- Home

- »

- Advanced Interior Materials

- »

-

Parts Washer Market Size, Share & Trends Report, 2030GVR Report cover

![Parts Washer Market Size, Share & Trends Report]()

Parts Washer Market (2024 - 2030) Size, Share & Trends Analysis Report By Cleaning Method (Solvent-based Parts Washers), By Operation Type (Manual, Automatic), By End-use (Automotive, Electronics), By Product (Spray Cabinet Parts Washer), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-464-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Parts Washer Market Size & Trends

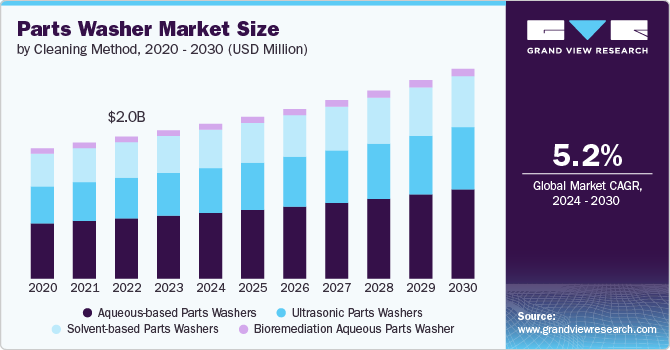

The global parts washer market size was estimated at USD 2,137.1 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The market is driven by governments’ and international bodies' stringent environmental regulations and standards. These regulations necessitate using environment friendly cleaning solvents and processes in various industries, including automotive, aerospace, manufacturing, and maintenance operations. For instance, companies in the automotive sector are increasingly adopting aqueous-based parts washers over traditional solvent-based systems to meet environmental standards and improve their sustainability practices. This shift not only helps reduce hazardous waste but also significantly lowers workers' exposure to harmful chemicals, thereby driving the demand for advanced parts washing solutions.

The rising growth in the parts washer market is largely attributed to the expanding automotive, aerospace, and manufacturing sectors, which require high levels of cleanliness and precision in component maintenance and manufacturing processes. As these industries grow, the demand for efficient, effective, and environmentally friendly parts cleaning solutions also increases. Additionally, the push towards sustainability and stricter environmental regulations has led companies to seek out parts washers that utilize safer, water-based cleaning solutions instead of traditional solvent-based methods. This shift not only aligns with regulatory compliance but also enhances workers' safety and reduces environmental impact. Moreover, technological advancements led to the development of automated and customized parts washers, further driving market growth by offering time and cost efficiencies to businesses aiming to maintain high-quality standards in their operations.

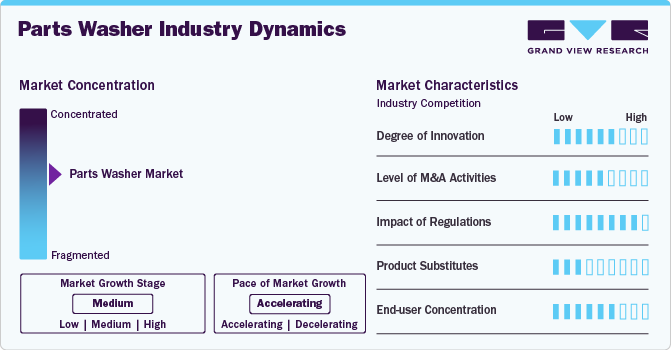

Market Concentration & Characteristics

The parts washer market is significantly influenced by the dynamics of industries such as automotive, aerospace, manufacturing, maintenance, repair, and overhaul (MRO). As these sectors continue to expand and evolve, the demand for efficient, cost-effective parts-cleaning solutions grows. Technological advancements are driving the development of more environmentally friendly, safer, and versatile parts washers, catering to a broader range of materials and contaminants. The market is becoming increasingly competitive, with companies focusing on innovative features such as automation, improved filtration systems, and waste minimization to gain an edge.

Additionally, the shift towards sustainability prompts manufacturers to adopt greener alternatives, influencing the types of cleaning agents and processes used. The regulatory framework surrounding environmental protection and worker safety significantly impacts the parts washer market. Stricter regulations on the use of chemicals and solvents, waste disposal, and emissions are pushing manufacturers and users of parts washers to consider eco-friendly and safer alternatives. Regulations such as the Resource Conservation and Recovery Act (RCRA) and the Clean Air Act in the United States, along with similar legislation globally, mandate the management of hazardous wastes and air quality standards. This has led to an increased demand for aqueous-based and bio-based cleaning systems, which are less harmful to the environment and the health of the workers. Compliance with these regulations not only affects the operational costs for users but also drives innovation among parts washer manufacturers as they strive to develop effective and regulatory-compliant solutions.

Drivers, Opportunities & Restraints

A notable trend in the parts washer market is the increasing adoption of eco-friendly and water-based cleaning solutions over traditional solvent-based cleaners. This shift is largely driven by the growing awareness of environmental issues and the stringent regulations regarding chemical use and disposal. For example, companies in sectors such as automotive and aerospace are now prioritizing the use of aqueous parts washers that utilize water and biodegradable detergents to minimize their environmental footprint. These water-based systems not only comply with regulatory standards but also offer benefits in terms of safety and cost-effectiveness, as they reduce hazardous waste disposal fees and lower insurance costs related to the storage of flammable solvents. This trend towards greener cleaning technologies is expected to continue, further propelling the growth of the parts washer market.

The market for parts washers is witnessing significant opportunities in the realm of technological advancements and innovation. The integration of automation and smart technologies in parts washer systems presents a promising avenue for growth. For instance, the development of IoT-enabled parts washers allows for real-time monitoring and control of the cleaning process, enhancing efficiency and reducing downtime. Furthermore, advancements in cleaning chemistries and methods, such as ultrasonic and high-pressure water jet technologies, offer superior cleaning capabilities, opening new applications in industries where precision and cleanliness are crucial.

Despite the growth prospects, the parts washer market faces certain restraints. The high initial investment cost for advanced parts washer systems is a significant barrier for small and medium-sized enterprises (SMEs). Additionally, the operational and maintenance costs associated with these systems can be considerable. Another challenge is the disposal of used cleaning solvents and solutions, which must comply with environmental regulations, adding to the operational burden. These factors can deter businesses from adopting new and advanced parts washer solutions, potentially slowing market growth.

Cleaning Method Insights

“The demand for ultrasonic parts washer segment is expected to grow at a significant CAGR of 5.7% from 2024 to 2030 in terms of revenue”

The aqueous-based parts washers cleaning method segment led the market and accounted for 42.5% of the global market revenue share in 2023. Aqueous-based parts washers use water-based cleaning solutions instead of solvents, reducing or eliminating the use of hazardous chemicals that can pose risks to human health and the environment. As regulations become stricter and businesses seek to reduce their environmental footprint, aqueous-based parts washers are expected to experience greater demand as they are a safer and more sustainable alternative aligned with corporate social responsibility goals and regulatory compliance requirements.

The demand for ultrasonic parts washers is expected to grow over the forecast period owing to their capability to clean delicate parts with speed and efficiency. Precision industries such as electronics are creating significant demand for these parts washers. According to the OEC, in 2022, electrical machinery and electronics ranked as the 2nd most traded products, growing at a CAGR of around 6.3% in terms of international trade. The industry benefits significantly from ultrasonic parts washers as they are used to clean delicate electronic components such as printed circuit boards (PCBs), semiconductor components, and microelectromechanical systems (MEMS). The gentle yet thorough cleaning action of ultrasonic waves ensures that sensitive electronic parts are cleaned without damage, maintaining their functionality and reliability.

Operation Type Insights

“The demand for automatic operation type segment is expected to grow at a significant CAGR of 5.7% from 2024 to 2030 in terms of revenue”

The automatic operation type segment led the market and accounted for 51.2% of the global market revenue share in 2023. One of the factors surging the demand for automatic parts washers is their efficiency and consistency in cleaning processes. These washers carry out standardized cleaning procedures that can be precisely replicated, ensuring uniform cleanliness across all parts. For instance, the Modular RT-FLEX+ by Cleaning Technologies Group is a fully automated system, which is used to clean cylinder blocks of all sizes and types without any manual intervention. This reliability is particularly valuable and high in demand in industries wherein stringent cleanliness standards must be met.

The requirement for improved efficiency while maintaining a certain degree of operator control and flexibility drives the demand for semi-automatic parts washers worldwide. These washers can be tailored to meet specific industry requirements and operational workflows. Moreover, they tend to have dedicated software that enables users to regulate the washing frequency based on the volume and temperature of the liquid and the volume of the parts to be washed.

End-use Insights

“The demand for electronics segment is expected to grow at a significant CAGR of 6.3% from 2024 to 2030 in terms of revenue”

The automatic end use segment led the market and accounted for 32.3% of the global market revenue share in 2023. Parts washers are used in the automotive industry for cleaning components such as engine blocks, transmission parts, and brake components. These parts often require meticulous cleaning to remove machining oils, metal shavings, and other contaminants that could impair performance or compromise safety.

Electronic components, such as circuit boards, microchips, and connectors, must be free from contaminants such as flux residues, solder paste, dust, and oils to function reliably and maintain optimal performance. Parts washers play a significant role in achieving the level of cleanliness required for electronic manufacturing processes, ensuring that components meet quality standards and reliability requirements. Effective cleaning helps prevent electrical failures, corrosion, and premature component wear by enhancing product longevity and customer satisfaction.

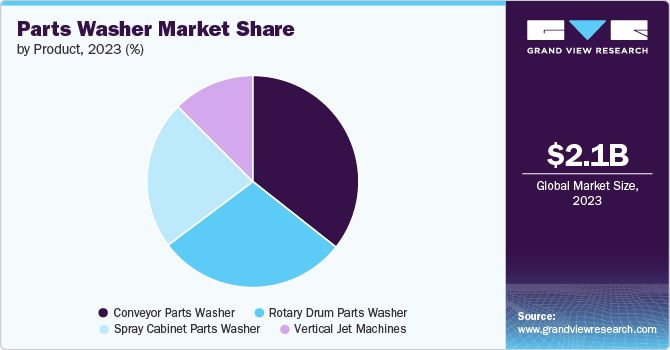

Product Insights

“The demand for spray cabinet parts washer segment is expected to grow at a significant CAGR of 6.0% from 2024 to 2030 in terms of revenue”

The conveyor parts washer product segment led the market and accounted for 35.6% of the global market revenue share in 2023. Conveyor parts washers are designed to handle high-volume cleaning operations, allowing manufacturers to clean significantly more parts in a shorter timeframe than manual cleaning methods. Several conveyor parts washers can perform the equivalent of two days' worth of manual cleaning in just three hours, substantially boosting productivity. For instance, Aquamaster CB, an industrial conveyor belt parts washer manufactured by Alliance Manufacturing, Inc., is primarily designed to quickly clean high volumes of parts.

A significant factor driving the growth of spray cabinet parts washer is the growing emphasis on precision and quality in manufacturing processes. As industries such as automotive, aerospace, and electronics continue to advance, the need for meticulous cleaning of parts to meet stringent quality standards has become more pronounced. Spray cabinet parts washers offer a reliable solution for achieving the high level of cleanliness required in these sectors, which, in turn, supports the production of high-quality, defect-free products.

Regional Insights

North America region accounted for 20.7% of the global market share in 2023. The growth of industrial manufacturing activities in North America amplifies the demand for reliable cleaning solutions. Automotive production in the region was estimated to be 19.1 million units in 2023, as per the International Organization of Motor Vehicle Manufacturers. Industries such as automotive, aerospace, electronics, and pharmaceuticals increasingly rely on parts washers to maintain stringent cleanliness standards and ensure product quality. The scalability and adaptability of parts washers make them indispensable tools for supporting production expansions and diversification across various sectors.

U.S. Parts Washer Market Trends

The parts washer market in the U.S. is expected to grow at a CAGR of 4.7% from 2024 to 2030. According to The International Organization of Motor Vehicle Manufacturers, the total vehicle sales in the country rose from 14.2 million units in 2022 to 16.0 million units in 2023. As manufacturing facilities scale up operations, the subsequent increase in production of machinery & equipment parts is expected to grow, and the need for reliable and efficient cleaning solutions is likely to increase to ensure product quality, operational reliability, and compliance with industry standards.

Europe Parts Washer Market Trends

The demand for parts washers in Europe is influenced by a variety of factors that reflect the region's industrial diversity, regulatory environment, and economic priorities. A primary driver is the stringent regulatory framework governing environmental protection and workplace safety. The European Union directives and national regulations impose strict standards on maintaining the cleanliness of machinery, such as Regulation 2023/1230/EU.

Germany's parts washer market held a 22.1% share in the European market. Germany, known for its robust automotive manufacturing sector, drives significant demand for parts washers primarily due to the high volumes of vehicles and related automotive parts produced in the country. According to the German Association of the Automotive Industry, domestic automobile production increased by 18% from 2022 to 2023.

Parts washer market in UK held an 11.8% share in the European market, which is driven by the increasingly robust and growing aerospace industry. Parts washers aid in ensuring that precision-engineered components, critical to aerospace manufacturing, meet rigorous quality and safety requirements. These machines enable aerospace manufacturers to achieve cleanliness and remove contaminants that could compromise the performance and reliability of aircraft components.

Asia Pacific Parts Washer Market Trends

“India to witness fastest market growth at 7.3% CAGR”

The parts washer market in Asia Pacific is experiencing robust growth, largely propelled by the expanding aerospace, automotive, medical, railway, and electronics industries. Each of these demands efficient cleaning solutions to maintain operational efficiency, safety standards, and product quality.

China parts washer market held a 39.5% share in the Asia Pacific market. China's vast manufacturing base across various industries, such as automotive, electronics, aerospace, and machinery, necessitates efficient cleaning solutions for maintaining production efficiency and product quality. Additionally, major players in the country are expanding their production capacities to cater to the increasing demand.

Parts washer market in India held a 9.3% share in the Asia Pacific market. There is a growing awareness among Indian industries about the importance of maintaining high-quality standards in manufacturing processes. Clean parts ensure product reliability, reduce operational downtime, and enhance overall efficiency. This awareness is prompting various industries to invest in advanced parts washer technologies that offer consistent and reliable cleaning results.

Middle East & Africa Parts Washer Market Trends

The growing aerospace industry in Saudi Arabia is a significant factor fueling the demand for parts washers. The kingdom's push to develop its aerospace manufacturing capabilities, including the production of aircraft parts and maintenance, has led to an increased requirement for specialized cleaning equipment to prepare components for assembly, inspection, and surface treatment.

Saudi Arabia parts washer market held 32.8% share in the Middle East & Africa market. The diversification of Saudi Arabia's industrial base, with the expansion of sectors such as machinery, manufacturing, and maintenance, has further amplified the need for efficient parts cleaning solutions. Across these industries, parts washers play a pivotal role in ensuring the cleanliness and reliability of equipment, enhancing operational efficiency and product quality.

Central & South America Parts Washer Market Trends

The rising vehicle production in Brazil, Mexico, and Argentina has led to a surge in the demand for parts washers. These machines play a crucial role in ensuring that automotive parts are thoroughly cleaned, which reduces the risk of corrosion and improves vehicle performance and longevity. As the region's automotive manufacturing capabilities continue to grow, the demand for parts washers is expected to increase over the forecast period.

Brazil parts washer market held a 41.5% share in Central & South America parts washer market. The manufacturing sector in Brazil has been experiencing considerable growth with a focus on producing a wide range of industrial equipment and machinery. As per Macrotrends LLC, the manufacturing output grew by 26.6% in 2023 compared to 2022. Parts washers are essential in production facilities for removing contaminants, grease, and other impurities from various components, ensuring that the final products meet the required quality standards.

Key Parts Washer Company Insights

Some of the key players operating in the market include CRC Industries, NCH Corporation, among others.

-

CRC Industries is a global supplier of specialty chemicals for maintenance, repair, and operation professionals. The company offers a comprehensive selection of products tailored to its customers' diverse maintenance and repair requirements. Their product line includes cleaners, lubricants, corrosion inhibitors, protective coatings, degreasers, greases, additives, and specialized products designed to address specific customer needs in maintaining and repairing equipment and assets. These products are designed to address issues in the automotive, industrial, electrical, marine, and aviation markets. One of their key product lines includes parts washers, designed to clean and de-grease parts effectively for various industries, including automotive, manufacturing, and maintenance facilities. CRC Industries trademarked brands include CRC, SmartWasher, K&W,Sta-Lube, Marykate, Weld-Aid, and Evapo-Rust.

-

The company offers products and services for commercial, institutional, and industrial maintenance. It is one of the largest global companies selling its products through direct marketing. It has branch offices and manufacturing plants on 6 continents and distributes its extensive and varied product line in over 50 countries. The company operates under segments including plumbing, industrial and institutional maintenance, parts washing, lubrication, and biologicals. Due to its strong global presence, the company is well-positioned to serve diverse markets worldwide.

Valliant TMS, and The Mart Corporationare some of the emerging market participants in the parts washer market.

-

The company specializes in automated assembly and test, welding and joining, material handling systems, final assembly, and industrial parts washers. Its service portfolio consists of custom metal fabrication, low-volume production, additive manufacturing, and inspection. The company has 1,300,000+ square feet of production capacity. It also has 20 locations across 10 countries.

-

MART stands out in the industry with its expansive product line, offering 34 Power Washer models and 104 engineered options, making it possible to tailor a wash system to even the most specific and demanding requirements. The company offers over 5 million unique Power Washer systems, ensuring no two configurations are the same. Its commitment to innovation is further demonstrated by its ongoing R&D efforts, which began in earnest in 1987. Since then, MART has invested over USD 3.5 million into research and development, a consistent annual investment that has kept its Power Washers at the forefront of technology. This commitment to innovation not only enhances the performance of its washers but also ensures that it caters effectively to a wide range of industries, from automotive to new manufacturing, including specialized sectors such as GSA contract, diesel, mining, and jet & piston aircraft, among others.

Key Parts Washer Companies:

The following are the leading companies in the parts washer market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Circle Surface Technology GmbH

- Walter Surface Technologies Inc

- Safety-Kleen Systems

- Heritage-Crystal Clean, Inc

- Safetykleen

- CRC Industries

- NCH Corporation

- SBS Ecoclean Group

- Karcher Professional Wash Systems

- Valiant TMS

- Cleaning Technologies Group

- The MART Corporation

- Service Line, Inc.

- PROCECO Ltd.

- Rozone

- Cleanway

- Waste Management NZ Limited

- Vollrath Manufacturing Services

- Ultrasonic Power Corporation

- DENIOS

Recent Developments

-

In November 2023, Safetykleen introduced Purified Cleaning Technology, a groundbreaking innovation that revolutionizes the cleaning industry by setting new standards for speed, efficiency, and environmental responsibility. This pioneering technology addresses the growing demand for faster, more efficient, and sustainable cleaning solutions by integrating three key elements: water purification, improved formula chemistries, and automatic dosing. The technology ensures unparalleled cleaning efficacy, reduces energy consumption, and maintains consistent cleaning quality throughout the service cycle, empowering businesses to achieve cleaner, safer, and more sustainable environments.

-

In March 2022, Valiant TMS acquired a 60,000 ft² facility in Querétaro, Mexico, to further expand its global capacity and better serve the growing commercial trucks & automotive sector in the region. Located in Parque Industrial Querétaro (PIQ), this facility is a thriving hub for industrial and technology companies, offering state-of-the-art infrastructure and services.

Parts Washer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,231.0 million

Revenue forecast in 2030

USD 3,026.8 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Cleaning method, operation type, end-use, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Thailand; Singapore; New Zealand; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Bio-Circle Surface Technology GmbH; Walter Surface Technologies Inc; Safety-Kleen Systems; Heritage-Crystal Clean Inc; Safetykleen; CRC Industries; NCH Corporation; SBS Ecoclean Group; Karcher Professional Wash Systems; Valiant TMS; Cleaning Technologies Group; The MART Corporation; Service Line, Inc.; PROCECO Ltd.; Rozone; Cleanway; Waste Management NZ Limited; Vollrath Manufacturing Services; Ultrasonic Power Corporation; DENIOS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Parts Washer Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the parts washer market based on cleaning method, operation type, end-use, product, and region:

-

Cleaning Method Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Solvent-based parts washers

-

Aqueous-based parts washers

-

Ultrasonic parts washers

-

Bioremediation Aqueous parts washer

-

-

Operation Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Manual

-

Semi-automatic

-

Automatic

-

-

End-use Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Automotive

-

Military/Defence

-

Industrial manufacturing

-

Electronics

-

Food & Beverage

-

Others

-

-

Product Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Spray Cabinet Parts Washer

-

Conveyor Parts Washer

-

Rotary Drum Parts Washer

-

Vertical Jet Machines

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Singapore

-

South Korea

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global parts washer market size was estimated at USD 2,137.1 million in 2023 and is expected to reach USD 2,237.1 million in 2024.

b. The global parts washer market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 3,026.8 million by 2030.

b. The conveyor parts washer product segment led the market and accounted for 35.6% of the global market revenue share in 2023. Conveyor parts washers are designed to handle high-volume cleaning operations, allowing manufacturers to clean significantly more parts in a shorter timeframe compared to manual cleaning methods.

b. Some of the key players operating in the parts washer market include Bio-Circle Surface Technology GmbH, Walter Surface Technologies Inc, Safety-Kleen Systems, Heritage-Crystal Clean, Inc, Safetykleen, CRC Industries, NCH Corporation, SBS Ecoclean Group, Karcher Professional Wash Systems, Valiant TMS, Cleaning Technologies Group, The MART Corporation, Service Line, Inc., PROCECO Ltd. , Rozone, Cleanway, Waste Management NZ Limited, Vollrath Manufacturing Services, Ultrasonic Power Corporation, DENIOS.

b. The parts washer market is driven by the stringent environmental regulations and standards imposed by governments and international bodies worldwide. These regulations necessitate the use of environmentally friendly cleaning solvents and processes in various industries, including automotive, aerospace, manufacturing, and maintenance operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.