Packaging Materials Market Size, Share & Trends Analysis Report By Material (Rigid Plastics, Flexible Plastics), By Packaging Format (Primary, Secondary), By Product, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-451-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Packaging Materials Market Size & Trends

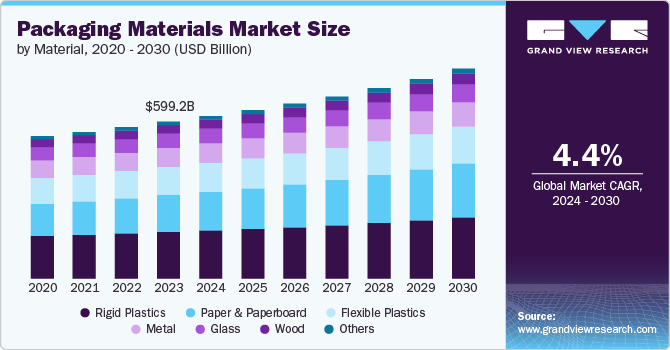

The global packaging materials market size was estimated at USD 599.23 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The market is being driven by increasing demand for sustainable, innovative, and multifunctional packaging solutions across various industries.

One key factor is rising consumer awareness about environmental sustainability, prompting companies to adopt eco-friendly materials like biodegradable plastics, recycled paper, and glass. This shift is supported by regulatory bodies across the globe, pushing for reduced plastic usage and encouraging recyclability.

The food and beverage, pharmaceutical, and personal care sectors are driving demand for new materials due to the growing need for safety, shelf-life extension, and aesthetic appeal. For example, newly developed biodegradable flexible plastics and compostable films are gaining momentum due to their ability to meet sustainability goals without compromising packaging quality.

Several companies are launching innovative products to cater to this demand. For instance, Amcor recently introduced a new recyclable plastic solution that retains the strength and flexibility of traditional materials while being more environmentally friendly. In addition, Tetra Pak has developed aseptic cartons made of plant-based polymers, addressing both environmental and functional needs.

Opportunities abound in the ongoing development of smart packaging materials that integrate IoT technology, as well as in the expansion of sustainable materials across new applications such as e-commerce packaging. As the demand for greener alternatives grows, there is a significant opportunity for companies to differentiate themselves by developing novel, sustainable packaging solutions that offer enhanced functionality, including barrier protection, lightweighting, and ease of use.

Material Insights

Based on materials, the market is segmented into rigid plastics, flexible plastics, paper & paperboard, glass, metal, and other materials. Rigid plastics is anticipated to dominate the overall market with a revenue share of over 29.7% in 2023. Rigid plastics dominate the market due to their versatility, durability, and cost-effectiveness. Widely used across industries like food & beverages, pharmaceuticals, and personal care, rigid plastics offer strong barrier properties, ensuring product safety and long shelf life. Their high strength-to-weight ratio makes them ideal for bottles, containers, and closures. While regulatory challenges around plastic usage persist, innovations in recyclable and reusable rigid plastics help maintain their stronghold in the market. Companies are increasingly focusing on developing rigid plastics from recycled content, further driving their dominance in the market.

The paper & paperboard material segment is expected to witness robust growth with a CAGR of 5.8% over the forecast period, driven by their sustainability and recyclability. As consumers and brands prioritize eco-friendly packaging, paperboard is emerging as a key alternative to plastic, particularly for cartons, boxes, and wraps. This material is favored in the food and beverage, e-commerce, and personal care industries for its biodegradability and ease of customization. In addition, advancements in barrier technologies are enhancing the functionality of paper-based packaging, making it more versatile for products requiring moisture resistance or increased durability. The market is anticipated to grow further as industries increasingly shift toward circular economy practices.

Product Insights

Based on product, the market is segmented into boxes & cartons, jars & containers, bottles & cans, films & wraps, bags & sacks, closures & lids, crates & pallets, and other products. Among these, boxes and cartons account for the largest market share in the product segment, largely due to their widespread use in shipping, retail packaging, and e-commerce. Corrugated boxes and folding cartons are particularly popular in sectors such as food, beverages, and consumer goods, offering excellent protection during transportation. In addition, the shift toward sustainable packaging is driving innovation in paper-based boxes, with brands opting for recyclable and biodegradable options. As e-commerce continues to grow globally, the demand for boxes and cartons will remain strong, supported by the need for efficient, protective, and customizable packaging solutions.

Bottles and cans are expected to witness the fastest CAGR over the forecast period. Driven by increasing demand in the beverage, healthcare, and personal care industries, bottles and cans provide excellent durability, preservation, and convenience. Metal cans are particularly popular for carbonated beverages, while plastic bottles dominate the personal care and healthcare markets. The growth in e-commerce is also fueling the demand for bottle and can packaging, as they offer robust protection during transportation. In addition, sustainability concerns are encouraging innovations in lightweight and recyclable materials for bottles and cans, further contributing to their growing demand.

Packaging Format Insights

Based on packaging format, the market is segmented into primary, secondary, and tertiary packaging. The primary packaging segment dominated the market and accounted for the largest revenue share of over 52.45% in 2023. Primary packaging helps in preserving the freshness, flavor, and overall quality of the product. It prevents exposure to elements that could lead to spoilage, contamination, or degradation of the product's sensory attributes.

Besides, secondary packaging shields the primary packaging and the product from external factors such as impacts, vibrations, and environmental conditions. This helps ensure that the product reaches its destination in optimal condition.

However, tertiary packaging helps in minimizing overall packaging waste by consolidating multiple units into larger, more efficient loads. This can contribute to sustainability goals by optimizing the use of materials and reducing the environmental impact of packaging.

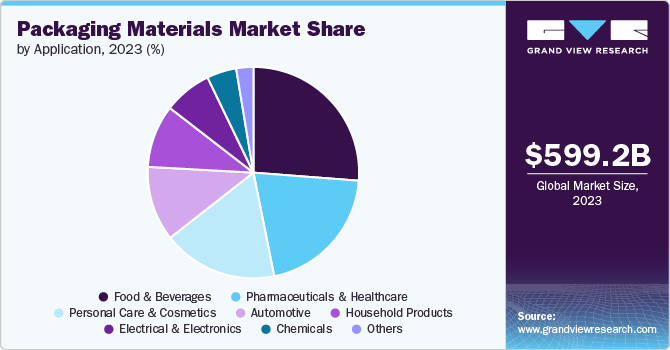

Application Insights

The market is segmented by application into food and beverages, pharmaceuticals and healthcare, personal care and cosmetics, automotive, household products, electrical and electronics, chemicals, and others.

The food and beverage sector holds the largest market share within the market due to the essential nature of packaging in preserving and transporting perishable goods. Rigid and flexible plastics, along with paper-based packaging, dominate this segment. As consumer preferences shift toward convenience and sustainability, demand for innovative packaging solutions, such as biodegradable materials and smart packaging that enhances shelf life, is growing. In addition, regulatory requirements for food safety and packaging integrity continue to shape the evolution of this segment, driving the need for advanced materials that maintain freshness and minimize environmental impact.

The pharmaceutical and healthcare industry is witnessing the fastest CAGR in packaging material demand, fueled by the need for safe, sterile, and tamper-proof packaging. With the rise of biologics, vaccines, and personalized medicine, packaging materials such as glass, plastic, and metal are critical for maintaining product integrity and extending shelf life. The COVID-19 pandemic further accelerated demand for medical supplies, prompting innovation in materials that ensure the protection and efficient distribution of sensitive products. The ongoing shift toward home-based care and e-pharmacies also contributes to the increased demand for secure and portable packaging.

Regional Insights

The North America packaging materials market is mature, but it continues to grow due to evolving consumer preferences, particularly regarding sustainability. The U.S. remained the dominant player in this region, with strong demand from industries such as food and beverages, pharmaceuticals, and e-commerce. Packaging manufacturers are increasingly focusing on developing recyclable and biodegradable materials to meet regulatory requirements and shifting consumer demands.

The rise of e-commerce in North America has significantly boosted the demand for corrugated boxes, paperboard, and flexible packaging materials as companies look for efficient and eco-friendly packaging solutions for shipping and logistics. The food and beverage sector, in particular, is driving demand for innovative materials that ensure product freshness while minimizing environmental impact. In addition, the pharmaceutical industry is contributing to the demand for high-barrier, sterile packaging materials, especially following the COVID-19 pandemic.

United States Packaging Materials Market Trends

The U.S. packaging materials marketis pushing innovations in material recycling and reuse as companies look to reduce their carbon footprints. As a result, theindustry is witnessing increased investment in technologies that allow for the production of lightweight, durable, and eco-friendly packaging materials.

Asia Pacific Packaging Materials Market Trends

The packaging materials market in Asia Pacific is the largest and fastest-growing market, driven by robust industrialization, rising consumer demand, and expanding e-commerce activities. Countries like China, India, and Japan are key players in this region, with rapid urbanization fuelling the need for both rigid and flexible packaging solutions across industries like food, beverages, pharmaceuticals, and personal care. The demand for sustainable packaging is growing in Asia Pacific as governments push for environmental regulations and waste reduction initiatives. The rise in disposable income and the booming retail sector are also contributing to the market’s growth.

China packaging materials market is the largest in the Asia Pacific region, and it continues to dominate due to its vast manufacturing base and growing consumer market. Meanwhile, India is witnessing significant growth due to its expanding middle class, increased focus on packaged goods, and a shift toward sustainable materials. As e-commerce and retail industries flourish, companies are increasingly seeking out innovative packaging solutions to meet the demand for efficiency, sustainability, and cost-effectiveness.

The packaging materials market in India is growing rapidly, fueled by a booming e-commerce sector, increased urbanization, and a shift toward organized retail. The demand for flexible packaging solutions, particularly in the food, beverages, and personal care sectors, is driving growth. Furthermore, the Indian government’s push for sustainable materials has led to the adoption of biodegradable plastics and recyclable paper-based packaging. The food packaging segment, in particular, is expanding as consumers demand convenience and safety in packaged products.

Europe Packaging Materials Market Trends

The packaging materials market in Europe is at the forefront of sustainability efforts in the market, driven by stringent environmental regulations and a strong emphasis on waste reduction. The European Union’s (EU) regulations on single-use plastics and the circular economy action plan are significantly influencing the packaging landscape, with companies across the region transitioning to more eco-friendly materials.

The region’s mature retail sector and strong consumer preference for sustainable products are creating opportunities for packaging manufacturers to innovate and offer green solutions. Paper-based packaging is particularly popular in Europe, with advancements in barrier coatings and other technologies that enhance the performance of these materials. As sustainability becomes a key priority for both regulators and consumers, the European market is expected to continue evolving toward greener solutions.

The packaging materials market in Germany is witnessing increased demand for paper and paperboard, metal, and glass packaging as companies move away from traditional plastics. In the food and beverage sector, rigid plastics and flexible packaging solutions are still widely used, but there is a growing focus on recyclable and biodegradable alternatives. In addition, Europe’s pharmaceutical industry is driving the demand for high-barrier, sterile, and tamper-evident packaging.

Central & South America Packaging Materials Market Trends

The packaging materials market in Central & South America is benefiting from investments in the pharmaceutical and healthcare sectors, where safe, sterile, and tamper-proof packaging is critical. As the country’s manufacturing sector grows, demand for protective materials, such as paperboard, flexible plastics, and metal packaging, is expected to rise. The government’s ban on single-use plastics is prompting companies to explore alternative materials, further driving growth in sustainable packaging solutions.

Key Packaging Materials Company Insights

The market is fragmented, with the presence of a significant number of companies. Over the past few years, the sustainable packaging industry has witnessed a significant number of new product launches and expansions. This can be attributed to circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

-

On February 20, 2024, IntegraMaterials launched its new heat-sealable paper pouch Cycle Pack. The Cycle Pack features a paper base, incorporating a surface treatment with protective barrier properties. The heat-sealable solution provides robust protection against humidity, light, and oxygen.

-

In May 2024, Iceland Foods, one of Britain’s fastest-growing and most innovative grocery retailers, will introduce a strong, lightweight, reusable, and moisture-resistant carrier bag made of Paptic material in all its stores. The wood fibers used in the bag are sourced from sustainably managed forests. At the end of its lifespan after multiple reuses, the bag will be recyclable with paper or cardboard.

-

In February 2024, Yorkshire Packaging Systems (YPS) launched compostable shrink films. The compostable film will be teamed up with an l-sealer for a high-gloss finish and strong seal, ideal for display packaging. It is available from 12-38 microns, with excellent tensile strength and a bright, highly transparent finish.

Key Packaging Materials Companies:

The following are the leading companies in the packaging materials market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Mondi Plc

- Sealed Air Corporation

- A-ROO Company LLC

- Flexpak Services

- Amerplast

- Ajover S.A.S.

- Oliver Packaging & Equipment Company3M

- Graham Packaging Company

- Tetra Pak Group

- Honeywell International Inc.

- International Paper

- Sonoco Products Company

- Westrock Company

- DS Smith

- Berry Global

- Avery Dennison Corporation

- CCL Industries Inc

- Mayr-Melnhof Karton AG

- ProAmpac

Packaging Materials Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 619.25 billion |

|

Revenue forecast in 2030 |

USD 801.11 billion |

|

Growth rate |

CAGR of 4.4% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion, Volume in Kilotons, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Material, product, packaging format, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Amcor plc, Mondi Plc, Sealed Air Corporation, A-ROO Company LLC, Flexpak Services, Amerplast, Ajover S.A.S., Oliver Packaging & Equipment Company, 3M, Graham Packaging Company, Tetra Pak Group, Honeywell International Inc., International Paper, Sonoco Products Company, Westrock Company, DS Smith, Berry Global, Avery Dennison Corporation, CCL Industries Inc, Mayr-Melnhof Karton AG, and ProAmpac |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Packaging Materials Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global packaging materials market report based on material, product, packaging format, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Rigid Plastics

-

Flexible Plastics

-

Paper & Paperboard

-

Metal

-

Glass

-

Wood

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Jars & Containers

-

Bags & Sacks

-

Bottles & Cans

-

Closures & Lids

-

Films & Wraps

-

Drums & IBC

-

Boxes & Cartons

-

Crates & Pallets

-

Others

-

-

Packaging Format Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Primary Packaging

-

Secondary Packaging

-

Tertiary Packaging

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals & Healthcare

-

Personal Care & Cosmetics

-

Automotive

-

Electrical & Electronics

-

Chemicals

-

Household Products

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global packaging materials market was estimated at USD 599.23 billion in 2023 and is expected to reach USD 619.25 billion in 2024.

b. The global packaging materials market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030, reaching around USD 801.11 billion by 2030.

b. Rigid plastics dominate the packaging materials market due to their versatility, durability, and cost-effectiveness. Widely used across industries like food & beverages, pharmaceuticals, and personal care, rigid plastics offer strong barrier properties, ensuring product safety and long shelf life.

b. Key players in the market include Amcor plc, Mondi Plc, Sealed Air Corporation, A-ROO Company LLC, Flexpak Services, Amerplast, Ajover S.A.S., Oliver Packaging & Equipment Company, 3M, Graham Packaging Company, Tetra Pak Group, Honeywell International Inc., International Paper, Sonoco Products Company, Westrock Company, DS Smith, Berry Global, Avery Dennison Corporation, CCL Industries Inc, Mayr-Melnhof Karton AG, and ProAmpac.

b. The global packaging materials market is driven by increasing demand for sustainable, innovative, and multifunctional packaging solutions across various industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."