- Home

- »

- Medical Devices

- »

-

Osteosynthesis Devices Market Size & Share Report, 2030GVR Report cover

![Osteosynthesis Devices Market Size, Share & Trends Report]()

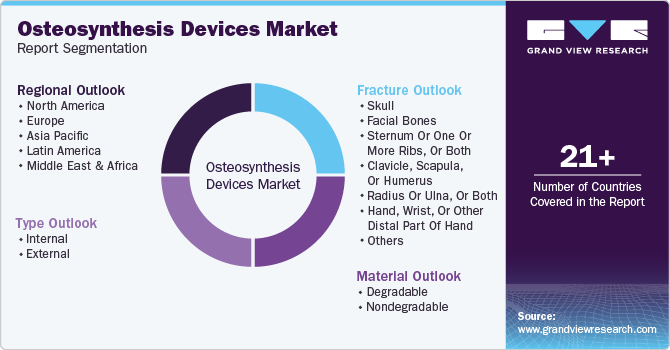

Osteosynthesis Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Internal, External), By Material (Degradable, Non Degradable), By Fracture (Facial bones, Skull), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-224-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Osteosynthesis Devices Market Trends

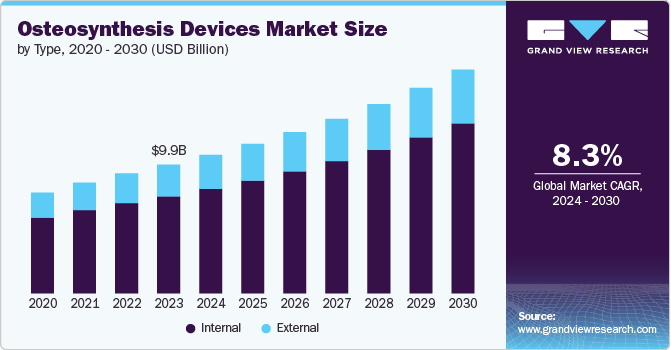

The global osteosynthesis devices market size was estimated at USD 9.91 billion in 2023 and is projected to grow at a CAGR of 8.30% from 2024 to 2030. Factors such as the growing prevalence of osteomalacia and osteoporosis and the rising incidence of sports injuries and road accidents fuel the demand for osteosynthesis devices across the globe. For instance, according to the World Osteoporosis Day Survey 2023 conducted by the International Osteoporosis Foundation, 43% of the surveyed women reported that they had experienced bone fractures from minor falls or accidents after age 50.

The availability of reimbursement coverage for orthopedic procedures has boosted the acceptance of related surgeries. These factors have enabled patients to seek advanced and more expensive treatment alternatives, contributing to the overall market growth. Furthermore, favorable government and private organization initiatives drive market growth. For instance, in July 2024, the University of Minnesota Department of Orthopedic Surgery introduced Orthopedic Bootcamp, an initiative to teach third-year medical students the complexities of the musculoskeletal system and orthopedics. This initiative offers medical students hands-on experience in procedural and surgical techniques.

Moreover, increasing public awareness of novel osteosynthesis devices and rising sports injuries propel the market growth. For instance, according to Johns Hopkins University, 30 million teens and children participate in sports activities, and over 3.5 million children aged 14 and younger suffer from sports injuries annually in the U.S. In addition, over 775,000 children aged 14 and younger are treated in hospital emergency rooms due to sports-related injuries annually in the U.S.

The market is expected to experience further growth due to an increasing number of road accidents. For instance, according to the ROAD SAFETY IN INDIA STATUS REPORT 2023, 371,884 individuals were injured, and 155,622 persons died from road accidents in India in 2021. Moreover, growing awareness and availability of minimally invasive surgical techniques, owing to the multiple benefits offered by these surgeries offer, is another key driving factor responsible for market growth.

Furthermore, technological advancements, the adoption of various strategies by key companies, and product approvals boost market growth. For instance, in October 2023, DePuy Synthes, a division of Johnson & Johnson, received U.S. FDA 510(k) clearances for the TriALTIS Navigation Enabled Instruments and the TriALTIS Spine System. The TriALTIS Spine System is a cutting-edge system of pedicle screws developed for the posterior thoracolumbar region, providing a wide array of implant choices.

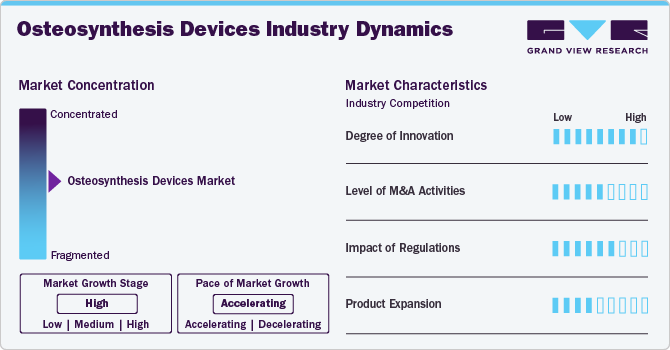

Market Concentration & Characteristics

The market is characterized by a high degree of innovation owing to advancements in biomechanics, materials science, and surgical techniques. For instance, in September 2021, Precision Spine, Inc., a MedTech company, introduced the Dakota ACDF Standalone System to treat degenerative disc disease. The system incorporates a titanium plate polyetheretherketone (PEEK) cage with cancellous and cortical screws for support, and it includes a large cavity designed for the insertion of an autogenous bone graft, assisting in the fusion process.

Regulations play a crucial role in shaping the market, ensuring their efficacy, safety, and quality. In the U.S., the FDA categorizes osteosynthesis devices as Class II medical devices. These devices are assigned the product code HRS, indicating they are either single- or multiple-component metallic devices used for bone fixation. Moreover, these devices require a premarket notification (510(k)).

Several market players are expanding their business by launching new products to expand their portfolio. For instance, in May 2024, OrthoXel received a U.S. FDA 510(k) clearance for the Vertex Hip Fracture Nail. It improves patient outcomes and streamlines surgical procedures.

Type Insights

The internal device segment dominated the market with a revenue share of 75.3% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. For fixing fractures, screws, metal plates, and nails are the most often utilized internal fixation devices. These pieces of apparatus assist in stabilizing and supporting the shattered bone while holding it together. In January 2023, Orthofix Medical launched a new Mariner Deformity Pedicle Screw System to provide surgeons with versatility and strength to facilitate posterior lumbar fixation through minimally invasive techniques.

The external device segment in the market is anticipated to grow significantly from 2024 to 2030. The increasing demand for external fixation osteosynthesis devices is due to the rising popularity of minimally invasive surgery and the number of product launches. For instance, in May 2024, Metric Medical Devices, Inc., an orthopedic company, received U.S. FDA clearance and launched LINK Percutaneous Dynamic Compression Bone Fixator to provide minimally invasive continuous dynamic compression for fracture, osteotomy, or arthrodesis fixation.

Fracture Insights

The patella, tibia, fibula, or ankle segment dominated the market with a revenue share of 21.4% in 2023. The increasing number of companies launching new products and making acquisitions in this market fuels the segment growth. For instance, in March 2023, Acumed introduced the Ankle Syndesmosis Repair System with Acu-Sinch Knotless Flexible Fixation Technology to treat disruptions to the tibiofibular joint.

The hip segment in the market is anticipated to register the fastest growth rate from 2024 to 2030. Increasing investments and funding have significantly contributed to the overall segment's growth. Furthermore, the rise in the number of hip fractures boosts the demand for osteosynthesis devices. For instance, according to the National Hip Fracture Database Annual Report 2023, 76, 00 0 hip fractures occur annually in the UK. Thus, such factors lead to the segment growth.

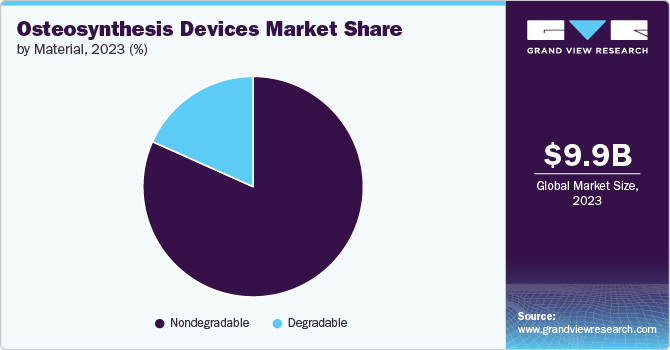

Material Insights

The nondegradable segment dominated and accounted for the largest revenue share of 81.7% in 2023. Companies are developing solutions for the expanding anatomic plate and screw sectors, particularly for less prevalent indications, are boosting the market segment. For instance, in February 2024, Tyber Medical LLC, an orthopedic device company, received Health Canada clearance for the anatomical plating system in Canada.

The biodegradable segment in the market is anticipated to register a significant CAGR from 2024 to 2030. Biodegradable osteosynthesis systems, composed of degradable polymers, could reduce the need to remove osteosynthesis systems. Factors such as ongoing clinical trials and studies and a growing number of product approvals drive the market growth. For instance, in March 2023, Bioretec Ltd, a man ufacturer of bioresorbable orthopedic devices, received U.S. FDA approval for its RemeOs trauma screw to be used for healing of bone fractures. Thus, such factors boost the segment growth.

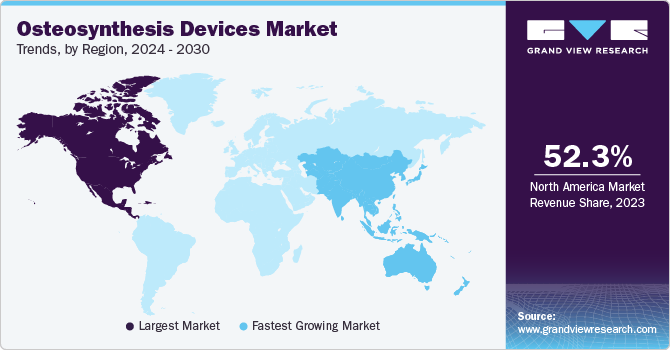

Regional Insights

North America osteosynthesis devices market dominated and accounted for the largest revenue share of 52.3% in 2023, owing to significant government initiatives, new product releases, substantial R&D expenditures, and the growing prevalence of osteoporosis fueling the market growth. For instance, according to the government of Canada, around 2.5 million Canadians aged 40 and above were living with diagnosed osteoporosis in 2020, and 81% of those were women.

U.S. Osteosynthesis Devices Market Trends

The U.S. osteosynthesis devices market held the largest revenue share in 2023. Factors such as the increased prevalence of orthopedics, rising technological advancements, and the growing number of joint surgical procedures boost market growth in the U.S. Furthermore, a strong distribution network and a well-established healthcare infrastructure in the country fuel market growth. For instance, in March 2022, Life Spine, a U.S.-based medical device company, received U.S. FDA clearance for its SImpact Si Joint Fixation System for Posterior-Oblique approaches.

Europe Osteosynthesis Devices Market Trends

Europe osteosynthesis devices market is anticipated to register a significant growth rate during the forecast period. The region's strong focus on research and development enables continuous innovation in osteosynthesis devices, enhancing patient outcomes and product efficacy. Moreover, favorable healthcare policies and structured regulatory frameworks ensure the quality and safety of osteosynthesis devices, thereby increasing their demand among the population

The osteosynthesis devices market in Germany is anticipated to register the fastest growth rate during the forecast period. The growing incidence of road accidents in the country leads to a rise in orthopedic injuries, further increasing the demand for osteosynthesis devices. For instance, in February 2023, according to Statistisches Bundesamt (Destatis), around 21,600 people were injured in road traffic accidents in Germany.

The UK osteosynthesis devices market is anticipated to register a considerable growth rate during the forecast period. Factors such as a rise in trauma and fracture cases, the introduction of biodegradable and internal fixation devices, and a surge in sports-related injuries are fostering market growth. The UK's National Health Service (NHS) supports initiatives aimed at improving access to advanced orthopedic care. Increased healthcare expenditure and initiatives to reduce waiting times for surgeries further support market growth.

Asia Pacific Osteosynthesis Devices Market Trends

The osteosynthesis devices market in the Asia Pacific is anticipated to register the fastest growth rate during the forecast period, owing to the increased R&D activities in this region. Moreover, growing strategic initiatives by market players are propelling regional market growth. For instance, in July 2023, Zimmer acquired OSSIS to gain access to engineering proficiency and clinical experience and to provide innovative med-tech technologies to its patients across various regions, including Asia Pacific.

Japan osteosynthesis devices market is anticipated to register a considerable growth rate during the forecast period.Factors such as advanced healthcare systems, with a strong focus on innovation and technological advancements, boost market growth. Furthermore, the growing prevalence of osteoporosis and the rise in hip fractures fuel the market growth. For instance, according to the Global Fragility Fracture Network, an estimated 13 million individuals live with osteoporosis, and 240,000 patients experience a hip fracture annually due to osteoporosis in Japan.

Latin America Osteosynthesis Devices Market Trends

The osteosynthesis devices market in the Latin America is anticipated to register a considerable growth rate during the forecast period owing to factors such as the growing aging population with a high risk of osteoporosis, technological advancements in osteosynthesis devices, and rising incidence of osteoarthritis. Furthermore, modern fixation technologies have replaced traditional surgical techniques in the osteosynthesis devices market, which is expected to drive the region’s market.

Brazil osteosynthesis devices market is anticipated to register a considerable growth rate during the forecast period. The country's increasing emphasis on sports and physical activity drives market growth. For instance, according to a study published in NIH in July 2023, out of 41 athletes who played for the team during the analyzed period, 12 suffered from 28 injuries, and 38 reported a total of 402 complaints. Such rising cases of injuries fuel market growth.

Middle East & Africa Osteosynthesis Devices Market Trends

The osteosynthesis devices market in the Middle East and Africa is anticipated to register a lucrative growth rate during the forecast period. The rising incidence of orthopedic conditions such as osteoporosis and osteoarthritis due to factors such as obesity, sedentary lifestyles, and an aging population is driving the market growth.

South Africa osteosynthesis devices market is anticipated to register a considerable growth rate during the forecast period. The country's aging population and a high prevalence of osteoporosis are fostering market growth. Furthermore, improving the healthcare system and growing investments in medical technology enable better access to osteosynthesis devices, supplementing market growth.

Key Osteosynthesis Devices Company Insights

Key participants in the market are focusing on developing innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Osteosynthesis Devices Companies:

The following are the leading companies in the fumaric acid market. These companies collectively hold the largest market share and dictate industry trends.

- DePuy Synthes (Johnson & Johnson)

- Stryker

- Zimmer Biomet

- Smith+Nephew

- GS Medical

- Life Spine, Inc.

- MicroPort Orthopedics, Inc

- Precision Spine, Inc

- Globus Medical

- Arthrex

- Medtronic

- Olympus Corporation

- Lepu Medical Technology (Beijing) Co. Ltd.

Recent Developments

-

In August 2024, SI-BONE, Inc., a medical device company, received clearance for its iFuse TORQ TNT Implant System (TNT) from U.S. FDA 510(k). This is the next-generation technology for sacroiliac joint fusion and pelvic fragility fracture fixation.

-

In March 2024, Stryker, a MedTech company, launched the Gamma4 Hip Fracture Nailing System in the European markets to treat femur and hip fractures.

Osteosynthesis Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.66 billion

Revenue forecast in 2030

USD 17.20 billion

Growth rate

CAGR of 8.30% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, fracture, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DePuy Synthes (Johnson & Johnson); Stryker, Zimmer Biomet; Smith+Nephew; GS Medical; Life Spine, Inc.; MicroPort Orthopedics, Inc; Precision Spine, Inc; Globus Medical; Arthrex; Medtronic; Olympus Corporation; Lepu Medical Technology (Beijing) Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Osteosynthesis Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global osteosynthesis devices market report based on the type, material, fracture and region:

-

Type Outlook (Revenue USD Million, 2018 - 2030)

-

Internal

-

Screws & Plates

-

Wires &pins

-

Intramedullary rods and nails

-

Spinal fixation devices

-

-

External

-

Fracture fixation

-

Bone lengthening

-

-

-

Material Outlook (Revenue USD Million, 2018 - 2030)

-

Degradable

-

Nondegradable

-

-

Fracture Outlook (Revenue USD Million, 2018 - 2030)

-

Skull

-

Facial bones

-

Sternum or one or more ribs, or both

-

Clavicle, scapula, or humerus

-

Radius or ulna, or both

-

Hand, wrist, or other distal part of hand

-

Vertebral column

-

Pelvis

-

Hip

-

Femur, other than femoral neck

-

Patella, tibia or fibula, or ankle

-

Foot bones except ankle

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global osteosynthesis devices market size was estimated at USD 9.91 billion in 2023 and is expected to reach USD 10.66 billion in 2024.

b. The global osteosynthesis devices market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 17.2 billion by 2030.

b. North America dominated the osteosynthesis devices market with a share of 52.3% in 2023. This is attributable to significant government efforts, new product releases, and substantial R&D expenditures. Increasing healthcare expenditures and the concentration of the major orthopaedic device market in the U.S.

b. Some key players operating in the osteosynthesis devices market include DePuy Synthes, Inc. (J & J Company), Stryker, Zimmer Biomet Inc., Smith & Nephew, GS Medical LLC, Life Spine, Inc., MicroPort Orthopedics, Inc, Precision Spine, Inc, Globus Medical, Inc., Arthrex.

b. Key factors driving the market growth include rising cases of osteoporosis for men and women worldwide, the high prevalence of traumatic incidents such as road traffic injuries and sporting injuries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.