- Home

- »

- Communication Services

- »

-

Over-the-Air Testing Market Size And Share Report, 2030GVR Report cover

![Over-the-Air Testing Market Size, Share & Trends Report]()

Over-the-Air Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Technology (Cellular Networks, Wi-Fi, Bluetooth, Others), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-368-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Over-the-Air Testing Market Summary

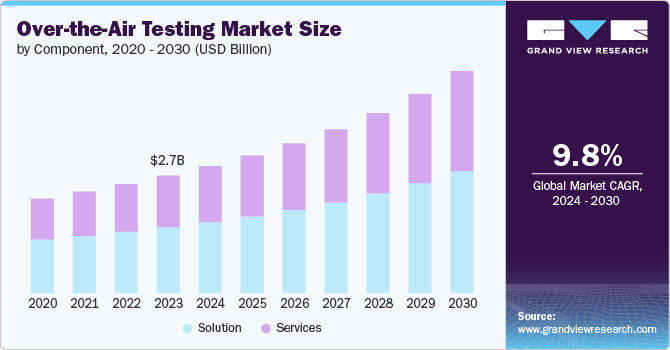

The global Over-the-Air testing market size was estimated at USD 2.68 billion in 2023 and is projected to reach USD 5.06 billion by 2030, growing at a compound CAGR of 9.8% from 2024 to 2030. Several factors are driving the growth of the market, including advancements in wireless technologies, increasing use of connected devices, and rapid deployment of 5G infrastructure. Over-the-Air (OTA) testing is a method used to evaluate the performance and compliance of wireless communication devices.

Key Market Trends & Insights

- North Americadominated the global Over-the-Air (OTA) testing market and accounted for a revenue share of over 33.0% in 2023.

- The Over-the-Air (OTA) testing market in the U.S. is expected to grow at a CAGR of 9.2% from 2024 to 2030.

- The Over-the-Air (OTA) testing market in Asia Pacific is expected to grow at the fastest CAGR of 10.9% from 2024 to 2030.

- Based on component, the solution segment dominated the market in 2023 and accounted for more than 56.0% share of global revenue.

- In terms of technology, the cellular networks segment dominated the market in 2023 and accounted for more than 37.0% share of global revenue.

Market Size & Forecast

- 2023 Market Size: USD 2.68 billion

- 2030 Projected Market Size: USD 5.06 billion

- CAGR (2024-2030): 9.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

OTA testing simulates real-world conditions to assess device performance, taking into account factors such as distance, interference, signal strength, multipath propagation, and fading. Moreover, it assesses how effectively devices can establish and maintain connections, transition between different cells or access points, and function in environments with varying levels of interference. OTA testing is essential for the success of wireless projects. It not only enhances device performance but also helps reduce network approval costs, shortens time-to-market, and identifies performance issues before a product reaches consumers.

Ongoing innovation in wireless technologies and significant R&D investments lead to the development of new products and applications, all of which require OTA testing. This continuous innovation cycle sustains market growth. In addition, the proliferation of Internet of Things (IoT) devices across various sectors, such as smart homes, industrial IoT, and healthcare, necessitates rigorous OTA testing to ensure reliable connectivity and performance. The increasing number of connected devices amplifies this demand.

The integration of automated testing solutions and software tools is enhancing the efficiency of OTA testing processes and reducing time-to-market and operational costs. For instance, Orbis Systems Oy, a Finnish company, offers 5G OTA solutions. These solutions have a high degree of pre-integration and automation that eliminates the need for separate add-ons, enhances testing capabilities, and delivers faster and more reliable results.

Component Insights

In terms of component, the market is classified into solution and services. The solution segment dominated the market in 2023 and accounted for more than 56.0% share of global revenue. The segment’s growth is attributed to the need to meet consumer expectations for device performance. As consumer expectations for device performance rise, manufacturers are investing in sophisticated testing solutions to optimize connectivity and user experience. Moreover, manufacturers are prioritizing quality assurance to maintain a competitive advantage, leading to increased investments in high-quality OTA testing solutions.

The services segment is projected to witness the fastest CAGR of 10.2% from 2024 to 2030. The evolution of wireless technologies drives the need for specialized testing services that can address complex standards and protocols, driving demand for expert services. Stringent regulatory requirements compel manufacturers to seek professional testing services to ensure compliance with industry standards and secure necessary certifications for their devices. Moreover, many companies find it more cost-effective to outsource testing services rather than develop in-house capabilities, driving growth in the services segment.

Technology Insights

In terms of technology, the market is classified into cellular networks, Wi-Fi, Bluetooth, and others. The cellular networks segment dominated the market in 2023 and accounted for more than 37.0% share of global revenue. The segment’s growth is attributed to the rapid growth in 5G deployment worldwide. According to GSM Association (GSMA) 2024 figures, by 2029, 5G connections are projected to account for over half of mobile connections, establishing 5G as the leading connectivity technology. The rollout of 5G networks necessitates extensive testing to ensure devices meet the new performance standards and can operate effectively within the 5G ecosystem.

The Bluetooth segment is projected to grow at a considerable CAGR of 9.9% from 2024 to 2030. The segment’s growth is attributed to the increasing adoption of smart devices and the expansion of IoT applications. The growing prevalence of smart devices, such as wearables, smart home products, and IoT devices, necessitates extensive OTA testing to ensure reliable Bluetooth connectivity. The rise of IoT applications that rely on Bluetooth for device interconnectivity drives demand for testing services to validate performance and interoperability. Moreover, continuous advancements in Bluetooth technology require updated testing solutions to ensure compliance with the latest specifications and enhancements.

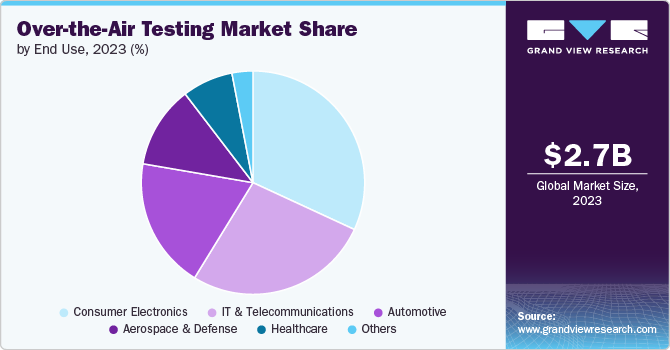

End Use Insights

In terms of end use, the market is classified into consumer electronics, automotive, IT & telecommunications, aerospace and defense, healthcare, and others. The consumer electronics segment dominated the market in 2023 and accounted for more than 31.0% share of global revenue. The growing proliferation of smartphones, tablets, and other connected consumer electronic devices drives the segment’s growth. The proliferation of smartphones, tablets, and other connected devices requires comprehensive OTA testing to ensure they function seamlessly across cellular networks. Moreover, intense competition among consumer electronics manufacturers drives the need for comprehensive testing to differentiate products and maintain a competitive edge.

The automotive segment is projected to witness the fastest CAGR of 10.6% from 2024 to 2030. The rising adoption of connected vehicles drives the segment’s growth. The rise of connected cars, which rely on wireless communication for features such as navigation, entertainment, and vehicle diagnostics, necessitates comprehensive OTA testing to ensure reliable performance. Moreover, the growing implementation of autonomous driving technologies requires rigorous testing to validate safety and performance standards. Stringent automotive regulations and safety standards compel manufacturers to conduct thorough OTA testing to meet compliance requirements and ensure consumer safety.

Regional Insights

North Americadominated the global Over-the-Air (OTA) testing market and accounted for a revenue share of over 33.0% in 2023. The market’s growth in the region is attributed to the high demand for connected devices and technological innovation in the region. North America has a significant market for connected devices, including smartphones, IoT products, and automotive systems, necessitating extensive OTA testing to ensure reliability and performance. Moreover, stringent regulatory requirements and standards in North America compel manufacturers to invest in OTA testing to ensure compliance and secure market approval.

U.S. Over-the-Air (OTA) Testing Market Trends

The Over-the-Air (OTA) testing market in the U.S. is expected to grow at a CAGR of 9.2% from 2024 to 2030. The presence of numerous Over-the-Air (OTA) testing solutions and service providers, such as Keysight Technologies and ETS-Lindgren, contribute to the market’s growth in the country. Moreover, the growing automotive sector, particularly with the rise of connected and autonomous vehicles, drives significant demand for OTA testing to ensure safety and reliability.

Asia Pacific Over-the-Air (OTA) Testing Market Trends

The Over-the-Air (OTA) testing market in Asia Pacific is expected to grow at the fastest CAGR of 10.9% from 2024 to 2030. The market's growth in the region can be attributed to the swift deployment of 5G networks in the region. The rapid rollout of 5G networks across the region creates a significant demand for OTA testing to ensure device compliance and optimal performance in this new network environment. Moreover, the booming consumer electronics market in countries such as China, Japan, and India leads to increased demand for OTA testing to maintain product quality and competitiveness.

Europe Over-the-Air (OTA) Testing Market Trends

The Over-the-Air (OTA) testing market in Europe is expected to grow at a significant CAGR of 9.1% from 2024 to 2030. The market's growth in the region can be attributed to the strong investments in Research and Development (R&D) within European countries. Strong investments in R&D drive innovation, leading to increased demand for advanced OTA testing solutions for new technologies.

Key Over-the-Air Testing Company Insights

Some of the key companies operating in the market include Anritsu, Rohde & Schwarz, Keysight Technologies, and TÜV Rheinland, among others.

-

Keysight Technologies, a U.S.-based company, provides electronic design and test solutions. It focuses on the communications, electronics, and semiconductor industries and offers a wide range of products and services, including Over-the-Air (OTA) testing solutions. The company also offers a broad portfolio of instruments for various applications, including network analysis, oscilloscopes, and signal generators.

Bluetest AB and ETS-Lindgren are some of the emerging companies in the target market.

- Bluetest AB, Sweden-based company, specializes in Over-the-Air (OTA) testing solutions, primarily for wireless communication devices. The company provides innovative testing services tailored for various sectors, including telecommunications, consumer electronics, and automotive industries. It has deployed over 400 OTA reverberation test systems globally in the last 20 years.

Key Over-the-Air (OTA) Testing Companies:

The following are the leading companies in the Over-the-Air (OTA) testing market. These companies collectively hold the largest market share and dictate industry trends.

- Anritsu

- Rohde & Schwarz

- Keysight Technologies

- ETS-Lindgren

- Bluetest AB

- TÜV Rheinland

- SGS Société Générale de Surveillance SA.

- MVG

- UL LLC

- Intertek Group plc

Recent Developments

-

In March 2024, Keysight Technologies and ETS-Lindgren announced the launch of an industry-first OTA test solution for devices using narrowband non-terrestrial networks (NB-NTN), enabling cellular communication via satellite to enhance coverage in remote areas. This joint solution combines Keysight Technologies' NTN software with ETS-Lindgren's OTA test chambers, allowing manufacturers to assess device performance and ensure compliance with regulatory standards while supporting new use cases such as asset tracking and emergency services.

-

In May 2023, Bluetest AB announced the launch of the TRU2 WLAN Reference Radio for Over-the-Air (OTA) testing. This radio features 4x4 MIMO radios for multiple frequency bands and supports all legacy Wireless Local-Area Network (WLAN) standards. It also features advanced capabilities for measuring data throughput and power levels through a high-speed 10 GbE interface.

Over-the-Air (OTA) Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.89 billion

Revenue forecast in 2030

USD 5.06 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end use, region

Regional scope

North America; Europe, Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Anritsu; Rohde & Schwarz; Keysight Technologies; ETS-Lindgren; Bluetest AB; TÜV Rheinland; SGS Société Générale de Surveillance SA.; MVG; UL LLC; Intertek Group plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Over-the-Air (OTA) Testing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Over-the-Air (OTA) testing market report based on component, technology, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Cellular Networks

-

Wi-Fi

-

Bluetooth

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer Electronics

-

Automotive

-

IT & Telecommunications

-

Aerospace and Defense

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global over-the-air testing market size was estimated at USD 2.68 billion in 2023 and is expected to reach USD 2.89 billion in 2024.

b. The global over-the-air testing market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 5.06 billion by 2030.

b. North America dominated the Over-the-Air (OTA) testing market with a share of over 33.0% in 2023. This is attributable to the presence of numerous Over-the-Air (OTA) testing solutions and service providers and technological advancements in the region.

b. Some key players operating in the OTA testing market include Anritsu, Rohde & Schwarz, Keysight Technologies, ETS-Lindgren, Bluetest AB, TÜV Rheinland, SGS Société Générale de Surveillance SA., MVG, UL LLC, and Intertek Group plc.

b. Key factors driving market growth include the rapid deployment of the 5G network globally and the advancements in wireless technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.