Paper Products Market Size, Share & Trends Analysis Report By Application (Graphic Paper, Sanitary & Household, Packaging Paper, And Other Paper), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-860-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Paper Products Market Size & Trends

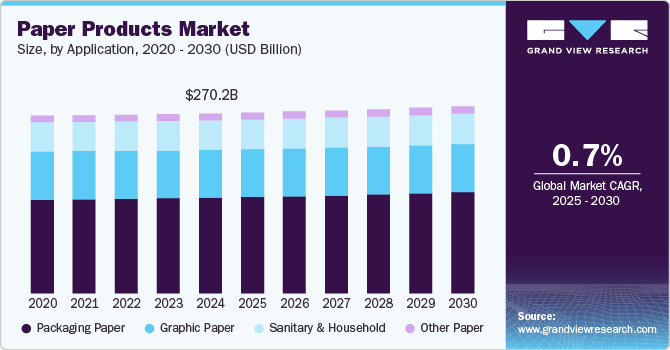

The global paper products market size was valued at USD 270.23 billion in 2024 and is expected to expand at a CAGR of 0.7% from 2025 to 2030. The growth is attributed to increasing demand for sustainable and eco-friendly products. Increasing environmental consciousness among consumers is driving the demand for paper products that are biodegradable and made from recycled materials, prompting manufacturers to innovate and alter their offerings accordingly.

Ongoing digital transformation across various industries has slowed the demand for paper products across various industries. As businesses and consumers increasingly rely on digital communication, the demand for traditional paper products, such as printing and writing papers, has diminished. For instance, many companies opt for digital invoices and contracts, reducing the need for physical paper. This shift has led manufacturers to focus on packaging solutions and specialty papers catering to specific needs.

The packaging segment remains a significant growth driver within the paper products industry. The growth of e-commerce has resulted in higher demand for packaging materials as online shopping continues to thrive. Companies are investing in innovative packaging solutions that protect products during transit and enhance consumer experience. Major retailers are increasingly opting for sustainable packaging options, which align with consumer preferences for environment-friendly practices.

Application Insights

The packaging paper segment dominated the market with the largest revenue share of 53.1% in 2024 in the paper products industry, driven by the rapid growth of e-commerce. Moreover, as environmental concerns rise, consumers and businesses are shifting away from plastic and non-biodegradable materials and opting for paper products that are recyclable and biodegradable. For instance, the European Union's Single-Use Plastics Directive has significantly influenced companies to adopt paper packaging alternatives to comply with new regulations. In addition, with the growth of e-commerce, businesses require efficient and sustainable packaging paper options to meet shipping needs while minimizing their environmental impact.

The sanitary & household paper segment is expected to grow at a significant CAGR over the forecast period, driven by increased hygiene and sanitation awareness, particularly after the COVID-19 pandemic, leading consumers to prioritize cleanliness in their daily lives. This shift has resulted in a surge in demand for products such as toilet paper, paper towels, and facial tissues, as they are essential for maintaining personal hygiene and preventing the spread of infectious diseases. In addition, urbanization and rising disposable incomes are driving consumption, particularly in developing regions where access to these products is expanding.

Regional Insights

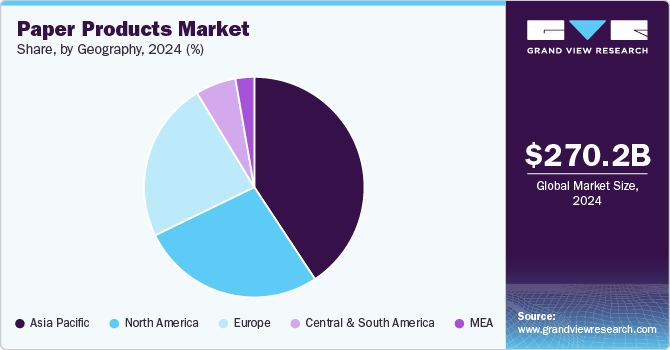

The North America paper products market is expected to grow significantly over the forecast period with increasing environmental consciousness among consumers, leading to a strong shift from plastic packaging to paper-based alternatives that are recyclable and biodegradable. For instance, many fast-food chains are now opting for paper straws and containers to reduce their carbon footprint and appeal to eco-minded customers. The rapid expansion of e-commerce has heightened the need for efficient packaging materials to ensure safe delivery of products, further boosting the demand for paper packaging. The healthcare sector also plays a crucial role, as it increasingly relies on paper products for packaging medical supplies and pharmaceuticals.

U.S. Paper Products Market Trends

The U.S. paper products market dominated North America in 2024 with the largestrevenue share, driven by significant growth in e-commerce and the increasing demand for sustainable packaging solutions. The demand for efficient and protective packaging materials, such as corrugated boxes and folding cartons, has surged with the growth of online shopping. In addition, consumer awareness regarding environmental issues has led to a heightened preference for eco-friendly paper products, further boosting market growth. Companies are responding by innovating sustainable packaging options that reduce waste and enhance recyclability. This combination of e-commerce expansion andsustainability initiatives positions the U.S. as a leader in the North America paper products market.

Asia Pacific Paper Products Market Trends

Asia Pacific paper products market dominated with a revenue share of 40.7% in 2024 due to rapid economic growth and urbanization across the region. Countries such as China and India are experiencing a significant rise in disposable income, driving consumer demand for various paper products, including packaging and specialty papers. The booming e-commerce sector has further fueled this demand, as businesses require efficient and sustainable packaging solutions to meet the needs of online shoppers. For instance, the rise of food delivery services in urban areas has led to increased use of paper-based packaging to ensure food safety and environmental sustainability. In addition, government initiatives promoting recycling and the reduction of plastic waste are encouraging industries to adopt paper alternatives, aligning with global sustainability trends.

The China paper products market dominated Asia Pacific in 2024 with the largest revenue share, driven by the country's rapid industrialization and urbanization, which have significantly increased the demand for various paper products across multiple sectors, including packaging and hygiene. The booming e-commerce industry in China has led to a surge in demand for corrugated packaging materials, essential for safely delivering goods. In addition, rising disposable income has fueled the consumption of premium paper products, such as high-quality tissues and specialty papers. China’s commitment to sustainability further enhances its market position as manufacturers increasingly adopt eco-friendly practices and materials to meet domestic and international environmental standards.

Central & South America Paper Products Market Trends

The Central & South America paper products market is expected to grow significantly over the forecast period due to Increased e-commerce activity, as online shopping has surged, leading to a higher demand for paper-based packaging materials that are lightweight and cost-effective. This trend is particularly pronounced in Brazil, where the rise of food delivery services has further fueled the need for sustainable packaging solutions. In addition to focusing on education, schools and universities require significant quantities of paper products such as notebooks, textbooks, and stationery. This demand is especially strong in countries including Brazil and Argentina, where educational institutions are expanding rapidly.

Key Paper Products Company Insights

Kimberly-Clark Corporation Inc, Procter & Gamble, Georgia-Pacific, KP Tissue inc, Essity Aktiebolag (publ), Irving Consumer Products Limited, Clearwater Paper Corporation, ST Tissue LLC, CASCADES INC.,andFirst Quality Enterprises, Inc. are among the key companies in the paper products market. These companies use various strategies, including the development of innovative and sustainable product lines that cater to increasing consumer demand for eco-friendly solutions, to maintain a competitive edge in the paper products market. They focus on enhancing production efficiency through technological advancements, improve product quality, and reduce environmental impact.

-

Kimberly-Clark Corporation Inc. specializes in a wide range of consumer and professional paper goods. The company is known for its brands, such as Kleenex, Scott, and Huggies, which focus on personal hygiene and household needs. Kimberly-Clark leverages advanced manufacturing technologies and sustainable practices to produce high-quality products while minimizing environmental impact.

-

Procter & Gamble is recognized for its extensive portfolio, including household essentials such as Charmin toilet paper and Bounty paper towels. The company emphasizes research and development to create products that combine quality with convenience, catering to diverse consumer needs.

Key Paper Products Companies:

The following are the leading companies in the paper products market. These companies collectively hold the largest market share and dictate industry trends.

- Kimberly-Clark Corporation Inc

- Procter & Gamble

- Georgia-Pacific

- KP Tissue inc.

- Essity Aktiebolag (publ)

- Irving Consumer Products Limited

- Clearwater Paper Corporation

- First Quality Enterprises, Inc.

- ST Tissue LLC

- CASCADES INC.

Recent Developments

-

In August 2024, First Quality Tissue announced the expansion of its manufacturing capabilities for tissue products and ultra-premium towels. The company aims to install two state-of-the-art Thru-Air-Dried (TAD) paper machines. The first machine is expected to be operational by 2027, and the second will follow approximately eighteen months later. This expansion aims to enhance First Quality's existing operations, including eight TAD machines across two Lock Haven, Pennsylvania, and Anderson, South Carolina facilities.

-

In July 2024, Georgia-Pacific launched production at its new cutting-edge Dixie plant, which specializes in manufacturing premium paper plates. This state-of-the-art facility is designed to enhance production efficiency and sustainability. The Dixie brand aims to meet the growing consumer demand for high-quality disposable tableware while implementing innovative practices that reduce waste and energy consumption.

Paper Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 271.53 billion |

|

Revenue forecast in 2030 |

USD 281.23 billion |

|

Growth Rate |

CAGR of 0.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Volume, Million Tons;Revenue in USD Billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Thailand, Brazil, South Africa |

|

Key companies profiled |

Kimberly-Clark Corporation Inc, Procter & Gamble, Georgia-Pacific, KP Tissue inc, Essity Aktiebolag (publ), Irving Consumer Products Limited, Clearwater Paper Corporation, ST Tissue LLC, CASCADES INC.,First Quality Enterprises, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Paper Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paper products market report based on application and region:

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Graphic Paper

-

Newsprint

-

Uncoated Mechanical

-

Uncoated Woodfree

-

Other coated

-

Sanitary & Household

-

Packaging Paper

-

Other Paper

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."