- Home

- »

- Consumer F&B

- »

-

Packaged Burgers Market Size, Share, Industry Report, 2030GVR Report cover

![Packaged Burgers Market Size, Share & Trends Report]()

Packaged Burgers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Patty, By Distribution Channel, By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68038-977-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaged Burgers Market Summary

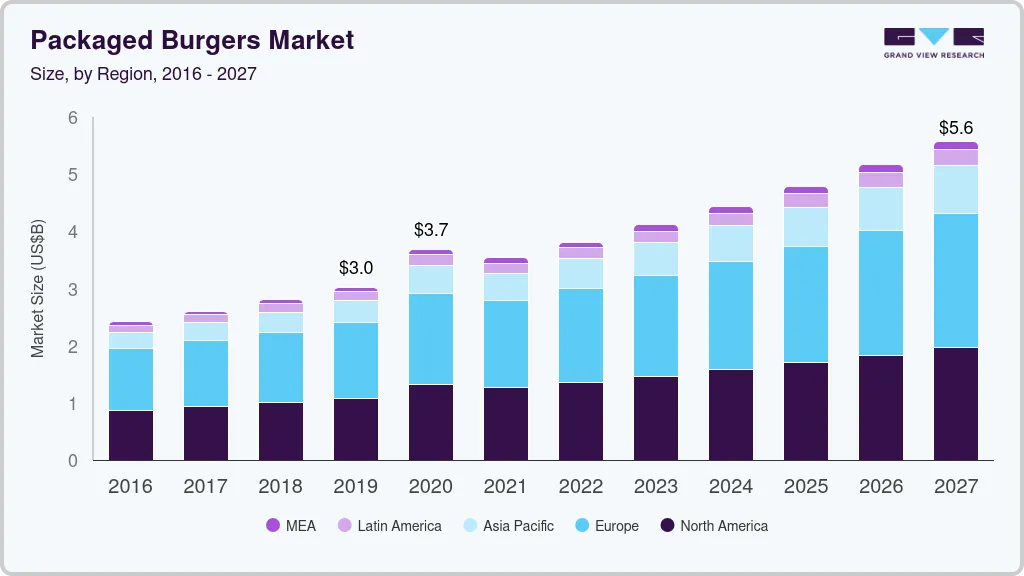

The global packaged burgers market size was valued at USD 4.43 billion in 2024 and is projected to reach USD 6.99 billion by 2030, growing at a CAGR of 7.9% from 2025 to 2030. This expansion is primarily driven by changing consumer preferences that favor convenience and ready-to-eat meals.

Key Market Trends & Insights

- The Europe packaged burgers market held the largest revenue share of 42.6% in 2024.

- The Germany packaged burgers market dominated Europe in 2024.

- Based on product, the frozen segment dominated the packaged burgers industry with the largest revenue share of 83.4% in 2024.

- Based on patty, the veg segment dominated the packaged burgers industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.43 Billion

- 2030 Projected Market Size: USD 6.99 Billion

- CAGR (2025-2030): 7.9%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

As lifestyles become busier, the demand for quick meal solutions, such as packaged burgers, is increasing. These are also becoming a popular option among consumers seeking taste and convenience. Companies are introducing burgers made from plant proteins to cater to health-conscious consumers and those seeking sustainable food options. For instance, Beyond Meat has gained considerable traction by offering products that closely resemble traditional meat while appealing to vegetarians and flexitarians. This shift supports market expansion and aligns with the growing trend toward healthier eating habits. Ongoing innovations in the food industry and rising popularity of plant-based alternatives are expected to propel the growth of the packaged burgers industry.

The packaged burgers industry also benefits from technological advancements and food processing techniques. Innovations in packaging have improved product shelf life and convenience, making it easier for consumers to purchase and store these items. In addition, the expansion of online grocery shopping and food delivery services has made packaged burgers more accessible. As a result, consumers can buy their favorite products with just a few clicks, which is further expected to drive the growth of the packaged burgers industry.

Product Insights

The frozen segment dominated the packaged burgers industry with the largest revenue share of 83.4% in 2024, primarily due to its convenience and longer shelf life. Consumers increasingly prefer frozen burgers as they can be stored for months, making them an ideal choice for busy lifestyles. In addition, advancements in freezing technology have improved the quality and taste of these products, enhancing consumer satisfaction. The ease of preparation with minimal cooking time further drives demand, as many people seek quick meal solutions without compromising taste or nutrition.

The fresh segment is expected to grow at a significant CAGR over the forecast period due to increasing consumer demand for healthier and more natural food options. As consumers become more health-conscious, there is a notable shift toward fresh products that are perceived as less processed and more nutritious. This trend is further supported by the growing popularity of clean eating and organic ingredients, which encourage consumers to seek out fresh burgers over frozen alternatives. For instance, many retailers are now offering fresh burger options that highlight locally sourced ingredients, appealing to consumers' desire for transparency in food sourcing.

Patty Insights

The veg segment dominated the packaged burgers industry in 2024, driven by the increasing consumer shift toward healthier and more sustainable food options. As awareness regarding health issues, environmental concerns, and animal welfare grows, many consumers opt for plant-based alternatives that offer lower fat content and fewer calories than traditional meat products. This trend is particularly evident among those who primarily follow plant-based diets and seek satisfying yet healthier meals. The surging popularity of these products in mainstream retail and fast-food chains further increases the dominance of the veg segment, responding effectively to the rising demand for convenient and nutritious meal solutions.

The non-veg segment is expected to grow at a significant CAGR over the forecast period due to the persistent popularity of meat-based products among consumers. As traditional meat burgers remain a staple in many diets, the demand for high-quality, flavorful options continues to rise. This growth is further fueled by the expansion of quick-service restaurants (QSRs) that offer diverse options in non-veg burgers, catering to consumers' cravings for convenience and taste. For instance, major fast-food chains such as McDonald's frequently introduce limited-time offers featuring gourmet beef burgers, which attract customers looking for premium food experiences. In addition, innovations in meat processing and flavor enhancement enable manufacturers to create more appealing products that meet consumer expectations of specific quality and taste.

Distribution Channel Insights

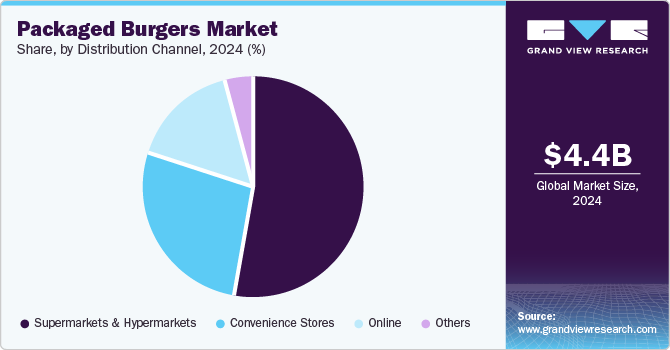

The supermarket & hypermarkets segment dominated the packaged burgers industry with the largest revenue share in 2024 due to their extensive reach and convenience. These retail formats offer various packaged burger options, including meat and plant-based choices, allowing shoppers to easily compare products and make informed decisions. The availability of multiple brands and variants under one roof enhances the consumer experience and encourages impulse purchases. For instance, Walmart, Tesco, and other major chains stock a range of packaged burgers, from budget-friendly to premium products, catering to diverse consumer preferences. In addition, the ability to purchase groceries in bulk at supermarkets allows consumers to stock up on their favorite items, further driving sales in this segment.

The online segment is expected to grow at the fastest CAGR over the forecast period due to the increasing consumer preference for convenience and the rise of e-commerce platforms. As more consumers turn to online channels for purchasing groceries, the accessibility and variety of packaged burgers available through these channels are expanding significantly. This shift is driven by busy lifestyles that make traditional shopping less feasible, prompting consumers to seek quick and efficient alternatives. In addition, promotional discounts and subscription services provided by online platforms further incentivize consumers to purchase packaged burgers online, enhancing the growth potential of this segment.

Regional Insights

The Europe packaged burgers market held the largest revenue share of 42.6% in 2024, driven by strong consumer demand for convenience and a diverse range of product offerings. European consumers increasingly favor ready-to-eat meals due to busy lifestyles, leading to higher sales of packaged burgers in supermarkets and through online platforms. The growing trend toward healthier eating has prompted many companies to innovate by introducing gourmet and plant-based burger options, appealing to health-conscious consumers. For instance, brands such as Quorn have successfully launched meat-free burgers that cater to the rising vegan population in countries such as the UK and Germany. The established fast-food culture in Europe and expansion of quick-service restaurants also continue to contribute to the market growth.

Germany Packaged Burgers Market Trends

The Germany packaged burgers market dominated Europe in 2024, driven by a strong consumer preference for convenience and a robust fast-food culture. As busy lifestyles become increasingly common, many consumers are opting for packaged burgers as a quick and satisfying meal option. This trend is further supported by the growing popularity of both traditional and plant-based burgers, catering to diverse dietary preferences. For instance, brands such as Rügenwalder Mühle have successfully launched a range of vegetarian and vegan burger options that appeal to health-conscious consumers while still delivering on taste.

North America Packaged Burgers Market Trends

The North America packaged burgers market is expected to grow significantly over the forecast period due to the increasing demand for convenient meal solutions and the expansion of fast-food chains. As lifestyles become busier, consumers seek quick and easy meal options that do not compromise taste or quality. This trend is further supported by the proliferation of quick-service restaurants (QSRs) that offer a variety of packaged burger options, catering to diverse consumer preferences. In addition, the rising health consciousness among consumers has led to a growing interest in high-quality, sustainable ingredients, prompting manufacturers to introduce healthier packaged burger options.

The U.S. packaged burgers market dominated North America in 2024, driven by the increasing demand for convenience foods, as busy lifestyles prompt consumers to seek quick meal solutions that require minimal preparation time. Packaged burgers offer a ready-to-eat option that aligns with this need, making them popular among American consumers. In addition, the strong presence of fast-food chains and the expansion of retail outlets provide easy access to a variety of packaged burger options, further fueling market growth. For instance, brands such as Impossible Foods have introduced innovative plant-based patties that appeal to health-conscious individuals and meat lovers alike, enhancing the product range in stores.

Asia Pacific Packaged Burgers Market Trends

The Asia Pacific packaged burgers market is expected to grow at the fastest CAGR of 9.8% over the forecast period, driven by rapid urbanization and a burgeoning middle class that is increasingly seeking convenient meal options. As urban areas expand, more consumers are adopting fast-paced lifestyles, leading to a higher demand for ready-to-eat foods such as packaged burgers. This trend is further fueled by the growing popularity of fast-food chains that offer diverse burger options tailored to local tastes. For instance, in countries such as India, McDonald's, an international brand, has successfully introduced localized menu items, including the McAloo Tikki burger, which caters to vegetarian preferences. The rise of online food delivery services has further enhanced accessibility, allowing consumers to conveniently order packaged burgers from their homes.

The China packaged burgers market dominated Asia Pacific in 2024 with the largest revenue share, driven by rapid urbanization and a growing middle class that increasingly seeks convenient meal solutions. As more consumers move to urban areas, their busy lifestyles create a demand for ready-to-eat foods, including packaged burgers, which are quick to prepare and consume. In addition, the expansion of fast-food chains and quick-service restaurants (QSRs) in China has introduced a wider variety of burgers tailored to local tastes, further enhancing market growth. For instance, KFC has successfully launched chicken burgers that resonate with preferences of Chinese consumers.

Key Packaged Burgers Company Insights

Some key players in the packaged burgers market are The Campbell's Company, The Kraft Heinz Company, WK Kellogg Co, and BUBBA foods, LLC. These companies in the packaged burgers market are engaging in innovative strategies to strengthen their position in the market. They focus on developing a diverse range of products that cater to evolving consumer preferences for convenience and quality. Many players are adopting eco-friendly practices in sourcing ingredients and packaging.

-

Beyond Meat is renowned for its innovative approach to plant-based products that cater to health-conscious consumers. By utilizing advanced food technology, the company develops burgers that closely mimic the taste and texture of traditional meat, appealing to both vegetarians and meat-eaters. Beyond Meat emphasizes sustainability through eco-friendly sourcing and production processes, aligning with the growing consumer demand for environmentally responsible food options.

-

The Kraft Heinz Company leverages its extensive portfolio of well-known brands to cater to diverse consumer preferences. The company focuses on product innovation, introducing various burger options that include meat-based, frozen, and plant-based alternatives. With a commitment to quality and convenience, Kraft Heinz aims to meet the increasing demand for quick meal solutions while maintaining high standards of taste and nutrition.

Key Packaged Burgers Companies:

The following are the leading companies in the packaged burgers market. These companies collectively hold the largest market share and dictate industry trends.

- BUBBA foods, LLC

- Dr. Praeger’s Sensible Foods.

- Drink Eat Well, LLC.

- WK Kellogg Co

- Monde Nissin

- Paragon Quality Foods & Paragon Foodservice

- The Kraft Heinz Company.

- Amy's Kitchen, Inc.

- Beyond Meat Inc.

- The Campbell's Company

Recent Developments

-

In April 2024, Beyond Meat, Inc. announced the launch of its fourth generation of the Beyond Burger and Beyond Beef, marking a significant advancement in plant-based meat products. These are known to be healthy offerings, with 21 grams of plant-based protein per serving and 2 grams of saturated fat derived from avocado oil.

-

In March 2024, Bubba Burger announced the introduction of a new protein option to its frozen burger, the Chicken Bubba Burger. Unveiled at the Annual Meat Conference in Nashville, this burger is said to be crafted from 100% all-natural chicken and has a quick preparation time of 12 minutes or less. This new ground chicken offering complements Bubba Burger's existing lineup, which includes various beef burgers and turkey options.

Packaged Burgers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.78 billion

Revenue forecast in 2030

USD 6.99 billion

Growth Rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, patty, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

BUBBA foods, LLC; Dr. Praeger’s Sensible Foods.; Drink Eat Well, LLC.; WK Kellogg Co; Monde Nissin; Paragon Quality Foods & Paragon Foodservice; The Kraft Heinz Company.; Amy's Kitchen, Inc.; Beyond Meat Inc.; The Campbell's Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaged Burgers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global packaged burgers market report based on product, patty, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen

-

Fresh

-

-

Patty Outlook (Revenue, USD Million, 2018 - 2030)

-

Veg

-

Non-veg

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.