Oxidative Stress Assay Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables, Services), By Test Type (Indirect Assays, Antioxidant Capacity Assays), By Technology, By Disease Type, By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-215-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Oxidative Stress Assay Market Size & Trends

The global oxidative stress assay market size was estimated at USD 1.12 billion in 2023 and is projected to grow at a CAGR of 9.43% from 2024 to 2030. The market is expected to expand significantly in the coming years due to the increasing prevalence of diseases associated with oxidative stress, increasing research & development activities by pharmaceutical companies & research institutions, and technological advancements in oxidative stress assays. Moreover, favorable initiatives undertaken by key players and government bodies to decrease the overall disease burden are anticipated to drive research activities, which will increase the demand for oxidative stress assays across the globe.

Increasing prevalence of oxidative stress-associated diseases such as cardiovascular diseases, respiratory diseases, oncology, diabetes, and others is expected to increase the market expansion. According to a report published by the Institute for Health Metrics and Evaluation in April 2023, the global prevalence of chronic respiratory diseases such as COPD, pneumoconiosis, asthma, and others is around 454.6 million cases, globally. Moreover, in the U.S., six out of 10 people living with a chronic disease such as cardiovascular chronic kidney diseases, COPD, diabetes, cancer, and others, which are associated with oxidative stress. Increasing risk of developing these chronic health conditions is expected to increase the demand for oxidative stress assays worldwide.

Increasing R&D expenditures of pharmaceutical & biotechnology companies to develop the novel treatment for different life-threatening diseases is expected to increase the demand for oxidative stress test, as oxidative stress is associated with numerous chronic diseases. According to the Pharma R&D Annual Review published in June 2023, the number of pharmaceutical companies conducting R&D were around 5,529 and there were around 21,292 pharmaceutical drugs in development phases across the globe. Small-to-mid-level pharmaceutical and research-based companies account around 17.5% share of total pipeline drugs. Moreover, according to the EFPIA 2023 report, the European pharmaceutical industry spent around USD 48 billion on research & development activities in 2021. Increasing R&D expenditure to develop novel therapeutic drugs for targeted diseases are expected to increase the market uptake of oxidative stress tests.

Moreover, favorable initiatives undertaken by key players and government institutes to improve overall health services are expected to drive the growth. Increasing funding by government bodies, surge in healthcare expenditure, increasing awareness about oxidative stress-related health issues are driving the market. For instance, in February 2024, the journal Environmental International published a study related to diet that can increase the risk of oxidative stress and inflammatory cascade during pregnancy. Moreover, the University of Western Australia has collaborated with Proteomics International Laboratories Ltd to develop novel medical diagnostic tests by using company’s patented technology, 2-tag, to measure oxidative stress. Such supportive initiatives are expected to fuel growth over the forecast period.

Market Concentration & Characteristics

The market is characterized by a medium degree of innovation owing to the technological advancements in the development of novel reactive oxygen species (ROS) test. Moreover, key players are conducting clinical research to develop accurate rapid tests such as ELISA to identify ROS in multiple life-threatening medical conditions at early stages.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new regions and technologies needed to consolidate in a rapidly growing industry. Moreover, research & academic institutes are collaborating with key companies to introduce new tests.

The market is subject to increasing regulatory scrutiny. A stringent regulatory framework at the country level related to diagnostic testing and clinical research is expected to hinder the market expansion. However, improvements in regulations and favorable government initiatives to increase R&D activities to improve healthcare services are expected to support growth in the forecast period.

The availability of molecular diagnostics and genetic tests to detect biomarkers at the early stages of diseases are key substitutes for the market. High accuracy, increased recommendation of molecular based tests, and introduction of AI in research activities are affecting the market expansion.

The market sees a moderate degree of geographical expansion strategies. Key players are collaborating with regional players to increase their product reach in regional markets. Moreover, research-based companies and institutions are collaborating with global players to launch their products in a large geographical area.

Product Insights

Based on product, the consumables segment led the market with the largest revenue share of 44.39% in 2023. This can be attributed to the availability of a wide range of kits & reagents used in the detection of oxidative stress and presence of strong market players in the segment. Moreover, according to the NCBI report published in December 2022, oxidative stress is associated with more than 100 health conditions including cardiovascular, diabetes, cancer, and others, which increased the demand for testing kits and reagents used to detect oxygen free radicals during the research activities.

The consumables segment are expected to grow at the fastest CAGR over the forecast period. High growth of the segment can be attributed to the increasing demand for oxidative stress assay (OSA) in clinical and research applications. Moreover, companies are expanding their product portfolio to fulfill the end user needs. For instance, in June 2022, AMSBIO announced the expansion of its antibodies, biomarkers and assay kits related to ROS and antioxidants for investigations of oxidative stress.

Test Type Insights

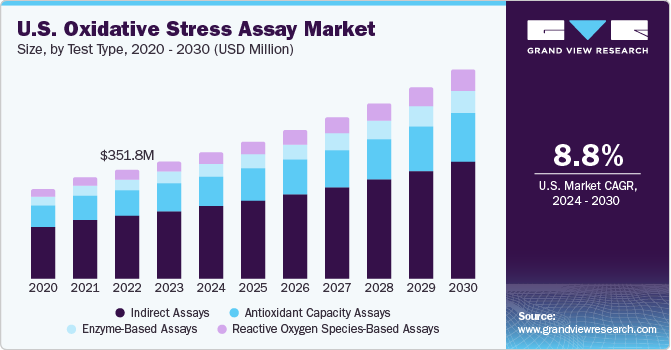

Based on test-type, the indirect assays segment led the market with the largest revenue share of 57.51% in 2023 and is anticipated to maintain its dominance throughout the forecast years. Indirect assays are cost-effective & easy to use and provide results with high accuracy in less time. The market share of the segment can be attributed to the high market penetration, availability of main indirect tests, and presence of a number of players offering these tests. Moreover, increasing adoption of protein-based assays, lipid-based assays, and nucleic acid-based assays is further expected to enhance the overall segment growth in the coming years.

The reactive oxygen species-based assays segment is estimated to grow at the fastest CAGR during the forecast period. Increasing adoption of hydrogen peroxide assays, nitric oxide assays, universal ROS & RNS assays, and their better results are expected to increase the market uptake. Some of the key ROS assay brands are OxiSelect in vitro ROS/RNS assay kit, OxiSelect intracellular ROS assay kit, Cellular ROS/Superoxide, ROS-ID Hypoxia/Oxidative stress detection kit, ROS-Glo H2O2 assay, and others.

Technology Insights

Based on technology, the enzyme-linked immunosorbent assay (ELISA) segment led market with the largest revenue share of 36.09% in 2023 and is expected to grow at the fastest CAGR over the forecast period. ELISA tests are highly sensitive and specific assay tests for quantifying the concentration of oxygen radicals in different types of samples. Moreover, its advanced testing technology, improved diagnostic results, and availability of rapid ELISA tests increased adoption of these tests in different end-use applications such as academic research, pharmaceutical research, and clinical diagnostics. Furthermore, key players such as Promega Corporation, Abcam Limited, Merck KGaA, and others offer a wide range of ELISA tests for oxidative stress detection.

The flow cytometry segment accounted for noticeable market share in 2023. High market penetration of this technology in emerging economies, a wide range of testing applications, and global acceptance of these tests are some key factors supporting the segment growth. Moreover, the high usage of these tests and the availability of several tests based on flow cytometry techniques to determine ROS are anticipated to increase the overall market growth.

Disease Type Insights

Based on disease type, the cardiovascular disease segment led the market with the largest revenue share of 29.36% in 2023. ROS promotes lipid peroxidation, endothelial dysfunction, inflammation, and the development of atherosclerosis in cardiovascular diseases. Increasing prevalence of cardiovascular diseases and research activities related to these health conditions are key factors driving the segment growth. According to the British Heart Foundation report published in January 2024, there are around 620 million individuals living with heart and circulatory disease, worldwide. Moreover, the WHO has estimated that annual cardiovascular disease-related deaths are around 17.9 million.

The cancer segment is projected to grow at the fastest CAGR over the forecast period. Increasing incidence of cancer, high mortality rate, and increasing research activities are some of the key factors driving the segment expansion over the forecast period. According to the American Cancer Society report, in the U.S., the number of new cancer cases is estimated 1.9 million and 609,360 cancer deaths in 2022. Moreover, in November 2023, a report published in Scientific Reports stated that a team of scientists in neurology in the U.S. developing cancer treatment strategies increasingly seek to increase ROS levels to manage cancer. Such initiatives are expected to increase the demand for OSA in clinical studies involved in cancer-related research.

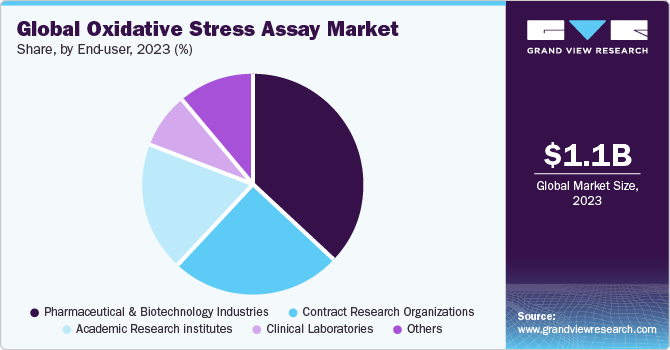

End-user Insights

Based on end-user, the pharmaceutical & biotechnology industries segment led market with the largest revenue share of 36.47% in 2023 and is anticipated to maintain its dominance throughout the forecast years. Pharmaceutical & biotechnology companies are actively involved in the development of multiple therapeutic drugs and conduct clinical trials associated with life-threatening diseases and investing heavily in R&D activities, which is expected to drive the demand for oxidative stress assay across the globe. Pharmaceutical companies in the U.S., Europe, Japan, China, and others are significantly investing in R&D activities to develop novel drugs for cardiovascular, cancer, and other health conditions.

The contract research organizations segment is estimated to register the lucrative CAGR during the forecast period. Increasing outsourcing of research & development activities by pharmaceutical & academic institutions, and service expansions by contract research organizations are some of the key factors expected to propel the segment growth in the coming years. Moreover, key market players are collaborating with CROs to expand their market footprint across the globe. For instance, in June 2022, AMSBIO announced that the company is partnering with key international research organizations and offering high-quality antibodies and assay kits for redox modulators, oxidative modification, and inflammatory biomarkers.

Regional Insights

North America held the largest share, having 36.26% in the oxidative stress assay market in 2023. The presence of many pharmaceutical & bio-pharmaceutical companies and research institutes involved in the development of novel therapies for different diseases and better healthcare infrastructure is supporting the regional market expansion. The market in the U.S. held the largest share in 2023 due to high R&D expenditures and favorable government initiatives to support R&D activities in healthcare. The U.S. medical and health R&D expenditure reached around USD 245 billion in 2020 and it is expected to increase in the coming years.

U.S. Oxidative Stress Assay Market Trends

The oxidative stress assay market in the U.S. is expected to grow at a lucrative rate over the forecast period due to the presence of leading pharmaceutical & biotechnology companies and a high number of research studies conducted in the country.

Europe Oxidative Stress Assay Market Trends

Europe oxidative stress assay market held the second-largest market share and is expected to grow at a lucrative rate. The growth of the market in the region can be attributed to an increasing prevalence of cardiovascular diseases, oncology, diabetes, and other targeted diseases aided by an increase in research activities and the presence of key market players in this region.

Oxidative stress assay market in UK is expected to grow steadily over the forecast period due to the presence of well-established biopharmaceutical companies involved in the R&D activities to develop novel therapeutic drugs and rising awareness about oxidative stress-related diseases.

France oxidative stress assay market is expected to grow over the forecast period attributed to the presence of local pharmaceutical companies and involvement in research & clinical trials to target life-threatening diseases.

Oxidative stress assay market in Germany is the largest in the Europe region and is expected to grow over the forecast period due to the rising number of initiatives being taken by the government to support research and clinical diagnostic services in the country.

Asia Pacific Oxidative Stress Assay Market Trends

Asia Pacific is expected to expand at the fastest CAGR over the foreseeable future owing to the developing economies such as India and China both generating robust revenues in 2023. Moreover, increasing overall healthcare expenditure and a surge in R&D investment by pharmaceutical companies and research institutes funded by government bodies are anticipated to drive the regional market growth over the forecast period.

Oxidative stress assay market in china is expected to grow at a significant rate over the forecast period due to the growing focus of international players to perform clinical trials in the country and the increasing involvement of local players in developing novel products for ROS detection.

Japan oxidative stress assay market holds the largest market share is expected to grow over the forecast period due to the presence of a well-established healthcare system to conduct research activities in the healthcare sector. Japan conducts a high number of clinical trials in the Asia Pacific region.

Latin America Oxidative Stress Assay Market Trends

Latin America oxidative stress assay market was identified as a lucrative region in this industry. Increasing foreign investments through global market players and technological advancements in the region are anticipated to fuel market growth.

The oxidative stress assay market in Brazil is expected to grow over the forecast period due to the rising prevalence of target diseases and an increasing number of pharmaceutical & biopharmaceutical companies engaged in the development of medical and health-related products.

MEA Oxidative Stress Assay Market Trends

MEA oxidative stress assay market was identified as a lucrative region in this industry. The market in this region is driven by the high prevalence of diseases associated with oxidative stress and high unmet medical needs in the region.

Oxidative stress assay market in Saudi Arabia is expected to grow over the forecast period owing to the increasing involvement of government bodies to improve the overall disease burden in the country.

Key Oxidative Stress Assay Company Insights

Some of the leading players in the market include Abcam Limited, Merck KGaA, Promega Corporation, QIAGEN, and Thermo Fisher Scientific Inc. Leading market players are adopting market strategies such as geographical expansion and enhancement of existing testing product applications for different health conditions. Moreover, the development of novel products for ROS tests is another strategy adopted by these companies.

Emerging players such as AMSBIO, Cell Biolabs, Inc., ImmunoChemistry Technologies, and OXFORD BIOMEDICAL RESEARCH are involved in the development of novel tests for research and clinical diagnostic applications. Moreover, emerging companies are collaborating with government bodies for financial aid and support in market approvals of novel tests for oxidative stress assay.

Key Oxidative Stress Assay Companies:

The following are the leading companies in the Oxidative Stress Assay Market. These companies collectively hold the largest market share and dictate industry trends.

- Abcam Limited

- AMSBIO

- Cell Biolabs, Inc.

- Enzo Life Sciences, Inc.

- Merck KGaA

- ImmunoChemistry Technologies

- Promega Corporation

- QIAGEN

- Thermo Fisher Scientific Inc.

- OXFORD BIOMEDICAL RESEARCH

Recent Developments

-

In February 2022, Invitae announced the availability of its FusionPlex Dx and LiquidPlex Dx for precision oncology diagnostics in the European countries

-

In July 2021, Immuchrom GmbH specializing in gastrointestinal, cardiovascular disease, oxidative stress, and others, collaborated with Ilex Life Sciences LLC for the distribution of gastrointestinal biomarker assays in the North America region

-

In May 2020, Arbor Assays introduced a new DetectX TBARS/MDA universal colorimetric detection kit to measure MDA in samples exposed to oxidative stress

Oxidative Stress Assay Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.22 billion |

|

Revenue forecast in 2030 |

USD 2.09 billion |

|

Growth rate |

CAGR of 9.43% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, test type, technology, disease type, end-user, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Germany, UK, Spain, France, Italy, Denmark, Sweden, Norway, Japan, China, India, South Korea, Australia, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Abcam Limited, AMSBIO, Cell Biolabs, Inc., Enzo Life Sciences, Inc., Merck KGaA, ImmunoChemistry Technologies, Promega Corporation, QIAGEN, Thermo Fisher Scientific Inc., OXFORD BIOMEDICAL RESEARCH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Oxidative Stress Assay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oxidative stress assay market report based on product, test type, technology, disease type, end user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Kits

-

Reagents

-

-

Services

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Indirect Assays

-

Protein-Based Assays

-

Lipid-Based Assays

-

Nucleic Acid-Based Assays

-

-

Antioxidant Capacity Assays

-

Glutathione Assays

-

Ascorbic Acid Assays

-

Cell-Based Exogenous Antioxidant Assays

-

-

Enzyme-Based Assays

-

Reactive Oxygen Species-Based Assays

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme-linked Immunosorbent Assay (ELISA)

-

Flow Cytometry

-

Chromatography

-

Microscopy

-

Others

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular disease

-

Respiratory Diseases

-

Cancer

-

Diabetes

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Industries

-

Academic Research institutes

-

Contract Research Organizations

-

Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oxidative stress assay market size was estimated at USD 1.12 billion in 2023 and is expected to reach USD 1.22 billion in 2024.

b. The global oxidative stress assay market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 2.09 billion by 2030.

b. North America dominated the oxidative stress assay market with a share of 36.26% in 2023. This is attributable well-established pharmaceutical and biopharmaceutical companies within the region.

b. Some key players operating in the oxidative stress assay market include Abcam Limited; AMSBIO; Cell Biolabs, Inc.; Enzo Life Sciences, Inc.; Merck KGaA; ImmunoChemistry Technologies; Promega Corporation; QIAGEN; Thermo Fisher Scientific Inc.; OXFORD BIOMEDICAL RESEARCH

b. Key factors that are driving the market growth include increasing prevalence of target diseases along with increasing spending on R&D by pharmaceutical companies

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."