- Home

- »

- Clinical Diagnostics

- »

-

PARP Inhibitor Biomarkers Market Size & Share Report, 2030GVR Report cover

![PARP Inhibitor Biomarkers Market Size, Share & Trends Report]()

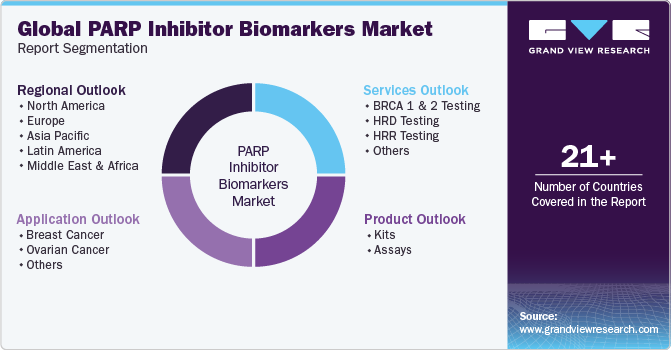

PARP Inhibitor Biomarkers Market Size, Share & Trends Analysis Report By Product (Kits, Assays), By Services (BRCA 1&2 Testing, HRD Testing), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-248-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

PARP Inhibitor Biomarkers Market Trends

The global PARP inhibitor biomarkers market size was estimated at USD 904.10 million in 2023 and is projected to grow at a CAGR of 8.54% from 2024 to 2030. The PARP (poly-ADP ribose polymerase) inhibitor biomarkers market growth is attributed to the increasing prevalence of breast cancer, increasing advancements in genetic technologies, and rising expenditure for oncology treatment. According to the report published by National Breast Cancer Coalition, in 2023, it is estimated that there will be 297,790 new cases of invasive breast cancer in women and 2,800 new cases in men.

Moreover, it is projected that 43,170 women and 530 men will die due to breast cancer. Inherited gene mutations are found to increase risk of breast cancer. According to the American Cancer Society, in the U.S., an estimated 5% of breast cancer are related to some inherited gene mutation which propels the need for effective diagnostic strategies, such as PARP inhibitor biomarkers, to improve survival rates and quality of life for patients diagnosed with this disease.

Advancements in genomic technologies have been a key aspect in the development and market growth. According to the NCBI article published in July 2023, the three key advancements are Next-Generation Sequencing (NGS), Third-Generation Sequencing, and Genomics Studies Using NGS. The NGS technologies have enabled researchers to sequence the entire human genome at an unprecedented scale, identifying new genetic mutations associated with various cancers, including those that are responsive to PARP inhibitors. NGS is now widely used in clinical settings to detect BRCA1 and BRCA2 mutations, which are predictive biomarkers for PARP inhibitor sensitivity. In addition, third-generation sequencing technologies, such as PacBio Sequencing and Oxford Nanopore sequencing, offer long-read sequencing capabilities. These technologies are crucial for identifying complex genetic variations associated with oncology-related diseases. PacBio Sequencing enables long-read sequencing of DNA fragments up to tens of kilobases in length, which is essential for detailed genetic analysis. NGS has been influential in genomics studies, allowing for profound DNA analysis through approaches like whole-genome sequencing, whole-exome sequencing, and targeted sequencing.

Rising expenditure for cancer treatment is boosting the market growth. According to the NCBI article published in August 2023, the price of breast cancer treatment is escalating rapidly, with original therapies and rising survival rates leading to exponential increases in treatment costs for later-stage disease. The per-case cost for the total duration of treatment by stage and molecular subtype has been calculated, with significant differences in cost by stage and subtype. The cost of breast cancer treatment is significantly higher for later stages and certain molecular subtypes. The study found that the cost for stage IV breast cancer was as high as USD 38,203 per case, which is up to 10.9 times higher than for stage. This provides a more accurate understanding of the cost-effectiveness of screening and the economic impacts on health systems, which is critical for developing and implementing effective treatment strategies, including using PARP inhibitor biomarkers.

The growing adoption of personalized medicine and precision therapy fuels the market's growth. According to the Elsevier B.V. article published in October 2023, the clinical trials recommend that combination treatment with PARP inhibitors makes strides in progression-free survival (PFS) in patients with specific DNA repair biomarkers. This shows that PARP inhibitors don't sensitize patients to chemotherapy medication, but where their cancer features a homologous recombination deformity or an elective biomarker of changed DNA repair. BRCA Status and SLFN11 Biomarkers Subgroup examination from the clinical trials showed that the BRCA status and SLFN11 biomarkers foresee benefits from combination treatment, and biomarker-driven benefits happened in ovarian, breast, and little cell lung cancers. This recommends that the utilization of these biomarkers can help distinguish patients who respond to a combination of PARP inhibitors and chemotherapy, which could be a key development driver for the PARP inhibitor biomarkers advertise.

However, the existing reimbursement system presents other challenges such as the development of personalized medicine and adoption of biomarker -based tests. Moreover, the coding system is not convenient for complications of these tests. It does not precisely describe the diagnostic tests, and recent practices are not consistent or clear. These process challenges are hindering the uptake of biomarker-based tests in the clinic, thereby reducing patient access to personalized medicine and may hamper investment in the development of innovative diagnostics.

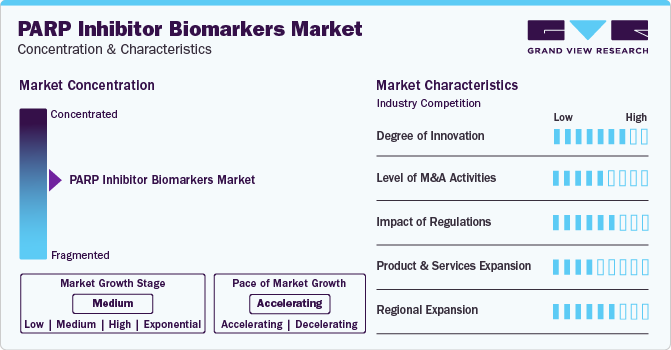

Market Concentration & Characteristics

The market is characterized by moderate-to-high levels of innovation, including the development and introduction of novel techniques and diagnostic technologies. The development of genomic technologies has led to the discovery of new genetic biomarkers that can predict patient responses to PARP inhibitors. These biomarkers, such as BRCA1/2 mutations, ATM alterations, and CHD1 deletion, are crucial for personalizing treatment plans and improving patient outcomes.

The market is characterized by the leading players with moderate levels of product launches and merger and acquisition (M&A) activity. Mature players like Myriad Genetics, Inc.; NeoGenomics Laboratories.; and Invitae Corporation are involved in new product launches, mergers, and acquisitions. Such strategic activities as M&A, partnership, and collaboration only increase companies’ competitiveness, expand their geographic reach, and help enter new territories.

The impact of regulations on the market is extreme, as regulatory agencies such as the FDA and EMA set stringent standards for approval, usage, and commercialization. These regulations shape market dynamics and adoption rates by ensuring these innovative therapies' efficacy, safety, and proper usage.

Product and service expansion within the market is growing, driven by the increasing demand for advanced diagnostic technologies and companion diagnostics. Manufacturers invest in research and development to enhance treatment outcomes and patient care, particularly by developing robust biomarkers to identify responsive patient populations.

The regional expansion of the market is significant, focusing on established regions like North America and Europe and emerging markets. This expansion is fueled by rising awareness, improving healthcare infrastructure, and growing investments in precision medicine initiatives. It presents significant growth opportunities for market players across diverse regions, indicating a promising outlook for the future of PARP inhibitors and biomarker utilization in treatment.

Product Insights

The kits segment led the market with the largest revenue share of 65.35% in 2023, owing to the use of these kits for testing and diagnosing conditions related to gene mutations and alterations. Breast cancer is one of the most common associated with inherited gene mutations. Key players operating in the market are constantly focusing on the development of novel solutions to meet the rising need for effective and efficient diagnostics. For instance, myChoice CDx from Myriad Genetics, Inc., is an FDA-approved test for identifying patients with advanced ovarian cancer with positive homologous recombination deficiency (HRD) status. The HRD is present in approximately 48% of tumors associated with ovarian cancer fueling overall market growth.

The assays segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to the rising technological advancements in oncology diagnosis and screening. For instance, in January 2023, the PARP Activity Screening and Inhibitor Testing Assay (PASTA) is a method tailored for semi-high-throughput in vitro analysis, focusing on the evaluation of PARP inhibitors' selectivity within a 96-well plate configuration. This assay aims to measure the relative selectivity of PARP inhibitors and evaluate ADP-ribosylation levels by individual PARPs under various conditions. It serves as a valuable tool in research and development environments, allowing for the exploration of the impact of PARP inhibitors on cancer cells or the development of new assays for potential clinical application.

Services Insights

Based on services, the BRCA 1 & 2 testing segment led the market with a revenue share of 43.54% in 2023. The BRCA1 and BRCA2 genes are two of the most common genes linked to an increased risk of cancer, particularly breast and ovarian cancer. When working properly, BRCA1 and BRCA2 act as tumor suppressor genes, protecting the body from developing certain cancers. Increasing prevalence of cancer associated with altered BRCA1 and BRCA2 genes is anticipated to drive market growth. According to an article published by the Memorial Sloan Kettering Cancer Center, Women with BRCA1 or BRCA2 genetic mutations are more likely to develop breast, ovarian, and pancreatic cancer. Men with BRCA1 or BRCA2 genetic mutations are more likely to develop prostate, pancreatic, or breast cancer.

The HRD testing segment is expected to register at the significant CAGR during the forecast period. According to the NCBI article published in August 2021, HRD, or Homologous Recombination Deficiency, is a condition that occurs when a cell is unable to repair DNA double-strand breaks. HRD testing is typically used to guide treatment decisions for patients with advanced ovarian cancer with positive HRD status. While it is an important tool in the management of ovarian cancer, it is not as widely adopted as BRCA testing due to its specificity and the fact that it is more commonly associated with BRCA mutations.

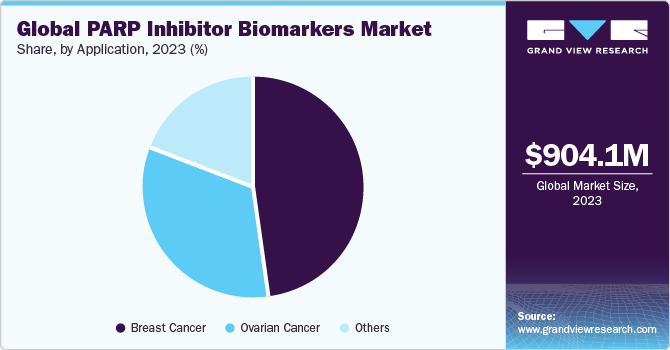

Application Insights

In terms of application, the breast cancer led the market with the largest revenue share of 48.42% in 2023. The growth of the segment is attributed to the rising prevalence of breast cancer associated with gene alteration linked to BRCA1 or BRCA2 genetic mutations. According to the WHO article published in February 2023, By 2040, breast cancer is projected to affect 2.5 million population. Breast cancer is a widespread form of cancer among women, ranking as the leading cause of cancer-related deaths in females across 95% of the countries. Despite this, the survival rates vary significantly, with a substantial majority of deaths occurring in low- and middle-income countries. High-income countries have seen a significant reduction in breast cancer mortality rates over the past few decades, whereas low- and middle-income countries have not achieved similar progress. This inconsistency in survival rates is largely due to the late diagnosis of breast cancer, insufficient diagnostic and treatment facilities, and the exclusion of breast cancer from universal health coverage in these countries.

The ovarian cancer segment is expected to register at the fastest CAGR of 9.33% during the forecast period. Ovarian cancer ranks as a significant cause of death among women. According to the American Cancer Society article published in January 2024, a woman's lifetime risk of causing ovarian cancer is around 1 in 87, and the likelihood of dying from this disease is about 1 in 130. This form is widespread and can have a profound impact on a woman's life, particularly as it often affects older individuals. The risk of ovarian cancer increases with age, with the majority of diagnoses occurring in women over 60 years of age. Despite advancements in treatment, the disease remains a leading cause of cancer-related deaths among women.

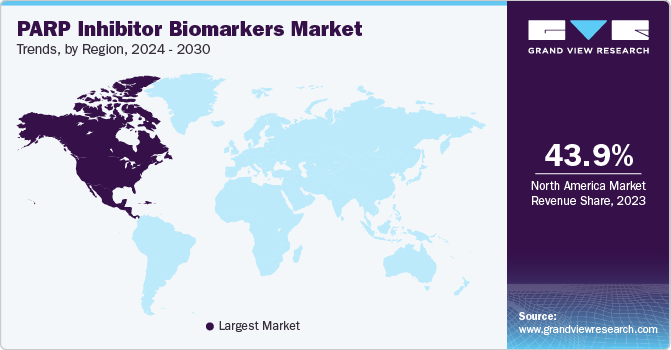

Regional Insights

North America dominated the PARP inhibitor biomarkers market with the revenue share of 43.95% in 2023. This high share is attributable to the increasing prevalence of cancer, advancements in genomic technologies, and rising expenditure for cancer treatment. According to the American Cancer Society article, in 2022, it is projected that there will be around 1.9 million new cancer cases diagnosed and approximately 609,360 cancer deaths in the U.S.

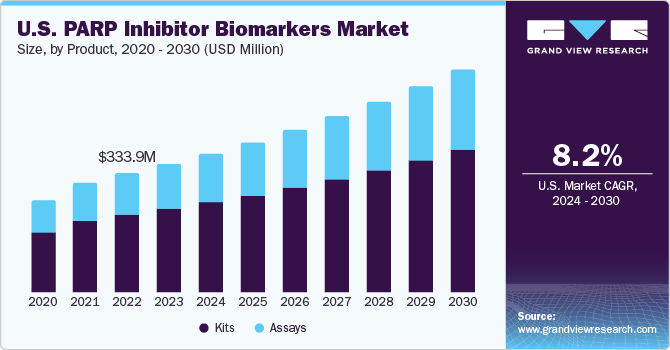

U.S. PARP Inhibitor Biomarkers Market Trends

The PARP inhibitor biomarkers market in the U.S. is expected to grow at the fastest CAGR over the forecast period, owing to the growing prevalence of breast cancer in the country. According to the American Cancer Society estimated that in 2024, each year, approximately 310,720 women are expected to be diagnosed with invasive breast cancer, while about 56,500 cases of ductal carcinoma in situ (DCIS) are anticipated. Furthermore, it is projected that roughly 42,250 women will succumb to breast cancer.

Europe PARP Inhibitor Biomarkers Market Trends

The PARP inhibitor biomarkers market in Europe was identified as a lucrative region in this industry. According to the European Cancer Information System (ECIS) in April 2022, approximately 21% of breast cancer cases in Europe are diagnosed in women who are younger than 50 years. This age group represents the peak incidence period for breast cancer, with 35% of cases occurring in women between the ages of 50 and 64. The remaining cases are reported in women 65 years of age and older.

The UK PARP inhibitor biomarkers market is anticipated to witness at a significant CAGR over the forecast period, due to presence of several small and medium-sized companies that significantly contribute to the economy. The regulatory environment in the UK, including the European Medicines Agency's (EMA) approval process, is favorable to the development and implementation of PARP inhibitors. This support creates a favorable environment for developing biomarkers that help in the early detection and monitoring of various cancers.

The PARP inhibitor biomarkers market in France is anticipated to witness at the significant CAGR over the forecast period. According to the NCBI article published in January 2024, the France cancer landscape is projected to witness a significant number of new cases, with 433,136 instances reported, of which 57% are occurring in men. The most common cancers across both genders are breast (61,214 new cases), and prostate (59,885 new cases) in the year 2023. These statistics highlight the critical role of PARP inhibitor biomarkers in the field of oncology, as these biomarkers are involved in the early detection and monitoring of these cancers.

The Germany PARP inhibitor biomarkers market is expected to grow at the fastest CAGR over the forecast period. With the ongoing developments in the regions, such as the German Cancer Research Center (DKFZ) is working on developing new diagnostic methods for breast, ovarian and pancreatic cancer.

Asia Pacific PARP Inhibitor Biomarkers Market Trends

The PARP inhibitor biomarkers market in Asia Pacific is anticipated to grow at the significant CAGR over the forecast period. This is attributed to the presence of major market players and local players such as Illumina, Inc., QIAGEN, and Thermo Fisher Scientific, Inc. In addition, this growth owes to the significantly increasing investments in PARP inhibitor biomarkers technologies across the region, rise in per capita income leading to increased adoption of diagnostic and therapy products coupled with government initiatives to improve healthcare infrastructure are expected to fuel the regional growth. The rising adoption of devices with new advanced features in emerging countries such as China, Japan, and India is anticipated to drive the market growth over the forecast period.

The China PARP inhibitor biomarkers market is expected to grow at the fastest CAGR over the forecast period, due to the rise in per capita income, leading to increased adoption of diagnostic and therapeutic products and government initiatives to improve healthcare infrastructure. These are expected to fuel the regional market growth. China's rapidly evolving healthcare landscape and patient needs significantly drives the market growth.

The PARP inhibitor biomarkers market in Japan is expected to grow at the fastest CAGR over the forecast period. According to theSpringer Nature Limited article published in September 2023, advances in genomic technologies have identified various biomarkers that can provide valuable insights into patient response to PARP inhibitor therapy. These biomarkers include BRCA mutations, HRD (Homologous Recombination Deficiency) status, and DNA damage repair biomarkers. For instance, recent research has highlighted the therapeutic implications of germline vulnerabilities in DNA repair for precision oncology, which is a key area where PARP inhibitors are being explored. The development of biomarker-guided DNA repair inhibitors is a significant trend in the field, as it allows for the personalization of treatment plans based on the genetic makeup of each patient.

Latin America PARP Inhibitor Biomarkers Market Trends

The PARP inhibitor biomarkers market in Latin America is experiencing growth, with several factors contributing to its expansion.The market growth is influenced by a combination of technological advancements, increasing healthcare awareness, and government initiatives to manage the condition.

The Brazil PARP inhibitor biomarkers market is expected to grow at the fastest CAGR over the forecast period, due to the rising prevalence of cancer aided with the rising use of biomarkers for diagnosis.

Middle East & Africa PARP Inhibitor Biomarkers Market Trends

The PARP inhibitor biomarkers market in Middle East & Africa is anticipated to grow at the significant CAGR over the forecast period, due to various factors, such as increasing prevalence of breast cancer aided by adoption of advanced technology and research & development activities.

The Saudi Arabia PARP inhibitor biomarkers market is expected to grow at the fastest CAGR over the forecast period, owing to the need for better diagnostics and improvements in treatment options due to the rising prevalence of cancer.

Key PARP Inhibitor Biomarkers Company Insights

Some of the key players operating in the market include Myriad Genetics, Inc., Ambry Genetics, Thermo Fisher Scientific, Inc., and Illumina, Inc. The market is highly concentrated, with a small number of manufacturers accounting for majority of the share. New product developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Agilent Technologies, Inc, CENTOGENE N.V., and Amoy Diagnostics Co., Ltd. are some of the key emerging players in the global market with a focus on securing funding from governmental bodies and healthcare institutions. These companies are gaining innovative product introductions to tap into unexplored market segments.

Key PARP Inhibitor Biomarkers Companies:

The following are the leading companies in the PARP inhibitor biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Myriad Genetics, Inc.

- Ambry Genetics

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- CENTOGENE N.V.

- Amoy Diagnostics Co., Ltd.

- Invitae Corporation

- NeoGenomics Laboratories.

- QIAGEN

- Agilent Technologies, Inc.

Recent Developments

-

In January 2024, Myriad Genetics, Inc., a genetic testing and precision medicine manufacturer announced its support for the American Society of Clinical Oncology (ASCO) and Society of Surgical Oncology (SSO) guidelines regarding germline testing for breast cancer patients. The company commends the ASCO-SSO's guideline revision as a significant advancement in integrating genomics into clinical care for patients

-

In February 2024, Myriad Genetics, Inc., a genetic testing and precision medicine company, completed acquisition of certain assets from Intermountain Health's Intermountain Precision Genomics (IPG) laboratory business. The acquisition includes Precision Oncology Testing, Precision Fluid Testing, and his CLIA-certified laboratory in St. George, Utah

-

In January 2023,CRISPR technology has key role in uncovering new markers for resistance to PARP inhibitors in prostate cancer. Scientists have utilized genome wide CRISPR knockout screens to explore how different genetic mutations influence the efficacy of PARP inhibitors. A notable discovery from these studies is the identification of MMS22L, a gene that, upon deletion, significantly increases the sensitivity to PARP inhibitors

PARP Inhibitor Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 979.74 million

Revenue forecast in 2030

USD 1,602.10 million

Growth rate

CAGR of 8.54% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, services, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Myriad Genetics, Inc.; AmbryGenetics; Thermo Fisher Scientific Inc.; Illumina, Inc.; CENTOGENE N.V.; Amoy Diagnostics Co., Ltd.; Invitae Corporation; NeoGenomics Laboratories.; QIAGEN; Agilent Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PARP Inhibitor Biomarkers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global PARP inhibitor biomarkers market report based on product, services, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits

-

Assays

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

BRCA 1 & 2 Testing

-

HRD Testing

-

HRR Testing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Ovarian Cancer

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global PARP inhibitor biomarkers market size was estimated at USD 904.10 million in 2023 and is expected to reach USD 979.74 million in 2024.

b. The global PARP inhibitor biomarkers market is expected to expand at a compound annual growth rate (CAGR) of 8.54% from 2024 to 2030 to reach USD 1,602.10 million by 2030.

b. The Kits segment dominated the PARP inhibitor biomarkers market with a share of 65.35% in 2023 owing to the use of these kits for testing and diagnosing conditions related to gene mutations and alterations. Breast cancer is one of the most common associated with inherited gene mutations.

b. Some key players operating in the ARP inhibitor biomarkers market include Myriad Genetics, Inc. , AmbryGenetics, Thermo Fisher Scientific Inc., Illumina, Inc., CENTOGENE N.V., Amoy Diagnostics Co., Ltd., Invitae Corporation, NeoGenomics Laboratories., QIAGEN, Agilent Technologies, Inc.

b. Key factors that are driving the market growth include the increasing prevalence of breast cancer, increasing advancements in genetic technologies, and a rising expenditure for oncology treatment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."