- Home

- »

- Consumer F&B

- »

-

Packaged Cactus Water Market Size, Industry Report, 2030GVR Report cover

![Packaged Cactus Water Market Size, Share & Trends Report]()

Packaged Cactus Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flavored, Plain), By Distribution Channel (Offline, Online), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-079-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaged Cactus Water Market Summary

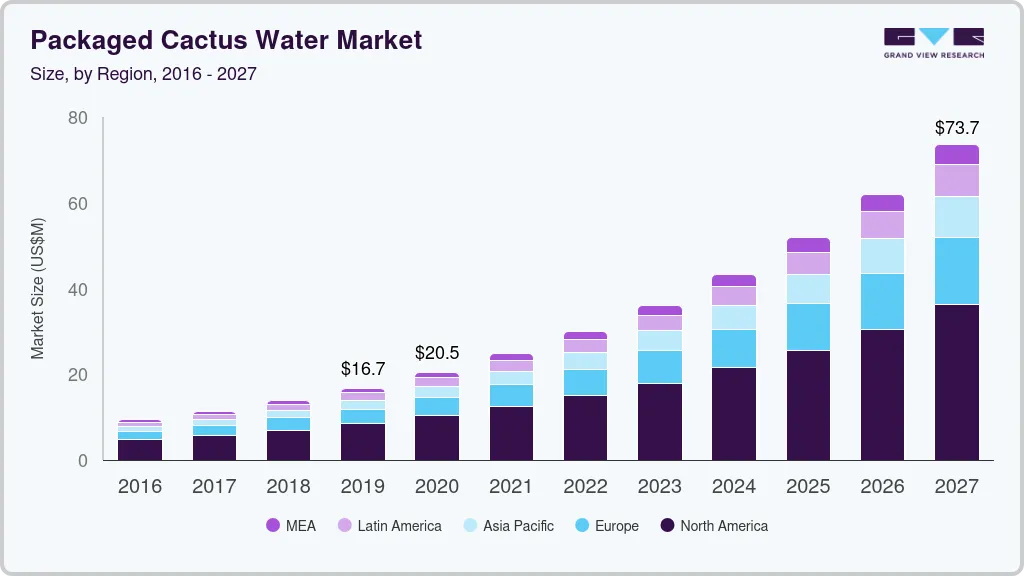

The global packaged cactus water market size was estimated at USD 43.2 million in 2024 and is projected to reach USD 86.0 million by 2030, growing at a CAGR of 10.7% from 2025 to 2030. The rapid shift towards health- and wellness-based lifestyles among consumers worldwide has led to increased sales of functional food and beverage products, with the cactus water category benefitting from this trend.

Key Market Trends & Insights

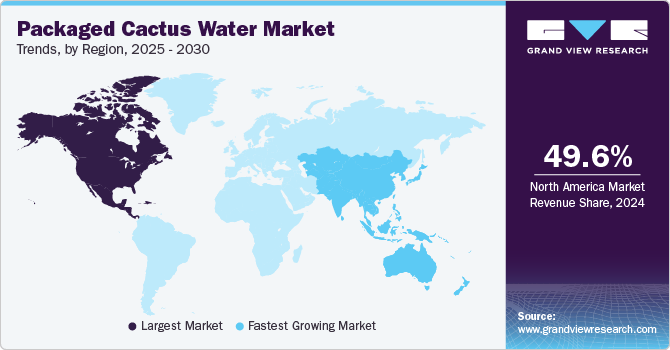

- The North America packaged cactus water market accounted for the largest global revenue share of 49.6% in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- By product, the flavored segment accounted for the largest revenue share of 66.0% in the global packaged cactus water industry in 2024.

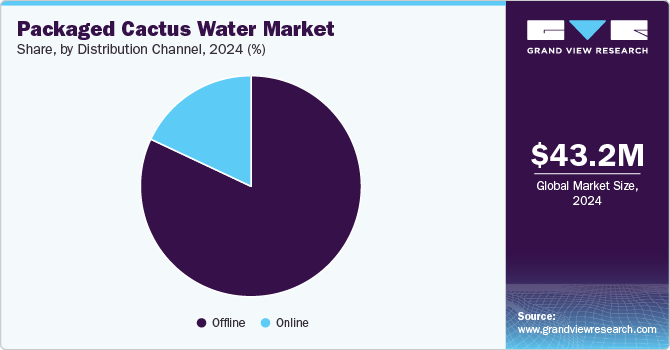

- By distribution channel, the offline segment accounted for the largest revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 43.2 Million

- 2030 Projected Market Size: USD 86.0 Million

- CAGR (2025-2030): 10.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hydration has become a major factor for consumers when purchasing beverages, and the presence of various useful electrolytes and minerals in cactus water has made it a functional alternative to generic sugary drinks, as well as coconut water. The product is marketed as an excellent option for maintaining hydration, replenishing electrolytes after physical activities, and supporting overall well-being, boosting its demand and sales.Cactus water, particularly derived from the prickly pear cactus (Opuntia), is gaining significant popularity due to its variety of potential health benefits. It offers a range of nutrients, antioxidants, and hydrating properties, making it an appealing beverage for health-conscious consumers. Cactus water is a rich source of antioxidants, particularly flavonoids, betalains, and vitamin C. These compounds help neutralize free radicals in the body, reducing oxidative stress and lowering the risk of chronic diseases such as heart disease and diabetes. The antioxidants in cactus water also possess anti-inflammatory properties, which may benefit individuals dealing with conditions such as arthritis or inflammation-related issues. Some other perceived benefits of the product, including improvements to skin and digestive health, are expected to further contribute to market growth.

A notable emerging trend across various developed and developing regions is the preference for beverages that are low in sugar and calories. Many consumers are reducing their intake of sugary drinks due to concerns over weight gain, diabetes, and general health issues. Cactus water, typically low in calories and sugar compared to fruit juices or soft drinks, appeals to health-conscious individuals looking to minimize their sugar intake without sacrificing taste or hydration benefits. The rising global interest in plant-based and natural products has made cactus water a popular option among those seeking plant-derived beverages that offer functional benefits. This trend is particularly noticeable among younger generations, such as the Millennial and Gen Z demographics, who are keen to try novel ingredients that have a distinct flavor and align with their plant-based or eco-conscious lifestyles.

The rapidly expanding clean label movement globally presents another notable growth avenue for the packaged cactus water industry. Clean-label products are those with a simple and transparent set of ingredients and contain no artificial additives, which are properties that have made them more desirable among modern consumers. Cactus water, generally advertised as a single-ingredient product consisting of cactus juice and water, appeals to people seeking natural and minimally processed beverages. Additionally, its simplicity and transparency in labeling have increased its popularity among consumers who aim to avoid artificial flavors, colors, and preservatives in their food products. Cactus has roots in various traditional cuisines and health practices, particularly in Mexico, the Middle East, and parts of Africa. As global exposure to these regional cultures increases, consumers in Western and Asian markets are becoming more receptive to trying ingredients such as cactus water, which is positively shaping its demand.

Product Insights

The flavored segment accounted for the largest revenue share of 66.0% in the global packaged cactus water industry in 2024. Rising wellness trends among consumers and growing demand for nutrient- and mineral-rich products have driven the popularity of niche products such as cactus water. Manufacturers are adding natural flavors, such as berry, citrus, or tropical fruits, to make the product more appealing for consumers demanding a more flavorful drink without the added sugars and artificial flavors commonly found in other flavored beverages. For instance, in July 2024, Caliwater announced the immediate availability of its Peach Mango flavor profile for cactus water in an exclusive partnership with GNC Stores across the U.S. The flavor joins other options by the brand, including Watermelon, Prickly Pear, Pineapple, and Ginger & Lime.

The plain cactus water segment is expected to advance at the highest CAGR during the forecast period in the global market. Many first-time consumers favor basic variants of packaged cactus water that do not contain any added flavors to better understand their overall nutritional value and taste. These products are increasingly being launched through offline and online channels that boost their visibility and create more opportunities for generating product sales. The emergence of new players in this market has further increased the availability of plain options for cactus water in supermarkets and grocery stores.

Distribution Channel Insights

The offline segment accounted for the largest revenue share in the global market in 2024. Cactus water is often sold in the health and wellness aisles of large grocery chains. Retailers such as Whole Foods, Walmart, Target, and Kroger in North America, as well as leading retail chains in Europe and Asia, are increasingly offering cactus water as part of their beverage selections. In-store tastings and sampling programs are effective sales drivers for cactus water through offline channels. Because this product is still gaining traction, retailers often use sampling to introduce it to new customers. Through this approach, customers can experience the taste and benefits of cactus water before purchasing. Innovative branding and marketing, including storytelling about the product’s origins and the unique properties of cactus water, can also capture consumer interest and increase sales.

The online segment is anticipated to advance at the highest CAGR from 2025 to 2030 in the packaged cactus water industry. Online platforms, including Amazon, Walmart, and a number of specialized health retailers, allow consumers to conveniently browse, compare, and purchase packaged cactus water. Many modern consumers, particularly Millennials and Gen Z, have become aware of these products through influencer marketing strategies on social media platforms. Brands leverage these platforms to bring audiences to their website and offer a wide selection of cactus water products at attractive prices. A growing number of online platforms cater specifically to health-conscious consumers, including e-commerce websites specializing in organic, plant-based, and functional products. These channels provide a promising avenue for companies to market their products and enhance sales, aiding market growth.

Regional Insights

The North America packaged cactus water market accounted for the largest global revenue share of 49.6% in 2024. Rising awareness regarding the benefits of cactus water and the presence of several local brands in regional economies have acted as major factors for market growth. Consumers in the U.S. and Canada increasingly prioritize hydration, especially as wellness and fitness trends continue to expand steadily. Cactus water is marketed as a hydrating beverage with a rich source of electrolytes such as magnesium, potassium, and calcium, making it appealing to consumers who lead active lifestyles or seek alternatives to sugary sports drinks and coconut water. Furthermore, a majority of brands advertise themselves as eco-friendly due to the known resilience of cacti in desert ecosystems and their low environmental impact. This addresses the sustainability concerns of consumers increasingly considering environmental factors in their purchasing decisions.

U.S. Packaged Cactus Water Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024. The growing adoption of busy and active lifestyles among American consumers has compelled them to seek health-oriented beverages that offer hydration benefits while possessing minimal sugar content. Cactus water is often marketed as a low-calorie and naturally sweetened alternative to other beverages, which appeals to consumers who are increasingly trying to reduce their sugar intake for health reasons. Furthermore, the well-established offline distribution channel and extensive usage of online platforms in the economy have encouraged companies to adopt omnichannel strategies to boost product sales, increasing market competition.

Europe Packaged Cactus Water Market Trends

Europe accounted for a substantial revenue share in the global packaged cactus water market in 2024. The growth of this business is still in the early stages in the region; however, consumer trends regarding health, wellness, and sustainability are expected to create promising opportunities for market players in economies such as the UK, Germany, and France in the coming years. Cactus water is being widely promoted as a functional beverage, offering benefits such as antioxidants, anti-inflammatory properties, and potential digestive health support in addition to hydration. The well-established e-commerce sector in Europe has enabled health-conscious consumers and fitness enthusiasts to purchase products from international markets, creating opportunities for brands to expand their geographical reach in this region.

Asia Pacific Packaged Cactus Water Market Trends

Asia Pacific is expected to advance at the highest CAGR in the global packaged cactus water industry from 2025 to 2030. Continued urbanization in economies such as China, India, and South Korea and rising disposable income levels of consumers have helped create a strong demand for functional food and beverage items, which is expected to encourage brands to expand their regional distribution networks. Moreover, consumers are increasingly seeking exotic and novel ingredients in their purchases. Cactus water offers a unique flavor, making it an appealing option for those seeking an alternative to conventional hydration products such as coconut water and fruit juices.

China accounted for the largest revenue share in the regional market in 2024 and is expected to maintain its position during the forecast period. The rapidly growing population of wellness-focused consumers in the economy and increasing awareness about the health advantages of functional beverages are expected to drive positive advancements in this industry. Moreover, social media platforms such as WeChat, Weibo, and Xiaohongshu (RedNote) have significantly shaped consumer behavior. Influencers and wellness bloggers often promote trending and health-oriented products, and cactus water’s exotic nature makes it well-suited for social media promotion.

Key Packaged Cactus Water Company Insights

Some major companies involved in the global packaged cactus water industry include Caliwater, Pricklee, and True Nopal, among others.

-

Caliwater is a U.S.-based beverage company specializing in producing functional drinks made from cactus water, primarily derived from the prickly pear cactus. Notable flavors include Peach Mango, Wild Prickly Pear, Watermelon, Ginger + Lime, and Pineapple. The company further offers a variety of packs for general consumers and kids, with its kid-oriented options including the Watermelon and Prickly Pear flavors.

-

Pricklee is a beverage manufacturer specializing in producing natural hydration drinks, particularly cactus water derived from prickly pear cacti. These products are available in canned versions, with the flavor range including Prickly Pear, Tropical Mango, and Wild Strawberry. The company further offers a Variety Pack option that includes all three flavors so that consumers can understand the product better. The company has stores across various U.S. states, including Arizona, California, New York, Massachusetts, and Ohio, among others.

Key Packaged Cactus Water Companies:

The following are the leading companies in the packaged cactus water market. These companies collectively hold the largest market share and dictate industry trends.

- Caliwater

- True Nopal Ventures LLC

- Pricklee LLC

- BetterDays

- Oka Products LLC

- Green-Go

- PURE KAKTAI

- ¡CACTUS!

- Evissi USA LLC

- The Lauro Company LLC

Recent Developments

-

In January 2025, Caliwater announced the launch of its Pineapple Kids Pouches cactus water line at Sprouts Farmers Market across the U.S. The products have been made available in 6-pack cartons at USD 6.99 or as single pouch offerings priced at USD 1.25. The introduction of the Pineapple flavor adds to the company's existing portfolio of Watermelon and Prickly Pear options for kids.

-

In October 2024, True Nopal announced the expansion of its distribution across Walmart outlets in the U.S. starting the following month. The company's prickly pear cactus water, available in 33.8oz pouches, was added to 914 Walmart stores as part of this strategy, bringing True Nopal's overall distribution to more than 2,300 stores nationwide. The company develops non-GMO, USDA Organic-certified, and 100% natural RTD beverages obtained from prickly pear cactus fruits.

-

In January 2024, BetterDays, an Australian start-up based in Melbourne, announced the launch of the country's first-ever non-alcoholic prickly pear beverage. The product range includes three options: Hibiscus & Watermelon + Nootropics, Prickly Pear + Electrolytes, and Cucumber & Mint + Collagen. Each provides different functions, such as promoting brain health, maintaining hydration, and improving skin health. The products have been made available in 250ml cans and can be purchased on the brand's website and select independent retailers as well as hospitality venues.

Packaged Cactus Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.8 million

Revenue forecast in 2030

USD 86.0 million

Growth rate

CAGR of 10.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; UAE; South Africa

Key companies profiled

Caliwater; True Nopal Ventures LLC; Pricklee LLC; BetterDays; Oka Products LLC; Green-Go; PURE KAKTAI; Evissi USA LLC; The Lauro, Company LLC; Lunae Sparkling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaged Cactus Water Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global packaged cactus water market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Plain

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.