- Home

- »

- Consumer F&B

- »

-

Packaged Tuna Market Size & Share, Industry Report, 2033GVR Report cover

![Packaged Tuna Market Size, Share & Trends Report]()

Packaged Tuna Market (2026 - 2033) Size, Share & Trends Analysis Report By Form (Canned, Pouches), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-047-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaged Tuna Market Summary

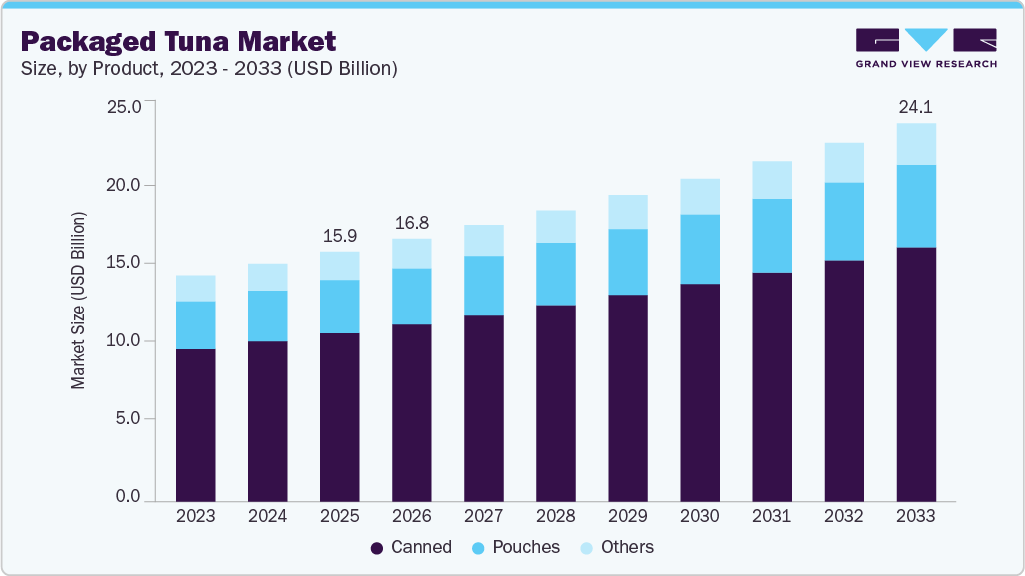

The global packaged tuna market size was estimated at USD 15.95 billion in 2025 and is expected to reach USD 24.14 billion by 2033, growing at a CAGR of 5.3% from 2026 to 2033. The market for packaged tuna has been expanding steadily, supported by changing consumer preferences toward convenient, nutritious, and shelf-stable protein sources.

Key Market Trends & Insights

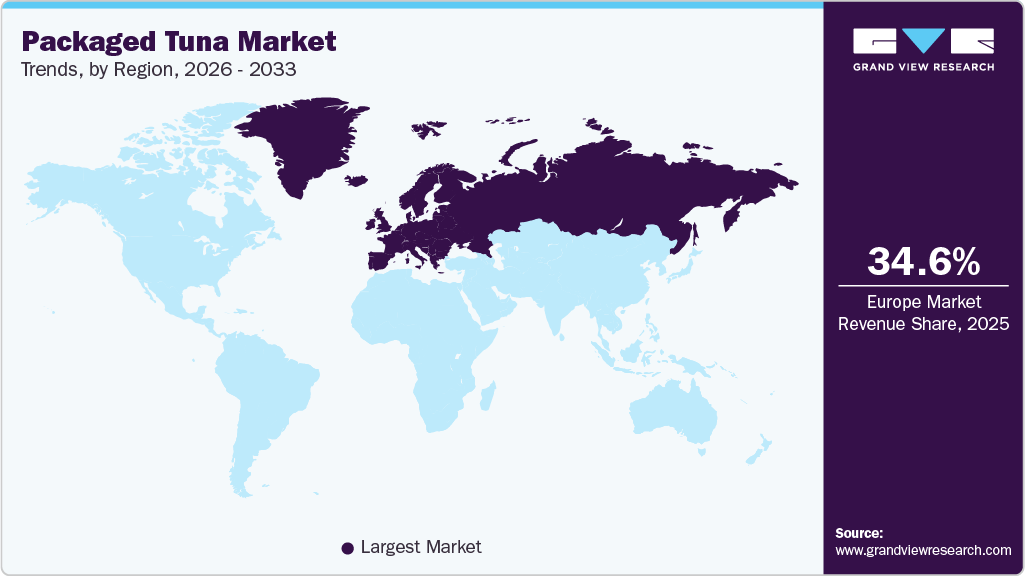

- Europe led the market with a share of 34.6% in 2025.

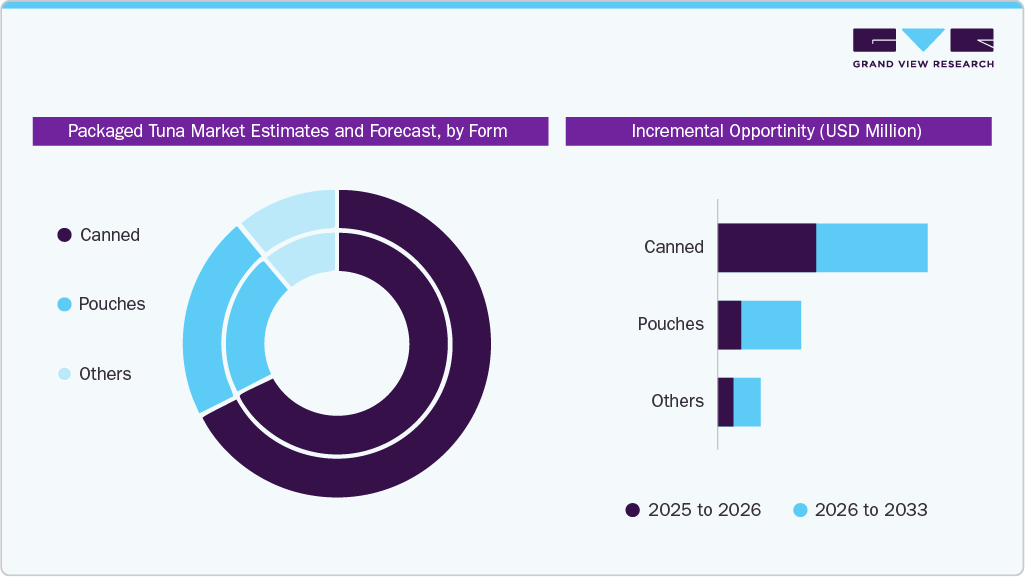

- By form, canned tuna led the market and accounted for a share of 67.5% in 2025.

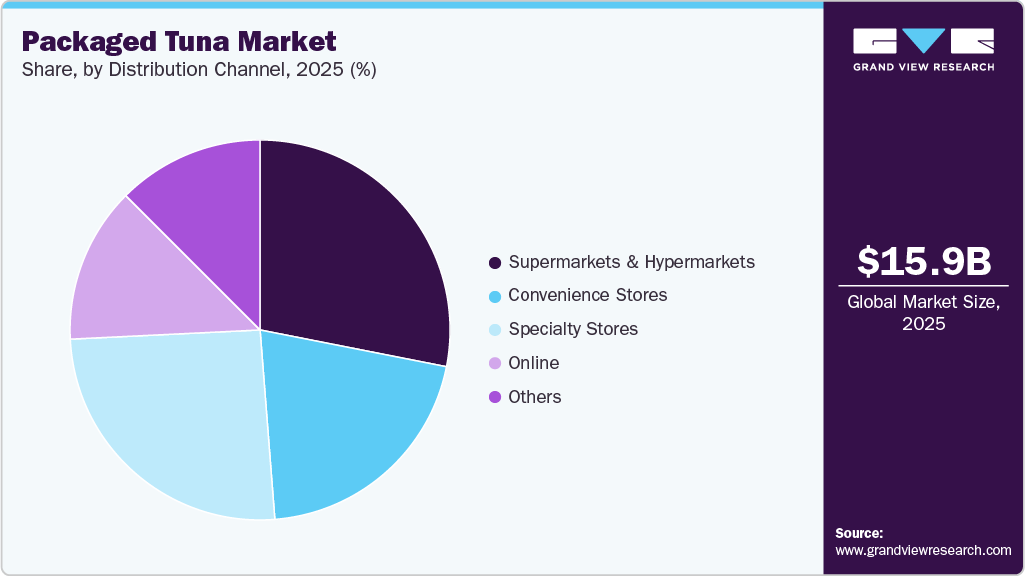

- By distribution channel, hypermarkets & supermarkets led the market and accounted for a share of 28.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 15.95 Billion

- 2033 Projected Market Size: USD 24.14 Billion

- CAGR (2026-2033): 5.3%

- Europe: Largest market in 2025

Convenience and modern lifestyles also play a significant role. Packaged and canned tuna products appeal to consumers with busy schedules who seek ready-to-eat or easy-to-prepare meal components. The product’s long shelf life, portability, and versatility in meal preparation further enhance its appeal, particularly among working professionals, students, and households seeking quick meal solutions. Moreover, innovations in flavor profiles such as lemon pepper, chili, Mediterranean blends, and olive oil variants have broadened its relevance across demographic groups, particularly Millennials and Gen Z, who show greater openness to global flavors and ready-made meal options.

Over the past few years, the consumption of seafood has increased significantly across the globe owing to its rich taste, nutritional properties, and smaller carbon footprint compared to other meat and beef products. Emerging markets, including India, Indonesia, Thailand, and the Philippines, are demonstrating rising adoption of canned seafood due to increasing workforce participation and demand for convenient meal options.

A blog by the National Fisheries Institute suggested that 88% of all families in the U.S. have consumed canned tuna. In addition, this fish is one of the top five most-consumed seafood globally. The tuna industry has witnessed a paradigm shift in recent years due to increasing production and price competition, changing technology, and shifting consumer demand.

Packaging innovation has also contributed meaningfully to market growth. Traditional canned tuna remains popular due to its long shelf life and affordability, while newer formats such as vacuum-sealed pouches and portion-controlled packs are gaining acceptance. These formats are often perceived as lighter, easier to open, and more suitable for on-the-go consumption. In addition, growing awareness around sustainability and waste reduction has encouraged the adoption of packaging that emphasizes recyclability, reduced material usage, and clear labeling.

Sustainability is another critical driver of innovation in the canned seafood market. Companies are increasingly adopting eco-friendly packaging materials and practices to reduce their environmental footprint. For example, John West's EcoTwist packaging not only reduces the amount of steel used but also eliminates the need for plastic shrink wrap, thereby decreasing overall packaging waste. The emphasis on sustainable packaging resonates with environmentally conscious consumers, enhancing brand loyalty and trust. Innovations such as the use of recyclable materials and the implementation of traceability features such as QR codes that inform consumers about the product's origin are becoming standard practices that align with consumer expectations for transparency and responsibility.

Form Insights

Canned tuna dominated the market with a share of 67.5% in 2025. As busy lifestyles and on-the-go eating habits increase, canned tuna offers a ready-to-eat, shelf-stable protein that requires minimal preparation, making it attractive for quick meals, work lunches, and home cooking. It is also perceived as a lean, high-protein, low-fat food rich in omega-3 fatty acids, aligning well with growing consumer focus on health, fitness, and weight management. In addition, rising interest in budget-friendly protein sources amid food price inflation has positioned canned tuna as a cost-effective alternative to fresh seafood and meat. Product innovations such as flavored varieties, single-serve packs, and sustainably sourced options have further broadened its appeal, particularly among younger and health-conscious consumers.

The tuna pouches for commercial use segment is predicted to have a CAGR of 5.7% from 2026 to 2033. The consumption of tuna in pouched form is rising among consumers due to its strong alignment with modern preferences for convenience, health, and portability. Tuna pouches offer ready-to-eat protein without the need for draining or refrigeration before opening, making them well-suited for on-the-go meals, office lunches, and fitness-oriented diets. Compared to canned formats, pouches are lighter, easier to open, and generate less mess, enhancing user convenience. In addition, growing consumer focus on high-protein, low-fat, and clean-label foods has positioned tuna pouches as a healthy staple, particularly among working professionals, students, and active individuals.

Distribution Channel Insights

Sales of packaged tuna through the supermarkets & hypermarkets dominated the market, accounting for a share of 28.1% in 2025. Sales of packaged tuna through supermarkets and hypermarkets are rising due to their ability to offer convenience, affordability, and product variety in a single shopping destination. These retail formats provide wide shelf space for multiple tuna formats, canned, pouch, flavored, and value multipacks, allowing consumers to compare brands, prices, and nutritional claims easily. Strong private-label penetration, frequent price promotions, and bulk discounts further support higher volumes, especially among cost-conscious households. In addition, supermarkets and hypermarkets benefit from high footfall and routine grocery purchasing behavior, positioning packaged tuna as a staple protein alongside other pantry essentials.

Sales of packaged tuna through the online distribution channel are expected to grow at a CAGR of 9.9% over the forecast period. E-commerce platforms allow shoppers to easily compare brands, pack sizes, and nutritional claims, making it simpler to choose products aligned with health goals such as high protein, low fat, or omega-3 content. Online channels also support subscription models and multi-pack discounts, which are particularly attractive for pantry staples such as tuna. In addition, improved cold-chain logistics, faster delivery timelines, and the expansion of grocery e-commerce have increased consumer confidence in purchasing shelf-stable seafood online. Health-conscious consumers, young urban professionals, and families seeking time-saving meal solutions are key contributors to the rising online sales of packaged tuna.

Regional Insights

North America Packaged Tuna Market Trends

North America packaged tuna market is expected to register the highest CAGR of 5.2% from 2026 to 2033. The packaged tuna market in North America is growing due to rising health consciousness and demand for convenient, high-protein foods. Tuna is viewed as a nutritious, low-fat source of protein and omega-3s, making it popular among fitness-focused and busy consumers. The expansion of ready-to-eat meal options, including flavored tuna pouches and snack kits, has further boosted appeal. In addition, increased availability in retail stores and innovations in sustainable fishing and packaging practices are attracting environmentally aware shoppers, contributing to steady market growth.

U.S. Packaged Tuna Market Trends

Packaged tuna, especially in canned and pouch formats, offers a shelf-stable, ready-to-eat solution that appeals to on-the-go eating habits and meal prepping trends. Rising awareness of tuna’s high protein and omega-3 content further boosts demand among wellness-oriented shoppers, while innovations in packaging (easy-open cans, flavored and premium products) and expanded retail and e-commerce availability make these products more attractive and accessible.

Europe Packaged Tuna Market Trends

Europe dominated the packaged tuna market with a share of 34.6% in 2025. Tuna is widely perceived as a high-protein, low-fat, and affordable source of animal protein, making it attractive to health-conscious consumers seeking nutritious meal options. Busy urban lifestyles and the increasing number of single-person households have further boosted demand for ready-to-eat and easy-to-prepare packaged tuna products, particularly canned and pouch formats. In addition, the popularity of Mediterranean and flexitarian diets across Europe has reinforced tuna’s role in salads, sandwiches, and light meals. Product innovation, including flavored tuna, portion-controlled packs, and sustainable sourcing certifications (such as MSC), has also helped manufacturers appeal to environmentally conscious consumers, supporting continued market growth across Western and Northern Europe.

Asia Pacific Packaged Tuna Market Trends

The Asia Pacific packaged tuna market is expected to register the highest CAGR of 5.5% from 2026 to 2033. Rapid growth in the working population and busy lifestyles across countries such as Japan, South Korea, China, Thailand, and Australia has driven preference for ready-to-eat and easy-to-prepare seafood products, including canned and pouch-packed tuna. Consumers are increasingly seeking high-protein, low-fat, and affordable animal protein alternatives, positioning packaged tuna as a healthy substitute to red meat and processed foods. In addition, rising health awareness around omega-3 fatty acids, coupled with strong seafood consumption traditions in the region, is supporting sustained demand. Expansion of modern retail formats improved cold-chain and packaging technologies, and the growing penetration of e-commerce grocery platforms is further accelerating market growth across the Asia Pacific region.

Key Packaged Tuna Company Insights

The presence of a few established players and new entrants characterizes the market. Many big players are increasing their focus on the growing trend of the packaged tuna market. Players in the market are diversifying their service offerings in order to maintain market share.

Key Packaged Tuna Companies:

The following key companies have been profiled for this study on the packaged tuna market.

- FRINSA DEL NOROESTE, S.A.,

- Thai Union Group PCL

- Bumble Bee Foods, LLC

- Century Pacific Food Inc.

- Jealsa

- Grupo Calvo

- Wild Planet Foods Inc.

- PT. Aneka Tuna Indonesia

- American Tuna Inc.

- Ocean Brands

Recent Developments

-

In December 2025, ALDI Australia began transitioning its entire canned tuna range under the Portview and OceanRise brands to Marine Stewardship Council (MSC) certified products. This move means all ALDI own-brand canned tuna in Australia will carry the MSC blue tick, supporting more sustainable tuna fisheries while maintaining affordable pricing for customers.

-

In January 2025, Chicken of the Sea and McCormick introduced two new on-the-go tuna packets: Wild Caught Light Tuna with Old Bay Seasoning and with McCormick Chili Lime, expanding the brand’s flavored seafood lineup; these ready-to-eat products are now available online and at major retailers across the U.S.

Packaged Tuna Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 16.77 billion

Revenue forecast in 2033

USD 24.14 billion

Growth rate

CAGR of 5.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilo tons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

FRINSA DEL NOROESTE, S.A.; Thai Union Group PCL; Bumble Bee Foods, LLC; Century Pacific Food Inc.; Jealsa; Grupo Calvo; Wild Planet Foods Inc.; PT. Aneka Tuna Indonesia; American Tuna Inc.; Ocean Brands

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaged Tuna Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the packaged tuna market on the basis of form, distribution channel, and region.

-

Forms Outlook (Volume, Kilo Tons; USD Million, 2021 - 2033)

-

Canned

-

Pouches

-

Others

-

-

Distribution Channel Outlook (Volume, Kilo Tons; USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, Volume, Kilo Tons; USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global packaged tuna market size was estimated at USD 15.95 billion in 2025 and is expected to reach USD 16.77 billion in 2026.

b. The global packaged tuna market is expected to grow at a compound annual growth rate of 5.3% from 2026 to 2033 to reach USD 24.14 billion by 2033.

b. Canned tuna dominated the market with a share of 67.5% in 2025. As busy lifestyles and on-the-go eating habits increase, canned tuna offers a ready-to-eat, shelf-stable protein that requires minimal preparation, making it attractive for quick meals, work lunches, and home cooking. It is also perceived as a lean, high-protein, low-fat food rich in omega-3 fatty acids, aligning well with growing consumer focus on health, fitness, and weight management.

b. Some key players operating in the packaged tuna market include FRINSA DEL NOROESTE, S.A.; Thai Union Group PCL; Bumble Bee Foods, LLC; Century Pacific Food Inc.; Jealsa; Grupo Calvo; Wild Planet Foods Inc.; PT. Aneka Tuna Indonesia; American Tuna Inc.; and Ocean Brands.

b. Shifting consumer preferences for seafood in various cuisines on account of being a rich source of essential proteins, vitamins, and minerals along with rising demand for packaged tuna in emerging economies owing to various health benefits are the primary factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.