Patient Scales Market Size, Share & Trends Analysis Report By Type (Mechanical, Electronic), By Product (Floor Scales, Body Fat Scales, Physician Scales), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-040-5

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Patient Scales Market Size & Trends

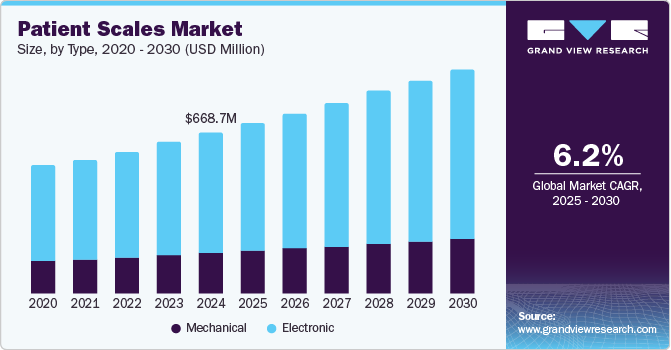

The global patient scales market size was estimated at USD 668.7 million in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. The market's growth can be attributed to increasing demand for effective portable weighing devices, increasing development in healthcare infrastructure, and the introduction of advanced healthcare technologies.

Modern patient scales have advanced sensors and measurement technologies that provide highly accurate weight readings. This precision is crucial for medical diagnostics and monitoring, where small deviations can be significant. Digital scales that integrate with electronic health records and other digital systems ensure accurate data collection & analysis, enhancing the reliability of health monitoring. The need for precise measurements in clinical settings and for personal health monitoring drives demand for advanced patient scales with superior accuracy. Accurate scales are essential for medical applications, including tracking weight changes in chronic conditions, which boosts demand in healthcare facilities.

As obesity rates rise globally, there is a growing need for effective weight management solutions. Obesity is linked to various health complications, including diabetes, cardiovascular diseases, and hypertension, which necessitates regular monitoring of body weight. Increased awareness of the health risks associated with obesity drives individuals to invest in personal health monitoring tools, including patient scales. The demand for patient scales is expanding as individuals seek tools to track and manage their weight more effectively. This drives growth in consumer and healthcare markets.

Chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders require ongoing monitoring and management. Regular weight monitoring is a crucial component of this management. Healthcare providers increasingly require precise and regular patient weight data to monitor disease progression, adjust treatment plans, and prevent complications. According to IDF, the total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. There is a rising demand for patient scales in clinical settings to support chronic disease management.

Companies are mainly focusing on the introduction of portable and compact products. Advanced technologies are integrated to achieve proper and accurate precision. For instance, in November 2022, DETECTO offered portable, high-capacity digital stretcher scales that could be used to weigh patients in emergency rooms precisely. In addition, in October 2022, Ceiba Healthcare entered into a partnership agreement with Pelstar LLC to allow customers access to EMR integration technologies for their patient weight data.

Type Insights

The electronic segment dominated the market in 2024 with over 77.0% share, offering more accurate results than mechanical patient scales. It is an essential tool in medical settings, such as hospitals, clinics, and doctor's offices, where it is necessary to monitor a patient's weight as a part of their overall healthcare management. Electronic scales have several integrated features, such as Bluetooth connectivity and automatic data logging, allowing seamless information sharing between patients and healthcare professionals. This integration supports comprehensive patient monitoring, enhancing the overall quality of care. In addition, the incorporation of AI and machine learning algorithms has made electronic scales an essential tool among healthcare providers as they offer predictive analytics for patient health trends

Mechanical patient scales are projected to witness considerable growth during the forecast period. Physicians usually require mechanical scales to offer important information for treating patients. Medical mechanical scales are properly designed machines used to obtain weight data. These scales are easy to use and read, and the healthcare personnel can direct patients onto the patients’ beam scale for accurate and quick measurement.

Product Insights

Floor scales captured the highest market share of 28.6% in 2024. Floor scales are easy and convenient to use the instrument, which offers accurate and fast results, and are ideal for several clinical settings. These are highly suitable weighing designs used by medical professionals globally. Moreover, the introduction of advanced technology, such as the integration of bluetooth connectivity, has helped to transfer patients' data from the scale to a central patient database through tablet, mobile, or PC. These factors have further advanced telehealth services.

The pediatric scales segment is projected to witness significant growth during the forecast period. Advancements in pediatric scales have significantly improved the accuracy and precision of measuring a child's weight and other vital signs. With the introduction of the latest technology, pediatric scales can now measure a baby's weight to within a few grams or ounces, making it easier for doctors and nurses to track a child's growth and development accurately.

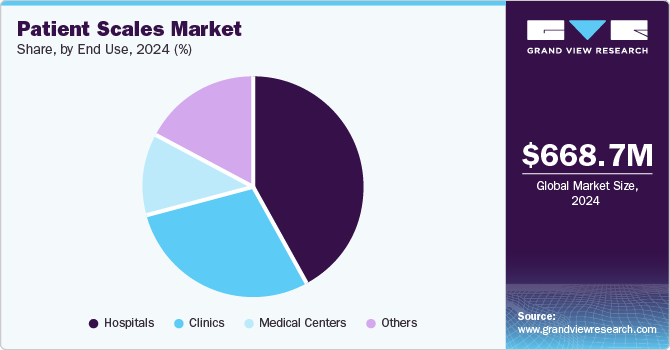

End Use Insights

The hospitals segment captured the highest market share in 2024 due to the increasing number of hospitalizations globally. Accurate and precise weight monitoring is essential for effective and safe patient care in healthcare, especially in hospitals. The patient’s weight is critical in fluid balance, medication prescription, and nutrition assessment. Moreover, the development of mobile scales has made it possible to easily transport them to different locations within hospitals or healthcare infrastructure.

The clinics segment is projected to witness lucrative growth during the forecast period. Clinics use patient scales as a crucial tool to monitor and manage patient health. It plays a critical role in weight management programs, where clinicians work with patients to establish healthy lifestyle habits and monitor progress toward weight loss goals. Moreover, clinics can use patient scales as part of a comprehensive patient-centered care approach, providing accurate and timely health information to improve health outcomes.

Regional Insights

The North America patient scales market dominated in 2024, accounting for a revenue share of 39.0%. The growth in the region can be attributed to factors such as increasing obesity among the population coupled with the development of advanced patient scales. In the U.S., approximately 6.0 million people have heart failure, costing the country an estimated USD 30.7 billion annually and causing 1.2 million hospitalizations every year. More than 90.0% of hospitalization is due to hemodynamic changes resulting in fluid accumulation. Thus, weight monitoring is the noninvasive standard of care to detect fluid changes in patients with heart failure.

U.S. Patient Scales Market Trends

The high incidence of chronic diseases such as diabetes, cardiovascular conditions, and kidney disorders requires consistent monitoring of patient weight to manage these conditions effectively is driving the market growth. For instance, diabetes patients need regular weight assessments to prevent complications. With obesity rates rising in the U.S., weight management and monitoring have become crucial. As per the CDC, the prevalence of obesity among U.S. adults 20 and over was 41.9% from 2017 to March 2020.

The Canada patient scales market growth is primarily driven bythe aging population . As the proportion of elderly individuals grows, the demand for accurate, reliable, and user-friendly weight measurement devices increases in healthcare facilities and home care settings. As people age, developing chronic conditions such as diabetes, heart disease, arthritis, and respiratory diseases increases.

Europe Patient Scales Market Trends

Patient scales are essential tools in both clinical and home settings for tracking weight changes, assessing the effectiveness of weight management programs, and guiding treatment decisions. This drives demand for reliable, high-capacity scales that handle diverse patient needs. According to the UK government, the prevalence of overweight and obesity among adults continues to rise, which is one of the primary driving factors for the market growth. In 2022-2023, an estimated 64.0% of adults aged 18 and over were classified as overweight or living with obesity, marking a slight increase from the previous year (63.8%).

The UK patient scales market is expected to grow during the forecast period. The UK has a large aging population, with the proportion of individuals aged 65 and over expected to rise significantly. The aging population faces age-related health issues, including mobility challenges, chronic diseases, and weight management concerns. Older adults must regularly monitor various health parameters, including body weight, to manage heart failure, diabetes, and frailty. Patient scales that offer features to elderly users, such as easy-to-read displays, stable platforms, and high-weight capacities, are essential in addressing these needs.

The growth of the patient scales market in Germany is driven by a high prevalence of chronic diseases such as diabetes, cardiovascular diseases, and obesity. As per IDF, by 2030, diabetes cases in Germany are expected to reach approximately 6.5 million. Effective management of these conditions requires regular weight monitoring. Patient scales are crucial for tracking weight changes, assessing treatment efficacy, and guiding health interventions.

Asia Pacific Patient Scales Market Trends

The Asia Pacific patient scales market, with an unhealthy lifestyle and rising prevalence of diseases, such as obesity, hypertension, and diabetes, is expected to witness growth. The proportion of elderly individuals is increasing rapidly, leading to a higher demand for healthcare services and medical devices, including patient scales.

The China patient scales market, with one of the fastest-growing elderly populations, is moving towards increasing life expectancy and declining birth rates. According to the National Bureau of Statistics, the elderly population (60 and above) is expected to reach over 400 million by 2035. This demographic shift drives the demand for healthcare services and medical devices, including patient scales, to monitor and manage age-related health conditions. Older adults often have chronic conditions that require regular monitoring. Patient scales are crucial in managing these conditions by providing essential data for weight management and overall health assessment.

In the patient scales market in Japan, with a significant proportion of elderly individuals in, there is an increased need for healthcare devices to monitor and manage health conditions prevalent in older adults, such as obesity, frailty, and chronic diseases. The demand for patient scales in elderly care facilities and home healthcare settings is rising to ensure accurate monitoring and management of weight-related health issues among seniors.

Latin America Patient Scales Market Trends

In the Latin America patient scales market, the growing incidence of chronic conditions such as diabetes, cardiovascular diseases, and obesity has increased the need to regularly monitor patient weight and body mass index (BMI). This trend has increased demand for patient scales, particularly in specialized care centers that manage chronic diseases.

To drive the Brazil patient scales market growth, the Brazilian government has invested in expanding access to basic healthcare services across rural and underserved areas. This drives the need for basic medical equipment, such as patient scales in primary care facilities. According to NIH, the Brazilian government has set a target of spending 10% of GDP on healthcare by 2023.

MEA Patient Scales Market Trends

The regulatory framework for MEA patient scales market falls under the broader health regulations and standards maintained by the Ministry of Health and Prevention (MoHAP) and the Emirates Authority for Standardization and Metrology (ESMA). Medical devices, including patient scales, must meet strict requirements for quality, safety, and efficacy to be legally marketed in the UAE.

The Saudi Arabia patient scales market is expected to grow over the forecast period. As part of Vision 2030, Saudi Arabia is working on expanding and reforming its healthcare system, including increasing the role of the private sector. This impacts the reimbursement process for medical devices. New regulations and public-private partnerships may influence the marker growth funding through direct procurement by hospitals or indirect reimbursement strategies for medical equipment in private healthcare facilities.

Key Patient Scales Company Insights

Key market players are entering into strategic collaborations and partnerships to expand their product portfolio. For instance, in November 2022, Bodyport announced receiving U.S. FDA authorization for its Bodyport cardiac scale, a noninvasive biomarker platform. This innovation would assist people with fluid management conditions such as kidney disease or heart failure.

Key Patient Scales Companies:

The following are the leading companies in the patient scales market. These companies collectively hold the largest market share and dictate industry trends.

- Health O Meter/ Pelstar, LLC

- Algen Scale Corp.

- Detecto Scale Company

- Hillrom (Welch Allyn Inc)

- Natus Medical Inc.

- Tanita

- Seca GmbH and Co.Kg

- Wedderburn Scales

- SR Instruments, Inc.

- Doran Scales Inc

Recent Developments

-

In August 2023, Pelstar, LLC, the Health o meter Professional Scales manufacturer, expanded its Safe Patient Handling portfolio by acquiring Bridge Healthcare USA. This acquisition aims to enhance Pelstar's ability to reduce healthcare worker injuries during patient transfers and repositioning.

-

In July 2023, LKL International Bhd (LIB), through its wholly-owned subsidiary, LKL Advance Metaltech Sdn Bhd (LAM), has entered into a distributorship agreement with Seca GmBH & Co KG (SECA). This agreement allows LAM to distribute SECA's medical devices, accessories, spare parts, and software. The partnership enhances LIB's healthcare offerings, leveraging SECA's expertise as a leading manufacturer and distributor of precision patient measurement devices, including medical scales and body composition analyzers.

Patient Scales Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 709.3 million |

|

Revenue forecast in 2030 |

USD 956.0 million |

|

Growth rate |

CAGR of 6.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand; South Korea, Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Health O Meter/ Pelstar LLC; Algen Scale Corp.; Detecto Scale Company; Hillrom (Welch Allyn Inc) Natus Medical Inc.; Tanita; Seca GmbH and Co.Kg; Wedderburn Scales; SR Instruments; Inc.; Doran Scales Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Patient Scales Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global patient scales market report based on type, product, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Electronic

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Floor Scales

-

Body Fat Scales

-

Physician Scales

-

Pediatric Scales

-

Chair Scales

-

Under Bed Scales

-

Bariatric Scales

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Medical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient scales market size was estimated at USD 668.7 million in 2024 and is expected to reach USD 709.3 million in 2025.

b. The global patient scales market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 956.0 million by 2030.

b. North America dominated the patient scales market with a share of over 37.4% in 2024. This is attributable to the growing cases of obesity, increasing adoption of advanced patient scales, and rising chronic diseases.

b. Some of the players operating in this market are Health O Meter/ Pelstar, LLC, Algen Scale Corp., Detecto Scale Company, Hillrom (Welch Allyn Inc), Natus Medical Inc., Tanita, Seca GmbH and Co.Kg, Wedderburn Scales, SR Instruments, Inc., and Doran Scales Inc

b. Key factors that are driving the patient scales market growth include the increasing demand for effective portable weighing devices, increasing development in healthcare infrastructure, and introduction of advanced healthcare technologies

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."