- Home

- »

- Consumer F&B

- »

-

Packaged Bread Market Size, Share & Growth Report, 2030GVR Report cover

![Packaged Bread Market Size, Share & Trends Report]()

Packaged Bread Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (White Bread, Brown Bread, Multigrain Bread, Whole Wheat Bread, Sourdough), By Packaging, By Distribution, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-482-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaged Bread Market Summary

The global packaged bread market size was estimated at USD 342.37 billion in 2024 and is projected to reach USD 398.58 billion by 2030, is expected to grow at a CAGR of 2.6% from 2025 to 2030. This growth is expected to be driven by factors such as health trends, improved product offerings, technological advancements, and sustainability concerns.

Key Market Trends & Insights

- Europe dominated the market with the highest revenue of USD 120 billion in 2023.

- By product, white bread was the preferred option, with market revenue exceeding USD 125 billion in 2023.

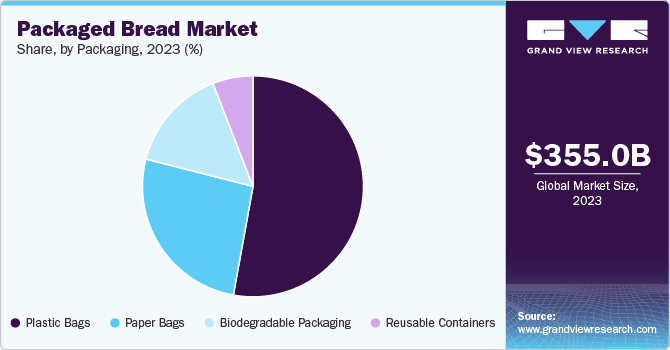

- By packaging, plastic was bread's most preferred packaging medium, with revenue exceeding USD 145 million in 2023.

- By distribution insights, specialty stores, such as bakeries and delis, were the key points of sale for packaged bread, with revenue of USD 95 billion in 2023.

Market Size & Forecast

- 2024 Market Size: USD 342.37 Billion

- 2030 Projected Market Size: USD 398.58 Billion

- CAGR (2025-2030): 2.6%

- Europe: Largest market

There is a significant shift towards health-conscious choices among consumers, with increasing demand for nutrient-rich and organic products. Options such as whole grain, multigrain, and gluten-free bread are gaining popularity as consumers seek healthier alternatives. The rise in health issues such as obesity is prompting a shift towards lower-carb and higher-protein bread options, aligning with dietary trends such as keto and low-carb diets.

Increasing urbanization is a crucial driver for market growth; as more people move to urban areas, the demand for convenient food options rises. Packaged bread offers a quick and easy meal solution for busy lifestyles, appealing to urban consumers who prioritize convenience. This, coupled with busy lifestyles and a growing trend towards on-the-go meals, has led consumers to favor packaged bread, which provides a longer shelf life and ease of use.

The availability of wider varieties of bread has also increased market penetration. Demand for newer bread products such as baguettes, rolls, and sandwich bread has fueled packaged bread production. This variety caters to household consumption and B2B sectors such as quick-service restaurants (QSRs) and cafes.

Advancements in packaging technology have made bread a suitable option for consumers looking for products with longer shelf life. Innovations in baking technology and packaging solutions enhance product freshness and longevity, making packaged bread more appealing to consumers. For instance, long-life packaging is increasingly popular in markets such as Asia because it prevents spoilage.

Product Insights

White bread was the preferred option, with market revenue exceeding USD 125 billion in 2023. White bread is favored for its convenience, soft texture, and versatility in various packagings such as sandwiches, toasts, and breakfast items. This makes it a staple in many households, appealing to busy consumers seeking quick meal solutions. The longer shelf life of white bread compared to other products makes it a practical choice for consumers, reducing food waste and ensuring availability. White bread is generally more affordable than specialty breads, making it accessible to a wider range of consumers. This affordability drives its popularity among budget-conscious shoppers.

A key concern with white bread is the increasing nutritional scrutiny. Increasing health consciousness among consumers has led to declining demand for traditional white bread, as many seek healthier alternatives such as whole grain, multigrain, and gluten-free options. This shift is driven by concerns over high carbohydrate content and gluten intolerance, which negatively impact white bread sales. Having said this, manufacturers continue to innovate within the white bread segment by introducing fortified options that appeal to health-conscious consumers. This includes adding vitamins and minerals to enhance nutritional value.

Multigrain breads are expected to grow at a CAGR of 3.1% from 2024 to 2030, predominantly due to their perceived health benefits over white bread. Multigrain bread can offer several advantages over white bread when made with the right ingredients. It typically contains more fiber, which aids digestion and helps maintain stable blood sugar levels. Many multigrain breads have a lower glycemic index (GI) than white bread. A lower GI means that multigrain bread raises blood sugar levels more slowly, making it a better option for individuals with diabetes or those looking to manage their blood sugar levels. Multigrain bread often includes a variety of grains, such as oats, barley, and flaxseeds, which provide essential vitamins, minerals, and antioxidants. These nutrients contribute to overall health.

Sourdough breads are expected to grow at a CAGR of over 6% from 2024 to 2030. There is a growing awareness among consumers about the health benefits of sourdough bread, including its easier digestibility, lower glycemic index, and higher nutritional value compared to conventional bread. This trend is evident in North America and Europe, where consumers increasingly opt for healthier food options. The rise in demand for artisanal and authentic food products has fueled interest in sourdough. Consumers seek unique flavors and textures from traditional sourdough, contributing to its popularity as a premium product in bakeries and home baking.

Packaging Insights

Plastic was bread's most preferred packaging medium, with revenue exceeding USD 145 million in 2023. The biggest driver for plastic packaging was its ability to prevent spoilage due to moisture. Plastic packaging creates an airtight barrier that helps retain moisture and prevents bread from drying. This extends the shelf life of bread, keeping it fresh for more extended periods compared to other materials such as paper, which can allow moisture loss and staleness. Plastic is known for its durability, providing a solid protective layer that can withstand handling, transportation, and environmental factors without compromising the integrity of the bread. This reduces the risk of damage during distribution.

Another critical advantage of plastic packaging is it's lightweight, which makes it cheaper to transport. This not only reduces shipping costs but also minimizes the carbon footprint associated with transportation. While plastics have environmental concerns, numerous products of plastic used in food packaging can be recycled. Companies are trying to improve recycling rates and develop more sustainable solutions for plastic food packaging.

Paper is one of the fastest-growing forms of packaging for bread and is expected to grow at a CAGR of 2.7% over the forecast period. Paper bags are increasingly used for bread packaging due to several advantages catering to consumer preferences and environmental considerations. Paper bags allow air circulation, which helps maintain the crustiness of freshly baked bread. This prevents moisture accumulation that can lead to mold growth, ensuring that the bread retains its desirable texture and flavor. With increasing consumer focus on sustainability, paper bags are often considered an eco-friendly alternative to plastic. They are compostable and biodegradable, breaking down faster in landfills than plastic bags, which can take hundreds of years to decompose. In addition, paper bags are easier to recycle if they are not heavily contaminated with food residues.

Cost-effectiveness is another essential facet of paper packaging. Paper is generally more affordable than plastic alternatives, making it a preferred choice for bakeries and food businesses. Its widespread availability also contributes to lower costs. Consumer preference associated with paper packaging also plays an essential role in promoting market growth. Many consumers associate paper packaging with freshness and quality, often preferring it over plastic for bakery items. Paper bags have a rustic and traditional feel that can enhance the overall customer experience.

Distribution Insights

Specialty stores, such as bakeries and delis, were the key points of sale for packaged bread, with revenue of USD 95 billion in 2023. There is a growing preference for artisanal breads, particularly sourdough, which has become a staple in many specialty stores. Sourdough accounts for a significant share of specialty loaves due to its perceived health benefits and unique flavor profile. Other specialty flavors such as olive and cheese-infused breads are also seeing strong growth.

The convenience & customization offered by bakeries is expected to remain an important market driver in the near future. With busy lifestyles, consumers are looking for convenient options that do not compromise quality. Specialty stores have responded by offering smaller loaves, half loaves, and customizable bread options, including subscription services where consumers can select their preferred products of bread. This, coupled with expanding flavor profiles of bread in bakeries, is expected to promote market growth.

Regional Insights

The North America packaged bread market is predominantly driven by the health conscious consumer perspective in the U.S. The U.S. packaged bread market was estimated at USD 35 billion in 2023 and is expected to grow at a CAGR of 2% over the forecast period. There is a significant shift toward products beneficial for health, with consumers increasingly favoring organic, gluten-free breads made with whole grains. This trend is partly driven by rising obesity rates and health issues in the U.S.

The market is seeing increased demand for various products of bread, including smaller loaves and those enriched with grains such as quinoa. Specialty breads such as cornbread and biscuits are also gaining popularity in regions such as the Southeast. Busy lifestyles push consumers toward packaged bread due to its convenience and longer shelf life. The pandemic further accelerated this trend, as many turned to packaged options for stability during uncertain times. These factors are expected to keep a stable demand for packaged bread in the U.S.

Europe Packaged Bread Market Trends

Europe was the largest market for packaged bread, with revenue of USD 120 billion in 2023. It is expected to grow at a CAGR of 2.2% over the forecast period. Bread is a staple food across many European countries and is a part of their daily diet. This popularity sustains demand for various products of packaged bread, reinforcing its market position in the near future.

Germany packaged bread market dominated the European region due to its strong baking culture and diverse product offerings. France follows closely, known for its artisanal bread and pastries, while Italy emphasizes quality bread varieties. The fast-paced lifestyle of many Germans has led to a preference for convenience foods. Packaged bread offers quick solutions, appealing to busy families and individuals. The rise of e-commerce has further facilitated access to these products, allowing consumers to shop online for their preferred bread options.

Asia Pacific Packaged Bread Market Trends

Asia Pacific is expected to remain the fastest-growing market for packaged bread over the forecast period, with a CAGR of 3%. The rise of convenience food in countries such as China and India has heightened demand for ready-to-eat products. The growing acceptance of western dietary habits, particularly in countries such as China and India, influences bread consumption patterns. This shift includes an increased preference for various bread products, including sandwich bread and burger buns.

Key Packaged Bread Company Insights

Regional and emerging players characterize the global packaged bread market. The competitive landscape of the packaged bread industry is dynamic and evolving, driven by innovation, changing consumer preferences, and increased competition from private-label brands. Major players focus on health-oriented products while expanding their distribution networks to maintain market share.

Key Packaged Bread Companies:

The following are the leading companies in the packaged bread market. These companies collectively hold the largest market share and dictate industry trends.

- Grupo Bimbo

- Flowers Foods, Inc.

- Associated British Foods

- Dan Cake

- Barilla Group

- General Mills, Inc.

- Kraft Heinz Company

- Yamazaki Baking Co., Ltd.

- PepsiCo, Inc.

- Almarai

- Interstate Bakeries Corporation

- CSM Bakery Solutions

- Aryzta AG

Recent Developments

-

In April 2023, La Brea Bakery launched a plant-based brioche bun tailored for the food service sector. This product features a distinctive buttery taste and delicate crumb texture, aligning with the growing demand for plant-based options.

-

In 2022, Moulins Dumée's Chanvrine launched a flour blend incorporating hemp, designed for bakeries looking to enhance their offerings with higher protein and fiber content.

Packaged Bread Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 350.07 billion

Revenue forecast in 2030

USD 398.58 billion

Growth rate (Revenue)

CAGR of 2.6% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada, Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Grupo Bimbo S.A.B. de C.V.; Flowers Foods, Inc.; Associated British Foods PLC; Dan Cake; Barilla Group; General Mills, Inc.; Kraft Heinz Company; Yamazaki Baking Co., Ltd.; PepsiCo, Inc.; Almarai; Interstate Bakeries Corporation; CSM Bakery Solutions; Aryzta AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaged Bread Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global packaged bread market report on the basis of product, packaging, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

White Bread

-

Brown Bread

-

Whole Wheat Bread

-

Multigrain Bread

-

Sourdough Bread

-

-

Packaging Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic Bags

-

Biodegradable Packaging

-

Paper Bags

-

Reusable Containers

-

-

Distribution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarket & Hypermarket

-

Convenience Stores

-

Specialty Stores (Bakery, Patisserie, Deli)

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global packaged bread market size was estimated at USD 335.0 million in 2023 and is expected to reach USD 324.4 million in 2024.

b. The global packaged bread market is expected to grow at a compounded growth rate of 2.6% from 2024 to 2030 to reach USD 398.6 million by 2030.

b. The white packaged bread market accounted for a revenue share of 47.0% in 2023. White bread has been a staple in many parts of the world for over a century. As bread production industrialized, white bread became the preferred variety because the production process was scalable and cost-effective.

b. The global packaged bread market is characterized by the presence of numerous well-established players such as Grupo Bimbo, Flowers Foods, Associated British Foods, Barilla Group, and others.

b. With the rise of low-carb and keto diets, consumers are gravitating toward low-carbohydrate and high-protein bread options. Manufacturers are responding by launching bread with alternative flours like almond or coconut flour, or fortified with additional protein.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.