Oxidized Polyethylene Wax Market Size, Share & Trends Analysis Report By Product (High-Density, Low-Density), By Application (Paints & Coatings, Printing Inks, Plastic Processing, Textiles), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-137-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Oxidized Polyethylene Wax Market Trends

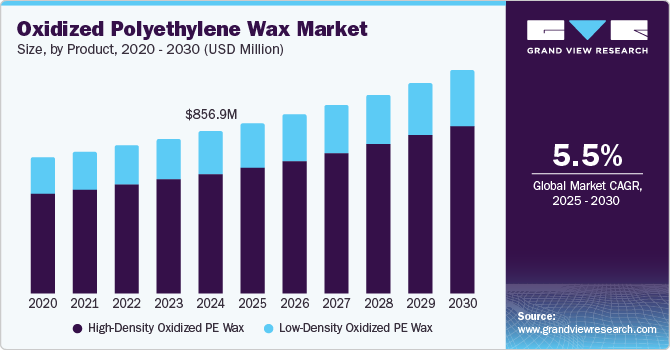

The global oxidized polyethylene wax market size was valued at USD 856.9 million in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2030. This growth can be attributed to the increasing demand for hot melt adhesives in consumer goods, such as packaging and furniture. In addition, its applications in various industries, including plastics, coatings, and rubber processing, are expanding. Furthermore, the unique properties of oxidized polyethylene wax, such as excellent water repellency, chemical resistance, and compatibility with other materials, further enhance its appeal, leading to broader adoption across multiple sectors.

Oxidized polyethylene wax (OPE wax) is a modified form of polyethylene wax characterized by its polar groups, such as carbonyl and hydroxyl, which enhance its compatibility with various materials. The market for oxidized polyethylene wax is experiencing growth due to several driving factors. One significant contributor is the escalating demand from the packaging sector, where OPE wax is utilized to improve moisture resistance, gloss, and barrier properties in packaging materials. As the consumption of packaged goods rises, particularly in food and pharmaceuticals, the need for OPE wax is expected to increase. Furthermore, the shift towards sustainable packaging solutions, including bio-based and biodegradable options, further propels demand since OPE wax can enhance these materials' properties.

In addition to packaging, the automotive industry increasingly adopts oxidized polyethylene wax for various applications. The wax provides essential benefits such as UV protection and scratch resistance while delivering a high-gloss finish to vehicle surfaces. With the rise in automobile production and sales, especially in developing regions, the demand for OPE wax in automotive applications is anticipated to grow steadily.

Moreover, the electronics industry represents another vital market for oxidized polyethylene wax. It manufactures printed circuit boards (PCBs), capacitors, and other electronic components. The surge in demand for electronic devices such as smartphones and laptops, along with the growing trend of wearable technology and IoT devices, is expected to fuel further growth in this sector. Overall, the expansion of these industries highlights the increasing significance of oxidized polyethylene wax across various applications.

Product Insights

The high-density oxidized polyethylene wax led the market and accounted for the largest revenue share of 73.8% in 2024, primarily driven by its robust properties and versatility in various applications. Its high density contributes to superior mechanical strength and thermal stability, making it ideal for demanding environments. In addition, the increasing demand from industries such as coatings, plastics, and adhesives significantly fuels market growth. Furthermore, the trend towards sustainable manufacturing practices encourages the use of high-density oxidized PE wax as an eco-friendly additive, further enhancing its appeal across multiple sectors.

The low-density oxidized polyethylene wax is expected to grow at a CAGR of 4.3% over the forecast period, driven by its unique characteristics that cater to specific applications. Its lower density allows for improved flexibility and dispersibility, making it particularly valuable in formulations for coatings and inks. In addition, the rising demand for lightweight materials in packaging and automotive applications drives this growth. Furthermore, the increasing focus on enhancing product performance in various consumer goods propels the adoption of low-density oxidized PE wax, as it can improve properties such as water repellency and adhesion.

Application Insights

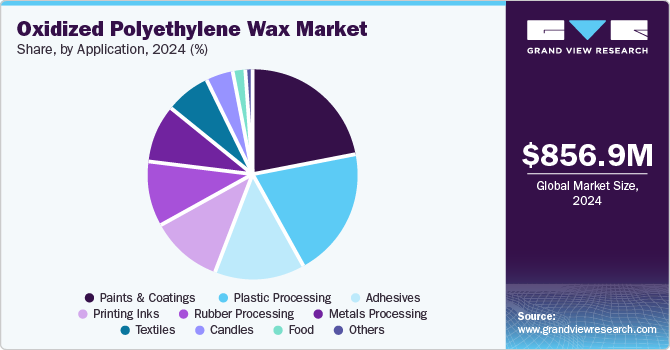

The paints and coatings segment dominated the market and accounted for the largest revenue share of 21.5% in 2024. This growth can be attributed to its exceptional properties that enhance product performance. This wax improves the durability, gloss, and smoothness of coatings, making it a valuable additive for manufacturers. In addition, the increasing demand for high-performance coatings, particularly in automotive and industrial applications, fuels this trend. Furthermore, the growing emphasis on environmentally friendly formulations encourages the incorporation of oxidized polyethylene wax, as it offers improved stability and compatibility with various resins and pigments, further supporting market expansion.

The printing ink segment is expected to grow at a CAGR of 6.5% from 2025 to 2030, owing to its ability to enhance ink formulations. This wax improves ink flow and leveling properties, improving print quality and surface finish. The growing need for high-quality printing solutions in packaging and labeling drives the adoption of oxidized polyethylene wax. Furthermore, its compatibility with various solvents and pigments makes it an ideal choice for ink manufacturers seeking to improve performance while meeting stringent regulatory requirements, thereby contributing to market growth.

Regional Insights

The North America oxidized polyethylene wax market accounted for a significant market share of 84.6% in 2024, primarily driven by the robust demand from the plastics and coatings industries. In addition, the region benefits from a well-established manufacturing base, which enhances the production capabilities of oxidized polyethylene wax. Furthermore, technological advancements and a strong focus on high-performance additives further propel market growth. Moreover, the increasing use of oxidized polyethylene wax in various applications, including adhesives and printing inks, reflects the region's commitment to innovation and efficiency in manufacturing processes.

U.S. Oxidized Polyethylene Wax Market Trends

The oxidized polyethylene wax market in U.S. dominated the North American market and accounted for the largest revenue share of 31.4% in 2024. This growth can be attributed to the rising demand for packaging materials and consumer goods. The country's strong economy and consumer market drive the need for effective packaging solutions that incorporate oxidized polyethylene wax for improved performance. Furthermore, the expansion of end-use industries such as automotive and electronics contributes to increased wax consumption as manufacturers seek to enhance product durability and quality through advanced formulations.

Asia Pacific Oxidized Polyethylene Wax Market Trends

The Asia Pacific oxidized polyethylene wax market is expected to grow at a CAGR of 6.6% over the forecast period, owing to rapid urbanization and the growing packaging sector, driven by rising consumer demand for packaged goods. Furthermore, investments in infrastructure development and expanding manufacturing capabilities in countries such as China and India contribute to increased production and consumption of oxidized polyethylene wax across various industries.

The oxidized polyethylene wax market in China led the Asia Pacific with the largest revenue share in 2024, driven by its significant role in the plastics industry. Furthermore, the country's ongoing initiatives to enhance its manufacturing capabilities and produce high-quality polymers have increased demand for oxidized polyethylene wax as a processing aid. Moreover, the expansion of end-use sectors such as automotive and electronics further drives consumption, positioning China as a leading player in the global oxidized polyethylene wax market.

Europe Oxidized Polyethylene Wax Market Trends

The growth of Europe oxidized polyethylene wax market is driven by stringent environmental regulations that promote sustainable solutions across industries. In addition, the coatings sector is a major consumer of this wax, leveraging its properties to improve product performance while adhering to eco-friendly standards. Furthermore, innovations in coatings technology and a growing emphasis on high-performance additives contribute to market growth as manufacturers seek to enhance their product offerings while meeting regulatory requirements.

Key Oxidized Polyethylene Wax Company Insights

Key players in the global oxidized polyethylene wax industry include SCG Chemicals Co., Ltd., Marcus Oil, Munzing Chemie GmbH, and others. These companies adopt various strategies to enhance their competitive edge. Mergers and acquisitions are frequently pursued to strengthen market presence and expand product portfolios, allowing companies to leverage collaborations in manufacturing and distribution. In addition, strategic partnerships are also common, fostering collaboration between manufacturers and end-users to innovate and develop tailored solutions for specific applications. Furthermore, new product launches focused on advanced formulations and specialized applications help companies meet evolving customer demands and enhance their market offerings.

-

Baerlocher GmbH manufactures a range of chemical products, including oxidized polyethylene wax, which enhances the performance of plastics, coatings, and adhesives. Operating primarily in the plastics and coatings segments, the company focuses on providing high-quality solutions that improve processing efficiency and product characteristics, catering to the needs of diverse industries worldwide.

-

The Lubrizol Corporation offers innovative solutions that enhance product performance across multiple sectors. The company produces oxidized polyethylene wax in its extensive portfolio of specialty chemicals and additives. Lubrizol operates in several segments, including coatings, adhesives, and plastics, where its products are designed to improve durability, stability, and application efficiency. By leveraging advanced technologies, Lubrizol aims to meet the evolving demands of its customers in various industrial applications.

Key Oxidized Polyethylene Wax Companies:

The following are the leading companies in the oxidized polyethylene wax Market. These companies collectively hold the largest market share and dictate industry trends:

- Baerlocher GmbH

- The Lubrizol Corp.

- SCG Chemicals Co., Ltd.

- Marcus Oil

- Munzing Chemie GmbH

- Honeywell International Inc.

- Cosmic Petrochem Pvt. Ltd.

- Micro Powders Inc.

- MPI Chemie B.V.

- DEUREX AG

- Shanghai Fine Chemical Co. Ltd.

- ER Chem

- Sanyo Chemical Industries Ltd.

Oxidized Polyethylene Wax Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 898.9 million |

|

Revenue forecast in 2030 |

USD 1.18 billion |

|

Growth Rate |

CAGR of 5.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Germany, UK, France, Italy, China, India, Japan, South Korea, Brazil, Argentina |

|

Key companies profiled |

Baerlocher GmbH; The Lubrizol Corp.; SCG Chemicals Co., Ltd.; Marcus Oil; Munzing Chemie GmbH; Honeywell International Inc.; Cosmic Petrochem Pvt. Ltd.; Micro Powders Inc.; MPI Chemie B.V.; DEUREX AG; Shanghai Fine Chemical Co. Ltd.; ER Chem; Sanyo Chemical Industries Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Oxidized Polyethylene Wax Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global oxidized polyethylene wax market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High-Density Oxidized PE Wax

-

Low-Density Oxidized PE Wax

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastic Processing

-

Paints & Coatings

-

Printing Inks

-

Textiles

-

Rubber Processing

-

Metals Processing

-

Adhesives

-

Candles

-

Food

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."