- Home

- »

- Homecare & Decor

- »

-

Party Supply Rental Market Size, Share, Growth Report 2030GVR Report cover

![Party Supply Rental Market Size, Share & Trends Report]()

Party Supply Rental Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tables & Chairs, Tents & Canopies, Crockery & Cutlery), By Event Type (Corporate Events, Weddings, Private Parties), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-431-2

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Party Supply Rental Market Summary

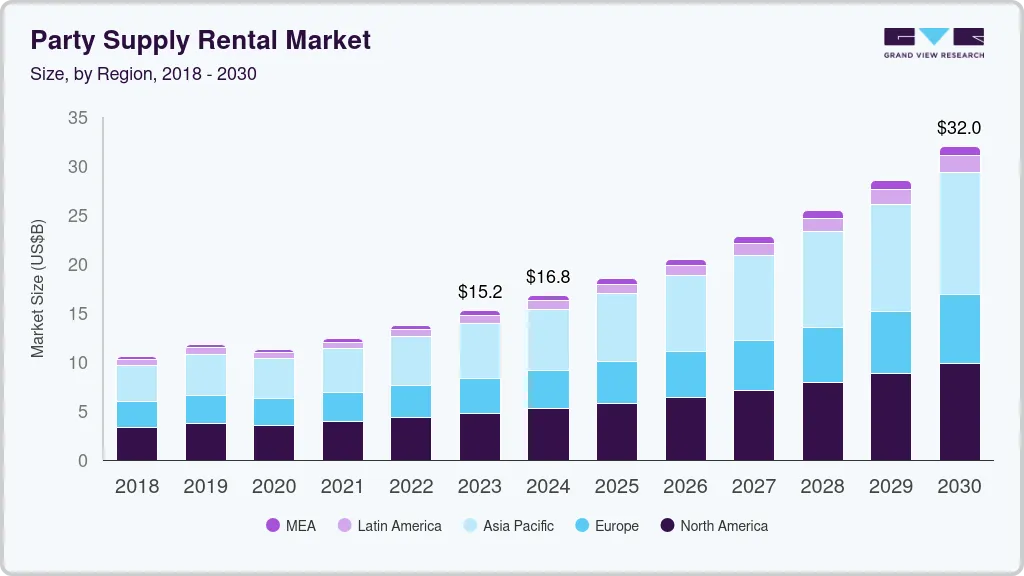

The global party supply rental market size was estimated at USD 15,225.4 million in 2023 and is projected to reach USD 32,025.9 million by 2030, growing at a CAGR of 11.2% from 2024 to 2030. The increasing demand for party supply rentals can be attributed to the growing culture of celebrating milestones and special occasions.

Key Market Trends & Insights

- Asia Pacific party supply rental market accounted for a revenue share of around 37% of the global revenue in 2023.

- By product, the tables & chairs accounted for a revenue share of around 29.65% in 2023.

- By event type, the weddings accounted for a revenue share of around 34.84% in the 2023.

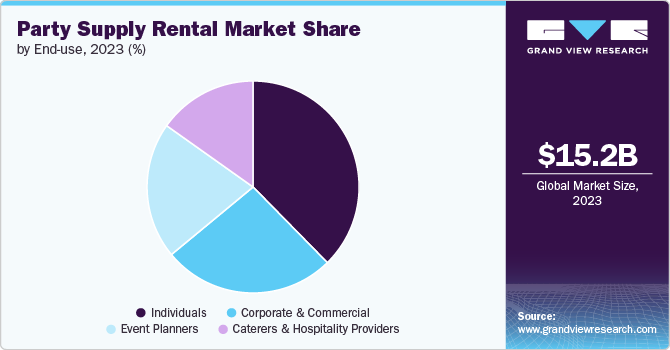

- By end-use, the individuals accounted for a revenue share of around 36.88% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15,225.4 Million

- 2030 Projected Market Size: 32,025.9 Million

- CAGR (2024-2030): 11.2%

- Asia Pacific: Largest market in 2023

Whether it’s weddings, birthdays, anniversaries, or corporate events, the need for organized, well-decorated, and themed celebrations has surged. In many cultures, significant life events are celebrated with grandeur, often necessitating elaborate decorations, seating arrangements, lighting, and catering equipment, all of which are typically sourced through rental services.

Social media has played a crucial role in the increasing demand for party supply rentals. Platforms like Instagram, Pinterest, and TikTok have transformed the way people view and plan events. The desire to create "Instagram-worthy" events has driven individuals and businesses to invest in more elaborate setups, often requiring the rental of specialized equipment and decorations.

People are now more inclined to host visually stunning events that can be shared on social media platforms, influencing their peers and followers. This trend has not only increased the frequency of such events but has also escalated the demand for unique and premium-quality party supplies. A survey conducted by The Knot in 2022 revealed that 78% of couples used social media as a source of inspiration for their weddings, with many opting for custom and themed decorations, increasing the demand for rental services.

The wedding industry has always been a major driver of the market. The demand for wedding rentals, including tents, tables, chairs, linens, lighting, and dance floors, has remained robust. As couples increasingly seek personalized and unique wedding experiences, the demand for customized and themed rentals has also risen. Destination weddings and outdoor weddings, in particular, have seen a surge in popularity, requiring specialized rental equipment that can accommodate various weather conditions and locations. The desire for unique, picturesque settings has driven the need for high-quality, aesthetic rental supplies.

The wedding industry has rapidly grown into the country's fourth-largest sector, fueled by factors such as increasing urbanization, higher disposable incomes, the rise of wedding technology (wed-tech), and the strong influence of social media. According to the latest annual report from WedMeGood, a leading wedding planning website and app in India, the Indian wedding industry generated revenue of US$ 57.1 billion in 2023, marking a significant 26.4% growth from the previous year. This detailed report, which draws on insights from over 2400 brides and grooms as well as feedback from 500 wedding vendors, sheds light on the shifting trends and key dynamics that are shaping the future of the Indian wedding industry.

Product Insights

The tables & chairs accounted for a revenue share of around 29.65% in 2023. It has an essential role in virtually all types of events, from weddings and corporate gatherings to social parties and community events. These items are fundamental for accommodating guests and creating a comfortable, organized environment. Renting tables and chairs offers a cost-effective solution, especially for large-scale events where purchasing would be prohibitively expensive. Additionally, the variety in styles, sizes, and designs available through rentals allows event planners to tailor the setup to match specific themes and aesthetics.

The demand for heating & cooling equipment is projected to grow at a CAGR of 13.0% from 2023 to 2030. Due to the increasing demand for outdoor events and the need to ensure guest comfort regardless of weather conditions. As more events, such as weddings, corporate functions, and festivals, are held outdoors, the necessity for temperature control has risen sharply. Renting heating and cooling equipment provides a flexible, cost-effective solution for event organizers to maintain a comfortable environment in varying climates.

Event Type Insights

The weddings accounted for a revenue share of around 34.84% in the 2023. The sheer scale and frequency of weddings, which often require a wide range of rental items, from tables and chairs to specialized décor, lighting, and sound systems. Weddings are typically large, meticulously planned events that demand high-quality, customized setups to create a memorable experience. Renting allows couples to access premium items that might be too expensive to purchase for a single use. Additionally, the growing trend of themed and destination weddings has increased the need for specialized rental equipment to match specific aesthetics and venues.

The demand for party supply in public events is projected to grow at a CAGR of 12.7% from 2024 to 2030. The increasing number and scale of festivals, concerts, community gatherings, and large-scale sporting events. As public events attract larger crowds, the need for extensive rental services-such as seating, staging, lighting, sound systems, and crowd control barriers-has grown significantly. Renting offers event organizers a cost-effective and flexible solution to accommodate the diverse and substantial logistical requirements of these events. Additionally, the rise of government-sponsored and corporate-sponsored public events, combined with the growing popularity of outdoor and themed festivals, has further driven demand in this segment, making it one of the fastest-growing areas in the market.

End-use Insights

The individuals accounted for a revenue share of around 36.88% in 2023.The growing trend of hosting personalized and themed private events, such as birthdays, anniversaries, baby showers, and intimate gatherings. As more people seek to create memorable experiences without the hassle and expense of purchasing supplies, renting offers a convenient and cost-effective solution. The wide variety of rental options available allows individuals to customize their events with unique décor, furniture, and entertainment equipment tailored to their specific themes and preferences.

The demand among event planners is estimated is projected to grow at a CAGR of 12.4% from 2024 to 2030. As events become more sophisticated and demand for personalized, high-impact experiences rises, event planners turn to rental services to provide customized solutions without the burden of purchasing and storing equipment. Additionally, the growth of the event planning industry itself, driven by corporate events, weddings, and large-scale social gatherings, further fuels the rapid expansion of this segment.

Regional Insights

The party supply rental market in North America held around 31% of the global revenue in 2023. There is an increasing trend towards hosting elaborate and customized events, such as weddings, corporate functions, and social gatherings, which require a diverse range of rental items like décor, furniture, and audio-visual equipment. The convenience and cost-effectiveness of renting these items, rather than purchasing and storing them, appeal to both individuals and businesses. Additionally, the rise of event planning services and the growing popularity of themed and outdoor events further drive the need for specialized rental products. Advances in technology and online rental platforms have also made it easier for consumers to access and book these services.

U.S. Party Supply Rental Market Trends

The party supply rental market in the U.S. is expected to grow at a CAGR of 10.8% from 2024 to 2030.The increasing frequency and scale of personal and corporate events, such as weddings, birthdays, and corporate functions, is a significant contributor. As events become more elaborate, there is a rising demand for high-quality rental items, including décor, furniture, and audio-visual equipment. Additionally, the growing trend of themed and outdoor events necessitates specialized rental services. The expansion of e-commerce platforms has also made it easier for consumers to access and book rentals, further fueling market growth.

Asia Pacific Party Supply Rental Market Trends

Asia Pacific party supply rental market accounted for a revenue share of around 37% of the global revenue in 2023. The region's burgeoning event industry, driven by rapid urbanization, increasing disposable incomes, and a growing middle class with a rising appetite for elaborate celebrations. The region has witnessed a surge in weddings, corporate events, and public gatherings, which drive demand for a wide range of party supplies. Additionally, the growing trend of hosting high-profile and destination events in countries like India, China, and Japan contributes to the region's dominant market position. The expansion of online rental platforms and the increasing focus on personalized and themed events further bolster the market's growth in Asia Pacific.

Europe Party Supply Rental Market Trends

The party supply rental market in Europe is projected to grow at a CAGR of 10.4% from 2024 to 2030. The trend towards themed and outdoor events in various European countries requires specialized equipment and décor that rental services can provide efficiently. Additionally, the rise of experiential and destination events, coupled with growing disposable incomes and changing consumer preferences for personalized experiences, contributes to market expansion. The advancement of online rental platforms and a focus on convenience and cost-effectiveness further support the market's robust growth in the region.

Key Party Supply Rental Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Party Supply Rental Companies:

The following are the leading companies in the party supply rental market. These companies collectively hold the largest market share and dictate industry trends.

- CORT Party Rental Corporation

- Chase Canopy Company Inc.

- Marquee Event Group LLC

- Bright Event Rentals LLC

- Quest Event LLC

- Avalon Tent

- Stuart Event Service Inc

- Hall’s Rental Service Inc.

- All Occasions Party Rental Inc

- A Classic Party Rental

Recent Developments

-

In Jan 2024, Logistic Events Corporation has established itself as a leader in providing temporary building and structure solutions for a variety of events and occasions across the United States and internationally. Known for its extensive selection of materials and modular components, along with advanced design capabilities, the company has built a strong reputation in the industry. Following its recent acquisition of Diamonette Party Rental, Logistic Events Corporation aims to expand its services and become a comprehensive solution provider for private gatherings, corporate functions, social events, as well as festivals, concerts, and commercial real estate projects.

Party Supply Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.76 billion

Revenue forecast in 2030

USD 32.03 billion

Growth rate

CAGR of 11.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, event type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

CORT Party Rental Corporation; Chase Canopy Company Inc.; Marquee Event Group LLC; Bright Event Rentals LLC; Quest Event LLC; Avalon Tent; Stuart Event Service Inc; Hall’s Rental Service Inc.; All Occasions Party Rental Inc; A Classic Party Rental

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Party Supply Rental Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the party supply rental market based on product, event type, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tables & Chairs

-

Tents & Canopies

-

Crockery & Cutlery

-

Lighting & Decor

-

Linens

-

Audio-visual Equipment

-

Dance Floors & Stages

-

Heating & Cooling Equipment

-

Others

-

-

Event Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Corporate Events

-

Weddings

-

Private Parties

-

Public Events

-

Educational Events

-

Others

-

-

End-use Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individuals

-

Corporate & Commercial

-

Event Planners

-

Caterers & Hospitality Providers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global party supply rental market was estimated at USD 15.23 billion in 2023 and is expected to reach USD 16.76 billion in 2024.

b. The global party supply rental market is expected to grow at a compound annual growth rate of 11.4% from 2024 to 2030 to reach USD 32.03 billion by 2030.

b. Asia Pacific dominated the party supply rental market with a share of over 36.89% in 2023. The growth of the regional market is mainly driven by rapid urbanization, growing disposable incomes, and an increasing number of large-scale events and celebrations in the region. The diverse cultural festivities and the rising trend of elaborate, high-profile events contribute significantly to the demand for rental services.

b. Some of the key players operating in the party supply rental market include CORT Party Rental Corporation, Chase Canopy Company Inc., Marquee Event Group LLC, Bright Event Rentals LLC, Quest Event LLC, Avalon Tent, Stuart Event Service Inc, Hall's Rental Service Inc, All Occasions Party Rental Inc, and A Classic Party Rental.

b. Key factors that are driving the party supply rental market growth include The rise of event planning, the need for cost-effective solutions, sustainability concerns, and the influence of social media.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.