasis on patient-centered healthcare, ongoing digital transformation in the healthcare industry, and the shift from fee-for-service to value-based care models drive demand. Healthcare providers in North America are increasingly focused on managing the health of entire populations, further fueling the market growth.

U.S. Patient Support Technology Market Trends

The patient support technology market in the U.S. is being driven by the active participation of key players. For instance, in June 2023, ClinOne and Mural Health collaborated to optimize the patient experience while lowering the burden on healthcare sites. This collaboration integrated Mural Link, a next-gen patient payments and participant management platform, with ClinOne's patient support, streamlining trial management technology and site-level operations and improving the participant journey.

Europe Patient Support Technology Market Trends

Europe patient support technology market is expected to grow significantly during the forecast period. The growth is attributed to the revolutionizing personalized healthcare and initiatives undertaken by several organizations. For instance, EFPIA, beyond offering innovative treatments, many pharmaceutical companies provide support and services to aid patients in managing their disease and enhancing the treatment effect through patient support programs. These activities are provided through partnerships with patient organizations.

The patient support technology market in Germany had a substantial market share in 2023. This can be attributed to the increasing partnerships among market players. For instance, in November 2023, Huma Therapeutics partnered with Merck KGaA, Darmstadt, to design a digital solution to support cancer patients in better understanding and managing their treatment and conditions.

UK patient support technology market is expected to grow significantly during the forecast period. The growth is attributed to the government initiatives undertaken to advance the healthcare technology. For instance, in 2023, the government invested USD 31.9 million (Euro 30.0 million) in advanced technology for the National Health Service (NHS).

Asia Pacific Patient Support Technology Market Trends

Asia Pacific is anticipated to register the fastest growth in the patient support technology market over the forecast period. Growth can be attributed to the growing demand for patient-centric solutions, increasing investment in healthcare technology, and the presence of market players to access markets in developing countries.

The patient support technology market in Japan had a significant market share in 2023. The increasing partnerships to introduce innovative patient support solutions contribute to the market growth. For instance, in October 2022, Otsuka Pharmaceutical Co., Ltd. partnered with Jolly Good Inc. to launch FACEDUO, a virtual reality-based support program specifically designed for individuals with schizophrenia. This partnership marks the inaugural phase of a comprehensive virtual-real-based (VR) mental healthcare joint initiative. The program recreates realistic scenarios that patients may encounter in daily life, such as visits to convenience stores and professional environments, through virtual reality imagery. This approach simplifies the comprehension of real-life situations for patients, thereby enhancing the efficiency of communication and understanding between the patients and their support networks. Furthermore, the VR images are integrated with patient guidance, enabling the delivery of high-quality Social Skills Training (SST) that is not limited by the supporters' level of expertise or experience.

India patient support technology market is expected to grow significantly during the forecast period. Growth in the country can be attributed to the increasing adoption of digital healthcare technologies. For instance, in October 2022, according to MoS Jitendra Singh, approximately 80% of the healthcare systems are expected to invest in digital healthcare tools in the next five years, starting from 2022. This adoption is consequently expected to contribute to the growth of India's patient support technology market.

Key Patient Support Technology Company Insights

The market is competitive, and some notable participants include Deloitte, HealthStream, McKesson Corporation, and others. These players engage in new product launches, partnerships, and acquisitions to gain a competitive edge over each other.

Key Patient Support Technology Companies:

The following are the leading companies in the patient support technology market. These companies collectively hold the largest market share and dictate industry trends.

- Deloitte

- Accenture

- McKesson Corporation

- Cardinal Health

- DataRiver S.r.l

- Medisafe

- Inizio Engage

- AssistRx

Recent Developments

-

In October 2023, Nye Health entered the patient support program market with a platform-based digital offer. The PSP offering, developed on the Nye platform, utilizes analytics and data integration to adapt, customize, and expand insights across various programs, regardless of treatment or disease area

-

In October 2023, CipherHealth launched a strategic initiative to integrate advanced AI technologies to enhance patient care and hospital operations. The company leveraged Google Cloud’s Vertex AI platform to build, train, deploy, and manage ML and AI models across the care spectrum and products

-

In September 2023, EVERSANA announced an advancement in its patient support services. It introduced its new proprietary electronic prior authorization (ePA) and electronic benefits verification (eBV) platform, ACTICS eAccess

-

In November 2022, Roche Pharma in India introduced The Blue Tree 2.0 mobile app, a new digital platform for patients in India registered for Roche’s Blue Tree patient support program. The mobile application is available on iOS and Android platforms

Patient Support Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.76 billion

Revenue forecast in 2030

USD 3.2 billion

Growth rate

CAGR of 10.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Deloitte; Accenture; McKesson Corporation; Cardinal Health; DataRiver S.r.l; Medisafe; Inizio Engage; AssistRx

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Support Technology Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global patient support technology market report based on type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Integrated

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient support technology market was estimated at USD 1.58 billion in 2023 and is expected to reach 1.76 billion in 2024.

b. The global patient support technology market is expected to grow at a compound annual growth rate (CAGR) of 10.7% from 2023 to 2030 to reach 3.2 billion by 2030.

b. North America dominated the global patient support technology market with a share of 41.12% in 2023. This is attributable to growing emphasis on patient-centered healthcare, ongoing digital transformation in the healthcare industry, and the shift from fee-for-service to value-based care models.

b. Some key players operating in the global patient support technology market include Deloitte, Accenture, McKesson Corporation, Cardinal Health, DataRiver S.r.l, Medisafe, and Inizio Engage

b. Key factors that are driving the market growth include increasing demand for comprehensive patient-centric engagement solutions, technological advancements, and strategic initiatives undertaken by the market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.