- Home

- »

- Electronic & Electrical

- »

-

Outdoor TV Market Size, Share And Trends Report, 2030GVR Report cover

![Outdoor TV Market Size, Share & Trends Report]()

Outdoor TV Market (2025 - 2030) Size, Share & Trends Analysis Report By Screen Size, By Resolution (4K, 1080p, 720p), By Luminous, By Application (Consumer TV, Digital Signage), By End-use (Residential), By Distribution Channel (Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-459-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Outdoor TV Market Size & Trends

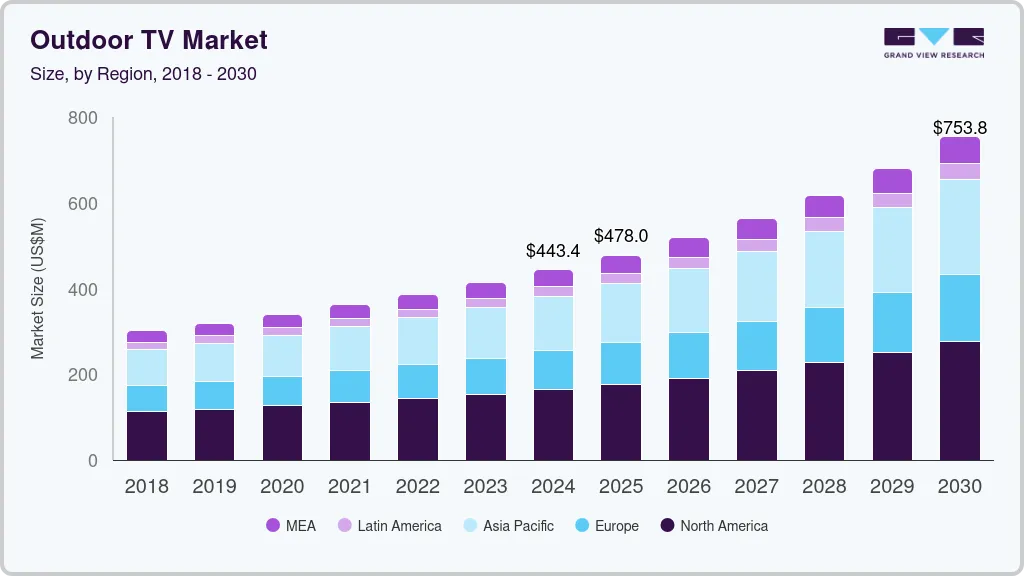

The global outdoor TV market size was estimated at USD 443.4 million in 2024 and is expected to grow at a CAGR of 9.5% from 2025 to 2030. A key factor driving the surge in demand for outdoor TVs is the increasing popularity of outdoor entertainment. Large, weather-resistant outdoor television units are being used in various settings, including bars, patios, backyards, sports arenas, and music events, to create vibrant and immersive entertainment experiences. Additionally, advancements in display technologies are contributing to the growth of the market. Modern outdoor TV solutions emphasize superior sound quality and anti-glare features, addressing challenges related to ambient noise and sunlight interference.

The market demand for outdoor TVs is experiencing significant growth, driven primarily by the increasing popularity of outdoor living spaces. Homeowners are now more focused on transforming their patios, gardens, and rooftops into comfortable extensions of their indoor living areas. This trend has led to a surge in demand for outdoor TVs as people look to enjoy entertainment and social gatherings in these newly enhanced outdoor environments.

Another key factor contributing to this demand is the heightened focus on home entertainment, a trend that was notably accelerated by the COVID-19 pandemic. With more people spending time at home, there has been a significant investment in creating enjoyable and versatile living spaces. Outdoor TVs have become an integral part of this shift, providing an additional avenue for entertainment, especially for family activities and socializing outdoors.

Technological advancements have also played a crucial role in the expansion of the market. Innovations in picture quality, sound systems, and weatherproofing have made these products more durable and appealing to consumers. The ability of outdoor TVs to withstand extreme weather conditions without compromising performance has encouraged more people to invest in them, further driving market growth.

In commercial settings, the demand for outdoor TVs is rising as businesses in the hospitality and retail sectors seek to enhance the customer experience. Restaurants, bars, hotels, and sports venues are increasingly incorporating outdoor TVs into their spaces to attract and retain customers by offering engaging outdoor entertainment options.

Additionally, rising disposable income levels, particularly in developed markets, have led to greater consumer spending on luxury items, including outdoor entertainment products like outdoor TVs. This trend, coupled with the seasonal demand for outdoor activities during warmer months, has resulted in a noticeable increase in outdoor TV sales as consumers look to upgrade their outdoor spaces.

Finally, the growing popularity of sports and outdoor events has further fueled the demand for outdoor TVs. As more people seek to enjoy these events in outdoor settings, whether at home or in public spaces, the market for outdoor TVs continues to expand, catering to the need for high-quality viewing experiences in outdoor environments.

Screen Size Insights

55 inch to 70 inch outdoor TV accounted for a revenue share of 39.0% in 2023. Larger screen sizes provide a more immersive and engaging viewing experience, making them ideal for outdoor settings where viewers are often at a greater distance from the screen. A 55-inch to 70-inch TV delivers a more cinematic feel for outdoor movies, sports events, and gatherings. Larger TVs are well-suited for social and entertainment purposes, such as backyard parties, family gatherings, or outdoor sports events. The bigger screen ensures that more people can comfortably view the content from various angles and distances, enhancing the overall experience.

40 inch to 55 inch outdoor TV is expected to grow at a CAGR of 9.3% from 2024 to 2030. Compared to larger outdoor TVs, those in the 40-inch to 55-inch range are generally more affordable. They offer a cost-effective solution for consumers who want to enjoy high-quality outdoor entertainment without the higher price tag associated with larger models.TVs in this size range often provide a higher resolution and better picture quality than smaller models. They deliver a more immersive viewing experience, making them suitable for a variety of outdoor activities, such as watching sports, movies, or playing games.

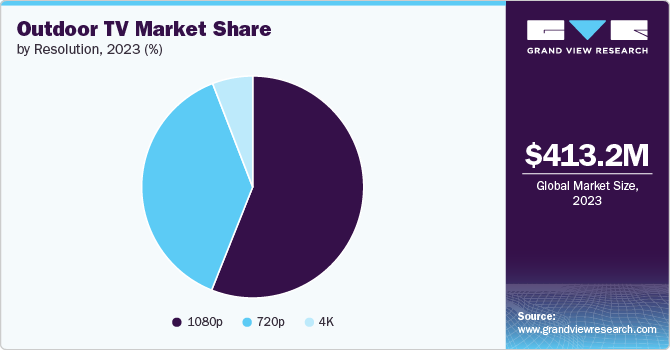

Resolution Insights

1080p outdoor TV accounted for a revenue share of 56.0% in 2023. 1080p resolution offers a higher level of detail and clarity compared to 720p, providing a more immersive and enjoyable viewing experience. This improved picture quality is particularly appealing for consumers who want better visuals while watching outdoor sports, movies, or events. As more homeowners invest in creating luxurious outdoor living areas, including entertainment zones with high-quality amenities, the demand for 1080p outdoor TVs grows. These TVs enhance outdoor gatherings by providing superior image quality that complements the upscale nature of these spaces.

720p outdoor TV are expected to grow at a CAGR of 9.7% from 2024 to 2030. 720p outdoor TVs are generally more affordable compared to their higher-resolution counterparts like 1080p or 4K models. This lower price point makes them a more accessible option for consumers looking to enhance their outdoor entertainment without a significant financial investment. Many 720p outdoor TVs are designed to withstand harsh weather conditions, including rain, dust, and extreme temperatures. This ruggedness makes them a practical choice for outdoor settings, such as patios, decks, and poolsides, where durability is crucial.

Luminous Insights

Up to 1000 nits outdoor TV accounted for a revenue share of 49.2% in 2023. Higher brightness levels, such as 1000 nits, ensure that outdoor TVs remain clearly visible even in direct sunlight or bright daylight conditions. This enhanced visibility allows users to enjoy a better viewing experience during the day, which is particularly important for outdoor settings like patios, decks, and pool areas. Higher brightness outdoor TVs are typically built with advanced technologies that make them more durable and resistant to environmental factors like UV rays and temperature fluctuations. This durability makes them a more reliable choice for long-term outdoor use.

1000 nits to 1500 nits outdoor TV is expected to grow at a CAGR of 9.8% from 2024 to 2030. As outdoor living spaces become more sophisticated and equipped with premium amenities, there is a growing demand for high-performance outdoor TVs that can match these upscale settings. TVs with higher brightness levels are seen as a necessary feature for delivering a top-tier outdoor entertainment experience, including during daytime gatherings and events. Higher brightness levels contribute to better contrast and color accuracy, making images appear more vibrant and detailed. This improved picture quality enhances the viewing experience, allowing users to enjoy sharper and more vivid visuals in various outdoor environments.

Application Insights

Consumer TV accounted for a revenue share of 76.1% in 2023. Improvements in outdoor TV technology, such as better weather resistance, higher brightness levels, and enhanced durability, have made outdoor TVs more appealing and practical for consumers. These advancements ensure that outdoor TVs can perform well in various weather conditions and lighting environments. The availability of a wider range of outdoor TV models and sizes has made it easier for consumers to find a product that fits their specific needs and budget. With more options to choose from, including various sizes and features, consumers are more likely to invest in outdoor TVs to complement their outdoor living spaces.

Digital signage is expected to grow at a CAGR of 9.6% from 2024 to 2030. Digital signage outdoor TVs are increasingly used by businesses to capture and engage customers with dynamic and visually appealing content. These TVs allow for real-time updates, advertisements, and interactive displays that can attract and retain customer attention in high-traffic outdoor locations. As businesses and organizations seek to expand their reach and impact through outdoor advertising, digital signage offers a modern and flexible solution. The ability to display changing content and targeted messages helps businesses effectively communicate with their audience and adapt to changing marketing strategies.

End-use Insights

Outdoor TV for residential accounted for a revenue share of 55.3% in 2023. Homeowners are increasingly investing in enhancing their outdoor living areas, such as patios, decks, and gardens. An outdoor TV complements these spaces, allowing for entertainment options like watching sports, movies, or shows in an open-air environment. The trend of staying home more, driven by lifestyle changes or global events, has led to a surge in demand for home entertainment solutions. Outdoor TVs offer a unique experience, blending the comforts of home with the ambiance of the outdoors.

Outdoor TV for commercial is expected to grow at a CAGR of 9.5% from 2024 to 2030. With the rise of outdoor dining, rooftop lounges, and open-air event spaces, commercial establishments are leveraging outdoor TVs to offer entertainment in these settings, capitalizing on the trend of outdoor socialization. Businesses such as restaurants, bars, hotels, and resorts are installing outdoor TVs to improve the customer experience. These screens are used to broadcast live events, advertisements, or entertainment, creating an engaging atmosphere that attracts and retains customers.

Distribution Channel Insights

Sales through offline accounted for a revenue share of 74.6% in 2023. Offline retail environments allow consumers to see, touch, and experience outdoor TVs in person. This hands-on experience helps potential buyers assess the quality, size, and features of the TVs, and get personalized advice from sales representatives. The ability to compare different models and receive expert recommendations often leads to higher confidence in purchasing decisions. Additionally, offline retailers frequently offer exclusive promotions, discounts, and bundled deals that are not always available online. Special sales events, in-store discounts, and financing options can incentivize consumers to make their purchases through physical stores rather than online.

Sales through online is expected to grow at a CAGR of 9.6% from 2024 to 2030. Online shopping provides unparalleled specialty and accessibility for consumers seeking outdoor TV. With the ability to browse and purchase from anywhere, at any time, shoppers can easily access a wide range of outdoor TV products without the limitations of physical store hours or geographical constraints. This specialty is particularly appealing to consumers who may not have local access to specialty stores that offer halal apparel.

Regional Insights

The market for outdoor TV market in North America accounted for a market share of 37.0% in 2023. There is a rising trend in North America towards creating luxurious and functional outdoor living spaces. Homeowners are investing in patios, decks, and outdoor kitchens, and outdoor TVs are becoming a popular addition to these areas. The desire to extend indoor entertainment options to outdoor spaces drives the demand for high-quality outdoor TVs.

U.S. Outdoor TV Market Trends

The outdoor TV market in the U.S. is facing intense competition and innovation. With the increasing popularity of outdoor gatherings, such as BBQs, parties, and family events, outdoor TVs offer a way to enhance these experiences by providing entertainment in an outdoor setting. Consumers are looking for ways to enjoy sports, movies, and other content in the comfort of their own backyards.

Europe Outdoor TV Market Trends

The outdoor TV market in Europe is expected to grow at a CAGR of 9.4% during the forecast period. Europeans are increasingly investing in outdoor living spaces such as gardens, terraces, and patios. This trend towards creating comfortable and stylish outdoor environments drives the demand for outdoor TVs, which enhance these spaces by providing entertainment options for outdoor gatherings and leisure activities. The cultural emphasis on outdoor dining and entertaining in Europe also contributes to the demand for outdoor TVs.

Asia Pacific Outdoor TV Market Trends

The outdoor TV market in Asia Pacific is expected to grow at a CAGR of 9.8% during the forecast period from 2024 to 2030. Rapid urbanization and the development of upscale residential properties in Asia Pacific are driving demand for outdoor living spaces. As more high-end apartments, villas, and homes are built with outdoor areas like balconies, terraces, and gardens, there is a growing interest in outdoor TVs to enhance these spaces for entertainment.

Key Outdoor TV Company Insights

The outdoor TV market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advance4Kts to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agree4Kts, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Outdoor TV Companies:

The following are the leading companies in the outdoor TV market. These companies collectively hold the largest market share and dictate industry trends.

- SunBriteTV

- Samsung

- LG

- Sony Bravia

- Furrion

- Séura

- Klein Electronics

- Starlight

- Tyler

- Maximus

Recent Developments

-

In May 2024, Yolo TV announced the launch of Yolo TV Rise, a new platform aimed at redefining outdoor entertainment. This initiative focuses on delivering engaging content centered around outdoor activities, including adventure sports, travel, and lifestyle programming. Yolo TV Rise seeks to connect audiences with the outdoor community through a variety of shows and digital content, promoting an active lifestyle and appreciation for nature. The platform aims to cater to both seasoned outdoor enthusiasts and newcomers, fostering a sense of community and encouraging exploration of the great outdoors.

-

In August 2023, Samsung unveiled the 85" Class Terrace Outdoor Neo QLED 4K TV, the largest model in their Terrace lineup, featuring a Neo QLED 4K panel with Direct-Sun Protection, upgraded IP56 weather resistance, Wide Viewing Angle, Anti-Glare screen, Quantum Processor 4K, built-in HD Base-T receiver, and support for Samsung Gaming Hub. Designed for permanent outdoor installation, this TV is ideal for high-end backyard theaters and is now available on Samsung.com for USD 19,999.

Outdoor TV Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 478.0 million

Revenue forecast in 2030

USD 753.8 million

Growth rate

CAGR of 9.5% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Seg4Kts covered

Screen size, resolution, luminous, application, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and UAE

Key companies profiled

SunBriteTV, Samsung, LG, Sony Bravia, Furrion, Séura, Klein Electronics, Starlight, Tyler, Maximus

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & seg4Kt scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Outdoor TV Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-seg4Kts from 2018 to 2030. For the purpose of this study, Grand View Research has seg4Kted the global outdoor TV market report based on screen size, resolution, luminous, application, end use, distribution channel, and region:

-

Screen Size Outlook (Revenue, USD Million; 2018 - 2030)

-

Less than 40 inch

-

40 to 55 inch

-

55 inch to 70 inch

-

More than 70 inch

-

-

Resolution Outlook (Revenue, USD Million; 2018 - 2030)

-

4K

-

1080p

-

720p

-

-

Luminous Outlook (Revenue, USD Million; 2018 - 2030)

-

Up to 1000 nits

-

1000 nits to 1500 nits

-

1500 nits to 2000 nits

-

2000 nits to 2500 nits

-

Above 2500 nits

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Consumer TV

-

Digital Signage

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global outdoor TV market size was estimated at USD 413.2 million in 2023 and is expected to reach USD 443.4 million in 2024.

b. The global outdoor TV market is expected to grow at a compounded growth rate of 9.2% from 2024 to 2030 to reach USD 753.8 million by 2030.

b. 4K outdoor TV is expected to grow at a CAGR of 9.3% from 2024 to 2030. 4K outdoor TVs offer superior resolution and image clarity compared to standard HD models. The increased pixel density provides sharper and more detailed visuals, which enhances the viewing experience, especially in outdoor settings where viewers may be further from the screen.

b. Some key players operating in outdoor TV market include SunBriteTV, Samsung, LG, Sony Bravia, Furrion, Séura, and others.

b. Key factors that are driving the market growth include rising intertest in outdoor entertainment and increasing technological advancements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.