Outdoor Power Equipment Market Size, Share, & Trends Analysis Report By Power Source (Gasoline, Battery), By End-use (Residential, Commercial/Government), By Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-973-1

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Outdoor Power Equipment Market Trends

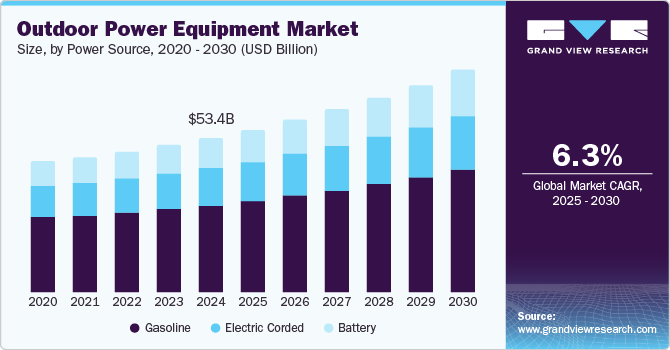

The global outdoor power equipment market size was estimated at USD 53.42 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. The market growth can be ascribed to the increasing demand for cordless outdoor power equipment as people are more inclined toward greater flexibility and portability. Furthermore, several companies’ technological advancements in outdoor power equipment are also expected to drive market growth.

For instance, in February 2020, Robert Bosch GmbH launched Indego M 700 and Indego M+ 700, two autonomous lawn mowers. These two connected lawn mowers feature 18 V lithium batteries with brushless DC motors that can cut grass from medium-sized gardens up to 700 square meters on a single charge.

The rising urbanization, disposable income, and infrastructure activities coupled with rising demand for landscaping services are expected to augment the growth of the outdoor power equipment industry. Furthermore, growing awareness of environmental issues leads to increasing adoption of outdoor power equipment using lithium-ion batteries as they are environment friendly and maximize energy output. Several companies are focused on innovation in lithium-ion batteries. For instance, in 2021, Techtronic's Industries started using red lithium-ion batteries for its cordless power tools, as they work faster and deliver more than expected from the battery's life.

The gardening trend has increased rapidly, mainly among younger generations. Most young people are inclined toward growing vegetables, fruits, and herbs. As young people are more likely to live in smaller yard lots, the type of equipment, plant, and tools they require should work in tighter spaces. The gardening and lawn industry is changing to adapt to various consumer requirements by launching equipment that is lighter in weight and makes work comfortable. Furthermore, the growing popularity of home improvement projects bodes well for the growth of the outdoor power equipment and garden tools market over the forecast period. Companies such as The Toro Company, Husqvarna, ANDREAS STIHL AG & Co. KG, and others gained profits from the stay-at-home trend due to the pandemic, which has extended the gardening season.

The pandemic in 2020 did cast a gloomy outlook on almost all industries worldwide. The outbreak of COVID-19 impacted market growth during the initial few months of 2020. However, in later months, demand for various outdoor power equipment has witnessed strong growth with the resumption of operations in multiple industries. A considerable increase in the market for Do-it-yourself (DIY) equipment and do-it-for-me (DIFM) services in the commercial and residential segments is expected to drive market growth. For instance, according to the Outdoor December forecast report in 2021, the commercial lawn mower grew by over 15 % in 2020, with shipping of nearly 7.7 billion units. Furthermore, rising concern about gasoline fumes and engine noise due to the COVID-19 pandemic has also increased the demand for energy-efficient outdoor power equipment.

Although the prospects look promising, the industry is still faced with several challenges regarding high maintenance costs. For accurate operations, one must inspect outdoor power equipment at various intervals. The factors to be reviewed regularly include inspecting cords, checking for damaged switches, sharpening, oiling, and other repairs needed for properly working the equipment. Hence, the maintenance cost of outdoor power equipment is relatively high, which is expected to hamper the market’s growth.

Power Source Insights

Based on power source, the market is segregated into gasoline, battery, and electric corded segments. The gasoline segment accounted for 56.30% market share in 2024 and is expected to witness a drop in demand because of gas fumes and noise produced. Various government regulations have been enacted to address gasoline-powered sources' environmental issues. For instance, California implemented laws banning gas-powered chainsaws, lawnmowers, and leaf blowers, which were anticipated to be in effect as early as 2024.

Meanwhile, the battery power source segment is estimated to grow at a significant CAGR over the forecast period. The battery-powered source segment is expanding owing to lower shipping costs, lighter than gasoline alternatives, and is more affordably purchased online. Furthermore, various online retailers are adjusting their inventory to optimize new government rules and regulations for developing electric outdoor power equipment products.

End-use Insights

Based on end use, the market is segregated into the commercial and residential sector segments. The residential segment accounted for a significant market share in 2024. The growing inclination of residential users towards investing more time in gardening and outdoor is expected to drive the demand for outdoor power equipment. Furthermore, the rising sales of DIY outdoor power equipment due to the pandemic are likely to drive the segment growth.

The commercial segment is expected to grow at a significant CAGR over the forecast period. The rising number of smart cities owing to increasing urbanization is expected to drive segment growth. According to a report published by World Urbanization Prospects in 2019 by the UN Department of Economic and Social Affairs (UN DESA), the recent urban population, which is 55.7%, is anticipated to increase to 68.4% in 2050 globally. Furthermore, with the rising number of golf players coupled with a growing number of golf club facilities, the demand for various outdoor power equipment is expected to increase for the commercial segment.

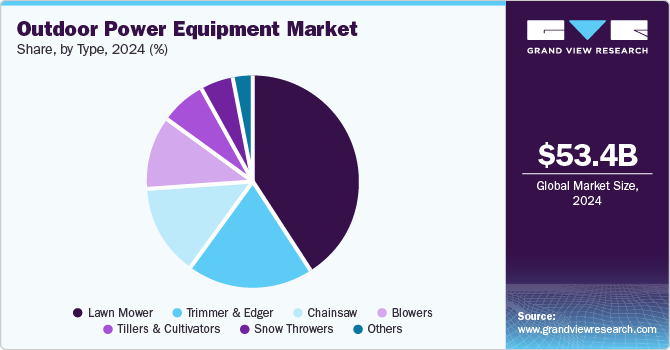

Type Insights

Based on type, the market is segregated into lawn mower, chainsaws, trimmers & edgers, blowers, tillers & cultivators, snow throwers, and others segments. The chainsaw segment is estimated to grow at a significant CAGR over the forecast period. A chainsaw is a handheld, portable mechanical device mainly used to cut wood and wood-related products. The increasing deforestation rate for various infrastructure activities is expected to drive market growth. Furthermore, the rising demand for interior décors such as wood-based flooring, roofing, panels, and more are augmenting the use of chainsaws in various furniture applications.

The lawn mower segment captured the largest market share and is expected to grow at a significant CAGR over the forecast period. Several companies are focused on introducing various robotic mowers due to the rising demand for technologically advanced mowers. Furthermore, the latest automated lawn mowers are equipped with GPS tracking and remote control, making it easier for the user to operate, monitor, and track the mower. In addition, changing consumer behavior in its spending power and aesthetic appeal for their gardening space is also expected to boost the market's growth.

Regional Insights

The North America outdoor power equipment industry accounted for 35.28% of the global overall market share in 2024. The regional market’s growth is attributed to North America’s larger geographical area compared to its population, which leads to more gardens and lawns in the region. This has led to increased demand for outdoor power equipment in the region. Furthermore, rising investment by the government in infrastructure is expected to drive the region’s growth. For instance, in 2022, the Canadian government provided USD 1.5 billion for the Canada Mortgage and Housing Corporation to expand the rapid housing initiative of building houses.

U.S. Outdoor Power Equipment Market Trends

The U.S. outdoor power equipment industry is expected to grow at a significant CAGR from 2025 to 2030. The U.S. market is driven by high consumer spending on lawn and garden care, rising demand for battery-powered tools due to sustainability trends, extensive landscaping in residential and commercial properties, and stringent emissions regulations accelerating electric equipment adoption.

Europe Outdoor Power Equipment Market Trends

The outdoor power equipment industry in Europe is expected to grow at a significant CAGR from 2025 to 2030. Europe market is driven by strict environmental regulations promoting low-emission and electric equipment, increasing urban green spaces, strong government support for sustainable landscaping, high adoption of robotic lawnmowers, and a well-established culture of gardening and outdoor leisure activities.

The UK outdoor power equipment industry is driven by a strong gardening culture, rising popularity of allotments and urban green projects, increasing demand for electric and battery-powered tools due to strict emission laws, and growing investments in smart, automated lawn care solutions.

Germany's outdoor power equipment industry is driven by a strong DIY and home improvement culture, high adoption of precision-engineered tools, stringent environmental laws favoring electric models, increasing demand for robotic lawn mowers, and a growing emphasis on sustainable landscaping in urban planning initiatives.

Asia Pacific Outdoor Power Equipment Market Trends

The Asia Pacific outdoor power equipment industry is expected to register a significant CAGR during the forecast period. The significant growth rate of the region is due to rising disposable income and changing lifestyles in various developing countries such as India and China. Furthermore, increasing annual events such as the Indian Premier League (IPL), World Baseball Classic, Asian Games, and various other sports activities are expected to boost the requirement for outdoor power equipment to enhance sports stadiums and fields.

Japan's outdoor power equipment industry is driven by the increasing adoption of compact and precision-engineered tools for small gardens, high demand for automated and robotic equipment due to labor shortages, government support for urban greening, and strong consumer preference for high-tech, low-noise solutions.

China's outdoor power equipment industry is driven by rapid urbanization fueling demand for landscaping tools, increasing government initiatives for green infrastructure, rising disposable income boosting consumer spending on garden maintenance, and growing local manufacturing capabilities supporting cost-effective and technologically advanced equipment production.

Key Outdoor Power Equipment Company Insights

Some of the key companies in the outdoor power equipment industry include Husqvarna Group, Makita Corporation, Honda Motor Co., Ltd., Briggs & Stratton, and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Makita Corporation is a key player in the global outdoor power equipment industry, known for its high-performance cordless and electric tools. The company leverages advanced battery technology, strong R&D, and a global distribution network to meet the rising demand for eco-friendly and durable equipment.

-

Briggs & Stratton is a manufacturer in the global outdoor power equipment industry, specializing in gasoline engines and battery-powered solutions. The company focuses on innovation, durability, and expanding its electrification portfolio to meet the growing demand for sustainable and high-performance equipment worldwide.

Key Outdoor Power Equipment Companies:

The following are the leading companies in the outdoor power equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Makita Corporation

- Honda Motor Co., Ltd.

- Briggs & Stratton

- MTD Inc

- Stanley Black & Decker, Inc.

- ANDREAS STIHL AG & Co. KG

- CHERVON (China) Trading Co., Ltd.

- Techtronic Industries Co. Ltd.

- YAMABIKO Corporation

- Robert Bosch GmbH

- AL-KO GmbH

- AriensCo

- The Toro Company

- Deere & Company

View a comprehensive list of companies in the Outdoor Power Equipment Market

Recent Developments

-

In October 2024, Husqvarna Group introduced four new robotic lawnmowers-580L EPOS, 580 EPOS, 560 EPOS, and an upgraded 535 AWD EPOS-expanding its boundary wire-free lineup for professional turf management. Available globally from March 2025, these advanced models feature precision GPS navigation and customizable cutting patterns, enhancing efficiency, sustainability, and cost-effectiveness for commercial users.

-

In January 2022, Robert Bosch GmbH launched Keo, a cordless garden saw. Keo is one of the products of 18V Power for All System, the alliance formed with Husqvarna Group. The product is acquainted with a powerful interchangeable battery pack with replaceable saw blades designed for DIY applications.

Outdoor Power Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 56.33 billion |

|

Revenue forecast in 2030 |

USD 76.61 billion |

|

Growth Rate |

CAGR of 6.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, Volume in ‘000 units, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue and volume forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Power source, end-use, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Netherlands; Denmark; Finland; Spain; Russia; China; India; Japan; South Korea; Singapore; Australia; New Zealand; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Husqvarna Group, Makita Corporation, Honda Motor Co., Ltd., Briggs & Stratton, MTD Inc, Stanley Black & Decker, Inc., ANDREAS STIHL AG & Co. KG, CHERVON (China) Trading Co., Ltd., Techtronic Industries Co. Ltd., YAMABIKO Corporation, Robert Bosch GmbH, AL-KO GmbH, AriensCo, The Toro Company, Deere & Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Outdoor Power Equipment Market Report Segmentation

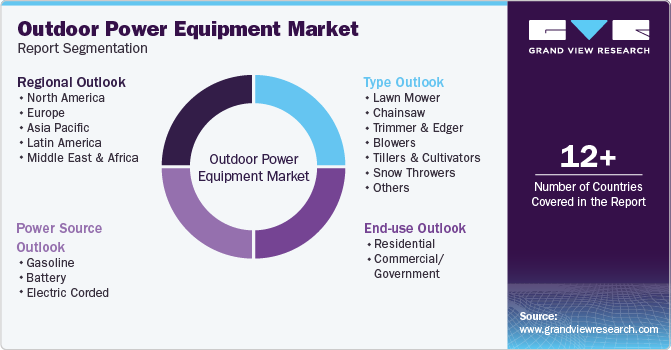

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends from 2018 to 2030 in each sub-segment. For this study, Grand View Research has segmented the global outdoor power equipment market report based on power source, end-use, type, and region:

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Battery

-

Electric Corded

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial/ Government

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Lawn Mower

-

Walk-Behind Lawn Mowers

-

Ride-on Lawn Mowers

-

Robotic Lawn Mowers

-

Zero -Turn Mowers

-

-

Chainsaw

-

Trimmer & Edger

-

Trimmers & Brush Cutter

-

Hedge Trimmers

-

Walk-Behind Edgers & Trimmers

-

-

Blowers

-

Snow

-

Leaf

-

-

Tillers & Cultivators

-

Snow Throwers

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Netherlands

-

Denmark

-

Finland

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global outdoor power equipment market size was estimated at USD 53.42 billion in 2024 and is expected to reach USD 56.33 billion in 2025.

b. The global outdoor power equipment market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 76.61 billion by 2030.

b. The lawn mower segment dominated the equipment type outdoor power equipment market and accounted for 40.99% of the global revenue share in 2024.

b. Asia Pacific is expected to emerge as the fastest-growing regional market for outdoor power equipment through 2030. The significant growth rate of the region is due to rising disposable income and changing lifestyles in various developing countries such as India and China.

b. Key factors that are increasing demand for cordless outdoor power equipment as people are more inclining toward greater flexibility and portability, rising demand for landscaping services, and growing awareness of environmental issues leads to increasing adoption of outdoor power equipment using lithium-ion batteries.

b. Some key players operating in the outdoor power equipment market include Husqvarna Group, Makita Corporation, Honda Motor Co., Ltd., Briggs & Stratton, MTD Inc, Stanley Black & Decker, Inc.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."