- Home

- »

- IT Services & Applications

- »

-

Partner Relationship Management Market Size Report, 2030GVR Report cover

![Partner Relationship Management Market Size, Share & Trends Report]()

Partner Relationship Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Service, By Deployment (On-Premise, Cloud), By Organization Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-481-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Partner Relationship Management Market Summary

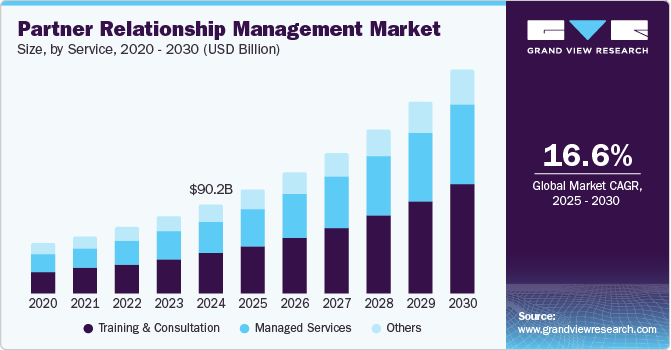

The Partner Relationship Management (PRM) market was estimated at USD 90.20 billion in 2024 and is projected to reach USD 226.51 billion by 2030, growing at a CAGR of 16.6% from 2025 to 2030. Factors such as the growing emphasis on enhancing partner communications, controlling channel management costs, and improving operational efficiency contribute to market growth.

Key Market Trends & Insights

- North America dominated the global market with a revenue share of 33.4% in 2024.

- The Asia Pacific region is expected to grow at the highest CAGR from 2025 to 2030.

- By deployment, the cloud segment dominated the market in 2024.

- By organization size, the SME segment is expected to grow at the highest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 90.20 Billion

- 2030 Projected Market Size: USD 226.51 Billion

- CAGR (2025-2030):16.6%

- North America: Largest market in 2024

In addition, the rise of digital transformation initiatives across various industries has led to heightened demand for innovative software solutions that facilitate collaboration and streamline processes between businesses and their partners.

The integration of advanced technologies, such as artificial intelligence (AI), machine learning, and big data analytics, enables organizations to optimize partner engagement and gain valuable insights into performance metrics. Furthermore, the increasing adoption of cloud-based solutions allows for greater flexibility and scalability, making it easier for businesses to implement effective partner relationship management strategies. As companies prioritize data-driven decision-making, the demand for sophisticated tools that enhance partner collaboration is likely to rise. For instance, Oracle PRM offers a partner portal that enables channel managers and partners to collaborate effectively which allows users to manage leads, register deals, and create quotes seamlessly.

In addition, the ongoing shift toward remote and hybrid work environments have underscored the importance of maintaining strong relationships with partners in a digital landscape. Organizations leverage partner relationship management solutions to ensure seamless communication and collaboration among stakeholders, regardless of location. This trend is further supported by the growing recognition of the value of strategic partnerships in driving revenue growth and expanding market reach. As businesses navigate these evolving dynamics, the partner relationship management industry is positioned for continued expansion in the coming years.

Service Insights

The training & consultation segment dominated the market with a share of 45.6% in 2024, reflecting the critical role these services play in enhancing partner effectiveness. Organizations are increasingly investing in tailored training programs and strategic consultations to ensure their partners are well-equipped to meet business objectives. This focus on education and support improves partner performance and fosters stronger relationships, ultimately contributing to the overall success of the partner ecosystem. The growing complexity of partner networks necessitates ongoing training to keep partners informed about new products, services, and market trends, further solidifying this segment's importance in driving revenue growth.

The managed services segment is projected to grow at a significant CAGR during the forecast period, driven by rising demand for ongoing support and maintenance of partner relationship management systems. As organizations expand their partner networks, many seek to outsource operational responsibilities to specialized service providers. This approach allows companies to focus on their core business functions while ensuring their partner management platforms operate efficiently. In addition, managed services offer scalability and flexibility, enabling organizations to adapt quickly to changing market conditions and partner needs. The increasing complexity of managing diverse partner relationships further emphasizes the need for robust managed services to enhance collaboration and streamline communication within the partner relationship management industry.

Deployment Insights

The cloud segment dominated the market with the largest revenue share in 2024 due to its flexibility and scalability. Cloud-based solutions enable organizations to implement systems that can easily adapt to changing business needs and accommodate varying user access levels. This adaptability is particularly valuable in today’s fast-paced business environment, where remote work and global partnerships are increasingly common. Moreover, cloud solutions facilitate real-time data sharing and collaboration among partners, which enhances decision-making processes and improves overall efficiency.

The on-premise segment is projected to grow at a significant CAGR during the forecast period as some organizations prefer maintaining control over their data and infrastructure. This preference is driven by concerns related to data security, compliance, and customization capabilities that on-premise solutions can provide. Companies that require stringent data governance measures may opt for on-premise systems, ensuring they have direct oversight of their partner relationship management processes while benefiting from advanced features. In addition, as regulatory requirements become more stringent across various industries, organizations may find it necessary to invest in on-premise solutions that allow for greater control over sensitive information.

Organization Size Insights

The large enterprise segment dominated the market with the largest revenue share in 2024, owing to major corporations' extensive adoption of partner relationship management solutions. These organizations have complex partner ecosystems that necessitate robust management tools to coordinate activities across various channels effectively. The scale and resources available to large enterprises enable them to invest significantly in advanced technologies that enhance their ability to manage relationships with multiple partners simultaneously. Furthermore, as these enterprises expand into new markets and regions, they increasingly rely on sophisticated PRM solutions to ensure consistent communication and collaboration with their global partners.

The SME segment is expected to grow at the highest CAGR over the forecast period as more SMEs recognize the value of effective partner management. As these businesses seek growth opportunities through partnerships, they increasingly adopt partner relationship management solutions tailored to their specific needs. The accessibility of cloud-based platforms has made it easier for SMEs to implement these tools, allowing them to compete more effectively in their respective markets. For instance, PartnerPortal.io is a user-friendly, plug-and-play platform specifically designed for managing partnerships, making it ideal for small or early-stage growth companies.

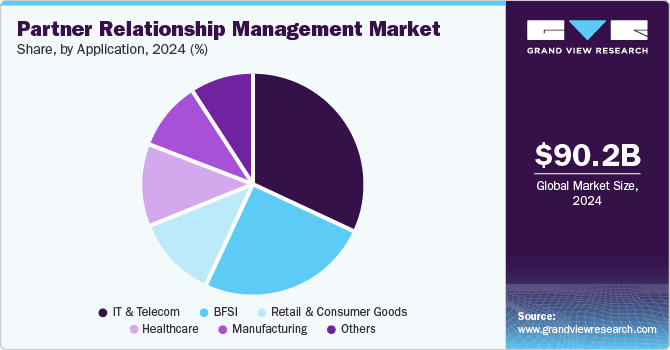

Application Insights

The IT & telecom segment accounted for the largest market revenue share in 2024. Companies in this sector often rely on a diverse range of partners for technology integration and service delivery, necessitating sophisticated management tools that can handle intricate workflows. The ability to streamline communication and collaboration among various stakeholders is essential for driving innovation and meeting customer demands in this rapidly evolving industry. Moreover, as technology continues to advance at a rapid pace, IT and telecom companies are increasingly leveraging PRM solutions to enhance their competitive edge through better partner engagement strategies.

The BFSI segment is expected to grow at a significant CAGR over the forecast period due to increasing collaboration with technology providers. Effective partner relationship management becomes crucial as financial institutions seek to enhance their service offerings through partnerships with fintech companies and other tech innovators. This collaboration enables BFSI organizations to leverage new technologies while ensuring compliance with regulatory requirements, ultimately enhancing customer experiences and driving business growth. In addition, as digital transformation initiatives gain momentum within the BFSI sector, PRM solutions play a vital role in managing relationships with various stakeholders efficiently while maintaining high security and trust standards.

Regional Insights

North America partner relationship management market dominated the global market with a revenue share of 33.4% in 2024, owing to the region’s strong technological infrastructure and major industry players. Companies such as Salesforce and Oracle are headquartered in this region, driving innovation and adoption of partner relationship management solutions. The increasing demand for efficient partner collaboration and enhanced communication tools has led to the widespread implementation of PRM software across various sectors.

U.S. Partner Relationship Management Market Trends

The U.S. partner relationship management market dominated the regional market in 2024 due to its advanced technological landscape and high adoption rates among businesses. The emphasis on improving partner engagement and optimizing channel management costs have prompted organizations to invest heavily in PRM technologies. As businesses prioritize digital solutions for enhancing operational efficiency, the U.S. remains a focal point for developments within the partner relationship management industry.

Asia Pacific Partner Relationship Management Market Trends

The Asia Pacific partner relationship management market is expected to grow at the highest CAGR from 2025 to 2030, driven by rapid urbanization and increasing digitalization across the region. Countries such as India and China are witnessing a surge in tech-savvy populations and a growing number of IT companies, contributing to the rising demand for effective partner management solutions. As businesses expand their operations and seek to establish strategic partnerships, robust PRM systems are essential. This growth trend reflects a broader recognition of the importance of managing partner relationships effectively within Asia Pacific’s rapidly evolving business landscape.

China partner relationship management market dominated the Asia Pacific region in 2024, fueled by its robust economic growth and significant investments in technology infrastructure. The Chinese government’s focus on digital transformation has led to increasing adoption of PRM solutions among enterprises seeking to enhance their competitive edge. In addition, as more companies engage in international trade and collaboration, effective partner management becomes crucial for navigating complex relationships across borders.

Europe Partner Relationship Management Market Trends

Europe partner relationship management market is expected to grow at the highest CAGR from 2025 to 2030, driven by increasing regulatory requirements and a focus on enhancing customer experience through partnerships. European organizations are recognizing the need for effective PRM solutions to comply with stringent data protection laws while managing complex partner networks. As businesses strive to improve collaboration with their partners, investing in advanced PRM technologies becomes essential for maintaining compliance and optimizing performance. The emphasis on sustainability and ethical business practices further supports growth within the European partner relationship management industry.

Key Partner Relationship Management Company Insights

The partner relationship management market features several key players that shape its landscape. Allbound, Inc. enhances partner engagement with onboarding and collaboration tools, while Channeltivity, LLC. offers solutions for managing partner relationships through training and performance tracking. Oracle provides cloud-based PRM solutions integrated with its enterprise software, and Salesforce, Inc. utilizes its CRM capabilities to improve communication between partners and internal teams. These companies play a significant role in shaping the partner relationship management industry.

-

Oracle is a global technology company that provides a comprehensive suite of software solutions, including its Partner Relationship Management (PRM) offerings. Oracle's PRM solutions are designed to help businesses manage their partner ecosystems effectively by providing tools for onboarding, deal registration, lead management, and performance tracking. The platform includes a branded partner portal that facilitates collaboration between channel managers and partners, enabling them to share resources and streamline workflows.

-

Salesforce, Inc. is a CRM platform offering robust partner relationship management solutions. Through its Salesforce Partner Community, the company provides tools that enable organizations to manage partner relationships effectively by facilitating communication, collaboration, and performance tracking. Salesforce's PRM capabilities allow businesses to onboard new partners, manage leads and opportunities, and access marketing resources seamlessly.

Key Partner Relationship Management Companies:

The following are the leading companies in the partner relationship management market. These companies collectively hold the largest market share and dictate industry trends.

- Allbound, Inc

- Channeltivity, LLC.

- Impartner Inc.

- Oracle

- The Learning Network

- Salesforce, Inc.

- Magentrix Corporation

- Zinfi Technologies Inc.

- Zift Solutions

- Mindmatrix Inc.

Recent Development

-

In July 2024, Acre Security announced the launch of its new PRM platform. This partner portal is a comprehensive, centralized resource designed to enhance the partner experience by providing streamlined access to support, marketing, sales, and training materials. By integrating these essential functions into a single interactive system, the platform facilitates efficient communication among partners and empowers them to operate more effectively.

-

In July 2022, Allbound Inc. announced that it had successfully secured USD 43 million in a majority investment from Invictus Growth Partners. This funding was expected to boost sales and marketing efforts and further develop its partner relationship management (PRM) platform. Allbound aimed to leverage this capital to enhance its offerings and assist businesses in effectively optimizing their partner ecosystems.

Partner Relationship Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 104.92 billion

Revenue forecast in 2030

USD 226.51 billion

Growth rate

CAGR of 16.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, deployment, organization size, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Allbound, Inc; Channeltivity, LLC.; Impartner Inc.; Oracle; The Learning Network; Salesforce, Inc.; Magentrix Corporation; Zinfi Technologies Inc.; Zift Solutions; Mindmatrix Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Partner Relationship Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global partner relationship management market report based on service, deployment, organization size, application, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed Services

-

Training & Consultation

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.