- Home

- »

- Homecare & Decor

- »

-

Outdoor Kitchen Market Size & Share, Industry Report, 2033GVR Report cover

![Outdoor Kitchen Market Size, Share & Trends Report]()

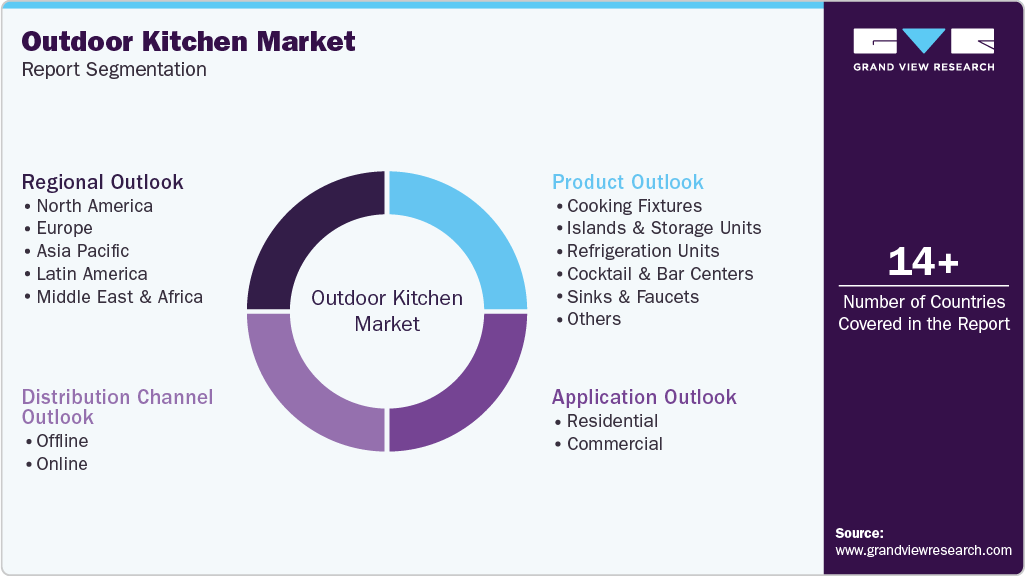

Outdoor Kitchen Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cooking Fixtures, Islands & Storage Units, Refrigeration Units, Cocktail & Bar Centers, Sinks & Faucets), By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-978-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Outdoor Kitchen Market Summary

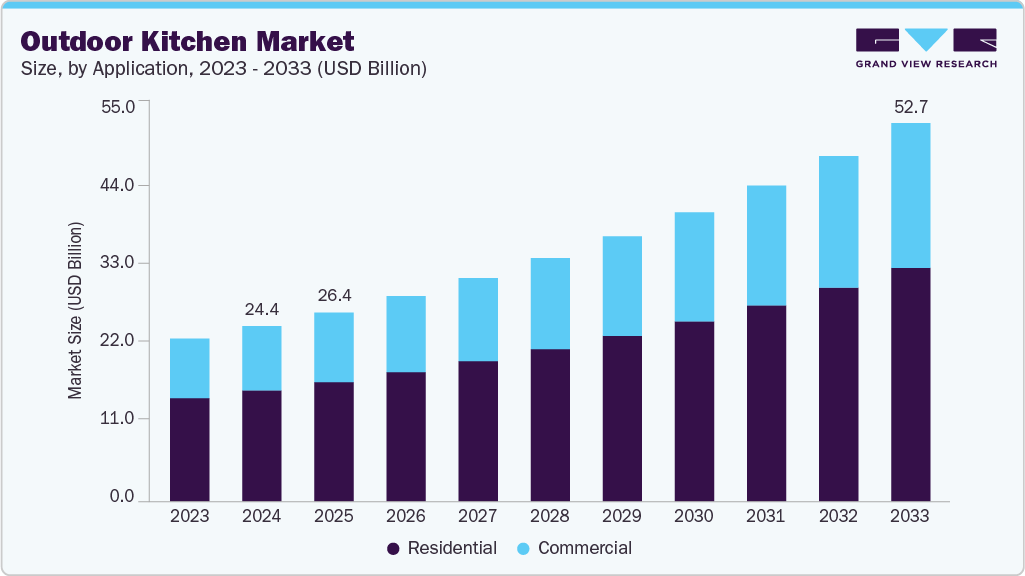

The global outdoor kitchen market size was estimated at USD 24.45 billion in 2024 and is projected to reach USD 52.75 billion by 2033, growing at a CAGR of 9.1% from 2025 to 2033. This growth is attributed to increasing consumer interest in outdoor living spaces and the rising trend of at-home entertainment.

Key Market Trends & Insights

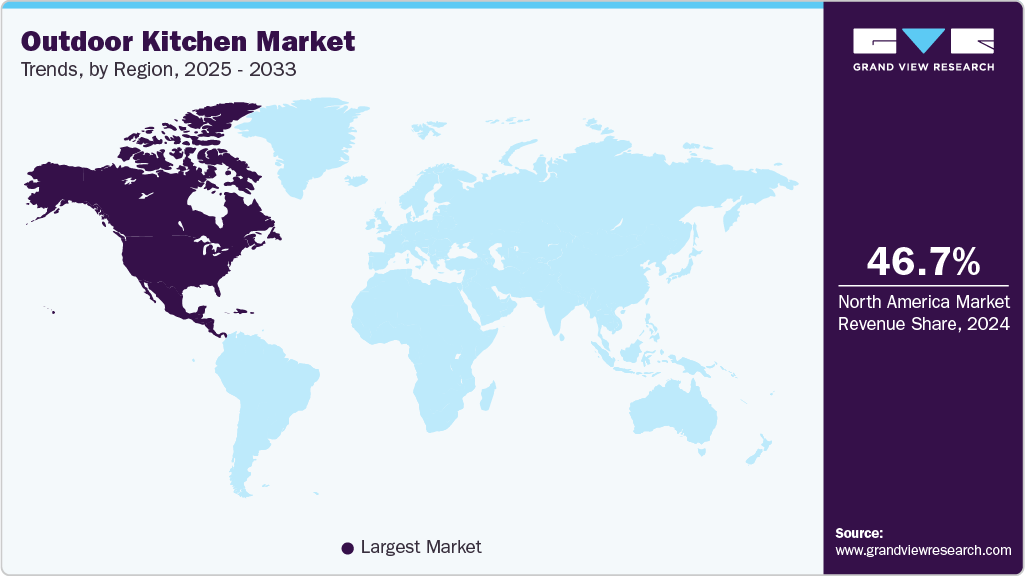

- North America dominated the global outdoor kitchen market with the largest revenue share of 46.73% in 2024.

- By product, the cooking fixtures segment led the market with the largest revenue share of 43.14% in 2024.

- By application, the residential segment led the market with the largest revenue share of 63.30% in 2024.

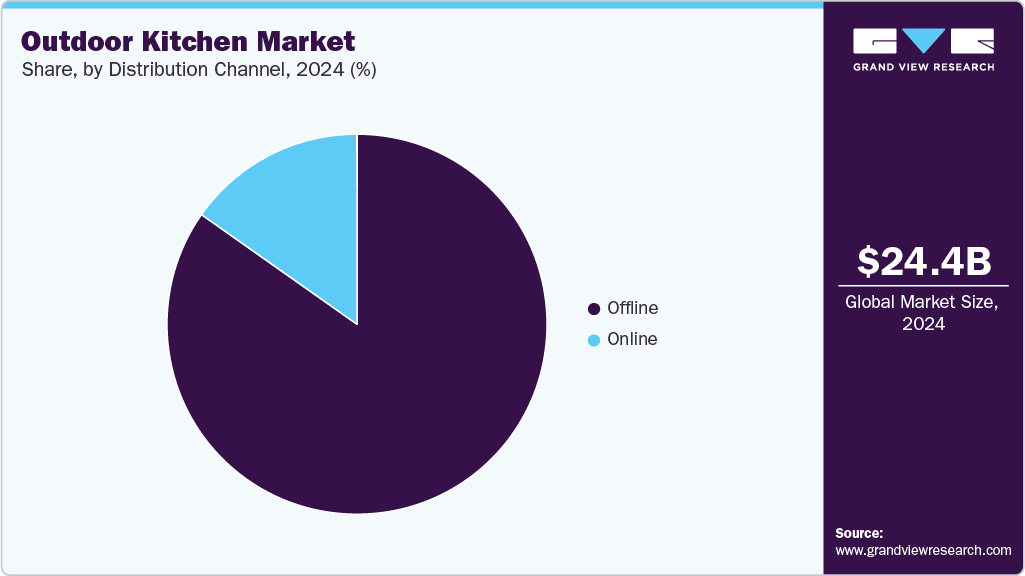

- By distribution channel, the offline segment led the market with the largest revenue share of 84.78% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.45 Billion

- 2033 Projected Market Size: USD 52.75 Billion

- CAGR (2025-2033): 9.1%

- North America: Largest market in 2024

Demand for premium and multifunctional outdoor kitchen products, such as grills, refrigerators, and cabinetry, is further driven by homeowners seeking to enhance their outdoor lifestyle with fully equipped, durable cooking spaces for social gatherings and relaxation.According to the Houzz Inc. 2024 U.S. Outdoor Trends Study, homeowners across generations are increasingly upgrading their outdoor spaces to extend livable areas, with 41% of Gen X, 38% of Millennials, and 28% of Baby Boomers undertaking such projects. Millennials lead in structural upgrades such as decks, outdoor kitchens, and pools (65%), followed by Gen X (61%) and Boomers (54%), reflecting their growing preference for multifunctional outdoor environments. In addition, 54% of Millennials plan to enhance their spaces with décor and accessories compared to 31% of Boomers, indicating a stronger focus on aesthetics and personalization. This aligns with the broader trend of “outdoor living as an extension of the home,” where younger homeowners prioritize comfort, entertainment, and social gatherings, driving demand for premium and customized outdoor furniture and amenities.

As consumers increasingly seek non-strenuous recreational activities, numerous service providers have developed programs such as Outdoorsy, ESCAPE Camp, and various adult summer camps designed exclusively for older campers. Such efforts are likely to expand the scope of the outdoor kitchen industry. Apart from this, millennials constitute the primary adventure seekers and largely opt for adventure sports and outdoor activities, including camping, which is further likely to propel market growth.

According to a survey conducted for the International Casual Furnishings Association in January 2023, people are spending more time relaxing, gardening, grilling, dining, exercising, playing with pets and children, and entertaining outside. In addition, approximately 17% of Americans plan to upgrade outdoor kitchens and bars in 2023. Planned purchases include outdoor lighting, fire pits, lounge chairs, and dining tables/chairs. These factors are estimated to drive the market growth over the forecast period.

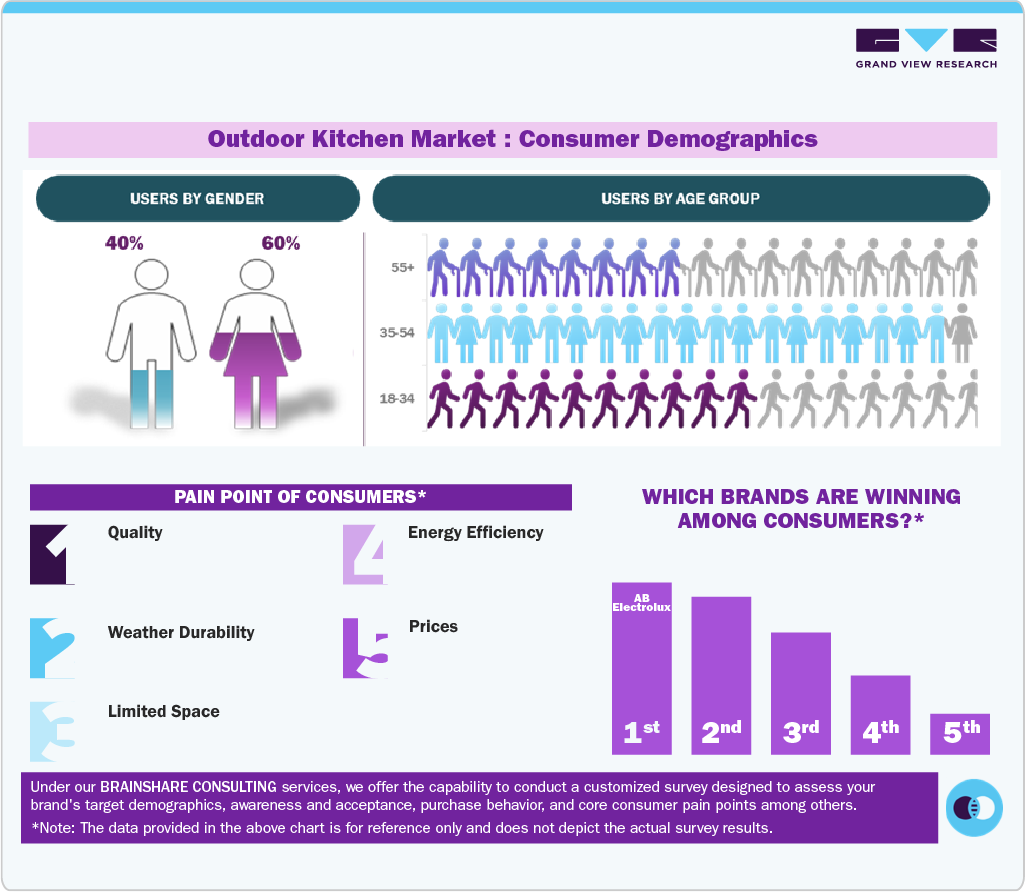

Consumer Insights

Product Insights

The cooking fixtures segment led the market with the largest revenue share of 43.14% in 2024. A key contributor to this growth is the rising popularity of outdoor pizza ovens, which are increasingly viewed as essential for enhancing outdoor living spaces. High-performance pizza ovens, such as those from Scotland-based Ooni, which can reach up to 950°F, allow consumers to replicate the authentic Neapolitan pizza experience at home. The ability to cook pizzas in just 60-90 seconds, combined with the immersive, social, and nature-connected cooking experience, has made these ovens highly desirable, driving demand for outdoor kitchens globally.

The refrigeration units segment is anticipated to witness at the fastest CAGR of 10.8% from 2025 to 2033. This growth is fueled by the increasing demand for outdoor kitchen appliances, particularly refrigeration units designed to store food and beverages in varying outdoor temperatures. Units capable of operating efficiently between 40 and 100 degrees Fahrenheit have become more popular, with companies like UK-based Lindström & Sondén AB offering high-quality, durable products. Their Stainless and Black Collection features outdoor refrigeration solutions with impressive warranties of up to 10 years, providing both cooling and dry storage options, driving further market growth.

Application Insights

The residential segment led the market with the largest revenue share of 63.30% in 2024. The demand for premium outdoor kitchen products for residential use has surged in line with the global increase in luxury home sales. Post-pandemic, homeowners are showing a heightened interest in upgrading their outdoor living spaces. The International Casual Furnishings Association (ICFA) 2025 survey reveals strong consumer enthusiasm for outdoor living investments, with 59% of households planning to purchase new outdoor furniture or accessories in 2025, and a notably higher 76% among Millennials. This generation’s willingness to invest underscores their desire for functional yet stylish outdoor spaces that reflect personal taste and lifestyle. Moreover, 57% of respondents stated they prefer to buy exactly what they want, even at a higher cost, rather than opting for discounted options.

The commercial segment is anticipated to witness at the fastest CAGR of 9.6% from 2025 to 2033. The demand for outdoor kitchens in the hospitality industry is on the rise as hotels and vacation rental properties seek to offer unique experiences that attract guests and stand out from competitors. High-quality outdoor kitchen setups, including grills, seating, and appliances, are becoming popular investments for hoteliers. For example, Homes & Villas by Marriott Bonvoy in the U.S. offers outdoor kitchens as part of its private deck amenities.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 84.78% in 2024. Many homeowners and commercial buyers opt for offline purchases to receive expert guidance, customization options, and installation services offered by specialty retailers. Manufacturers in the industry generally opt for a three-tier sale and distribution structure, comprising distributors, wholesalers, and retailers. The emerging concept of a hybrid model of distribution, such as the combination of brick-and-mortar stores and e-retailing, is gaining popularity in the market.

The online segment is anticipated to witness at the fastest CAGR of 10.1% from 2025 to 2033. Consumers increasingly prefer shopping online due to the ease of product comparison, access to wider design options, and transparent pricing across brands. The pandemic accelerated this shift as people focused on home improvement and outdoor living, discovering that large furniture items could be conveniently purchased online with virtual visualization tools, AR-based placement apps, and detailed customer reviews, enhancing confidence in quality and fit. In addition, free delivery, flexible return policies, and financing options have made online buying more accessible.

Regional Insights

North America dominated the outdoor kitchen market with the largest revenue share of 46.73% in 2024, owing to rising income levels across the region and improving business environment in countries like the U.S. and Canada. The increase in the construction of outdoor kitchens in the U.S. is accelerating industry growth. Moreover, homeowners are seeking advice from designers and garden specialists for their outdoor kitchens.

U.S. Outdoor Kitchen Market Trends

The outdoor kitchen market in the U.S. accounted for the largest market revenue share in North America in 2024. The May 2023 Luxury Outdoor Kitchen Report by the National Kitchen & Bath Association highlighted the growing demand for high-end outdoor kitchens in the U.S., driven by the trend of creating seamless indoor-outdoor living spaces, especially during the pandemic. Outdoor kitchens are gaining popularity as they offer extra living space and are now designed for year-round use due to advancements in materials. California, Texas, and Florida lead the U.S. market, accounting for over a third of outdoor kitchen sales, owing to favorable climates and high home improvement spending.

Europe Outdoor Kitchen Market Trends

The outdoor kitchen market in Europe is anticipated to grow at a significant CAGR during the forecast period. Outdoor kitchens are increasingly popular in Europe, particularly in countries with a strong culture of outdoor dining during warmer months. Higher disposable incomes have encouraged investments in outdoor kitchens as a home enhancement, contributing to property value and quality of life. Companies like Bull Europe Ltd. in the UK cater to this demand by offering a range of high-quality outdoor kitchen appliances, including grills, pizza ovens, and kitchen islands.

Asia Pacific Outdoor Kitchen Market Trends

The outdoor kitchen market in Asia Pacific is expected to grow at the fastest CAGR of 10.6% from 2025 to 2033. The rise in spending power and improving standard of living are some of the major factors accountable for attracting people to outdoor living spaces, which is fueling the growth of the outdoor kitchen industry in Asia. Moreover, the rise in spending on home improvement can be attributed to an increase in social activities, such as family reunions and house parties. In addition, the rising consumer inclination toward innovative and modern kitchens in the Asia Pacific is expected to accelerate industry growth.

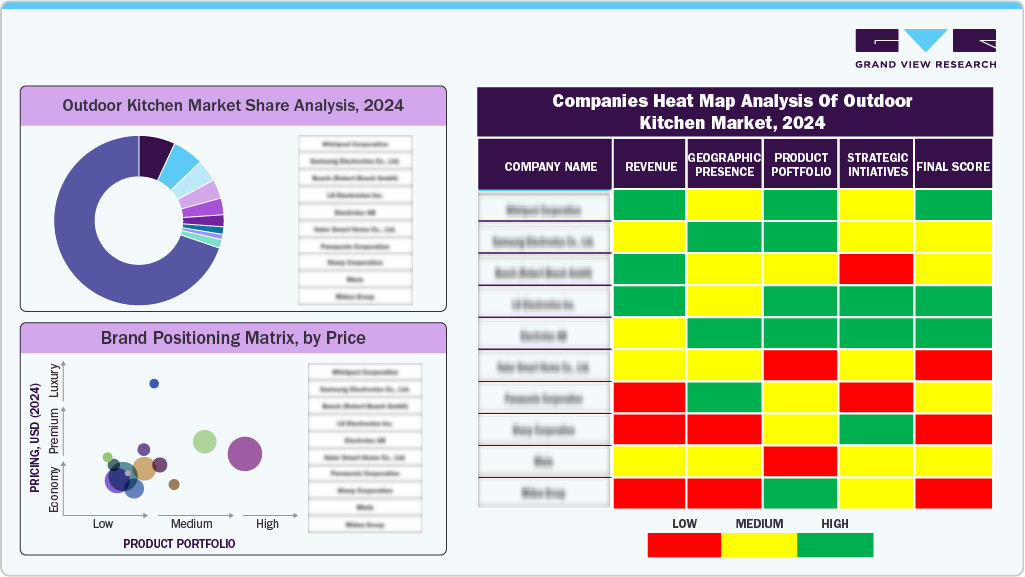

Key Outdoor Kitchen Company Insights

Leading players in the outdoor kitchen industry include RH Peterson Co., AB Electrolux, and DCS Appliances. The global outdoor kitchen industry remains highly competitive, with leading players expanding their production capabilities and strengthening distribution networks across both online and offline channels. Manufacturers are focusing on product innovation, sustainable material sourcing, and advanced design technologies to meet the rising demand for premium, functional, and eco-friendly outdoor cooking solutions.

Market growth is further fueled by increasing consumer investment in outdoor living spaces, growing interest in luxury home entertainment, and the expanding adoption of modular kitchen systems across residential, hospitality, and commercial sectors.

Key Outdoor Kitchen Companies:

The following are the leading companies in the outdoor kitchen market. These companies collectively hold the largest market share and dictate industry trends.

- AB Electrolux

- DCS Appliances

- Bull Outdoor Products, Inc.

- Alfresco Grills

- RH Peterson Co.

- Summerset Grills

- Wolf Steel Ltd

- Coyote Outdoor Living, Inc.

- Brown Jordan Outdoor Kitchens

- Danver Stainless Outdoor Kitchens

- Kalamazoo Outdoor Gourmet, LLC

- Blaze

Recent Developments

-

In September 2025, the acquisition of Mont Alpi by BBQGuys represents a strategic expansion of BBQGuys’ portfolio into high-end modular outdoor kitchen systems. Mont Alpi is known for its premium, ready-to-assemble outdoor kitchen islands and grills, which align with BBQGuys’ aim to deepen its presence in the booming outdoor living market. The move also highlights the growing importance of turnkey, modular solutions in the outdoor kitchen segment, driven by homeowners seeking luxury, convenience, and flexibility in their outdoor living spaces.

-

In February 2025, RH Peterson Co., the maker of the premium outdoor kitchen brand Fire Magic, launched its first built-in outdoor induction cooktop, designed for luxury outdoor kitchens. The 1,800-watt unit offers precise temperature control (150-450°F) and rapid heating. It features such as automatic pan recognition, a five mm-thick tempered glass surface, an LED display, and a built-in safety shut-off.

Outdoor Kitchen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.35 billion

Revenue forecast in 2033

USD 52.75 billion

Growth rate

CAGR of 9.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and the Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Indonesia; Australia; Brazil; South Africa

Key companies profiled

AB Electrolux; DCS Appliances; Bull Outdoor Products, Inc.; Alfresco Grills; RH Peterson Co.; Summerset Grills; Wolf Steel Ltd; Coyote Outdoor Living, Inc.; Brown Jordan Outdoor Kitchens; Danver Stainless Outdoor Kitchens; Kalamazoo Outdoor Gourmet, LLC; Blaze

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Outdoor Kitchen Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global outdoor kitchen market report based on the product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cooking Fixtures

-

Gas Grills

-

Pizza Ovens, Smokers & Specialty Grills

-

Side Burners & Other Secondary Cooking Fixtures

-

-

Islands & Storage Units

-

Prefabricated Islands

-

Cabinets and Storage Units

-

Countertops

-

-

Refrigeration Units

-

Cocktail & Bar Centers

-

Sinks & Faucets

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global outdoor kitchen market was estimated at USD 24.45 billion in 2024 and is expected to reach USD 26.35 billion in 2025.

b. The global outdoor kitchen market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2030 to reach USD 40.32 billion by 2030.

b. The outdoor kitchen market in North America accounted for a share of 45.89% of the global market revenue in 2024. This is owing to the rising income levels across the region, improving the business environment in countries like the U.S. and Canada.

b. Some key players operating in the outdoor kitchen market include AB Electrolux, Affordable Outdoor Kitchens, Bull Outdoor Products, Inc., Charlotte Grill Company, R.H. Peterson Co., Summerset Professional Grills, Wolf Steel Ltd., The Outdoor Kitchen Collective Ltd., Brown Jordan Outdoor Kitchens, Danver Outdoor Kitchens, Kalamazoo Outdoor Gourmet, Blaze Outdoor Products.

b. Key factors that are driving the outdoor kitchen market growth include the rising spending on outdoor entertainment spaces by boomers and millennials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.