- Home

- »

- Pharmaceuticals

- »

-

Paracetamol IV Market Size, Share & Growth Report, 2030GVR Report cover

![Paracetamol IV Market Size, Share & Trends Report]()

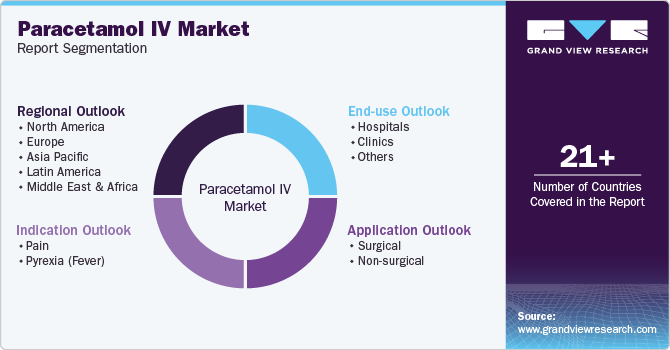

Paracetamol IV Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication (Pain, Pyrexia), By Application (Surgical, Non-surgical), By End Use (Hospitals, Clinics), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-965-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Paracetamol IV Market Summary

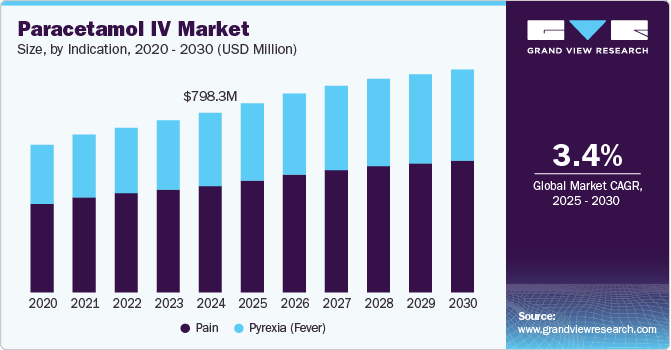

The global paracetamol IV market size was estimated at USD 798.25 million in 2024 and is projected to reach USD 994.23 million by 2030, growing at a CAGR of 3.43% from 2025 to 2030. The growth is primarily driven by its application in pain management and fever reduction in post-surgical procedures.

Key Market Trends & Insights

- The North America paracetamol IV market dominated the global industry and accounted for 39.76% revenue share in 2024.

- The U.S. held a significant share of the North American market in 2024.

- Based on indication, the pain indication segment dominated the market and accounted for the largest revenue share of 60.49% in 2024.

- Based on application, the surgical application segment dominated the market and accounted for the largest revenue share of 63.05% in 2024.

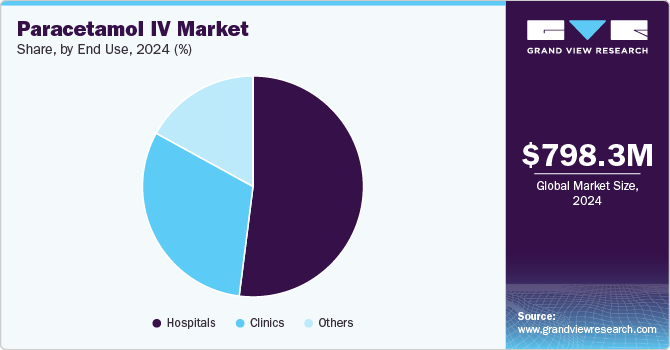

- Based on end use, the hospital segment dominated the market and accounted for the largest revenue share of 52.13% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 798.25 Million

- 2030 Projected Market Size: USD 994.23 Million

- CAGR (2025-2030): 3.43%

- North America: Largest market in 2024

Intravenous administration of paracetamol serves as an efficient therapeutic option, providing effective pain relief. Furthermore, the combined use of intravenous paracetamol with NSAIDs and narcotics has gained significant acceptance, supporting the expansion of the industry. This combination therapy offers a well-rounded approach to post-operative pain management, aligning with the increased demand for comprehensive pain relief solutions in clinical settings.

The market is propelled by the rising need for rapid and effective pain management solutions, especially for patients unable to take oral medication post-surgery or with severe conditions. Intravenous paracetamol provides a faster onset and reliable dosage control, crucial in clinical settings where non-opioid pain relief is preferred. Increasing surgical procedures, particularly orthopedic and abdominal surgeries, drive demand as paracetamol IV offers targeted pain relief, reducing opioid reliance. Innovations in IV formulation and heightened awareness of non-opioid pain solutions are accelerating growth. Expanding healthcare infrastructure in emerging economies and a growing prevalence of chronic discomfort conditions are further boosting the industry, presenting opportunities for expansion globally.

Furthermore, the rising demand for effective post-surgical management solutions, including intravenous paracetamol as part of multimodal analgesia, significantly boosts market growth by addressing pain reduction needs, minimizing opioid dependence, and enhancing patient recovery outcomes. The study published in Frontiers in Pharmacology in 2022 evaluated the effectiveness of intravenous (IV) paracetamol in reducing opioid consumption and postoperative aches for patients undergoing lumbar disc surgery. This meta-analysis evaluated the effectiveness of IV paracetamol in reducing postoperative pain and opioid consumption in lumbar disc surgery. Results showed that IV paracetamol significantly lowered pain scores at various postoperative intervals and reduced cumulative opioid use by 10.61 mg within 24 hours.

Additionally, IV paracetamol aligns with previous findings in enhancing discomfort management across surgeries, including joint replacements and cesareans. These findings highlight IV paracetamol's role in effective post-surgical pain management and its potential for reducing opioid reliance. Further studies are suggested to refine its optimal dosing and timing for clinical use.

The adoption of IV paracetamol in neonatal care, as detailed in UNICEF guidelines, supports industry growth by highlighting its essential role in pain and fever management, driving demand for safe, precise dosing solutions in healthcare settings. This aligns with increasing investments in pediatric and neonatal healthcare improvements, advancing the market for effective analgesic options. The UNICEF report on neonatal health in Eswatini recommends intravenous (IV) paracetamol for managing pain and fever in cases where oral administration is not feasible. It provides dosing guidelines tailored by age and weight, focusing on safety and efficacy for neonates, children, and adults.

Indication Insights

The pain indication segment dominated the market and accounted for the largest revenue share of 60.49% in 2024, driven by the need for effective pain management in postoperative care. The rising focus on reducing opioid use is prompting healthcare providers to adopt non-opioid alternatives. This shift supports enhanced patient care strategies and aligns with evolving clinical practices. Increasing demand for paracetamol IV reflects its role in ache relief protocols, contributing to growth in this segment. The market dynamics indicate a transition toward safer solutions, reinforcing the segment's importance in the healthcare landscape.

The pyrexia (fever) segment is poised for rapid growth due to the increased prevalence of fever-related conditions. The demand for effective fever management solutions is driving this trend. Healthcare professionals are prioritizing intravenous formulations to ensure swift and reliable symptom relief. This industry expansion aligns with broader health initiatives focused on improving patient outcomes. Enhanced awareness of fever management protocols will further support this segment's growth, emphasizing the strategic importance of paracetamol IV in clinical settings. Overall, the pyrexia segment is a key area for future development.

Application Insights

The surgical application segment dominated the market and accounted for the largest revenue share of 63.05% in 2024 due to its significant demand for postoperative care. Paracetamol IV is preferred for effective ache management and reducing the need for opioids in surgical settings. Its ability to provide rapid analgesia enhances recovery protocols, driving its adoption among healthcare providers. The focus on improved patient outcomes and reduced complications further supports market growth in this segment. Increased surgical procedures globally will continue to reinforce the dominance of this application in the market.

The non-surgical application segment is projected to experience substantial growth during the forecast period. This growth is driven by the increasing prevalence of conditions requiring effective pain management and fever control outside surgical settings. Paracetamol IV's effectiveness in diverse clinical scenarios, such as emergency departments and outpatient care, is enhancing its adoption. As healthcare providers seek alternatives to opioids, the demand for non-opioid discomfort relief options will likely fuel this segment's expansion, contributing to overall industry development.

End Use Insights

The hospital segment dominated the market and accounted for the largest revenue share of 52.13% in 2024, primarily due to the increasing number of surgeries and hospital admissions necessitating effective pain management. Hospitals serve as key environments for administering intravenous paracetamol, particularly for postoperative patients requiring rapid relief from pain and fever. The growing preference for non-opioid analgesics within hospital settings is driving the adoption of paracetamol IV. Additionally, the establishment of protocols and guidelines in hospitals enhances the utilization of paracetamol IV as a standard treatment option, contributing to the segment's dominance in the overall market landscape.

The clinics segment is expected to demonstrate growth over the forecast period due to the increasing demand for outpatient services and minor surgical procedures requiring effective pain management. The rise in healthcare facilities focusing on patient-centric care enhances the utilization of intravenous paracetamol in clinics. Additionally, the growing awareness of non-opioid analgesics as a safe alternative to managing discomfort is contributing to the segment's expansion. The trend toward quick recovery protocols and enhanced patient comfort in clinics further supports this growth trajectory.

Regional Insights

North America paracetamol IV market dominated the global industry and accounted for 39.76% revenue share in 2024, driven by high demand for pain management solutions in hospitals and surgical settings. The region benefits from advanced healthcare infrastructure, regulatory support, and the increasing prevalence of surgical procedures requiring effective analgesia. Strategic partnerships among key players enhance product availability and industry penetration. Continuous innovation in formulations and delivery methods further boosts the competitive landscape. The focus on non-opioid alternatives aligns with rising concerns over opioid use, positioning North America as a critical hub for paracetamol IV sales.

U.S. Paracetamol IV Market Trends

The paracetamol IV market in the U.S. held a significant share of the North American market in 2024, propelled by the rising demand for effective pain management solutions. Key drivers include an increase in surgical procedures, a growing preference for non-opioid treatments, and strong support from regulatory bodies. The market benefits from the presence of major pharmaceutical players and a trend toward intravenous formulations, reinforcing the U.S.'s position as a leader in the sector within the region.

Europe Paracetamol IV Market Trends

The Europe paracetamol IV market is experiencing notable growth due to increasing awareness of the benefits of intravenous formulations in pain management. Factors contributing to this growth include rising surgical procedures, a shift toward non-opioid analgesics, and enhanced healthcare infrastructure. Regulatory support and the presence of established pharmaceutical companies further bolster industry expansion. The emphasis on effective management strategies positions the Europe market as a key player in the global paracetamol IV sector.

The UK paracetamol IV market is growing due to its established healthcare system and robust pharmaceutical infrastructure. Factors such as an increasing number of surgical procedures, a growing preference for non-opioid pain management solutions, and supportive regulatory frameworks contribute to market growth. Additionally, the presence of leading pharmaceutical companies enhances innovation and availability, positioning the UK as a key contributor to the overall market in Europe.

The paracetamol IV market in Germany holds a significant market share due to its advanced healthcare system and extensive pharmaceutical infrastructure. Key drivers include a high volume of surgical procedures and a growing focus on non-opioid pain management solutions. Additionally, stringent regulatory frameworks and strong support from established pharmaceutical companies further enhance market presence, positioning Germany as a critical player in the Europe region.

Asia Pacific Paracetamol IV Market Trends

The paracetamol IV market in Asia Pacificis growing at a lucrative rate owing to the increasing prevalence of chronic diseases, growth of the geriatric population, presence of key industry players, lower cost associated with the drug, and quick relief offered in postoperative pain. For instance, according to UNFPA, the older population in Asia is rising at an unprecedented rate, and the older population is expected to triple in the region, reaching 1.3 billion by 2050.

China paracetamol IV market is expanding due to increasing surgical procedures and rising demand for effective pain management solutions. The government's focus on improving healthcare infrastructure and access to advanced medications drives this growth. Additionally, the growing prevalence of chronic diseases necessitates enhanced pain management strategies.

The paracetamol IV market in Japan benefits from a robust healthcare system and high standards for medical practices. Factors such as an aging population and increasing surgical interventions support market growth. Moreover, the emphasis on non-opioid analgesics aligns with national health policies aimed at reducing opioid dependence.

Latin America Paracetamol IV Market Trends

Brazil paracetamol IV market is poised for growth due to a rising incidence of surgeries and increased awareness of non-opioid pain management. Regulatory support and partnerships with local pharmaceutical companies enhance industry accessibility. The need for effective pain relief alternatives drives demand for intravenous formulations.

Middle East & Africa Paracetamol IV Market Trends

The paracetamol IV market in the Middle East & Africais growing due to increasing healthcare investments and rising surgical procedures. Enhanced awareness of pain management and a shift toward modern medical practices contribute to this growth. Collaborations with global pharmaceutical companies support market entry and development across the region.

The Saudi Arabia paracetamol IV market is expanding, driven by a focus on improving healthcare services and increasing surgical volumes. The government’s Vision 2030 initiative promotes better healthcare access and modern medical practices. The rising demand for effective pain management solutions further supports market growth.

Key Paracetamol IV Company Insights

The competitive landscape of the paracetamol IV market includes key players such as Mallinckrodt Pharmaceuticals, Cipla Inc., Lupin, Dr. Reddy's Laboratories, Aurobindo Pharma, Sun Pharmaceutical Industries, Novartis AG, and Pfizer Inc. These companies focus on expanding their product portfolios and enhancing market reach through strategic partnerships, licensing agreements, and regulatory approvals. Innovations in formulation and delivery methods are also a priority, aiming to meet the growing demand for effective pain management solutions. Competitive strategies, including price adjustments and promotional activities, will significantly influence industry dynamics and overall growth in this sector.

Key Paracetamol IV Companies:

The following are the leading companies in the paracetamol IV market. These companies collectively hold the largest market share and dictate industry trends.

- Mallinckrodt (Mallinckrodt Pharmaceuticals)

- Cipla Inc.

- Lupin

- Dr Reddy's Laboratories Ltd.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Limited

- Novartis AG

- Pfizer Inc.

- Abbott

- Sanofi

- Bristol-Myers Squibb Company

Recent Developments:

-

In July 2024, Hyloris Pharmaceuticals entered into an agreement with Halex Istar for the licensing and distribution of Maxigesic IV in Brazil, broadening availability of this non-opioid pain management option in one of South America’s largest markets. Maxigesic IV combines paracetamol and ibuprofen for improved post-operative pain relief, aiming to help address the increased use of opioids in Brazil. This collaboration aligns with Hyloris’s objective of enhancing existing drugs to fulfill unmet medical needs. The company anticipates revenue growth through associated royalties and milestone payments stemming from this partnership.

-

In January 2023, Hyloris Pharmaceuticals SA (Euronext Brussels: HYL) announced a partnership with Salus Pharmaceuticals for exclusive licensing and distribution of Maxigesic IV across nine European countries. This dual-action, non-opioid IV pain treatment, combining paracetamol and ibuprofen, is already registered in five of these markets, with launches expected later in 2023. This collaboration aligns with Hyloris’s strategy to repurpose existing medications and expand the availability of innovative, non-opioid options for pain management.

Paracetamol IV Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 839.84 million

Revenue forecast in 2030

USD 994.23 million

Growth rate

CAGR of 3.43% from 2025 to 2030

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Eli Lilly and Company; Sanofi; Novo Nordisk A/S; Biocon; Boehringer Ingelheim; Tonghua Dongbao Pharmaceutical Co. Ltd; Wockhardt; Julphar; United Laboratories International Holdings Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Paracetamol IV Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paracetamol IV market report on the basis of indication, application, end-use, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain

-

Pyrexia (Fever)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical

-

Non-surgical

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global paracetamol IV market size was estimated at USD 798.25 million in 2024 and is expected to reach USD 839.84 million in 2025.

b. The global paracetamol IV market is expected to grow at a compound annual growth rate of 3.43% from 2025 to 2030 to reach USD 994.23 million by 2030.

b. North America dominated the paracetamol IV market with a share of 39.76% in 2024. This is attributable to the use of paracetamol intravenously in emergency surgery, cohorts where the risk of morbidity can be reduced by adequately maintaining hemodynamics

b. Key players operating in the paracetamol IV market are Mallinckrodt (Mallinckrodt Pharmaceuticals), Cipla Inc., Lupin, Dr Reddy's Laboratories Ltd., Aurobindo Pharma, Sun Pharmaceutical Industries Limited, Novartis AG, Pfizer Inc., Abbott, Sanofi, and Bristol-Myers Squibb Company.

b. Key drivers driving the paracetamol IV market are rising cases of patients reporting postoperative pain, increasing prevalence of chronic disorders that requires pain management, and increasing use of intravenous paracetamol in combination with NSAIDs and narcotics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.