- Home

- »

- Healthcare IT

- »

-

Patient Lateral Transfer Market Size And Share Report, 2030GVR Report cover

![Patient Lateral Transfer Market Size, Share & Trends Report]()

Patient Lateral Transfer Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Air-assisted Transfer Mattress), By Usage (Reusable, Disposable), By End Use (Hospitals, ASC’s), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-345-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Patient Lateral Transfer Market Summary

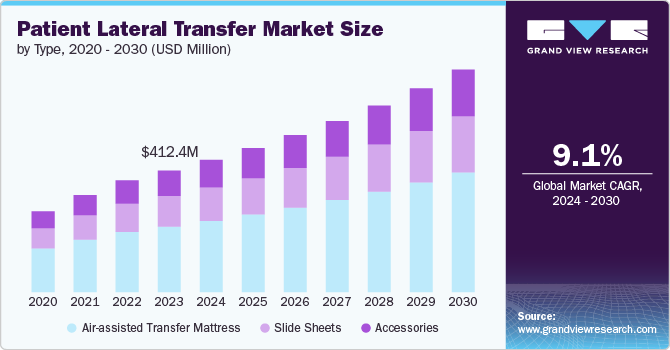

The global patient lateral transfer market size was estimated at USD 412.4 million in 2023 and is projected to reach USD 755.3 million by 2030, growing at a CAGR of 9.1% from 2024 to 2030. The market is affected by several factors. The increasing prevalence of chronic diseases and disabilities is driving demand.

Key Market Trends & Insights

- North America patient lateral transfer market dominated with 39.88% market share in 2023.

- The patient lateral transfer market of the U.S. is expected to grow at a significant rate over the forecast period.

- Based on type, the air-assisted transfer mattress segment held the largest market share of 53.95% in 2023.

- Based on usage, the reusable segment held the largest market share of 54.75% in 2023.

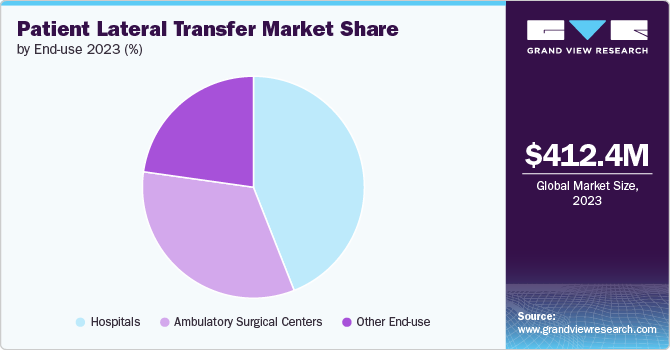

- Based on end use, the hospitals segment held the largest market share of 44.01% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 412.4 Million

- 2030 Projected Market Size: USD 755.3 Million

- CAGR (2024-2030): 9.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Advancements in technology have led to the development of innovative transfer devices. There is also a rising awareness about the importance of safe patient handling practices. Furthermore, stringent regulations mandate the use of proper transfer equipment in healthcare settings.

The growing incidence of chronic diseases and disabilities worldwide has necessitated the need for efficient patient transfer solutions. Conditions such as obesity, musculoskeletal disorders, and neurological impairments often require specialized equipment for safe and comfortable lateral transfers. For instance, in March 2024, the World Health Organization reported that as of 2022, 1 in 8 people worldwide were living with obesity. Furthermore, out of 2.5 billion adults aged 18 and older who were overweight, 890 million were categorized as living with obesity. This rise in chronic conditions has fueled the demand for transfer aids that can ensure both patient comfort and caregiver safety.

Technological advancements have revolutionized the patient transfer market by enabling the development of sophisticated transfer devices that enhance efficiency and reduce the risk of injuries during transfers. Devices such as air-assisted lateral transfer systems, slide sheets, and mechanical lifts have significantly improved the ease and safety of moving patients. These innovations streamline healthcare workflows and contribute to better patient outcomes. In March 2022, Sage unveiled a new mobile air transfer system for operating rooms, the Multi-Position MATS. This device aims to ensure the safe positioning and transferring of patients by OR nurses, minimizing the risk of sliding and injuries in critical tilt positions like lithotomy, Trendelenburg, and more.

There is a growing recognition among healthcare providers about the importance of implementing safe patient handling practices to prevent musculoskeletal injuries among caregivers and ensure optimal patient care. Organizations increasingly invest in training programs and ergonomic assessments to promote proper lifting techniques and use of assistive devices during transfers. Facilities with comprehensive safe patient handling programs experience lower injury rates among staff members. In 2023, Medline invested an extra USD 300 million into its Healthcare Resilience Initiative to enhance the U.S. healthcare supply chain, focusing on distribution, manufacturing, and sustainability. This raises their total investment to USD 2 billion, demonstrating their ongoing commitment to improving customer service.

Regulatory bodies worldwide are enforcing guidelines that mandate healthcare facilities to implement appropriate transfer equipment to safeguard both patients and caregivers. Non-compliance with these regulations can result in penalties or legal consequences for institutions. For instance, in the U.S., agencies like OSHA (Occupational Safety and Health Administration) have specific standards addressing safe patient handling requirements in healthcare settings. Such regulations act as catalysts for hospitals and long-term care facilities to invest in state-of-the-art lateral transfer solutions to ensure compliance with industry standards. Based on information from Midwest Medical Edition, implementing lifting devices is critical for an effective safe patient-handling initiative, significantly lowering the risk of injuries from manual lifting by as much as 95%.

Type Insights

The air-assisted transfer mattress segment held the largest market share of 53.95% in 2023. The growth in the air-assisted transfer mattress segment is driven by the demand for safe patient handling, the rise of obesity and bariatric patients, and a focus on reducing healthcare costs and improving efficiency. These mattresses minimize injury risks and are designed for heavier patients, playing a crucial role in efficient healthcare service delivery. Moreover, they alleviate the need for manual lifting, thus reducing worker's compensation claims and enhancing operational efficiency. In September 2023, Pelstar LLC, together with its Health o meter Professional, McAuley Medical, and Bridge Healthcare divisions, launched the innovative BridgeAir mattress, revolutionizing patient transfer and care in healthcare settings.

The slide sheets segment is expected to grow at the fastest CAGR over the forecast period. The growth in the slide sheets segment within the market is largely driven by a growing emphasis on patient safety and the reduction of injury risks in healthcare settings. These sheets offer a safe, efficient, and cost-effective solution for transferring patients, appealing to many healthcare facilities. In July 2022, research featured in the International Journal of Industrial Ergonomics showed significant reductions using slide film over standard sheets: peak force dropped by 38.1% and force impulse by 40.6%. Vertical Ground Reaction Forces (GRF) were also 9.8% lower, demonstrating that light friction-reducing devices greatly reduce the boosting force required.

Usage Insights

The reusable segment held the largest market share of 54.75% in 2023. The reusable segment in patient lateral transfer is primarily driven by the increasing focus on sustainability and cost-effectiveness in healthcare facilities. Hospitals and healthcare institutions are increasingly adopting reusable patient transfer equipment to reduce waste generation, lower overall costs, and minimize environmental impact. A study highlighted in the European Journal of Public Health in February 2023 revealed that adopting reusable healthcare products can significantly mitigate environmental impacts across various categories, though it may not decrease water consumption. The magnitude of these benefits varies depending on the type of product.

The disposable segment is expected to grow at the fastest CAGR over the forecast period. The disposable segment in patient lateral transfer is driven by factors such as convenience, infection control, and hygiene considerations. Disposable transfer sheets and devices offer a single-use solution that eliminates the need for cleaning and disinfection between patients, reducing the risk of cross-contamination and healthcare-associated infections.SPH Medical's Air Powered Transfer and Positioning System, available in various widths, ensures patient and caregiver safety globally. This leading solution includes disposable options, high-quality control, and expert education for hospital safety programs.

End Use Insights

The hospitals segment held the largest market share of 44.01% in 2023. In hospitals, key factors encouraging the adoption of patient lateral transfer include enhancing patient safety and comfort, minimizing injuries to patients and healthcare staff, increasing efficiency in patient handling, and adhering to patient care regulations. According to the World Health Organization, as many as 72% of nurses experience non-specific chronic low back pain. This type of low back pain contributes to absenteeism among health workers, reduced efficiency, a greater economic burden, diminished quality of life, and burnout.

Musculoskeletal injuries, prevalent among healthcare workers due to patient handling, have led to the prioritization of safe patient handling programs and the investment in lateral transfer devices for better and safer transfers. Moreover, the focus on quality of care and patient experience has driven the adoption of best practices and specialized equipment for patient handling.

The ambulatory surgical centers segment is expected to witness the fastest CAGR over the forecast period. Ambulatory surgery centers (ASCs) focus on efficient, high-quality outpatient surgical care, with a rising demand for minimally invasive procedures. This demand necessitates precise patient positioning and transfer, prompting ASCs to invest in advanced transfer equipment and staff training. Regulatory demands for patient safety during procedures underscore the significance of proper handling practices in ASCs. For instance, The SimPull is an automated, mobile device designed to simplify patient transfers, allowing healthcare workers to focus on other tasks. It's easy to use, works with all sheets, and enhances efficiency in care settings.

Regional Insights

North America patient lateral transfer market dominated with 39.88% market share in 2023. In North America, the market is adopting advanced technologies like motorized and air-assisted devices, driven by a focus on patient safety and healthcare quality. The FDA in the U.S. ensures compliance with safety regulations and promotes ergonomic solutions to prevent injuries among healthcare workers. In March 2024, Medline acquired AG Cuffill from Hospitech Respiration, enhancing patient safety in clinical settings by accurately measuring airway cuff pressures, particularly vital during patient repositioning to prevent complications.

U.S. Patient Lateral Transfer Market Trends

The patient lateral transfer market of the U.S. is expected to grow at a significant rate over the forecast period. The U.S. market is characterized by a high level of competition among key players, leading to continuous type advancements and technological innovations. The country’s robust healthcare infrastructure and reimbursement policies influence the market dynamics significantly. Moreover, factors such as the Affordable Care Act (ACA) have emphasized the importance of patient safety and quality care, driving healthcare facilities to invest in efficient transfer solutions.

There is a rising preference for disposable slide sheets and transfer belts in the U.S., reflecting a shift towards cost-effective and user-friendly transfer methods. In April 2022, AliMed, Inc., a medical supply company from Massachusetts, launched a disposable version of its PPS Glide Air-Assisted Lateral Transfer System. This new patient transfer device reduces the need for physical effort and staff, lowering the chances of injuries and infections, and enhancing patient comfort.

Europe Patient Lateral Transfer Market Trends

Europe patient lateral transfer market was identified as a lucrative region in this industry. In Europe, the market is characterized by strict regulations concerning patient handling practices. These regulations are aimed at reducing work-related musculoskeletal disorders (MSDs) among healthcare workers. For example, countries like Germany and France have specific guidelines that require the use of mechanical aids for patient transfers to ensure staff safety and prevent injuries.

This regulatory environment has led to an increase in the adoption of powered lateral transfer devices and slide sheets in European healthcare facilities. There is a growing recognition of the importance of early mobilization in patient care, which has driven the demand for innovative transfer solutions in the region. For instance, GBUK Group Ltd provides lateral transfer boards designed for smooth and secure patient transfers, featuring latex-free, easy-to-clean surfaces with anti-slip pads. Available in various sizes, these durable, lightweight boards with handles are suitable for healthcare environments in the UK and internationally.

Asia Pacific Patient Lateral Transfer Market Trends

The patient lateral transfer market of Asia Pacific is anticipated to witness the fastest CAGR from 2024 to 2030. The Asia Pacific region is experiencing rapid growth in the market due to increasing investments in healthcare infrastructure and rising awareness about safe patient handling practices. Countries such as Japan and South Korea are at the forefront of implementing advanced transfer technologies to enhance patient comfort and reduce caregiver strain.

A strong emphasis on respect for patients’ dignity influences type preferences in this region, leading to a demand for gentle and non-invasive transfer methods. Highlighting a surge in sales of air-assisted lateral transfer devices in Asia Pacific, indicating a shift towards more sophisticated transfer solutions. For instance, the AirPal system allows for safe and efficient patient transfers and repositions by using a bed of air, produced by air flowing through a perforated mattress, to lift patients.

Key Patient Lateral Transfer Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their types and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Patient Lateral Transfer Companies:

The following are the leading companies in the patient lateral transfer market. These companies collectively hold the largest market share and dictate industry trends.

- Arjo

- Medline Industries, Inc.

- AliMed

- HoverTech International.

- EZ Way Inc.

- Haines Medical Australia

- Patient Positioning Systems, LLC.

- Stryker

- Agiliti Health, Inc.

- Wy’East Medical.

Recent Developments

-

In February 2024, Agiliti Inc. was acquired by Thomas H. Lee Partners, L.P. (THL) in a deal valuing the company at USD 2.5 billion, with the purchase price set at USD 10.00 per share for stocks not already owned by THL and certain executives and directors.

-

In January 2024, a voluntary recall was initiated by Sizewise Manufacturing, under Agiliti, for their Bari Lift and Transfer patient transfer device. This measure was taken because of the potential for an increased risk of injuries to patients associated with its use.

-

In August 2022, Brightmark teamed up with Jamar Health Products to launch a recycling initiative targeting plastic medical waste. Their plan focuses on transforming Jamar’s Patran slide sheets into environmentally friendly products, including low-carbon fuels and recyclable plastics, showcasing an innovative approach to reducing medical waste's environmental impact.

Patient Lateral Transfer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 449.0 million

Revenue forecast in 2030

USD 755.3 million

Growth rate

CAGR of 9.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, usage, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Arjo; Medline Industries, Inc.; AliMed; HoverTech

International.; EZ Way Inc.; Haines Medical Australia.

Patient Positioning Systems, LLC.; Stryker; Agiliti Health,

Inc.; Wy’East Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Lateral Transfer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global patient lateral transfer market report based on type, usage, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Air-assisted Transfer Mattress

-

Regular Mattress

-

Split-leg Mattress

-

Half Mattress

-

-

Slide Sheets

-

Accessories

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The patient lateral transfer market size was estimated at USD 412.43 million in 2023 and is expected to reach USD 449.0 million in 2024.

b. The patient lateral transfer market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 755.3 million by 2030.

b. The air-assisted transfer mattress segment held the largest market share of 53.95% in 2023. The growth in the air-assisted transfer mattress segment is driven by the demand for safe patient handling, the rise of obesity and bariatric patients, and a focus on reducing healthcare costs and improving efficiency.

b. Some key players operating in the patient lateral transfer market include Arjo; Medline Industries, Inc.; AliMed; HoverTech International.; EZ Way Inc.; Haines Medical Australia., Patient Positioning Systems, LLC.; Stryker; Agiliti Health, Inc.; Wy’East Medical.

b. Key factors that are driving the patient lateral transfer market growth include rising awareness about the importance of safe patient handling practices and increasing prevalence of chronic diseases and disabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.