- Home

- »

- Consumer F&B

- »

-

Packaged Water Market Size & Share, Industry Report, 2030GVR Report cover

![Packaged Water Market Size, Share & Trends Report]()

Packaged Water Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Still Water, Sparkling Water), By Distribution Channel (Off-Trade, On-Trade), By Packaging (PET, Cans), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-293-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaged Water Market Summary

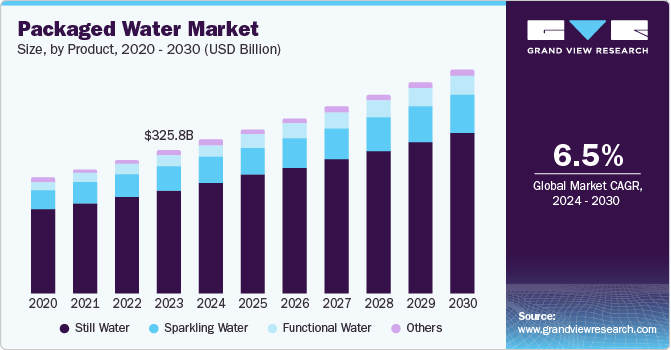

The global packaged water market size was estimated at USD 325,832.1 million in 2023 and is projected to reach USD 509,183.2 million by 2030, growing at a CAGR of 6.6% from 2024 to 2030. Rising health awareness among consumers leads to a higher demand for bottled drinking water as a healthier alternative to sugary beverages.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, still water accounted for a revenue of USD 325,832.1 million in 2023.

- Still Water is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 325,832.1 Million

- 2030 Projected Market Size: USD 509,183.2 Million

- CAGR (2024-2030): 6.6%

- Asia Pacific: Largest market in 2023

The emergence of various diseases caused by consuming contaminated and non-purified water further drives market expansion. According to a report by the Beverage Marketing Corporation (BMC), bottled water emerged as the largest beverage category in the United States in 2021, reaching a volume of 15.7 billion gallons.

Consumers increasingly prefer convenient access to clean and safe drinking water on the go. Packaged water, available in various sizes and forms, effectively meets this requirement. The versatility and portability of packaged water make it a preferred choice for people across the globe, ranging from its availability in a small bottle to carry while conducting physical exercises to large containers for home use. Manufacturers are launching new product lines to cater to this demand. For instance, in February 2024, Gatorade announced the launch of its unflavored water, called Gatorade Water, with a pH of 7.5 or more. The water is available in 1-liter and 700-milliliter bottles on Gatorade.com and Amazon. This is the company’s first product in this category and uses 100% recyclable packaging. Such initiatives by major companies are anticipated to maintain steady market growth.

Urbanization and changing lifestyles have played a crucial role in the rise of the packaged water business. As more people shift to urban areas and adopt busier lifestyles, the demand for portable and convenient hydration solutions has increased. Additionally, the rising popularity of outdoor activities, fitness routines, and travel has further boosted the demand for these products. Environmental awareness and sustainability concerns are further influencing this market. Many companies are leveraging and investing in recycled plastic and biodegradable bottles to strengthen their sustainability initiatives and address environmental concerns.

Additionally, the emergence of refillable water stations and reusable water bottles indicates a shift towards more sustainable consumption patterns, impacting market dynamics. According to Oceana, an increase of 10% in the share of sales of beverages in refillable bottles may lead to a reduction of 22% in marine plastic pollution. It has led to companies frequently collaborating with material specialists to launch innovative products in this market. For instance, in January 2024, Petainer, in collaboration with Oonly, launched a refillable PET (refPET) water bottle in Hungary. The bottle weighs 106g and uses around 4.24g of material per cycle, significantly less than the approximately 800g used in a refillable 1.5L glass bottle. Other brands are following similar initiatives to minimize the discarding of bottles and reduce waste generation, aiding industry expansion.

Product Insights

Still water dominated the global market, accounting for a revenue share of 72.6% in 2023. Still water is the most common form of water available for consumers at an attractive pricing, driving steady sales in this segment. Moreover, the absence of any additives, sugars, and calories in this water, which is generally present in abundance in other beverages, has led to its high demand. Companies differentiate their products through water source purity, mineral content, and packaging aesthetics. Marketing strategies emphasize unique selling points, such as water obtained from fresh sources or enhanced with beneficial minerals, leading to consumers getting a premium hydration experience. This trend enables segment growth by offering a range of still water products that cater to varying tastes and preferences.

Meanwhile, the functional water segment is expected to witness the fastest CAGR from 2024 to 2030. Functional water is a very popular choice among sports and fitness enthusiasts pursuing hydration solutions, as it replenishes electrolytes and enhances performance. It also aids in restoring minerals lost during exercise, promoting quicker recovery and improved hydration efficiency. Brands often market these functional waters as ideal for athletes and other individuals following an active lifestyle. For instance, in March 2024, Essentia Water launched Hydroboost, a flavored and functional water designed to provide optimum hydration. The product contains no artificial colors, sweeteners, or flavors, is enriched with B-complex vitamins, and offers 30 times more electrolytes than still water. This range is available in Raspberry Pomegranate, Lemon Lime, and Peach Mango flavors.

Distribution Channel Insights

The off-trade segment accounted for a dominant revenue share in 2023. Packaged water is widely available in supermarkets, convenience stores, and groceries, making it easy for consumers to purchase this product during regular shopping trips. Additionally, increasing competition in the packaged water segment has led to a growing number of companies leveraging physical stores to promote and sell their packaged water. The availability of various packaging sizes, from single-serve bottles to larger multipacks, caters to different consumer needs, either for immediate consumption or for stocking up at home. For instance, in March 2024, Bubly, the sparkling water unit of PepsiCo, introduced a new product line - the bubly burst. It is a sweetened sparkling water beverage available in six flavors, including triple berry, peach mango, and watermelon lime. The products contain less than ten calories and are being sold in 100% single-serve recycled PET bottles.

The on-trade segment is expected to register a fastest CAGR during the forecast period. A steady rise in demand for packaged water in places such as restaurants, bars, cafes, and other events is driving segment growth. As consumers become more health-conscious, they are increasingly preferring water over sugary or alcoholic beverages while dining out. Restaurants offer various bottled water options to cater to this demand, including still, sparkling, and flavored water. Additionally, offering branded or exclusive water options creates a unique dining and hospitality experience. These outlets have also become knowledgeable regarding the harms of using single-use plastic bottles and have moved towards sustainable and recyclable options, which helps in creating better consumer awareness.

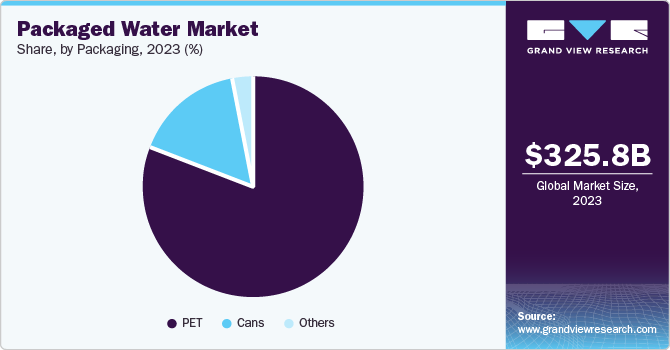

Packaging Insights

The PET segment accounted for the largest revenue share in the market in 2023. PET is a lightweight and durable material that is extensively being utilized in bottled water packaging processes globally. Its durability ensures that the bottles can withstand handling during transportation and storage without breaking or leaking, thus preserving product quality and safety. PET is highly recyclable, which aligns with the increasing environmental awareness and sustainability initiatives of packaged water and beverage companies. Brands are making containers that are constituted of 50%, 75%, and 100% recycled PET, making it easier for them to be utilized multiple times. As per Beverage Marketing Corporation, companies using recycled PET for their water containers saw a 452% increase in the use of this material per container between 2008 and 2017, highlighting a growing awareness about this form of packaging.

The cans segment is expected to witness the fastest CAGR over the forecast period. Cans are highly portable and convenient, making them an attractive option for consumers on the go. They are lightweight, easy to carry, and fit comfortably in bags and cup holders. This portability makes canned water suitable for various occasions, including outdoor activities, travel, and sports, catering to the needs of active and busy lifestyles. Additionally, aluminum cans have a higher recyclable rate than plastic bottles, increasing their usage. For instance, in June 2024, the Eastern Band of Cherokee Indians (EBCI) Division of Commerce launched Cherokee Bottled Water in eco-friendly aluminum cans. The launch aims to reduce plastic waste, provide eco-friendly packaging, and promote sustainability.

Regional Insights

Asia Pacific accounted for a leading revenue share of 45.3% in the global market in 2023. The demand for convenient and safe drinking water has increased in the region, owing to rapid industrialization and urbanization in regional economies. Urban areas often face water quality and distribution challenges, making packaged water a reliable alternative for residents. People are becoming more health-conscious and prefer safe and clean drinking water to avoid water-borne diseases. This trend is particularly prominent in Asia Pacific countries, where concerns over tap water quality are widely prevalent. Additionally, regional consumers' increasing focus on following an active lifestyle has further increased demand for products such as functional water.

China Packaged Water Market Trends

The China packaged water market is expected to grow significantly in the coming years. The rapid expansion of retail and e-commerce channels in the economy has greatly facilitated the growth of this market. The increasing presence of supermarkets, hypermarkets, and convenience stores has ensured that bottled water is easily accessible to consumers. The availability of platforms such as Alibaba's Tmall and JD.com has made it convenient for consumers to select and purchase bottled water online. Increasing concerns regarding tap water quality in the country have been a major driver of product demand in recent years. A study published by China Water Supply Services Promotion Alliance stated that respondents who had stopped consuming tap water preferred bottled water as its alternative, followed by filtered water. This highlights a growing trust in packaged water products in the economy.

North America Packaged Water Market Trends

The North American market for packaged water is expected to account for a substantial revenue share in the coming years. Busy lifestyles of North American consumers have fueled the demand for convenient and portable beverage options, including packaged water. This beverage offers a practical solution for instantaneous hydration, catering to the needs of people with active schedules. Additionally, water availability in recyclable containers has helped create awareness among consumers regarding the circular economy and the impact of sustainability. According to Mintel, between June 2022 and May 2023, almost three-quarters of bottled water launches in the region used environment-friendly and recyclable packaging, signifying a constant need to maintain innovations in this industry.

U.S. Packaged Water Market Trends

The U.S. packaged water market is expected to witness significant growth over the forecast period. Environmental awareness and sustainability initiatives increasingly influence the packaged water market and the economy. Consumers are becoming more eco-conscious and seeking products that align with such values. Many bottled water companies are adopting sustainable practices, such as using recyclable materials and reducing plastic composition. For instance, in July 2023, SPLENDOR Water announced the launch of its new glass bottle design in partnership with Ardagh Glass Packaging. The bottles are available in 350 ml and 750 ml sizes and are made with completely recyclable indigo glass bottles.

Europe Packaged Water Market Trends

The European region is projected to advance at a substantial growth rate over the forecast period. Steady growth of the tourism sector has significantly impacted the packaged water market in Europe by driving product demand among millions of visitors traveling across economies such as France, Spain, Italy, Switzerland, and Germany. Tourists prefer the convenience of bottled water and its perceived safety, which increases sales in urban centers, coastal areas, and other locations. Moreover, sustainability initiatives established by the European Union have further ensured positive developments in the regional industry.

The UK is projected to become a major contributor to the regional packaged water market revenue in the coming years. Food service establishments in the country, including restaurants, cafes, and vending machines, contribute to this growth by providing bottled water to consumers and diners. Effective distribution strategies and partnerships with retailers and distributors are essential for market players to maintain a competitive edge and meet the increasing nationwide demand for packaged water. Additionally, an emphasis on unique selling points such as natural spring sources, high mineral content, and ideal pH balance enables brands to differentiate their products in a competitive market.

Key Packaged Water Company Insights

Some of the key companies in the packaged water market include Nestlé, PepsiCo, The Coca-Cola Company, and FIJI Water Company, among others.

-

Nestlé is a multinational food and beverage processing conglomerate. Its leading products include bottled water, tea, candy, coffee, confectionery, baby food, ice cream, infant formula, frozen foods, breakfast cereals, dry packaged foods and snacks, and pet foods. Through its Nestlé Waters division, the company has developed the Nestlé Pure Life bottled water brand that uses recyclable PET bottles. Other notable natural mineral and purified water brands from this division include S.Pellegrino, Perrier, Acqua Panna, Buxton, and Vittel.

-

PepsiCo is a multinational food, beverage, and snack corporation with several major products in the global market, including Pepsi, Mountain Dew, Gatorade, Lays, Doritos, Quaker foods and snacks, Lipton tea, and Aquafina bottled water. The Aquafina brand includes both flavored and unflavored water, with products including Aquafina, Aquafina Can, and FlavorSplash available in a range of sizes.

Key Packaged Water Companies:

The following are the leading companies in the packaged water market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- PepsiCo

- The Coca-Cola Company

- DANONE

- Primo Water Corporation

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- Voss of Norway AS

- Nongfu Spring

- National Beverage Corp.

- Keurig Dr Pepper Inc.

Recent Developments

-

In June 2024, Primo Water Corporation and BlueTriton Brands, Inc. announced a merger agreement to form a North American healthy hydration company. This deal is expected to leverage the strengths of both these companies to offer a diverse portfolio across products, channels, and use cases. The new company would be headquartered in Stamford, Connecticut, and Tampa, Florida.

-

In December 2023, FIJI Water announced that it would be strengthening its environmental sustainability initiatives with an immediate shift to 100%-recycled plastic (rPET) for its flagship 330 mL and 500 mL bottles in Canada. Through this development, the company has replaced plastic in 70% of its bottles globally with recycled materials. The company’s primary objective is to transition its complete bottle portfolio to recycled PET by 2025.

Packaged Water Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 348.64 billion

Revenue forecast in 2030

USD 509.18 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, packaging, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Indonesia, Thailand, Singapore, Brazil, Argentina, UAE, South Africa

Key companies profiled

Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Gerolsteiner Brunnen GmbH & Co. KG; Voss of Norway AS; Nongfu Spring; National Beverage Corp.; Keurig Dr Pepper Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaged Water Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the packaged water market report based on product, distribution channel, packaging, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Still Water

-

Sparkling Water

-

Functional Water

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Off-Trade

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Others

-

-

On-Trade

-

-

Packaging Outlook (Revenue, USD Million, 2017 - 2030)

-

PET

-

Cans

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.