- Home

- »

- Pharmaceuticals

- »

-

Particle Therapy Market Size, Share & Growth Report, 2030GVR Report cover

![Particle Therapy Market Size, Share & Trends Report]()

Particle Therapy Market Size, Share & Trends Analysis Report By Therapy Type (Proton Therapy, Heavy Ion Therapy), By System, By Application (Treatment, Research), By Cancer Type (Pediatric, Breast, Lung), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-289-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Particle Therapy Market Size & Trends

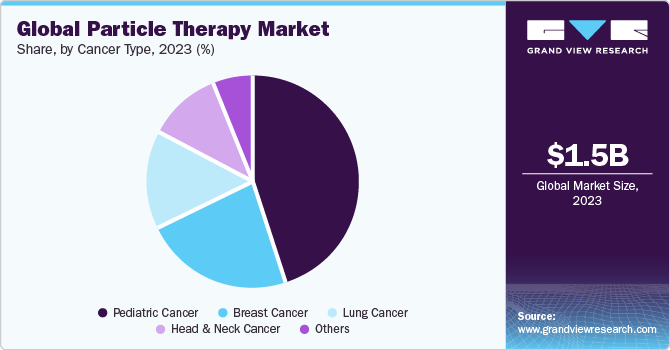

The global particle therapy market size was estimated at USD 1.54 billion in 2023 and is projected to grow at a CAGR of 7.63% from 2024 to 2030. The market's growth is attributed to the growing prevalence of various types of cancer. According to the WHO, in 2022, approximately 20 million new cases of cancer were reported, resulting in 9.7 million deaths. An estimated 53.5 million individuals survived for at least 5 years after being diagnosed with cancer. Roughly one-fifth of the global population is affected by disease during their lifetime, with around 1 in 9 men and 1 in 12 women succumbing to the illness. Thus, increasing awareness about cancer and growing technological advancements in radiotherapy treatments are further propelling market growth.

Moreover, life expectancy is now exceeding 80 years in most developed economies. Aging is influenced by the interaction of several environmental & genetic factors and is characterized as the single most substantial risk factor for cancer development. Based on the American Cancer Society database, 39.6% of women and 41.6% of men are estimated to develop cancer during their lifetime. Nearly two-thirds of all new cases are diagnosed in people aged 65 years and above, showing that aging can make people more vulnerable to cancer. Thus, the rising geriatric population is expected to boost the market growth.

Advances in developing vector molecules for targeting tumors and combining them with particle treatment have led to uniquely paired radiopharmaceuticals. Particle therapy is widely preferred for oncology treatment due to its high safety and efficacy. Ongoing research and studies demonstrating positive results are expanding the application of radioisotopes for diagnosing and treating various cancers. For instance, cyclotron beams are also suitable for PET scanning. Some cyclotrons are also retrofitted to enable them to produce technetium-99. Some key players offering cyclotron in the market are IBA, GE Healthcare, Siemens, Sumitomo Heavy Industries, ACSI, and Best Medical.

Competitive rivalry in this market is likely to be moderate to high due to intense competition, the introduction of new products, and key players' pricing decisions, which may render existing products outdated. In addition, companies are entering into collaborations and undertaking other strategic initiatives to expand their product portfolio. For instance, in July 2022, IBA Radiopharma Solutions and Chengdu New Radiomedicine Technology Co., Ltd (CNRT) signed a collaboration agreement to install a Cyclone IKON in Chengdu, China's Sichuan Province. The Cyclone IKON will produce new isotopes for theragnostic and tailored therapeutics.

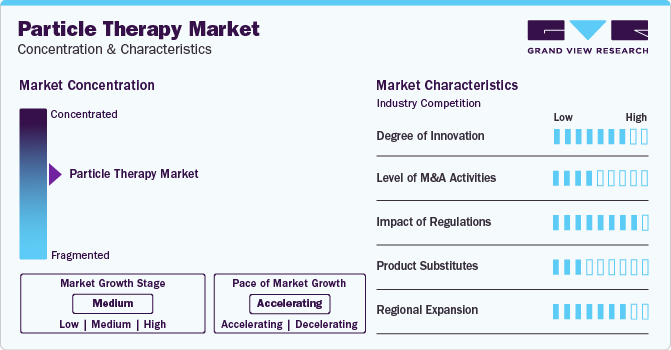

Market Concentration & Characteristics

Particle therapy treatment has undergone significant innovation, with numerous current R&D projects aiming at enhancing particle therapy's use, efficacy, and accessibility. These innovations include online image guidance and adaptive therapy with ML algorithms, the creation of gantryless beam delivery, compact accelerators using superconductive magnets, high-intensity accelerators coupled to online imaging, and the clinical translation of ultra-high dose rate (FLASH) radiation

Several players engage in M&A activities to strengthen their market position. This strategy enables companies to increase their capabilities, expand their portfolios, and improve competency. For instance, in April 2021, Siemens Healthcare GmbH completed the acquisition of Varian Medical Systems, Inc. This would enhance Siemens’ oncology products portfolio

Regulatory agencies globally stress patient safety, quality assurance, and guideline adherence in radiation therapeutic. They aim to standardize protocols, ensure proper professional training, and enforce strict quality control. One trend is equipment manufacturers' rising use of quality management systems like ISO 13485 and ISO 9001. Authorities like the FDA and EMA mandate compliance with these standards for product approval, underscoring the need for quality assurance in treatment effectiveness and patient safety

Advancements in treatment, despite their efficacy, threaten existing treatments like surgeries and chemotherapy due to potential adverse effects. Technologies like IGRT, internal beam radiation therapy (IBRT), Brachytherapy, and 3D-conformity treatment provide patients with more advanced options. However, the lack of effective treatments for complex cancers and the adverse effects of therapies may hinder overall growth in the field

Regional market expansion is improving access to efficient diagnosis in developed and developing countries. Some such approaches are collaborations with nearby healthcare providers, educational campaigns emphasizing the value of early detection and infection prevention, and creating reasonably priced testing solutions customized to various healthcare systems' requirements

Therapy Type Insights

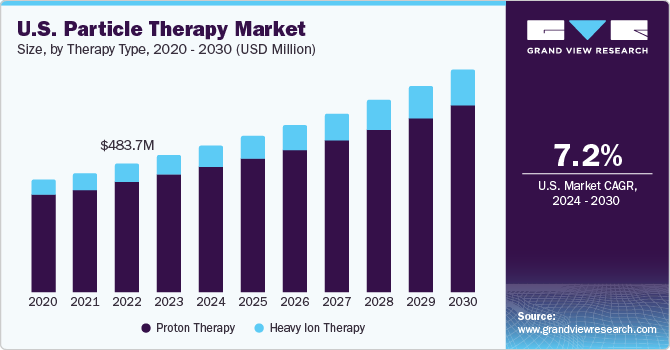

The proton therapy segment dominated the market and accounted for a share of 86.16% in 2023. Growing investments in proton therapy facilities and the expanding use of proton therapy in cancer treatment are the main drivers of this growth. Proton therapy's advantages over conventional radiation therapy, such as its increased ability to precisely target cancer cells and less damage to surrounding healthy tissue, have contributed to its increasing acceptance. Moreover, the number of proton radiation treatment centers is expected to increase due to the rising awareness among patients and physicians about the benefits of proton therapy. Japan has the largest number of centers in Asia, with new centers under construction in Singapore, South Korea, Thailand, and China.

However, high treatment cost is a major restraint for market growth. Heavy ion therapy is projected to grow at the fastest CAGR from 2024 to 2030. Heavy ion therapy uses radiation beams of accelerated charged particles heavier than protons. These beams are highly efficient for targeting tumor tissue and have minimal impact on healthy tissue. Thus, their growing prevalence indicates significant market potential for businesses in the dental industry. Some companies offering heavy ion beam therapy products are Toshiba, Hitachi, and IBA. In May 2023, Hitachi, Ltd. expanded its footprint in Taiwan by supplying its heavy-ion therapy system to the Taipei Veterans General Hospital, Taiwan hospital.

System Insights

The single-room systems segment is expected to grow at the fastest CAGR rate of 7.97% over the forecast period. Proton therapy in a single room is a small proton treatment equipment. Over the last few years, cancer patients have been selecting particle therapy for their treatment owing to its high advantages over multi-room systems. This includes fewer adverse effects because patients do not feel discomfort during treatment, and there is a lower risk of radiation damage to healthy tissue. Furthermore, patients' quality of life is usually maintained since they can continue their daily activities during therapy. Thus, the global market for single-room proton treatment systems is anticipated to grow significantly throughout the projection period.

The multi-room systems segment is anticipated to grow significantly during the forecast period. The rising cost of particle therapy treatments and infrastructure investments are the main drivers of market growth. Multi-room systems and particle therapy facilities with numerous treatment rooms allow healthcare professionals to treat more patients and provide greater treatment options. Increased patient throughput, shorter treatment wait times, and more treatment planning flexibility are benefits of multi-room systems over single-room systems. The increasing use of particle therapy as a cancer treatment option is one of the main factors propelling the market's growth.

Application Insights

The treatment segment held the largest share in 2023 and is expected to grow at a CAGR of 7.77% from 2024 to 2030. Hospitals and cancer centers play a crucial role in patient care, providing diagnoses and treatments directly to patients within the hospital setting. As cancer diseases are increasingly recognized for their high mortality rate, hospitals are integrating comprehensive cancer care into their treatment protocols, including the treatment of patients using particle therapies, such as proton beam therapy. Hence, the demand for particle therapy treatment is expected to increase over the forecast period.

Clinical research held the second-largest share of the market in 2023. Particle therapy plays a significant role in clinical research for developing and commercializing new radiation therapy treatments. For instance, in December 2023, Mevion Medical Systems and Kansas City Proton Institute (KCPI) reported that the MEVION S250i Proton Therapy System was used to treat the first four patients at KCPI on December 19. Thus, the growing use of particle therapy for research purposes is anticipated to drive market growth.

Cancer Type Insights

The pediatric cancer segment held the largest share of 44.97% in 2023. This can be attributed to the increasing number of pediatric cancer cases worldwide. According to the International Agency for Research on Cancer (IARC), around 400,000 children and adolescents aged 0 to 19 years are diagnosed with cancer every year. Brain cancers, leukemia, and lymphomas are the most common types of cancer found in children. Decreases in the number of childhood cancer-related deaths can be achieved through increasing access to high-quality care and improving the capacity and accuracy of diagnostics and treatment. Thus, developing and launching new proton systems for pediatric disease treatment drives market growth.

The breast cancer segment is anticipated to grow rapidly over the forecast period. Breast cancer is the most common form of cancer affecting women. According to Globocan, in 2022, approximately 2.30 million new cases of breast cancer were diagnosed, with projections estimating an increase to about 2.70 million new cases by 2030. Proton therapy uses protons to target and destroy breast cancer cells. Thus, the growing number of breast cancer cases is anticipated to drive market growth during the forecast period.

Regional Insights

The North America particle therapy market accounted for a share of 37.65% in 2023 owing to its well-established healthcare infrastructure, high healthcare expenditures, a rise in the prevalence of cancer diseases & number of radiation treatment procedures, and high awareness regarding preventive health treatment. The rise in skilled radiotherapy practitioners also drives the market's growth.

U.S. Particle Therapy Market Trends

The particle therapy market in the U.S. is expected to grow rapidly over the forecast period owing to various factors, such as high awareness among healthcare professionals about available radiation therapies for treating cancer and a rise in disease prevalence. As per the American Cancer Society, an estimated 1.9 million new cases of cancer were diagnosed in the U.S., and over 609,000 cancer deaths were recorded in 2022.

Europe Particle Therapy Market Trends

The Europe particle therapy market is a lucrative regional market. The region claims a significant population base, including an aging demographic more prone to periodontal diseases. This demographic trend has increased the demand for particle therapy in Europe. In addition, Europe has a strong healthcare infrastructure with well-established dental care facilities and professionals.

The particle therapy market in the UK is projected to expand due to the growing awareness among the population regarding the importance of cancer prevention and treatment. This heightened awareness is often accompanied by a greater willingness to seek professional cancer care, including treatment for breast, pediatric, and lung cancer.

The France particle therapy market is influenced by changes in lifestyle factors, such as diet, smoking habits, and stress levels, which can impact people's health and increase the risk of developing cancer. As awareness of these risk factors grows, individuals may seek particle therapy treatment to address and manage their health concerns.

The particle therapy market in Germany is expected to grow over the forecast period due to a strong healthcare system with comprehensive coverage for cancer care. Favorable healthcare policies and reimbursement schemes may incentivize individuals to seek treatment for cancer diseases, driving demand for particle therapy in the country.

Asia Pacific Particle Therapy Market Trends

The Asia Pacific particle therapy market is anticipated to witness the fastest growth over the forecast period. The presence of a large target population, high unmet clinical needs, and developing healthcare infrastructure is anticipated to provide high growth potential for the region. Major players are constantly focusing on developing new particle therapy solutions owing to the rising aging population and the prevalence of cancer disease.

The particle therapy market in China is primarily driven by a large population with a rising prevalence of cancer diseases attributed to factors, such as changing dietary habits, lifestyle factors, and an aging population.

The Japan particle therapy market is expected to grow over the forecast period. The country has one of the world's most rapidly aging populations, with a significant proportion of elderly individuals. Aging is associated with an increased risk of cancer owing to a weak immune system.

Latin America Particle Therapy Market Trends

The particle therapy market in Latin America is expected to grow significantly. The region has a rapidly growing population and increasing urbanization rates. Urbanization often leads to lifestyle changes such as dietary habits, tobacco use, and stress, which can contribute to the prevalence of cancer diseases.

The Brazil particle therapy market is expected to grow over the forecast period due to the rising awareness of the importance of cancer diagnosis and treatment among the Brazilian population. As a result, individuals are becoming more proactive in seeking preventive care and treatment for cancer diseases, driving the demand for particle therapy in the country.

MEA Particle Therapy Market Trends

The particle therapy market in MEA was identified as a lucrative region in this industry. The regional market growth is driven by the high prevalence of cancer diseases due to various factors, such as poor oral hygiene practices, tobacco use, and inadequate access to cancer care.

The Saudi Arabia particle therapy market is growing owing to increasing awareness of the importance of early cancer diagnosis and treatment, driven by educational initiatives and public health campaigns. As a result, individuals are becoming more proactive in seeking preventive care and treatment for cancer diseases, increasing demand for particle therapy in the country.

Key Particle Therapy Company Insights

Some leading players operating in the particle therapy market include Siemens Healthcare GmbH (Varian Medical Systems, Inc., Hitachi Ltd, and IBA Worldwide. Key players use existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built market positions. These players are heavily investing in infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their presence.

P-Cure Ltd., PTW FREIBURG GMBH, and B dot Medical Inc. are some of the emerging players in this market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel launches to capitalize on untapped avenues.

Key Particle Therapy Companies:

The following are the leading companies in the particle therapy market. These companies collectively hold the largest market share and dictate industry trends.

- IBA Worldwide

- Siemens Healthcare GmbH (Varian Medical Systems, Inc.)

- Hitachi Ltd

- Mevion Medical Systems

- Provision Healthcare.

- Optivus Proton Therapy, Inc.

- Sumitomo Heavy Industries, Ltd.

- ProTom International.

- B dot Medical Inc.

- LeyBold

- Advanced Oncotherapy Plc.

- Others

Recent Developments

-

In January 2024, OncoRay launched the world’s first research prototype for complete body MRI-guided proton therapy. This system is designed to offer real-time MRI tracking of moving tumors during proton therapy

-

In October 2023, Hitachi, Ltd. delivered a proton therapy system to the National Cancer Centre Singapore (NCCS). With this newly installed base, Hitachi expanded its presence into Southeast Asia

-

In September 2023, Siemens Healthineers AG (Varian Medical Systems, Inc., part of the company) highlighted its commitment to innovation and enhanced results by showcasing its advanced technologies at the American Society for Radiation Oncology (ASTRO) 2023 annual meeting held from October 1 to 4 in California.

Particle Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.64 billion

Revenue forecast in 2030

USD 2.55 billion

Growth rate

CAGR of 7.63% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, system, application, cancer type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

IBA Worldwide; Siemens Healthcare GmbH (Varian Medical Systems, Inc.); Hitachi Ltd.; Mevion Medical Systems; Provision Healthcare; Optivus Proton Therapy; Inc.; Sumitomo Heavy Industries, Ltd.; ProTom International; B dot Medical Inc.; LeyBold; Advanced Oncotherapy Plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Particle Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global particle therapy market report based on therapy type, system, application, cancer type, and region:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Proton Therapy

-

Heavy Ion Therapy

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Room Systems

-

Multi-Room Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Treatment

-

Clinical Research

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric Cancer

-

Breast Cancer

-

Lung Cancer

-

Head & Neck Cancer

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global particle therapy market size was estimated at USD 1.54 billion in 2023 and is expected to reach USD 1.64 billion in 2024.

b. The global particle therapy market is expected to grow at a compound annual growth rate of 7.63% from 2024 to 2030 to reach USD 2.55 million by 2030.

b. North America particle therapy market accounted for 37.65% share in 2023 owing to its well-established healthcare infrastructure, high healthcare expenditures, an increase in the prevalence of cancer diseases, a surge in the number of radiation treatment procedures in the region, and high awareness regarding preventive health treatment.

b. Some key players operating in the particle therapy market include IBA Worldwide, Siemens Healthcare GmbH (Varian Medical Systems, Inc.) Hitachi Ltd, Mevion Medical Systems, Provision Healthcare., Optivus Proton Therapy, Inc., Sumitomo Heavy Industries, Ltd., ProTom International, B dot Medical Inc., LeyBold, Advanced Oncotherapy Plc.

b. Key factors that are driving the particle therapy market growth include a growing prevalence of cancer, increasing awareness about benefits of particle therapy, rising geriatric population, and technological advancements in particle therapy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."