Packaging Printing Market Size, Share & Trends Analysis Report By Product (Labels, Flexible Packaging, Corrugated Packaging), By Application (Food & Beverages, Healthcare, Consumer Goods), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-522-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Packaging Printing Market Size & Trends

The global packaging printing market size was valued at USD 417.8 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. Increasing demand for sustainable packaging, growth in the e-commerce sector, advancements in printing technology, and rising consumer preference for visually appealing packaging are propelling the packaging printing market's growth.

The rapid expansion of the e-commerce industry has fueled demand for printed packaging, particularly for corrugated boxes, labels, and flexible packaging. Companies such as Amazon, Flipkart, and Alibaba rely on customized printed packaging to enhance brand identity and improve consumer engagement. Moreover, the rise of direct-to-consumer (DTC) brands has further pushed the need for personalized and short-run packaging prints, leading to the adoption of digital printing technologies such as HP Indigo and Xeikon presses. These technologies offer cost-effective, high-quality, and quick turnaround solutions, enabling brands to adapt to changing consumer preferences.

Innovations in printing technologies, including digital, flexographic, and gravure printing, are significantly driving the market. Digital printing is gaining traction due to its cost efficiency, high-speed production, and ability to print variable data. Smart packaging, incorporating QR codes, augmented reality (AR), and near-field communication (NFC), is also boosting demand for advanced printing techniques. For example, Coca-Cola’s personalized “Share a Coke” campaign used digital printing technology to print individual names on bottles, demonstrating how innovative printing strategies can enhance brand engagement.

Consumers are increasingly seeking visually appealing packaging, especially in segments such as food & beverages, cosmetics, and personal care products. High-quality printing methods such as gravure and offset printing are widely used to create luxury packaging with vibrant colors, embossed textures, and metallic finishes. Brands such as L'Oréal and Estée Lauder invest in high-end packaging printing to differentiate their products and create a premium feel. The alcohol and confectionery industries also heavily rely on advanced printing techniques to add holographic and foil stamping effects, further boosting market demand.

Product Insights

The labels segment recorded the largest revenue share of over 35.0% in 2024. Labels are an essential part of packaging, serving as a medium for branding, product identification, and regulatory compliance. They can be pressure-sensitive, shrink sleeves, in-mold, or wet-glue labels, used across industries such as food & beverage, pharmaceuticals, cosmetics, and logistics. Labels enhance product appeal while providing critical information such as ingredients, usage instructions, and barcodes. The rise in e-commerce, growing regulatory requirements for product traceability, and advancements in digital printing technologies, such as variable data printing and RFID-enabled labels, are also fueling demand.

The flexible packaging segment is projected to grow at the fastest CAGR of 7.4% during the forecast period. Flexible packaging includes pouches, sachets, wraps, and bags made from materials such as plastic, paper, and aluminum foil. Printing on flexible packaging enhances branding and product differentiation.

Corrugated packaging primarily consists of corrugated boxes and cartons, widely used for shipping, storage, and retail display. Its structure provides excellent protection and strength, making it ideal for e-commerce, food delivery, and industrial applications. Printing on corrugated packaging enhances branding, marketing, and customer engagement.

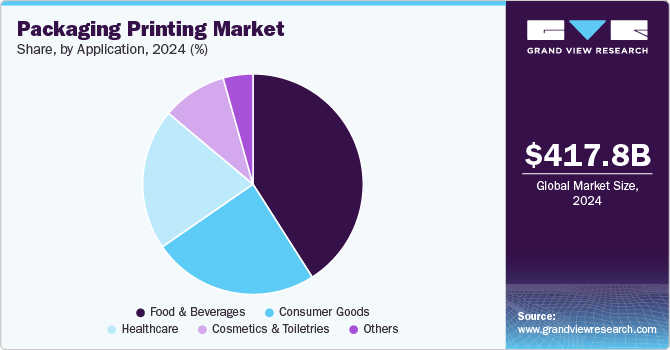

Application Insights

The food & beverage segment recorded the largest share of over 40.0% in 2024. Packaging printing plays a crucial role in the food & beverages industry by enhancing product presentation, ensuring regulatory compliance, and providing vital consumer information such as ingredients, nutritional values, and expiration dates. The expansion of e-commerce and food delivery services has increased the need for high-quality printed packaging to ensure brand visibility and product differentiation.

The healthcare segment is expected to grow at the highest CAGR of 7.4% during the forecast period. Packaging printing is essential for ensuring the accuracy and safety of pharmaceutical and medical product packaging. Printed information such as dosage instructions, barcodes, tamper-evident labels, and regulatory warnings are critical to maintaining product authenticity and patient safety. Advanced printing technologies, including UV printing and digital variable data printing, enable precise and secure labeling, reducing the risk of counterfeiting and errors in medical packaging.

In the consumer goods segment, packaging printing focuses on enhancing product branding, shelf appeal, and user experience. This includes printed packaging for electronics, household items, stationery, and personal care products. The increasing preference for aesthetically appealing packaging, rising disposable incomes, and the growth of the e-commerce sector drive the demand for printed packaging in consumer goods.

Region Insights

North America packaging printing market is driven by the stringent regulations regarding food safety and product labeling in North America. The FDA's requirements for clear nutritional information, allergen warnings, and tracking codes have necessitated high-quality, precise printing solutions. This has led to innovations in UV-curable inks and water-based coatings that ensure both compliance and sustainability.

U.S. Packaging Printing Market Trends

The packaging printing market in the U.S. is growing due to its robust consumer economy, coupled with a highly developed retail sector, which drives constant demand for innovative and high-quality packaging solutions. Major brands such as Coca-Cola, Procter & Gamble, and Amazon continuously invest in advanced packaging printing technologies to enhance their product presentation and brand recognition.

Asia Pacific Packaging Printing Market Trends

The packaging printing market in Asia Pacific dominated the global industry and accounted for the largest revenue share of over 41.0% in 2024 and is anticipated to grow at the fastest CAGR of 7.3% over the forecast period. The region’s growth in the global packaging printing market is driven by rapid urbanization, particularly in countries such as China, India, and Indonesia, which has led to a surge in consumer goods consumption and, subsequently, increased demand for packaged products. This urbanization, coupled with a growing middle class with higher disposable incomes, has created a robust market for packaged food, beverages, personal care items, and other consumer products that require sophisticated printing solutions.

China packaging printing market is primarily driven by its massive manufacturing base and export-oriented economy. As the world's largest manufacturer and exporter of consumer goods, China requires an enormous volume of packaging materials for products ranging from electronics and toys to textiles and household items. For example, major manufacturing hubs like Shenzhen and Guangzhou have developed specialized packaging printing industrial parks that serve thousands of factories producing everything from iPhone boxes to luxury cosmetics packaging. This concentrated demand has led to significant investments in advanced printing technologies such as digital printing, flexography, and intelligent packaging solutions, thus driving the market growth in the country.

Europe Packaging Printing Market Trends

The packaging printing market in Europe is growing due to the presence of well-established luxury and premium brands, particularly in countries such as France, Italy, and Switzerland, which has fueled growth in high-end packaging printing. Companies such as L'Oréal, LVMH, and Nestlé demand sophisticated printing techniques such as foil stamping, embossing, and specialty coatings to differentiate their products. This has led to the development of advanced printing technologies and techniques in the region.

Germany packaging printing market is primarily driven by its commitment to sustainability and environmental regulations, which has driven innovation in eco-friendly packaging printing solutions. Moreover, the country's strong industrial base, particularly in manufacturing and chemicals, has fostered the development of advanced printing technologies and materials.

Key Packaging Printing Company Insights

The packaging printing market is highly competitive, driven by advancements in digital and flexographic printing technologies, increasing demand for sustainable packaging solutions, and stringent regulatory requirements. Major players compete based on innovation, print quality, and customization capabilities. The market is fragmented, with numerous regional and specialized players catering to industries such as food & beverages, pharmaceuticals, and personal care. Price competitiveness, technological advancements, and the ability to offer short-run, high-quality, and eco-friendly printing solutions are key differentiators. Additionally, strategic partnerships, mergers, and acquisitions are common as companies seek to expand their market share and technological capabilities.

-

In November 2024, Sealed Air launched a new on-demand printing system called AutoPrint for customized, late-stage printing on protective packaging. The digital printing solution integrates into packaging lines to directly print customized designs and information onto closed boxes, saving storage space, labor, and waste from unused pre-printed materials.

-

In September 2023, Tetra Pak announced a Custom Printing collaboration with Flow Beverage Corp. and Live Nation Canada. Flow Beverage Corp. will distribute naturally alkaline spring water across the U.S. and Canada and is the first brand to use this technology to create unique designs for an engaging consumer experience. Tetra Pak Custom Printing is the first and only premium ink jet-based carton package printing solution that offers brands a customizable system while providing all the environmental benefits of paper-based beverage cartons.

Key Packaging Printing Companies:

The following are the leading companies in the packaging printing market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper

- Sealed Air

- Tetra Pak

- WestRock Company

- ITC LIMITED

- Shree Arun Packaging Company Private Limited

- Parksons Packaging LTD

- DuPont

- Rainbow Packaging

- Uniflex

- Virtual Packaging

- Oliver, Inc.

- Transcontinental Inc.

- Belmont Packaging Ltd.

- Arihant Packaging

- Sun Print Solutions

Packaging Printing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 443.1 billion |

|

Revenue forecast in 2030 |

USD 615.7 billion |

|

Growth rate |

CAGR of 6.8% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

International Paper; Sealed Air, Tetra Pak, WestRock Company; ITC LIMITED; Shree Arun Packaging Company Private Limited; Parksons Packaging LTD; DuPont; Rainbow Packaging; Uniflex; Virtual Packaging; Oliver, Inc.; Transcontinental Inc.; Belmont Packaging Ltd.; Arihant Packaging; Sun Print Solutions. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Packaging Printing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global packaging printing market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Labels

-

Flexible Packaging

-

Corrugated Packaging

-

Folding Cartons

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Healthcare

-

Consumer Goods

-

Cosmetics & Toiletries

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global packaging printing market was estimated at around USD 417.8 billion in the year 2024 and is expected to reach around USD 443.1 billion in 2025.

b. The global packaging printing market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach around USD 615.7 billion by 2030.

b. Food & beverages emerged as the dominating application segment within the packaging printing market, with a value share of around 40.0% in 2024, owing to the increasing demand for high-quality, visually appealing, and informative packaging solutions.

b. The key players in the packaging printing market include International Paper; Sealed Air, Tetra Pak, WestRock Company; ITC LIMITED; Shree Arun Packaging Company Private Limited; Parksons Packaging LTD; DuPont; Rainbow Packaging; Uniflex; Virtual Packaging; Oliver, Inc.; Transcontinental Inc.; Belmont Packaging Ltd.; Arihant Packaging; and Sun Print Solutions.

b. Increasing demand for sustainable packaging, growth in the e-commerce sector, advancements in printing technology, and rising consumer preference for visually appealing packaging are propelling the packaging printing market's growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."