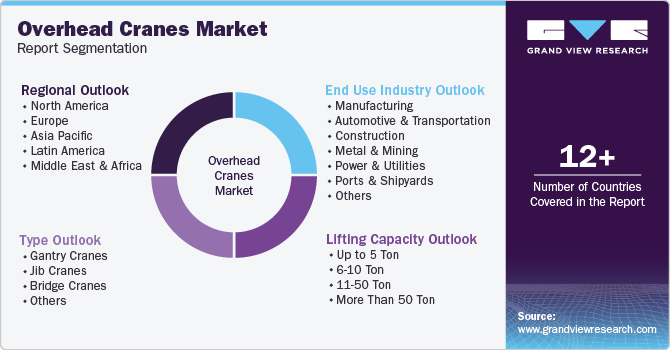

Overhead Cranes Market Size, Share & Trend Analysis Report By Type (Gantry Cranes, Jib Cranes), By Lifting Capacity (Up to 5 Ton, 6-10 Ton), By End-use Industry (Manufacturing, Construction), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-477-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Overhead Cranes Market Size & Trends

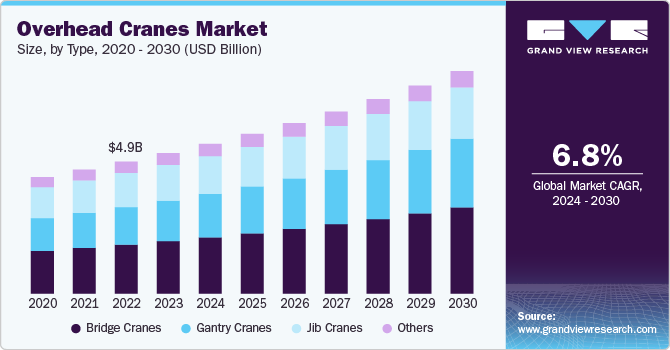

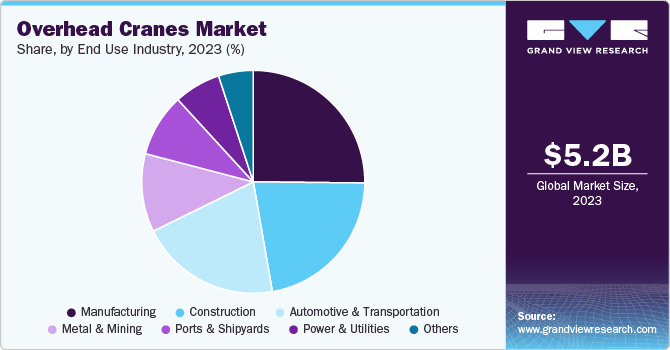

The global overhead cranes market size was estimated at USD 5.18 billion in 2023 and is projected to grow and at a CAGR of 6.8% from 2024 to 2030. The market is witnessing robust growth due to rising demand across several end-user industries, such as manufacturing, construction, automotive, and power generation. As these sectors expand, they require efficient material handling solutions to manage increased workloads and improve productivity. Overhead cranes enable heavy lifting and the transport of goods, which is essential for meeting the increased output requirements of these industries.

Rapid urbanization and increasing infrastructure development across the globe are driving the demand for overhead cranes. Governments are investing heavily in infrastructure projects such as bridges, highways, and power plants, which require substantial lifting equipment such as overhead cranes. Overhead cranes are essential for their versatility in lifting and transporting materials across construction sites. Thus, rising government investments in infrastructure projects and a growing focus on sustainable building practices are fueling the market's growth.

Technological advancement is a pivotal trend in the overhead crane market. Integrating advanced technologies such as automation, variable-speed drives, and automated positioning systems enhances operational efficiency and precision in material handling. These advancements reduce total production time and minimize personnel costs. Safety features such as collision avoidance systems and overload protection have become increasingly important to improve worker safety and reduce the rate of accidents. The ongoing development of remote monitoring capabilities allows for real-time performance tracking and predictive maintenance, further optimizing crane operations and thereby driving the market's growth.

Furthermore, sustainability is emerging as a core focus for industries worldwide. Manufacturers are innovating to produce energy-efficient cranes that consume less power and reduce carbon footprints. Technologies such as regenerative drives and lightweight materials are being utilized to enhance energy efficiency. Additionally, companies are demanding cranes that can integrate with renewable energy sources. Thus, as industries move toward greener practices, the demand for sustainable lifting solutions is expected to increase, and contribute to the market's growth.

The high initial investment needed for purchasing and maintaining overhead cranes is a major factor that could hamper market growth. Ongoing maintenance expenses, such as regular inspections and component replacements, can add up over time, resulting in a long-term financial burden for companies. The time-consuming and costly nature of inspections varies based on the crane's size and complexity. These inspection costs can be a significant barrier for small businesses or those with limited budgets. However, the advantages of regular overhead crane inspections far outweigh the drawbacks, as they ensure the safety of both workers and equipment while helping companies maintain productivity and profitability.

Type Insights

The bridge cranes segment led the market and accounted for 37.3% of the global revenue in 2023. The segment growth can be attributed to the increasing adoption of bridge cranes in various industries owing to their versatility and efficiency in material handling. Designed to traverse large areas, these cranes provide significant lifting capabilities and can easily handle heavy loads. In addition, the growing demand for automation in manufacturing and warehousing is further driving the adoption of bridge cranes equipped with advanced control systems and IoT technologies.

The gantry cranes segment is expected to register significant growth from 2024 to 2030. Gantry cranes are gaining traction, especially in outdoor applications and construction settings, where their flexibility and portability provide significant advantages. These cranes are designed to move along tracks. They can easily lift and transport heavy materials, making them ideal for loading and unloading containers, equipment, and large machinery. The rising focus on construction and infrastructure development, particularly in emerging economies, is propelling the demand for gantry cranes.

Lifting Capacity Insights

The up to 5 Ton segment accounted for the largest market revenue share in 2023. Overhead cranes with a lifting capacity of up to 5 tons are experiencing strong demand, particularly in small to medium-sized enterprises and light industrial applications. These cranes are ideal for assembly, maintenance, and material handling in warehouses, automotive shops, and smaller manufacturing facilities. The trend toward automation and improved safety standards drives investments in overhead cranes with a lifting capacity of 5 tons that can easily integrate into existing workflows.

The 6–10 Ton segment is expected to register significant growth from 2024 to 2030. Overhead cranes with lifting capacities between 6 and 10 tons are becoming increasingly popular in sectors that require more robust material handling solutions, such as manufacturing, construction, and logistics. Furthermore, advancements in overhead crane technology, including improved safety features and enhanced control systems, are increasing the appeal of these cranes. Various industries focus on maximizing productivity and minimizing downtime, thereby driving the demand for overhead cranes with lifting capacities between 6 and 10 tons.

End Use Industry Insights

The manufacturing segment accounted for the largest market revenue share in 2023. The growing demand for efficient material handling in the manufacturing industry is a major growth factor behind the segment’s growth. In the manufacturing industry, overhead cranes streamline operations by automating lifting tasks and movement of heavy materials, which enhances productivity and reduces labor costs. In addition, the rising adoption of advanced crane technologies, such as automation and remote monitoring in the manufacturing sector, is further boosting the segment growth.

The automotive and transportation segment is expected to register significant growth from 2024 to 2030. The automotive and transportation sectors are heavily dependent on overhead cranes to enhance their manufacturing and logistics operations. In automotive production, these cranes facilitate the movement of critical components such as engines, transmissions, chassis, and axles between stations on the assembly line, as well as the lifting and transport of entire vehicles during assembly. In addition, overhead cranes significantly boost assembly line efficiency by enabling the rapid and seamless transfer of parts and vehicles. In transportation sector, overhead cranes are essential for unloading ships and efficiently transporting finished vehicles from the assembly line to the shipping area. By accelerating the movement of large items, these cranes optimize both production and shipping processes, contributing to overall operational efficiency, and thereby driving the growth of the segment.

Regional Insights

North America overhead cranes marketis anticipated to register the moderate growth from 2024 to 2030. A high demand for advanced material handling solutions and a strong industrial base is a major driver behind the market growth in the region. The region's focus on automation and technological innovation drives the adoption of sophisticated overhead cranes equipped with smart features such as remote monitoring and control systems. Furthermore, government investments in infrastructure projects, including bridges and highways, are expected to further enhance demand for overhead cranes.

U.S. Overhead Cranes Market Trends

Overhead cranes market in the U.S.is anticipated to register significant growth from 2024 to 2030. The ongoing trend towards automation in the country’s automotive and manufacturing industries is driving demand for overhead cranes that can handle heavy loads with precision and efficiency. In addition, the U.S. government's infrastructure initiatives are creating opportunities for overhead crane manufacturers as businesses invest in upgrading their equipment to meet modern safety and efficiency standards.

Europe Overhead Cranes Market Trends

Overhead cranes market in Europeis poised for moderate growth from 2024 to 2030. The region's well-established manufacturing base, particularly in automotive and aerospace sectors, drives demand for innovative lifting solutions that enhance productivity while ensuring worker safety. European manufacturers are increasingly adopting automation technologies to streamline operations and reduce labor costs associated with manual handling. Additionally, government regulations promoting sustainability are encouraging investments in eco-friendly overhead crane technologies across the region.

Asia Pacific Overhead Cranes Market Trends

Overhead cranes market in Asia Pacific dominated the global market and accounted for 36.38% of the global revenue share in 2023. The market growth in the region is driven by rapid industrialization and urbanization in countries such as China, India, Japan, and Australia. The region's expanding manufacturing sector requires efficient material handling solutions to manage increased production demands. Significant investments in infrastructure projects such as roads, bridges, and power plants further propel the need for high-capacity overhead cranes. Moreover, the expansion of e-commerce and logistics industries demands advanced warehousing solutions that rely heavily on overhead cranes for efficient operations, thereby propelling the market’s growth.

Key Overhead Cranes Company Insights

The competitive landscape of the market is characterized by mix of established brands and emerging players, with key companies focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. For instance, in August 2024, Konecranes introduced the Konecranes X-series industrial crane, which succeeds its renowned CXT model. This new product features a compact design along with advanced, safe, and reliable technology. The X-series aims to transform industrial lifting with cutting-edge technology and lifting capacities of up to 20 tons. Its unique wireless upgrade feature provides customers with enhanced flexibility. Additionally, the groundbreaking ergonomic radio and low headroom hoist improve the operator experience. The X-series is equipped with an upgraded hoisting motor and components designed to optimize efficiency and reduce environmental impact.

Key Overhead Cranes Companies:

The following are the leading companies in the overhead cranes market. These companies collectively hold the largest market share and dictate industry trends.

- Konecranes,

- Indef Manufacturing Limited

- American Crane & Equipment Corporation

- Dongqi Crane

- Aicrane

- WeiHuaCrane

- Munck Cranes Inc.

- Columbus McKinnon Corporation.

- Tri-State Overhead Crane

- Hoosier Crane Service Company.

Recent Developments

-

In August 2024, Konecranes introduced the Konecranes X-series industrial crane, which succeeds its renowned CXT model. This new product features a compact design along with advanced, safe, and reliable technology. The X-series aims to transform industrial lifting with cutting-edge technology and lifting capacities of up to 20 tons. Its unique wireless upgrade feature provides customers with enhanced flexibility. Additionally, the groundbreaking ergonomic radio and low headroom hoist improve the operator experience. The X-series is equipped with an upgraded hoisting motor and components designed to optimize efficiency and reduce environmental impact.

Overhead Cranes Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.52 billion |

|

Revenue forecast in 2030 |

USD 8.20 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, lifting capacity, end-use industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Konecranes; Indef Manufacturing Limited; American Crane & Equipment Corporation; Dongqi Crane; Aicrane; WeiHuaCrane; Munck Cranes Inc.; Columbus McKinnon Corporation.; Tri-State Overhead Crane; Hoosier Crane Service Company |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Overhead Cranes Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the overhead cranes market based on type, lifting capacity, end-use industry, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gantry Cranes

-

Jib Cranes

-

Bridge Cranes

-

Others

-

-

Lifting Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 5 Ton

-

6-10 Ton

-

11-50 Ton

-

More Than 50 Ton

-

-

End Use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Automotive and Transportation

-

Construction

-

Metal and Mining

-

Power and Utilities

-

Ports and Shipyards

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global overhead cranes market size was estimated at USD 5.18 billion in 2023 and is expected to reach USD 5.52 billion in 2024.

b. The global overhead cranes market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 8.20 billion by 2030.

b. The bridge crane segment dominated the component segment in 2023. The segment growth can be attributed to the increasing adoption of bridge cranes in various industries owing to their versatility and efficiency in material handling.

b. Key players operating in the overhead cranes market include Konecranes, Indef Manufacturing Limited, American Crane & Equipment Corporation, Dongqi Crane, Aicrane, WeiHuaCrane, Munck Cranes Inc., Columbus McKinnon Corporation., Tri-State Overhead Crane, and Hoosier Crane Service Company.

b. Rapid urbanization and increasing infrastructure development across the globe, and integration of advanced technologies in overhead cranes are major driving factors behind the market's growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."