Parkinson’s Disease Treatment Market Size, Share & Trends Analysis Report By Drug Class (Carbidopa-Levodopa, Dopamine Agonists, MAO-B Inhibitors), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-990-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

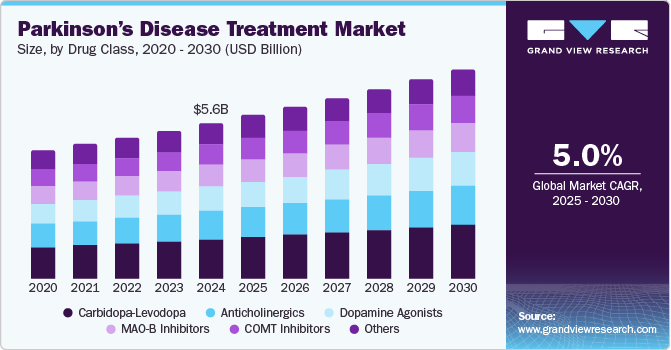

The global parkinson’s disease treatment market size was estimated at USD 5.65 billion in 2024 and is expected to grow at a CAGR of 5.04% from 2025 to 2030.The market experiences growth due to increasing global prevalence, driven by aging populations and enhanced diagnostic capabilities. Key drivers include advancements in drug development, such as neuroprotective therapies, RNA-based treatments, and improved drug delivery systems. Rising awareness, supportive government initiatives, and reimbursement policies further promote treatment adoption. Additionally, a robust pipeline of innovative therapies addressing motor and non-motor symptoms expands market potential, aligning with the growing patient base.

These increasing prevalence rates, rising diagnostic cases, and significant healthcare costs underscore a growing demand for advanced therapies and innovative solutions, driving the expansion of the market. According to the Parkinson’s Foundation (2024), nearly one million people in the U.S. currently live with Parkinson’s disease (PD), projected to rise to 1.2 million by 2030. Globally, over 10 million are affected. Annually, about 90,000 new U.S. cases are diagnosed, with men 1.5 times more likely to develop PD. Annual U.S. costs total USD 52 billion, including USD 2,500 for medications and up to USD 100,000 for surgery per patient. Studies reveal prevalence increases with age and varies by region, with higher rates in the Rust Belt. These findings, published by the Parkinson’s Foundation and The Michael J. Fox Foundation in 2022, emphasize the growing need for research and advanced treatments.

According tothe National Institute of Neurological Disorders and Stroke (NINDS) (last reviewed September 20, 2024), PD affects 500,000 to 1 million Americans, causing motor issues like slowness and rigidity, alongside non-motor symptoms such as sleep disturbances and mood changes. While current treatments improve movement, they have limited efficacy in addressing other symptoms or halting disease progression. In 2022, NINDS allocated USD 125 million of the USD 259 million NIH budget for PD research, supporting initiatives like biomarker discovery and translational research. Programs include the Morris K. Udall Centers and the Accelerating Medicine Partnership, aimed at advancing therapeutic development for PD. The investment in PD research by institutions such as NINDS drives advancements in biomarker discovery, translational research, and innovative therapies. These efforts expand treatment options, improve patient outcomes, and fuel growth in the market by addressing unmet medical needs.

The strategic initiatives, including product launches and ongoing research efforts, play a key role in expanding the market for advanced treatments for Parkinson's disease by introducing novel therapies and enhancing existing treatment options. In October 2024, AbbVie revealed that the U.S. FDA had approved VYALEV (foscarbidopa and foslevodopa), a pioneering 24-hour continuous subcutaneous infusion therapy of levodopa for adults with advanced PD.The approval follows positive results from the Phase 3 M15-736 study, which demonstrated that VYALEV significantly improves motor fluctuations, increasing "on" time without troublesome dyskinesia compared to oral carbidopa/levodopa. This therapy offers a continuous, personalized delivery of levodopa, addressing the challenges faced by patients as the disease progresses. VYALEV’s approval represents a significant advancement, as current treatments often become less effective over time, leading to the need for surgical interventions.

The studies found that VYALEV provided superior improvements in motor control, reducing "off" time and improving quality of life. It also showed a favorable safety profile, with common adverse reactions, including infusion site events, hallucinations, and dyskinesia. Coverage for Medicare patients is expected by mid-2025. AbbVie aims to expand access to VYALEV globally, as the treatment has already been approved in 35 countries and initiated in over 4,200 patients worldwide.

Drug Class Insights

The carbidopa-levodopa segment dominated the Parkinson’s disease treatment industry and accounted for the largest revenue share of 25.12% in 2024 due to its long-established efficacy in managing symptoms, particularly tremors, stiffness, and bradykinesia. The combination therapy addresses the brain's dopamine deficiency, improving motor function and quality of life for patients. Its proven track record, widespread availability, and cost-effectiveness make it the first-line treatment for Parkinson's. Additionally, its combination with other drugs in various formulations, such as extended-release versions, provides tailored treatment options. Despite the emergence of newer therapies, Carbidopa-Levodopa remains the cornerstone of Parkinson's disease management due to its long-term success and consistent clinical outcomes.

Dopamine agonists are expected to register moderate growth during the forecast period due to their effectiveness in managing Parkinson's disease symptoms, particularly in patients who experience motor fluctuations or as adjuncts to Carbidopa-Levodopa therapy. These drugs mimic dopamine in the brain, helping to improve motor control and reduce tremors and stiffness. Their growth is driven by increasing Parkinson's disease prevalence and expanding patient populations. However, the growth rate is tempered by the preference for Carbidopa-Levodopa as first-line therapy and the development of newer treatment options, such as gene therapies and advanced deep brain stimulation techniques, which may limit market share expansion.

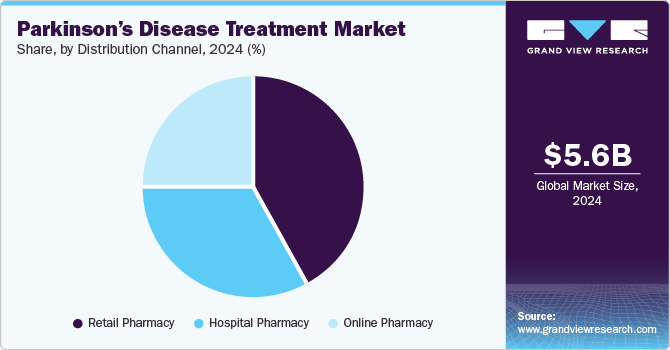

Distribution Channel Insights

The retail pharmacy segment dominated the Parkinson’s disease treatment market with the revenue share of 41.59% in 2024 and is anticipated to witness the fastest growth over the forecast period due to its widespread accessibility and convenience for patients. Retail pharmacies are the primary distribution channel for prescription medications, including Carbidopa-Levodopa, dopamine agonists, and other treatments for managing Parkinson’s disease symptoms. This segment benefits from a large number of patients seeking ongoing treatment and refills. Additionally, the growing prevalence of Parkinson's disease, coupled with an aging population, drives demand for easily accessible medications. The availability of over-the-counter supplements and supportive therapies in retail pharmacies further contributes to the segment’s strong position in the overall market.

The online pharmacy segment is expected to witness moderate growth over the forecast period due to increasing patient preference for the convenience of purchasing medications from home. With the rise of e-commerce platforms and advancements in digital health services, online pharmacies offer a wide range of Parkinson’s disease treatments, including prescription and over-the-counter medications. The growth is also driven by factors such as better accessibility, time savings, and competitive pricing. However, regulatory challenges and limited patient awareness in some regions may moderate the segment's growth. Despite these challenges, the convenience and growing adoption of online platforms fuel its expansion.

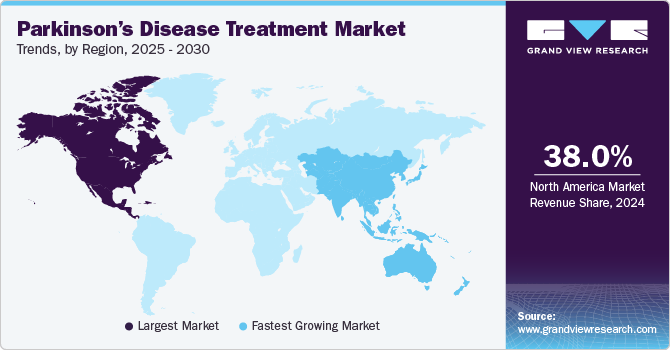

Regional Insights

North America dominated the Parkinson’s disease treatment market with a revenue share of 38.03% in 2024 due to a combination of factors such as a high prevalence of the disease, advanced healthcare infrastructure, and significant research and development investments. The region benefits from robust healthcare systems and a high rate of early diagnosis, contributing to a larger patient base for Parkinson's treatments. Additionally, the presence of key pharmaceutical companies and government initiatives aimed at improving patient care further supports market growth. The increasing adoption of novel therapies and the rising demand for personalized treatments are expected to sustain North America’s dominance in the market.

U.S. Parkinson’s Disease Treatment Market Trends

The U.S. Parkinson’s disease treatment industry holds a significant share in the region, driven by the increasing prevalence of the disease and growing demand for effective therapeutic options. The market benefits from expanding awareness about the therapeutic applications of treatments like carbidopa-levodopa and dopamine agonists. Advancements in drug formulations, along with the growing acceptance of Parkinson’s disease treatments within clinical protocols, are further contributing to market growth. The continuous development of new medications and treatment combinations is expected to enhance the treatment landscape, maintaining the U.S. market's dominance.

Europe Parkinson’s Disease Treatment Market Trends

The Europe Parkinson’s disease treatment industry is experiencing notable growth due to increasing awareness of the condition and growing adoption of therapeutic interventions. The aging population in Europe, which is more susceptible to neurological disorders like Parkinson’s, is a key driver of market demand. Rising healthcare expenditure and advancements in treatment formulations for chronic condition management contribute to market growth. Regulatory support for novel Parkinson’s therapies and expanding treatment options in key markets such as Germany, France, and the UK are expected to enhance the overall market landscape.

The UK Parkinson’s disease treatment market is expected to witness significant growth, driven by an increasing focus on neurological health and rising awareness of the benefits of advanced treatments for Parkinson’s management. The National Health Service (NHS) has integrated Parkinson’s treatments into patient healthcare plans, improving accessibility. UK pharmaceutical companies are developing new Parkinson’s treatment formulations, contributing to market growth. Additionally, government initiatives to improve public health and the availability of advanced Parkinson’s medications support market expansion.

Parkinson’s disease treatment market in Germany holds a prominent share in Europe, driven by its strong healthcare system and increasing demand for effective neurological treatments. The adoption of Parkinson’s treatments for managing motor symptoms and supporting quality of life is expanding, with a growing emphasis on evidence-based therapies. Regulatory support for Parkinson’s therapies and advancements in formulation technologies are contributing to market growth. Additionally, the country’s focus on improving patient access to Parkinson’s treatments through healthcare infrastructure development is expected to continue supporting market expansion.

Asia Pacific Parkinson’s Disease Treatment Market Trends

The Asia Pacific Parkinson’s disease treatment industry is experiencing rapid growth, attributed to rising healthcare expenditure, an aging population, and increased consumer awareness of neurological health. The region’s rising incidence of Parkinson’s, particularly in countries like China, India, and Japan, is contributing to the growing demand for therapeutic options. Government initiatives to improve healthcare access, along with expanding healthcare infrastructure, are supporting market development. The expansion of pharmaceutical companies' product portfolios and distribution networks is expected to enhance market penetration in this region.

China Parkinson’s disease treatment market is witnessing moderate growth due to the increasing prevalence of neurological conditions and the country’s expanding aging population. Government efforts to improve healthcare infrastructure and increase access to neurological treatments foster market development. The growing adoption of Parkinson’s therapies in managing motor symptoms and slowing progression is expected to continue driving demand. The presence of local and international pharmaceutical companies further supports the availability and accessibility of Parkinson’s treatments.

Parkinson’s disease treatment market in Japan is characterized by high consumer awareness and a well-established healthcare system. The growing prevalence of Parkinson’s, coupled with the country’s aging population, is driving demand for therapeutic interventions. Japanese healthcare providers increasingly recommend new treatment options as part of patient care protocols. Ongoing research and developing novel Parkinson’s medications are contributing to market growth. Additionally, collaborations between pharmaceutical companies and healthcare providers are facilitating greater access to Parkinson’s treatments nationwide.

Latin America Parkinson’s Disease Treatment Market Trends

The Latin America Parkinson’s disease treatment industry is experiencing high growth over the forecast period owing to the increasing prevalence of Parkinson's disease, greater awareness, and the rising demand for advanced therapies and drugs. As the population in Latin America continues to age, the incidence of Parkinson's disease is expected to rise, creating a significant demand for treatments.

Brazil Parkinson’s disease treatment market is witnessing steady growth, fueled by an increasing focus on healthcare accessibility and a rising prevalence of neurological conditions. Government policies to improve healthcare coverage and expand access to treatment options support market expansion. The demand for Parkinson’s therapies, particularly for managing motor symptoms and improving quality of life, is increasing. Additionally, growing consumer awareness of Parkinson’s treatment benefits will continue driving the market forward.

Middle East & Africa Parkinson’s Disease Treatment Market Trends

The Middle East and Africa Parkinson’s disease treatment industry is experiencing growth due to rising awareness about neurological health and the increasing prevalence of related conditions. Key markets such as South Africa, UAE, and Saudi Arabia are witnessing an uptick in demand for Parkinson’s treatment options. Governments in the region are focusing on improving healthcare systems and expanding access to medications, further stimulating market growth. Collaborative efforts between healthcare providers and pharmaceutical companies are helping to improve the availability of Parkinson’s treatments, driving market expansion in the MEA region.

The Saudi Arabia Parkinson’s disease treatment market is expanding, driven by increasing healthcare initiatives and a rising focus on neurological condition management. The country’s Vision 2030 framework emphasizes improving health outcomes, contributing to greater demand for effective treatments for Parkinson’s. With an increasing prevalence of age-related conditions, Parkinson’s treatments are becoming an essential part of patient care protocols. The government’s efforts to improve healthcare infrastructure and drug accessibility, along with growing awareness of the condition, are expected to support market growth. Key international and local pharmaceutical companies are expanding their regional offerings, enhancing availability and competition.

Key Parkinson’s Disease Treatment Company Insights

The Parkinson’s disease treatment industry is competitive, with key players such as AbbVie, Merck, and GlaxoSmithKline leading the market through their established product portfolios, including Carbidopa-Levodopa and dopamine agonists. Companies are focusing on innovation, including the development of advanced formulations, combination therapies, and personalized treatments. New entrants are challenging market leaders with novel drug candidates, while ongoing research and clinical trials further intensify competition. Additionally, strategic partnerships, mergers, and acquisitions are common as companies seek to expand their market presence and enhance R&D capabilities. The market's growth is driven by continuous advancements in therapeutic options and improving patient outcomes.

Key Parkinson’s Disease Treatment Companies:

The following are the leading companies in the parkinson’s disease treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Cerevel Therapeutics

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

- GlaxoSmithKline plc. (GSK)

- AbbVie, Inc.

- H. Lundbeck A/S

- Amneal Pharmaceuticals LLC

- Supernus Pharmaceuticals, Inc.

Recent Developments

-

In October 2024, MeiraGTx reported favorable outcomes from its AAV-GAD clinical bridging study for Parkinson's disease, achieving both safety and efficacy goals. The high-dose group showed an 18-point improvement in the UPDRS Part 3 score at 26 weeks, while both high and low-dose groups exhibited significant improvements in the PDQ-39 score, a measure of quality of life. The treatment was well-tolerated, with no serious adverse events, reinforcing the move toward Phase 3 trials.

-

In September 2024, Amneal Pharmaceuticals introduced CREXONT (carbidopa and levodopa) extended-release capsules for the treatment of Parkinson's disease. The product features a unique formulation that combines immediate-release granules with extended-release pellets, offering a longer duration of effective symptom control with fewer doses compared to traditional immediate-release options. CREXONT is now available in U.S. pharmacies and is supported by affordability services. Amneal plans to present CREXONT at the International Congress of Parkinson's Disease and Movement Disorders in September 2024. The medication is intended to effectively manage Parkinson's symptoms.

-

In September 2024, AbbVie reported positive topline results from the Phase 3 TEMPO-1 trial assessing tavapadon as a monotherapy for early Parkinson's disease. The trial showed a statistically significant improvement in the combined MDS-UPDRS Parts II and III score at week 26 for both the 5 mg and 15 mg doses of tavapadon. The treatment also met important secondary endpoints, demonstrating significant improvements in motor aspects of daily living. The safety profile was consistent with previous studies. Full data will be shared at upcoming medical conferences.

Parkinson’s Disease Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.93 billion |

|

Revenue forecast in 2030 |

USD 7.58 billion |

|

Growth rate |

CAGR of 5.04% from 2025 to 2030 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Drug class, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Cerevel Therapeutics; Novartis AG; Teva Pharmaceutical Industries Ltd.; Merck & Co., Inc.; GlaxoSmithKline plc. (GSK); AbbVie, Inc.; H. Lundbeck A/S; Amneal Pharmaceuticals LLC; Supernus Pharmaceuticals, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Parkinson’s Disease Treatment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Parkinson’s disease treatment market report based on drug class, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbidopa-Levodopa

-

Dopamine Agonists

-

MAO-B Inhibitors

-

COMT inhibitors

-

Anticholinergics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Parkinson's disease treatment market size was valued at USD 5.65 billion in 2024 and is anticipated to reach USD 5.93 billion in 2025.

b. The global Parkinson's disease treatment market is expected to witness a compound annual growth rate of 5.04% from 2025 to 2030 to reach USD 7.58 billion by 2030.

b. Based on drug class, the carbidopa-Levodopa segment accounted for a share of 25.12% in 2024 due to high prescription and usage rate of Carbidopa-Levodopa due to long-term effects and immediate result.

b. Some of the key players in the Parkinson's disease treatment market are Cerevel Therapeutics; Novartis AG; Teva Pharmaceutical Industries Ltd.; Merck & Co., Inc. GlaxoSmithKline plc. (GSK); AbbVie, Inc.; H. Lundbeck A/S; and Amneal Pharmaceuticals LLC.

b. The major factors driving the market growth are the presence of strong product pipeline, approval of disease-modifying therapies, and rising disease burden of Parkinson’s in developed countries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."