Parcel Sortation Systems Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Service), By Type, By Industry Vertical (Commercial, Defense), By Region, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-376-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Parcel Sortation Systems Market Trends

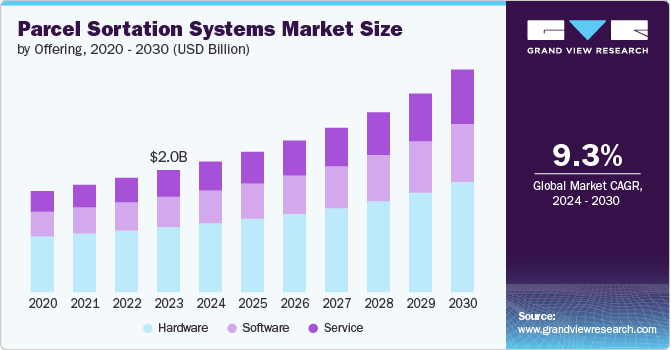

The global parcel sortation systems market size was estimated at USD 2.01 billion in 2023 and is expected to grow at a CAGR of 9.3% from 2024 to 2030. Parcel sortation systems automate the process of segregating and routing packages within warehouses and distribution centers. These systems utilize a combination of conveyors, scanners, sorters, and software to handle high volumes of parcels efficiently and accurately. The market encompasses various technologies like belt conveyors, roller conveyors, tilt trays, shoe sorters, and cross-belt sorters.

The parcel sortation systems market is experiencing growth due to the e-commerce boom and consumer demand for faster deliveries. Warehouses and logistics companies are adopting automation to handle surging parcel volumes, optimize operations for speedier order fulfillment, and address labor shortages. Advancements in robotics, AI, and machine vision are revolutionizing sorting processes, while the rise of omnichannel retail necessitates flexible systems to manage diverse fulfillment models. This confluence of trends positions the parcel sortation systems market for continued expansion and innovation in the future of efficient and reliable package delivery.

The parcel sortation systems market is experiencing a surge driven by a confluence of factors. The ever-expanding e-commerce landscape is generating a tidal wave of parcels, overwhelming traditional manual sorting methods. Logistics companies prioritize solutions such as automated sortation systems to meet this challenge and maintain efficiency. These systems not only handle increased parcel volumes but also offer significant operational advantages. By streamlining sorting processes and reducing manual labor dependence, they contribute to faster order fulfillment and lower operating costs.

Furthermore, the growing trend towards automation across industries is influencing the logistics sector, making automated sorting systems a natural progression. Additionally, government regulations mandating faster delivery times and stricter package handling procedures are pushing logistics companies to adopt advanced sorting technologies to ensure compliance and maintain customer satisfaction. This confluence of rising demand, operational efficiency needs, automation trends, and regulatory pressures positions the parcel sortation systems market as a key driver for a future of efficient and reliable package delivery.

Despite the promising growth trajectory, the parcel sortation systems market faces some hurdles. A significant barrier is the high initial investment required for implementing these systems. This can be a major deterrent for smaller and medium-sized businesses with limited budgets. Additionally, integrating a sorting system with existing warehouse infrastructure is a complex task demanding specialized expertise, further adding to the initial cost burden. Furthermore, ongoing maintenance costs associated with these systems require careful consideration during the selection process. Implementing a parcel sortation system might necessitate additional warehouse space to accommodate the equipment, which could pose a challenge for facilities with limited space availability. Addressing these restraints through cost-effective solutions, modular system designs, and readily available support services will be crucial to ensure wider adoption and continued growth of the parcel sortation systems market.

Offering Insights

The hardware segment dominated the market in 2023 and accounted for a more than 54% share of global revenue. This segment holds the largest market share due to the core functionality it provides. Conveyor belts, sortation shoes, diverters, and scanners are the essential building blocks of any parcel sortation system. As technology advances, hardware innovation plays a crucial role in driving market growth. We can expect advancements in materials, efficiency, and integration capabilities to solidify hardware's dominance further.

The service segment is projected to witness significant growth from 2024 to 2030. This segment encompasses design and consultation, training, installation and deployment, and maintenance and repair. As companies shift towards automation, the expertise needed for system design, integration, and ongoing support is creating a rapidly growing market. Additionally, complexities associated with maintaining these systems will propel the service segment as a key driver for successful implementation.

Type Insights

The loop (circular) parcel sortation system segment dominated the market in 2023. Despite being the dominant segment, loop systems like cross-belt sorters and tilt tray sorters are experiencing the fastest growth. Their high throughput capacity and suitability for large-scale operations cater perfectly to the burgeoning e-commerce industry. Additionally, advancements in loop systems, such as dynamic sortation and integration with AI, enhance their functionality and contribute to their rapid growth.

The linear parcel sortation system segment is projected to witness significant growth from 2024 to 2030. Linear systems like activated roller belt sorters, pop-up sorters, and shoe sorters offer a simple and efficient solution for handling smaller parcel volumes or specific sorting needs. Their modularity and scalability make them attractive to a wider range of companies, especially those implementing automation for the first time. This adaptability contributes to the significant growth in this segment.

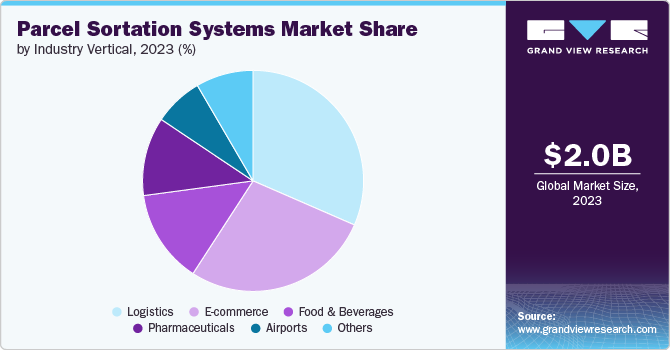

Industry Vertical Insights

The logistics segment dominated the market in 2023. The logistics industry has traditionally been the dominant user of parcel sortation systems. Existing logistics companies rely heavily on efficient sorting for timely deliveries and meeting customer expectations. However, their established infrastructure might favor upgrades to existing systems rather than complete overhauls, limiting explosive growth.

The E-commerce segment is projected to witness significant growth from 2024 to 2030. This segment is experiencing the fastest growth due to the exponential rise in online shopping. E-commerce companies require robust and scalable sorting solutions to handle the ever-increasing volume of parcels. Their focus on speed and efficiency drives the adoption of advanced loop systems and innovative hardware solutions, propelling the e-commerce segment to become a major growth driver for the entire parcel sortation systems market.

Regional Insights

The parcel sortation systems market in North America is expected to witness steady growth from 2024 to 2030. North America remains a significant market for parcel sortation systems, driven by well-established e-commerce giants and high consumer demand for fast deliveries. North American logistics companies are constantly seeking innovative solutions to optimize operational costs and maintain their competitive edge. The market sees strong demand for high-capacity and technologically advanced sorting systems.

U.S. Parcel Sortation Systems Market Trends

The parcel sortation systems market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. Within North America, the U.S. represents a major market due to its dominant e-commerce sector and consumer spending habits. The U.S. market is similar to North America as a whole, observing high demand for advanced sorting solutions driven by competition and consumer expectations. However, the vast geographical size of the U.S. presents unique challenges for efficient delivery, creating opportunities for innovative solutions that address long-distance parcel sorting and routing.

Asia Pacific Parcel Sortation Systems Market Trends

The Asia Pacific region dominated the parcel sortation systemsmarket in 2023 and accounted for a share of over 40% the global revenue. Fueled by the booming e-commerce sector in countries like China, India, and South Korea, the demand for efficient logistics solutions is skyrocketing. Government initiatives promoting e-commerce infrastructure and rising disposable income are further driving market growth. Additionally, the presence of major manufacturing hubs in the region creates a cost-competitive environment for hardware production, making these systems more accessible.

The parcel sortation systems market in Japan is expected to grow at a significant CAGR from 2024 to 2030. Japan has a well-established logistics infrastructure, and parcel sortation systems play a vital role in maintaining its efficiency. The increasing adoption of automation and focus on operational excellence among Japanese logistics companies are driving significant growth in this market. Additionally, Japan's aging population and growing demand for online grocery delivery create a unique opportunity for innovative sorting solutions catering to smaller packages.

India parcel sortation systems market is expected to grow at a significant CAGR from 2024 to 2030. India's e-commerce market is witnessing explosive growth, making it a significant growth area for parcel sortation systems. With a large and geographically diverse population, efficient sorting solutions are crucial for timely delivery across the country. Government initiatives like "Digital India" are promoting investments in logistics infrastructure, providing a fertile ground for the market to flourish. However, factors like limited warehouse space and lack of skilled personnel might necessitate innovative solutions and training programs to ensure successful implementation.

Europe Parcel Sortation Systems Market Trends

The parcel sortation systems market in Europe is expected to grow at a significant CAGR from 2024 to 2030. Europe presents a significant growth market for parcel sortation systems due to its well-developed e-commerce sector and stringent regulations on delivery times. European companies are increasingly adopting automation to enhance efficiency and comply with regulations. Additionally, the growing demand for omnichannel retail fulfillment necessitates flexible sorting solutions, further propelling market growth.

France parcel sortation systems market is expected to grow at a significant CAGR from 2024 to 2030. France has a thriving e-commerce market and a strong focus on customer satisfaction, driving the adoption of advanced parcel sortation systems. French logistics companies are prioritizing automation to meet faster delivery expectations and optimize operations. Additionally, government regulations promoting sustainability within the logistics sector are creating a demand for energy-efficient sorting solutions, offering opportunities for innovative manufacturers.

Key Parcel Sortation Systems Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Parcel Sortation Systems Companies:

The following are the leading companies in the parcel sortation systems market. These companies collectively hold the largest market share and dictate industry trends.

- Beumer Group

- Interroll Group

- Vanderlande Industries B.V.

- Daifuku Co., Ltd.

- Kion Group AG

- Bastian Solutions, LLC

- Körber AG

- Okura Yusoki Co., Ltd.

- Dematic

- Honeywell International, Inc.

- Murata Machinery, Ltd.

- SSI Schaefer

- TGW Logistics Group

- Equinox

Recent Development

-

In January 2024, Viettel Post, a Vietnamese logistics company, adopted a fully automated robot-based parcel sorting system. The new system, installed by LiBiao Robotics, can process 6,000 parcels per hour and has significantly increased order throughput speed and reduced errors. This automation allows Viettel Post to improve its already high standard of shipping services.

-

In December 2023, BeeVision, a warehouse automation company, is providing its BeeSort parcel sorting system to Aramex, a global logistics provider. This AI-powered system will be implemented across Aramex's hubs in 9 locations, improving package sorting efficiency and accuracy. By using BeeSort, Aramex aims to meet customer expectations and maintain operational excellence.

-

In October 2023, Pitney Bowes, a shipping and mailing company, partnered with Ambi Robotics, a California startup developing robotic parcel sorting systems. Pitney Bowes has already deployed AmbiSort A-Series systems for last-mile deliveries and is now implementing the B-Series solution for middle-mile sorting at the U.S. coastal hubs. This investment in automation aims to improve speed, accuracy, and worker safety during the peak holiday season.

-

In December 2021, Beumer Group launched a new sorting system for small and medium e-commerce parcels. This system allows separate sorting from larger items, facilitating deliveries by smaller vehicles in urban areas. Installed in Germany, it processes parcels in a dedicated area and increases sorting capacity by over 40,000 parcels per hour.

Parcel Sortation Systems Market Report Scope

|

Attribute |

Details |

|

Market size value in 2024 |

USD 2.15 billion |

|

Revenue forecast in 2030 |

USD 3.66 billion |

|

Growth rate |

CAGR of 9.3% from 2024 to 2030 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, type, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Beumer Group; Interroll Group; Vanderlande Industries B.V.; Daifuku Co. Ltd.; Kion Group AG; Bastian Solutions, LLC; Körber AG; Okura Yusoki Co., Ltd.; Dematic; Honeywell International, Inc.; Murata Machinery, Ltd.; SSI Schaefer; TGW Logistics Group; Equinox. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Parcel Sortation Systems Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the parcel sortation systems market based on offering, type, industry vertical, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Conveyor Belts

-

Sortation Shoes

-

Diverters

-

Scanners

-

Others

-

-

Software

-

Service

-

Design and Consultation

-

Training, Installation, and Deployment

-

Maintenance and Repair

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Linear Parcel Sortation System

-

Activated Roller Belt Sorters

-

Pop-Up Sorters

-

Shoe Sorters

-

Others

-

-

Loop (Circular) Parcel Sortation System

-

Cross Belt Sorters

-

Tilt Tray Sorters

-

Others

-

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Logistics

-

E-commerce

-

Airports

-

Pharmaceuticals

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global parcel sortation systems market size was estimated at USD 2.01 billion in 2023 and is expected to reach USD 2.15 billion in 2024.

b. The global parcel sortation systems market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030, reaching USD 3.66 billion by 2030.

b. Asia Pacific dominated the parcel sortation systems market, with a share of 40.2% in 2023. Fueled by the booming e-commerce sector in countries like China, India, and South Korea, the demand for efficient logistics solutions is skyrocketing. Government initiatives promoting e-commerce infrastructure and rising disposable income are further driving market growth.

b. Some key players operating in the parcel sortation systems market include Beumer Group, Interroll Group, Vanderlande Industries B.V., Daifuku Co., Ltd., Kion Group AG, Bastian Solutions, LLC, Körber AG, Okura Yusoki Co., Ltd., Dematic, Honeywell International, Inc., Murata Machinery, Ltd., SSI Schaefer, TGW Logistics Group, and Equinox.

b. Driven by the e-commerce boom and consumer demand for faster deliveries, the parcel sortation systems market is experiencing significant growth. Warehouses and logistics companies are adopting automation to handle surging parcel volumes, optimize operations for speedier order fulfillment, and address labor shortages. Advancements in robotics, AI, and machine vision are revolutionizing sorting processes, while the rise of omnichannel retail necessitates flexible systems to manage diverse fulfillment models.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."