- Home

- »

- Automotive & Transportation

- »

-

Passenger Cars Market Size, Share & Growth Report, 2030GVR Report cover

![Passenger Cars Market Size, Share & Trends Report]()

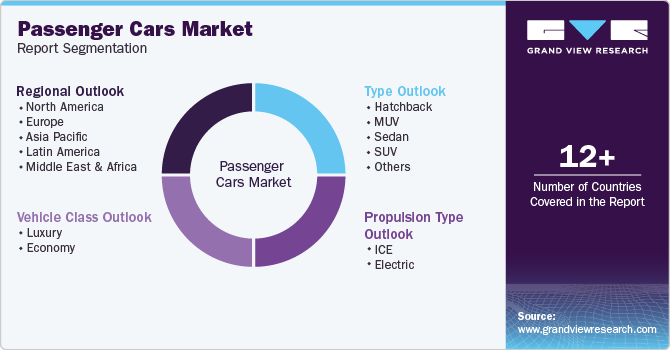

Passenger Cars Market (2024 - 2030) Size, Share & Trends Analysis Report By Propulsion Type (ICE, Electric), By Vehicle Class (Luxury, Economy), By Type (Hatchback, MUV, Sedan, SUV), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-382-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Passenger Cars Market Summary

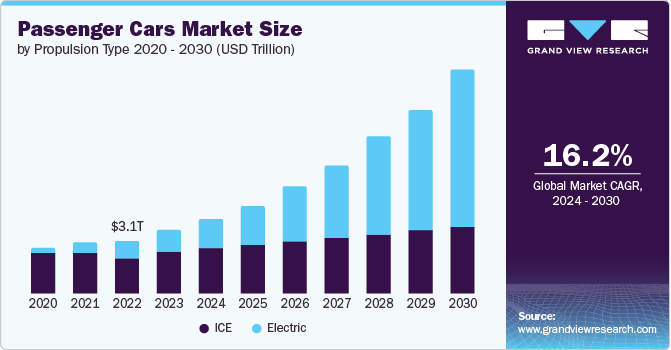

The global passenger cars market size was estimated at USD 3,415.11 billion in 2023 and is projected to reach USD 9,664.49 billion by 2030, growing at a CAGR of 16.2% from 2024 to 2030. The market growth is attributed to the rapid development and integration of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies.

Key Market Trends & Insights

- Asia Pacific passenger cars market accounted for a revenue share exceeding 62.2% in 2023.

- The passenger cars market in China accounted for a revenue share exceeding 33.4% in 2023.

- By propulsion type, the ICE segment accounted for the largest market share of nearly 76.0% in 2023.

- By vehicle class, the economy segment accounted for the largest market share of nearly 87.0% in 2023.

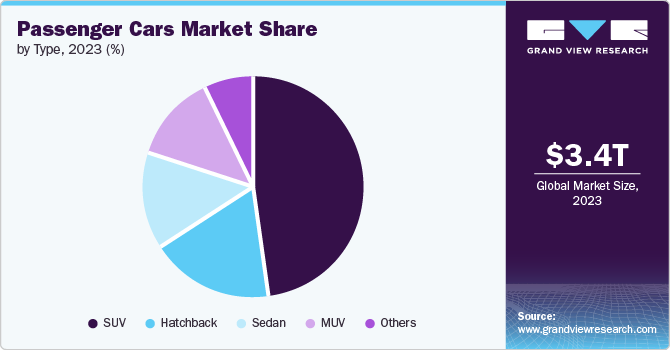

- By type, the SUV segment accounted for the largest market share, exceeding 48.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3,415.11 Billion

- 2030 Projected Market Size: USD 9,664.49 Billion

- CAGR (2024-2030): 16.2%

- Asia Pacific: Largest market in 2023

These innovations have significantly transformed the passenger car by enhancing safety and driving experience. With the integration of features such as adaptive cruise control, lane-keeping assist, and autonomous parking capabilities, consumers are increasingly drawn to the convenience and safety benefits offered by these technologies.

In March 2023, the California Department of Motor Vehicles stated that the number of miles driven by autonomous vehicles on public roads in the state increased 21% y/y in 2022. As these advanced systems become more sophisticated and reliable, they are instilling a sense of trust and confidence in potential car buyers, leading to increased demand. The assurance of a safer driving experience and reduced risk of accidents is a key driving force behind the growing demand for passenger cars across the globe.

Another significant factor, such as rapid economic development in emerging countries from Asia Pacific and Latin America, is driving the market growth. These regions have been experiencing robust economic growth, leading to a considerable increase in disposable incomes among the population. As a result, consumers in these areas are increasingly able to afford and aspire to own passenger cars, marking a significant shift in consumer preferences from traditional modes of transportation to personal vehicles. In addition, the growing middle-class population in Asia Pacific and Latin America has become a crucial driving force behind the escalating demand for passenger cars. As more individuals enter the middle-income bracket, the aspirations for improved standards of living and enhanced mobility options have intensified. With a burgeoning middle-class population that values mobility and convenience, there is a growing demand for passenger cars.

Fluctuations in the raw material prices, including steel, aluminum, and petroleum-based products, play a pivotal role in shaping the global demand for passenger cars. As these materials constitute the backbone of automobile manufacturing, any significant price shifts can substantially impact the overall production costs. With manufacturers heavily reliant on these materials for vehicle construction, an increase in raw material prices can trigger a surge in manufacturing costs, subsequently prompting automakers to adjust their pricing strategies. As a result, fluctuating raw material prices restrain the growth of the passenger cars market.

The integration of advanced infotainment systems, connectivity features, and in-car digital services has emerged as a pivotal factor in influencing the purchase decisions of modern consumers. As the world becomes increasingly interconnected, there is a growing demand for vehicles that offer seamless connectivity, entertainment options, and personalized driving experiences. This demand is expected to fuel the growth of passenger cars globally from 2024 to 2030. For instance, in August 2022, Mitsubishi Motors Corporation announced the launch of the new Xpander Cross, a crossover MPV featuring a more robust design and offering improved driving performance. The new model featured a refreshed rear and front design in line with the robust SUV styling and was designed to ensure enhanced comfort and a secure ride.

Moreover, the ongoing development of sophisticated digital and connectivity solutions has led to the creation of a diverse range of in-car services, including navigation assistance, real-time traffic updates, and personalized entertainment options. These features enhance the overall driving experience and also contribute to improved safety and convenience, making them a significant selling point for modern passenger cars.

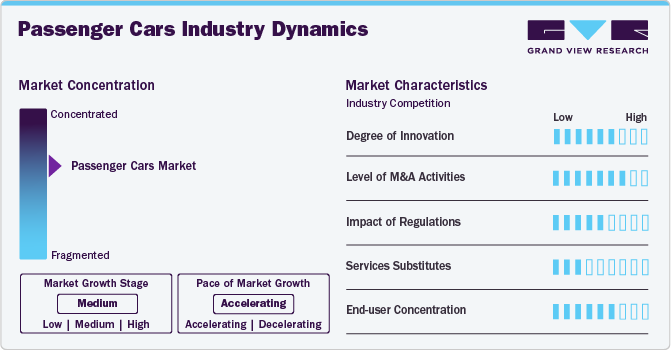

Industry Dynamics

The market growth stage is medium and the pace of growth is accelerating. The passenger cars market is characterized by a high degree of innovation owing to integration with smart technologies, allowing for connectivity and communication with other components in the system. The integration often includes features such as remote monitoring and control through Internet of Things (IoT) platforms.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the focus on developing energy-efficient passenger cars, customizable passenger cars with modular designs, and the need to consolidate in a rapidly growing market.

The market for passenger cars is also subject to several regulatory considerations. The regulations are essential for manufacturers and users to ensure propulsion type safety, reliability, and legal compliance. Manufacturers need to follow regulations related to propulsion type safety standards, environmental regulations, energy efficiency standards, CE marking, and labeling, among others.

The threat of substitutes for passenger cars is higher in the market. Linear passenger cars are chosen based on factors such as precision, speed, force capacity, and environmental considerations. The threat of substitutes varies across industries and applications within the passenger car market. Market players need to continually innovate and offer unique value propositions to mitigate the impact of potential substitutes.

End user concentration is a significant factor in this market. Several end user industries are driving demand for passenger cars. Staying abreast of technological developments and market trends is crucial for businesses operating in this space.

Propulsion Type Insights

The ICE segment accounted for the largest market share of nearly 76.0% in 2023. The global automotive industry has been significantly influenced by the continued demand for personal transportation, especially in developing economies, and has remained a primary driving force. ICE cars have historically been more affordable compared to electric vehicles, making them a preferred choice for many consumers, particularly in regions where infrastructure for electric vehicles is still developing. The existing infrastructure for gasoline and diesel fuel distribution has played a crucial role in sustaining the dominance of ICE passenger cars globally. Additionally, the versatility of ICE cars, including their ability to function in various weather conditions and terrains, has further bolstered their demand across the globe.

The electric segment is expected to register the fastest CAGR from 2024 to 2030. The stringent environmental regulations and ambitious carbon emission targets set by various countries have compelled automakers to prioritize EV production, thus accelerating the shift from traditional combustion engines. For instance, in January 2021, Honda Motor Co., Ltd. and Komatsu Ltd. signed a joint development agreement aimed at creating a battery-sharing system by leveraging Honda Motor Co., Ltd.'s Mobile Power Pack (MPP) batteries. The primary focus was on providing these batteries for use in diverse EVs. Furthermore, advancements in battery technology, leading to enhanced driving ranges and reduced charging times, have alleviated range anxiety concerns, fostering greater confidence in the feasibility of electric vehicles and encouraging more widespread adoption.

Vehicle Class Insights

The economy segment accounted for the largest market share of nearly 87.0% in 2023. In many regions across the globe, the middle class is expanding, resulting in increased purchasing power for individuals who aspire to own personal vehicles. The affordability and cost-effectiveness of economy passenger cars make them an attractive option for this burgeoning consumer base. These vehicles are designed with fuel efficiency in mind, offering cost savings during the initial purchase and also in terms of day-to-day operational expenses. As fuel prices continue to fluctuate, the emphasis on fuel efficiency becomes a critical factor in the decision-making process for consumers seeking economical transportation solutions. As a result, such factors drive the growth of the economy segment across the globe.

The luxury segment is anticipated to register a significant growth from 2024 to 2030. The rising disposable incomes and an expanding affluent consumer base have fueled the appetite for high-end automobiles. As economies continue to grow, particularly in emerging markets, more individuals find themselves in a position to afford luxury vehicles, contributing to increased sales. Moreover, the allure of status and prestige associated with luxury cars remains a powerful driver, especially in cultures where conspicuous consumption is highly valued. The integration of advanced driver-assistance systems and connectivity features has become a key differentiator for luxury brands, attracting discerning buyers who seek not only opulence but also the latest in automotive technology. The convergence of luxury and technological innovation has positioned these vehicles as symbols of modernity and sophistication, driving the sustained demand observed across the global luxury cars segment.

Type Insights

The SUV segment accounted for the largest market share, exceeding 48.0% in 2023. The inherent versatility and adaptability of SUVs have appealed to a diverse range of consumers. SUVs offer a compelling combination of spaciousness, comfort, and off-road capabilities, making them suitable for various lifestyles and terrains. Additionally, the growing emphasis on safety and advanced technological features has prompted many consumers to opt for SUVs, as these vehicles often incorporate the latest safety innovations and cutting-edge infotainment systems. SUV manufacturers adopt strategies to stay competitive and meet evolving consumer demands for innovative and sustainable products. For instance, in August 2022, Mercedes-Benz Group AG announced the new EQS SUV, the first all-electric luxury SUV from Mercedes-EQ vehicle line-up. The SUV’s avant-garde, luxurious interior offers plenty of space and comfort. As a result, such factors significantly propelled the global demand for SUV segment in recent years.

The sedan segment is expected to grow at the fastest CAGR from 2024 to 2030. The surge in the popularity of sedans can be attributed to the inherent versatility and adaptability of sedans, which have appealed to a diverse range of consumers. These vehicles offer a compelling combination of spaciousness, comfort, and off-road capabilities, making them suitable for various lifestyles and terrains. For instance, in December 2023, BYD Co. Ltd. unveiled a pure electric sports sedan, named BYD SEAL. It is the second Ocean series model launched in Mexico, following the BYD Dolphin in September 2023. The BYD SEAL includes innovative features, including the company's Blade battery technology, which is known for its safety and durability.

Regional Insights

The North American passenger cars market is expected to grow at a CAGR of 19.5% in 2024-2030. A robust economy plays a significant role in driving the demand for passenger cars in North America. Rising disposable income and higher employment rates are driving consumers' purchasing power and willingness to invest in personal cars in North America.

U.S. Passenger Cars Market Trends

The growth of the passenger cars market in the U.S. is due to growing innovations in automotive technology, such as electric vehicles, advanced safety systems, autonomous driving features, and infotainment options. These technological advancements attract customers looking for modern, feature-rich vehicles in the U.S. market. Consumers are increasingly prioritizing safety, comfort, and fuel efficiency, driving demand for SUVs, crossovers, and fuel-efficient cars in the market.

Asia Pacific Passenger Cars Market Trends

Asia Pacific passenger cars market accounted for a revenue share exceeding 62.2% in 2023. The Asia Pacific region has witnessed a surge in demand for passenger cars owing to the driving forces of the rapid economic growth in countries such as China, India, and Southeast Asian nations, leading to an expansion of the middle class and a subsequent increase in disposable incomes.

The passenger cars market in China accounted for a revenue share exceeding 33.4% in 2023. The growth of passenger cars in China is attributed to the burgeoning urbanization in the region, which has led to an increased need for convenient and reliable transportation, spurring the preference for passenger cars over public transportation.

The Japan passenger cars market is projected to grow at a CAGR of 10.1% from 2023 to 2030. The cultural emphasis on individual mobility and the convenience of personal transportation are particularly contributing to a high demand for passenger cars in Japan.

The passenger cars market in India is expected to witness growth during the forecast period. The growing infrastructural development, including the construction of improved roads and highways, has further facilitated the adoption of cars, making them a more practical mode of commuting in India.

Europe Passenger Cars Market Trends

The passenger cars market in Europe was valued at USD 772.97 billion in 2023 and is anticipated to register the fastest CAGR from 2024 to 2030. Stringent environmental regulations imposed by the European Union have prompted an accelerated shift towards electric and hybrid vehicles. As a result, this is anticipated to increase the demand for passenger cars in Europe over the forecast period.

The passenger cars market in the UK is projected to grow at a CAGR of 22.4% from 2024 to 2030. The push for reduced carbon emissions and the implementation of ambitious targets for a greener future have the UK to offer incentives and subsidies for the purchase of electric cars, fostering a surge in demand for sustainable vehicles.

The Germany passenger cars market is projected to grow at a CAGR of 21.8% from 2024 to 2030. The proliferation of smart mobility solutions, including ride-sharing services and integrated transport networks, has influenced the way Germany perceive car ownership, with many opting for shared mobility solutions over traditional car ownership.

The passenger cars market in Germany is expected to grow from 2024 to 2030. Growing concerns over the rising levels of vehicular emissions have triggered a paradigm shift from conventional vehicles to EVs, and the incumbents of the automotive industry are responding to this shift promptly by introducing new, innovative EVs for both personal and commercial applications in France.

Latin America Passenger Cars Market Trends

The Latin America passenger cars market accounted for a share over 5.1% of the global revenue in 2023. In recent years, Latin America has witnessed a notable shift in buyer trends for EVs, reflecting a growing awareness of environmental concerns and advancements in EV technology.

The Brazil passenger cars market is anticipated to grow during the forecast period. The primary drivers of passenger cars in Brazil are fuelled by a robust economic landscape and increasing urbanization. The demand for passenger cars in the country is experiencing significant growth due to a burgeoning middle class and a shift towards a more consumer-driven economy.

The passenger cars market in Mexico is projected to grow at a considerable CAGR from 2024 to 2030. The favourable economic conditions and financing options contribute to the robust growth of the automotive sector in Mexico, making it a key market for both domestic and international automotive manufacturers.

Middle East & Africa Passenger Cars Market Trends

The Middle East & Africa passenger cars market is expected to grow at a CAGR 10.5% from 2024 to 2030. The market is anticipated to grow owing to rising government expenditures in infrastructure development and large infrastructure projects. The construction industry is expanding, particularly in emerging nations, due to numerous residential, infrastructure, and non-residential growth opportunities.

The passenger cars market in Saudi Arabia is driven by government initiatives to promote the manufacturing and adoption of EVs in the country. As a result, the manufacturers recognize the potential the region holds for EVs owing to its rising urbanization rate and population. This increases demand for passenger cars in the country.

The South Africa passenger cars market is expected to grow from 2024 to 2030. The startup ecosystem in Africa is developing as EV startups are looking to expand their operations in the region. For instance, Nigerian startup Metro Africa Xpress aims to deploy electric cars in eight African nations, including Cameron, Uganda, and Egypt by 2023. Metro Africa Express is currently present in Nigeria and Ghana.

Key Passenger Cars Company Insights

Some of the key players operating in the market include Volkswagen Group; General Motors; Tesla; Ford Motor Company; Mercedes-Benz; AUDI AG.; and BMW AG.

-

General Motors has been strategically focusing on electric and hybrid vehicle development, aiming to align with the growing consumer demand for eco-friendly and energy-efficient options.

-

Tesla is pushing traditional automakers to accelerate their electrification strategies. This heightened rivalry has prompted a wave of investments in research and development, as well as collaborations within the automotive industry to stay competitive in the evolving landscape.

Hyundai Motor India; Suzuki; Nissan Motor Co., Ltd.; Renault Group; TATA Motors; and Kia India Pvt. Limited. are some of the emerging market participants.

-

Suzuki has expanded its global presence through a combination of competitive pricing, quality offerings, and strategic partnerships.

-

Renault Group provides vehicles under different automobile segments, including SUVs, passenger vehicles, MPVs, commercial vehicles, and electric vehicles. The company markets its products under the RENAULT, DACIA, ALPINE, RSM, and LADA brands.

Key Passenger Cars Companies:

The following are the leading companies in the passenger cars market. These companies collectively hold the largest market share and dictate industry trends.

- AUDI AG.

- BMW AG

- Ford Motor Company

- General Motors

- Honda Cars India Limited

- Suzuki

- Hyundai Motor India

- Kia India Pvt. Limited.

- Mercedes-Benz

- Nissan Motor Co., Ltd.

- Renault Group

- TATA Motors

- Tesla

- Volkswagen Group

Recent Developments

-

In June 2024, Tata Motors Limited launched Altroz Racer, a sports model in the company’s hatchback segment. The key highlights of the car include a 1.2L turbo petrol engine, torque of 170 Nm @ 1750 to 4000 rpm, power of 120 Ps @ 5500 rpm, 360-degree camera, and six airbags, among others.

-

In September 2023, Mercedes-Benz Group AG announced its entry into the autonomous driving industry with the launch of its DRIVE PILOT system in the U.S. by MY2024. DRIVE PILOT is a Level 3 automated driving system developed by Mercedes-Benz. This means the car can handle certain driving tasks on its own under specific conditions. This innovative technology marks a significant step toward Level 3 conditionally automated driving, offering drivers a glimpse into the future of hands-free motoring. DRIVE PILOT will only be available in California and Nevada in late 2023.

-

In January 2023, BYD Co. Ltd. launched its Yangwang sub-brand. The initiative was aimed at the premium electric vehicle (EV) market, Yangwang launched two flagship models, namely the U8 luxury off-road SUV and the U9 all-electric supercar. BYD plans to develop a range of premium EVs under the Yangwang brand, leveraging the e4 Platform's versatility and performance.

-

In August 2022, Mercedes-Benz Group AG announced the new EQS SUV, the first all-electric luxury SUV from Mercedes-EQ vehicle line-up. The SUV’s avant-garde, luxurious interior offers plenty of space and comfort.

Passenger Cars Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,929.33 billion

Revenue forecast in 2030

USD 9,664.49 billion

Growth rate

CAGR of 16.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

propulsion type, vehicle class, type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AUDI AG.; BMW AG; Ford Motor Company; General Motors; Honda Cars India Limited; Suzuki; Hyundai Motor India; Kia India Pvt. Limited.; Mercedes-Benz; Nissan Motor Co., Ltd.; Renault Group; TATA Motors; Tesla; Volkswagen Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passenger Cars Market Report Segmentation

The report forecasts volume & revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the passenger cars market report based on propulsion type, vehicle class, type, and region:

-

Propulsion Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Vehicle Class Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Luxury

-

Economy

-

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Hatchback

-

MUV

-

Sedan

-

SUV

-

Others

-

-

Region Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global passenger cars market size was estimated at USD 3,415.11 billion in 2023 and is expected to reach USD 3,929.33 billion in 2024.

b. The global passenger market is expected to grow at a compound annual growth rate of 16.2% from 2024 to 2030 to reach USD 9,664.49 billion by 2030.

b. The economy segment accounted for the largest market share of 87.5% in 2023. In many regions across the globe, the middle class is expanding, resulting in increased purchasing power for individuals who aspire to own personal vehicles. The affordability and cost-effectiveness of economy passenger cars make them an attractive option for this burgeoning consumer base.

b. Some key players operating in the passenger cars market include Volkswagen Group; General Motors, Tesla, Ford Motor Company, AUDI AG., and BMW AG among others.

b. Key factors that are driving the market growth include advancements in battery technology, driving improved range and affordability, and a growing infrastructure for electric vehicle charging stations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.