- Home

- »

- Electronic Devices

- »

-

Paralleling Switchgear Market Size & Share Report, 2030GVR Report cover

![Paralleling Switchgear Market Size, Share & Trends Report]()

Paralleling Switchgear Market Size, Share & Trends Analysis Report By Application (Prime Power, Standby Power, Peak Shaving), By Type, By Voltage, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-385-4

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Paralleling Switchgear Market Size & Trends

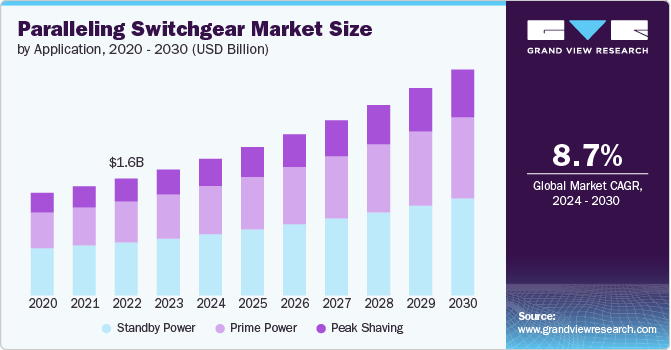

The global paralleling switchgear market size was valued at USD 1.71 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. The increasing demand for reliable and uninterrupted power supply across various industries is a major factor contributing to the growth of the market. With the rising adoption of automation and digital technologies, businesses are becoming increasingly dependent on consistent power sources. Paralleling switchgear systems, which ensure continuous power by synchronizing multiple power sources, are critical in maintaining operational efficiency and preventing costly downtimes. This growing emphasis on power reliability is pushing industries to invest heavily in advanced paralleling switchgear solutions.

The market is witnessing significant growth, primarily driven by the critical benefits it offers, such as improved reliability. One of the main advantages of paralleling switchgear is its ability to enhance the reliability of power systems. By connecting multiple generator sets in parallel, the system ensures continuous power supply even if one generator fails. This redundancy is crucial in mission-critical applications such as hospitals, data centers, and industrial facilities, where power interruptions can lead to severe consequences. The increased demand for uninterrupted power supply across various sectors is fueling the adoption of paralleling switchgear, thus propelling market growth.

Another key driver of the market is its capability to deliver enhanced performance. Paralleling switchgear systems helps maintain stable voltage and frequency levels by distributing the load among multiple generators. This load-sharing mechanism not only prevents individual generators from being overloaded but also extends their operational lifespan. Additionally, the ability to add or remove generators from the system without disrupting the power supply allows for scalable and flexible power management solutions, making paralleling switchgear an attractive option for growing businesses and facilities undergoing expansion.

The growing emphasis on energy efficiency and sustainability is further contributing to the market expansion. Paralleling switchgear enables optimal utilization of generator sets, reducing fuel consumption and emissions. This is particularly important in industries and regions where stringent environmental regulations are in place. The adoption of renewable energy sources and the integration of these sources into the existing power grid also benefit from paralleling switchgear, as it ensures smooth transitions and reliable power supply. As organizations increasingly prioritize sustainable practices, the demand for efficient and environmentally friendly power solutions is driving the growth of the paralleling switchgear market.

However, the market faces challenges, particularly in terms of the high initial costs and complexity of installation and maintenance. The advanced technology and sophisticated control systems required for paralleling switchgear can lead to substantial upfront investments, which may deter smaller enterprises from adopting. Additionally, the need for specialized expertise to install and maintain these systems can be a barrier. To address these challenges, key market players are focusing on innovations that simplify installation processes and reduce costs. They are also investing in training programs to build a skilled workforce capable of handling these advanced systems, thereby mitigating the restraining factors and ensuring sustained market growth.

Application Insights

Based on application, the standby power segment dominated the market and accounted for 45.2% of the global revenue in 2023. The increasing reliance on continuous and uninterrupted power supply across critical industries such as healthcare, data centers, and manufacturing is a major driving force. These sectors require robust backup power solutions to ensure operational continuity during power outages or disruptions. Paralleling switchgear systems, which seamlessly synchronize multiple generators to provide reliable standby power, are becoming essential investments for these industries. The growing prevalence of natural disasters and grid instability further underscores the need for effective standby power solutions, driving demand in this segment.

The peak shaving segment is expected to register significant growth from 2024 to 2030. The emphasis on energy efficiency and cost reduction is a key trend influencing the segment growth. Peak shaving involves reducing energy consumption during periods of high demand to lower utility costs and avoid peak demand charges. Paralleling switchgear systems enables businesses to manage their power usage more effectively by integrating various power sources and optimizing load distribution. This capability not only helps in reducing operational expenses but also supports grid stability by mitigating the strain during peak times.

Type Insights

The open transition system segment accounted for the largest market revenue share in 2023. For open transition systems, the primary driver is their simplicity and cost-effectiveness, making them a popular choice for applications where momentary power interruptions are acceptable. These systems are particularly favored in industries with non-critical processes, where the brief loss of power during transition does not significantly impact operations. The cost-efficiency of open transition systems appeals to businesses looking to balance reliability with budget constraints, driving steady demand in this segment.

The closed transition system segment is expected to grow significantly from 2024 to 2030. Closed transition systems are experiencing growing demand due to their ability to provide seamless power transfer without any interruption. This feature is crucial for sectors where even a momentary power loss can lead to significant operational disruptions and financial losses, such as healthcare, data centers, and critical manufacturing processes. The increasing emphasis on continuous, reliable power supply in these industries is a major trend driving the adoption of closed transition systems. Additionally, advancements in technology have enhanced the efficiency and reliability of these systems, making them more attractive to organizations that prioritize operational continuity and minimal downtime.

Voltage Insights

The low voltage segment accounted for the largest market revenue share in 2023. The increasing adoption in commercial and industrial sectors of low voltage paralleling switchgear is a significant driver contributing to the growth of the segment. These systems are essential for facilities such as hospitals, data centers, and office buildings where reliable and efficient power distribution is critical. The growth of urban infrastructure and the rising need for backup power solutions in commercial buildings are further propelling demand for low voltage switchgear. Additionally, advancements in low voltage technology, including improved safety features and enhanced automation capabilities, are making these systems more attractive to businesses seeking to optimize their power management and ensure continuous operations.

The medium voltage segment is expected to grow significantly from 2024 to 2030. The primary trend driving the growth of the segment is the expansion of industrial and utility applications. Medium voltage paralleling switchgear is crucial for heavy industries, utilities, and large-scale renewable energy projects where robust and reliable power distribution is required to handle higher loads. The increasing focus on upgrading aging power infrastructure and integrating renewable energy sources into the grid is boosting demand for medium voltage systems. Furthermore, the trend toward smart grid development and the need for advanced power management solutions are driving the adoption of medium voltage switchgear.

End Use Insights

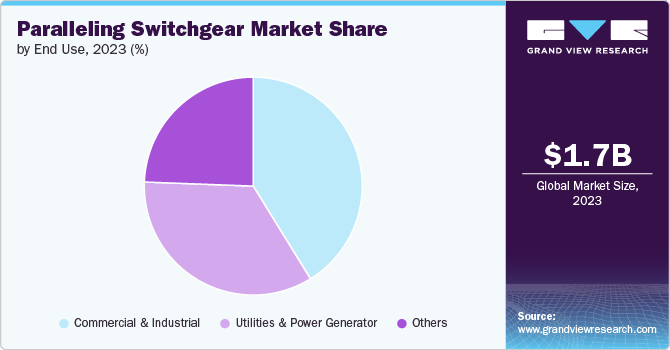

The commercial & industrial segment accounted for the largest market revenue share in 2023. In the commercial and industrial segments, the growing emphasis on operational efficiency and uninterrupted power supply is a major driving force. Industries such as manufacturing, healthcare, and data centers require reliable power systems to prevent costly downtimes and maintain continuous operations. The increasing automation and digitalization of industrial processes further amplify the need for advanced paralleling switchgear solutions, which ensure seamless power transfer and enhanced power management capabilities. As businesses strive to optimize productivity and energy efficiency, the demand for sophisticated switchgear systems in the commercial and industrial sectors continues to rise.

The utilities and power generator segment is expected to register significant growth from 2024 to 2030. The primary trend driving the growth of the segment is the modernization of the power grid and the integration of renewable energy sources. Utilities are increasingly focusing on upgrading their aging infrastructure to improve grid reliability and accommodate the rising influx of renewable energy. Paralleling switchgear plays a crucial role in this transition by enabling the synchronization of diverse power sources and enhancing grid stability. Additionally, the growing number of power generation projects, including those involving wind, solar, and other renewable energies, is boosting the demand for advanced switchgear solutions that can efficiently manage and distribute power.

Regional Insights

North America paralleling switchgear market dominated the global market and accounted for 30.1% in 2023. North America registers the largest share in the paralleling switchgear market due to its well-established industrial base and significant investments in power infrastructure modernization. The region's focus on integrating renewable energy sources and upgrading aging grid systems drives demand for advanced paralleling switchgear solutions. Additionally, the presence of key market players and high adoption rates of new technologies further bolster the market. The stringent regulatory standards for power reliability and safety also contribute to the strong market presence in North America.

U.S. Paralleling Switchgear Market Trends

The paralleling switchgear market in the U.S.is anticipated to register significant growth from 2024 to 2030. The demand for reliable backup power systems in critical sectors such as healthcare, data centers, and industrial facilities further boosts market growth. Additionally, stringent regulatory standards for power reliability and safety enhance the adoption of advanced switchgear solutions.

Europe Paralleling Switchgear Market Trends

The paralleling switchgear market in Europe is poised for significant growth from 2024 to 2030. The paralleling switchgear market is influenced by the region's strong commitment to renewable energy and sustainability goals. The ongoing efforts to modernize the power grid and enhance grid stability drive the adoption of advanced switchgear solutions.

Asia Pacific Paralleling Switchgear Market Trends

The paralleling switchgear market in Asia Pacific is poised for significant growth from 2024 to 2030. The increasing need for reliable power supply in emerging economies and the expansion of manufacturing facilities fuel the demand for advanced switchgear systems. The government's initiatives to develop smart grids and integrate renewable energy sources into the power mix further propel market growth.

Key Paralleling Switchgear Company Insights

Key market players are known for their ongoing innovation and sophisticated switchgear technologies, addressing diverse industrial requirements. Schneider Electric is especially noted for its state-of-the-art automation and energy management systems, whereas Cummins Inc. and Caterpillar are distinguished for their reliable power generation solutions. Their substantial investments in research and development keep them leading the market, fostering growth, and influencing industry trends.

Numerous players in the market are focusing on expanding their product portfolio to expand their geographical presence. For instance, in April 2023, Siemens Smart Infrastructure expanded its lineup of environmentally-friendly and digitally integrated medium-voltage switchgear solutions, aimed at facilitating the decarbonization of contemporary power grids. The latest addition includes the F-gas-free blue GIS primary switchgear, designed to support an early shift towards sustainable grids in anticipation of upcoming regulations.

Key Paralleling Switchgear Companies:

The following are the leading companies in the paralleling switchgear market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Regal Rexnord Corporation

- Schneider Electric

- Cummins Inc.

- Pioneer Power Solutions

- General Electric Company

- INDUSTRIAL ELECTRIC MFG

- EMI

- Kohler Co.

- Nixon Power Services

Paralleling Switchgear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.85 billion

Revenue forecast in 2030

USD 3.06 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Application, type, voltage, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Caterpillar; Regal Rexnord Corporation; Schneider Electric; Cummins Inc.; Pioneer Power Solutions; General Electric Company; INDUSTRIAL ELECTRIC MFG; EMI; Kohler Co.; Nixon Power Services

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paralleling Switchgear Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the paralleling switchgear market based on application, type, voltage, end use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Prime Power

-

Standby Power

-

Peak Shaving

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Transition System

-

Closed Transition System

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial & Industrial

-

Utilities & Power Generator

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global paralleling switchgear market size was estimated at USD 1.71 billion in 2023 and is expected to reach USD 1.85 billion in 2024.

b. The global paralleling switchgear market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 3.06 billion by 2030.

b. North America dominated the paralleling switchgear market with a share of 30.1% in 2023. North America registers the largest share in the paralleling switchgear market due to its well-established industrial base and significant investments in power infrastructure modernization.

b. Some key players operating in the paralleling switchgear market include Caterpillar, Regal Rexnord Corporation, Schneider Electric, Cummins Inc., Pioneer Power Solutions, General Electric Company, INDUSTRIAL ELECTRIC MFG, EMI, Kohler Co., and Nixon Power Services.

b. Key factors that are driving the market growth include the growing need for a stable power source and growth in infrastructure development and construction.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."