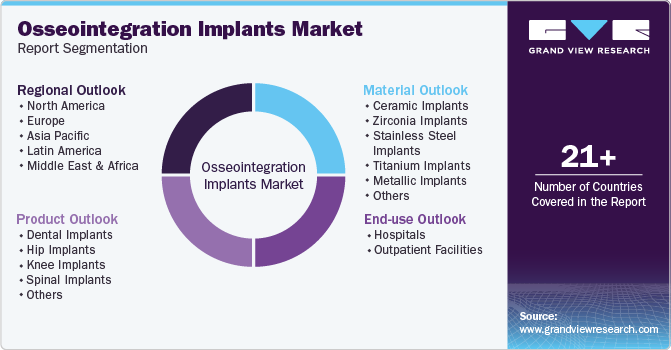

Osseointegration Implants Market Size, Share & Trends Analysis Report By Product (Dental, Hip, Knee, Spinal), By Material (Ceramic, Zirconia, Stainless Steel, Titanium), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-466-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Osseointegration Implants Market Trends

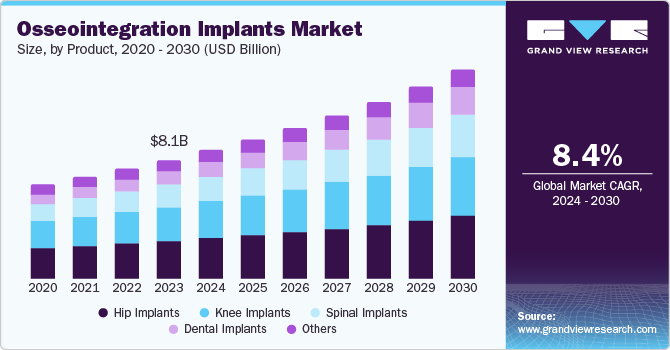

The global osseointegration implants market size was valued at USD 8.10 billion in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. This growth is driven by the increasing prevalence of orthopedic conditions and dental disorders, which necessitate the use of implants for effective treatment. In addition, the rising awareness and acceptance of dental and orthopedic implants among patients and healthcare providers further boost market expansion.

The growing number of trauma cases and sports injuries coupled with the increasing adoption of minimally invasive surgical procedures contribute to the rising demand for osseointegration implants. Moreover, favorable reimbursement policies and the expansion of healthcare infrastructure in emerging economies are expected to support market growth over the forecast period.

The aging population, particularly in developed regions, significantly contributes to the demand for osseointegration implants, as older adults are more prone to conditions such as osteoporosis and dental issues such as cavities, gum diseases, and missing teeth. Consequently, there is a rise in the demand for dental implants due to their effectiveness and long-term benefits. Advancements in new implant materials and designs have enhanced the success rates of osseointegration and reduced the risk of implant failure. Companies are producing implants with various metals such as stainless steel, zirconia, titanium, ceramic, and more to increase their market penetration.

Technological advancements in implant materials and design, which enhance implant success rates and longevity, also play a crucial role in market growth. Digital technologies such as CAD/CAM systems and cone-beam CT scanners have improved the accuracy and precision of implant placement, decreasing the likelihood of complications and implant failure. Additionally, rising reimbursement rates for implant procedures from insurance companies and government healthcare programs have made implant treatment more accessible and economical for patients.

Product Insights

The hip implants segment dominated the market in 2023 with a share of 31.3% in 2023 attributed to several factors, including the rising prevalence of osteoarthritis and other degenerative joint diseases, which are particularly common among the aging population. The increasing number of hip replacement surgeries, driven by advancements in surgical techniques and implant materials, has also contributed to the growth of this segment. Additionally, the growing awareness about the benefits of hip implants, such as improved mobility and quality of life, has led to a higher adoption rate.

The dental implants segment is expected to grow at a CAGR of 11.0% over the forecast period. This growth can be attributed to the increasing demand for dental prosthetics and the rising prevalence of dental disorders, such as tooth decay and periodontal diseases. The advancements in dental implant technology, including the development of more biocompatible materials and the use of digital imaging for precise implant placement, have significantly improved the success rates of dental implant procedures. Moreover, the growing aesthetic consciousness among individuals and the increasing disposable income in emerging economies are driving the demand for dental implants. The market is also benefiting from the expanding geriatric population, which is more susceptible to tooth loss and requires dental implants for oral rehabilitation.

Material Insights

The metallic implants segment dominated the market in 2023 due to the widespread use of metals such as titanium, stainless steel, and cobalt-chromium alloys in various types of implants, including orthopedic, dental, and spinal implants. Titanium, in particular, is highly favored for its excellent biocompatibility, strength, and resistance to corrosion, making it ideal for long-term implantation. The high prevalence of orthopedic conditions, such as osteoarthritis and rheumatoid arthritis, has driven the demand for metallic implants, especially in joint replacement surgeries. Additionally, the increasing number of trauma cases and sports injuries has further fueled the market growth.

The ceramic implants segment is projected to grow at the fastest CAGR during the forecast period. This rapid growth can be attributed to the unique advantages offered by ceramic materials, such as zirconia and alumina, which include superior biocompatibility, high wear resistance, and minimal risk of allergic reactions. Ceramic implants are particularly popular in dental and orthopedic applications due to their aesthetic appeal and ability to integrate well with bone tissue. The increasing demand for minimally invasive surgical procedures and the growing awareness about the benefits of ceramic implants are key factors driving this segment’s growth. Furthermore, technological advancements in ceramic materials and manufacturing processes have improved the durability and performance of these implants, making them a viable alternative to metallic implants.

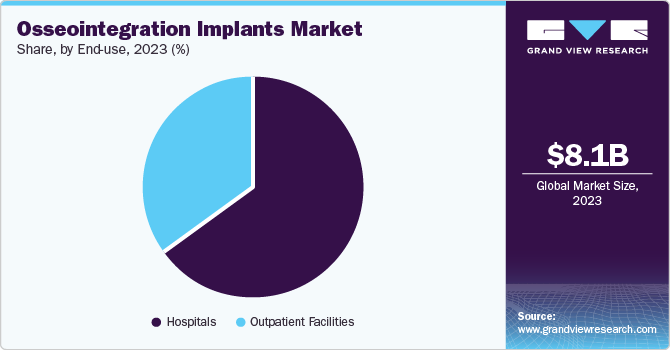

End-use Insights

The hospitals segment dominated the market with a revenue share of 65.4% in 2023 primarily due to the comprehensive range of services that hospitals offer, including complex surgical procedures and post-operative care, which are essential for the successful integration of osseointegration implants. Hospitals are equipped with advanced medical technologies and staffed by specialized healthcare professionals, making them the preferred choice for patients undergoing implant surgeries.

The outpatient facilities segment is expected to grow at a CAGR of 8.2% over the forecast period. This growth is driven by the rising preference for minimally invasive procedures and the increasing availability of advanced medical technologies in outpatient settings. Outpatient facilities, including ambulatory surgical centers and specialized clinics, offer several advantages, such as reduced hospital stays, lower costs, and quicker recovery times, which are appealing to both patients and healthcare providers. The shift towards outpatient care is also supported by advancements in surgical techniques and anesthesia, which allow for safe and effective procedures outside of traditional hospital settings. Furthermore, the growing emphasis on patient convenience and the expansion of healthcare services in emerging economies are expected to boost the demand for osseointegration implants in outpatient facilities.

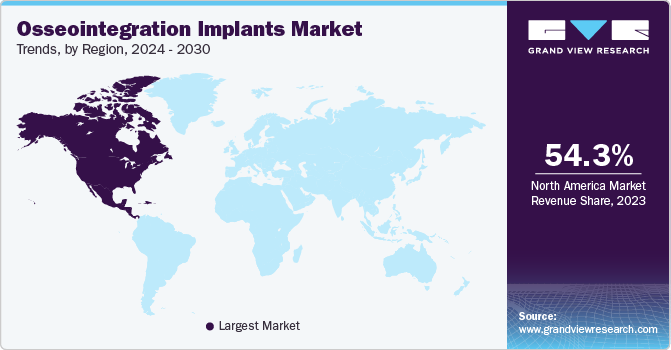

Regional Insights

The North America osseointegration implants market held the largest revenue share of 54.3% in 2023 attributed to the increasing geriatric population and the presence of major companies manufacturing osseointegration implants in the region. The developed healthcare infrastructure, equipped with technologically advanced equipment, has facilitated a rise in the number of implant surgeries. Additionally, there is growing awareness regarding cosmetic and joint implant surgeries. Furthermore, the increase in disposable income has led to a higher number of patients seeking implant surgeries. These factors collectively contribute to the market growth in this region.

U.S. Osseointegration Implants Market Trends

The U.S. osseointegration implants market held a revenue share of 89.3% in North America due to the presence of a developed healthcare infrastructure and an increasing geriatric population opting for joint replacement surgeries. Favorable reimbursement policies and the presence of key manufacturing companies also support market growth. Additionally, the rise in disposable income has resulted in an increase in the number of patients opting for implant surgeries.

Europe Osseointegration Implants Market Trends

Europe was identified as a lucrative region for osseointegration implants industry in 2023. This growth is attributed to the expanding healthcare sector and the rising geriatric population opting for joint replacement surgeries. Increased awareness regarding the availability of implants that can improve patient functionality has led to a higher number of patients undergoing implant surgeries. Furthermore, favorable reimbursement policies and the easy availability of healthcare facilities have supported market growth in this region.

The UK osseointegration implants market is expected to grow rapidly due to the presence of major healthcare institutions and key companies manufacturing technologically advanced implants to meet patient demands. There is an increase in patients suffering from dental issues such as gum infections and tooth loss, leading to a higher number of patients opting for dental implant surgeries.

Asia Pacific Osseointegration Implants Market Trends

Asia Pacific accounted for a revenue share of 12.2% in 2023 attributed to the expansion of the healthcare sector and the increasing population in countries such as China, Japan, and India. The growing geriatric population and the rising need for implant surgeries have led to increased demand for effective and durable implants. Major companies are targeting developing countries in this region to boost their sales of osseointegration implants.

China dominated the osseointegration implants market in 2023. The factors driving market growth in the country include population growth and the expansion of the healthcare sector. The presence of a developed manufacturing sector enables companies to produce technologically advanced and cost-effective implants. Additionally, rising disposable income has led to increased sales of osseointegration implants as patients seek better solutions for their physical issues.

Key Osseointegration Implants Company Insights

Some of the major companies in the osseointegration implants market are Medtronic, Stryker, Smith+Nephew, Zimmer Biomet, and others. Companies are focusing on improving their market position and product quality through product innovation, mergers and acquisitions, collaborations, and more.

-

Smith+Nephew is a medical technology company specializing in products that aid in the repair, regeneration, and replacement of soft and hard tissues. The company also deals with the manufacturing and sale of advanced wound management products, arthroscopy products, orthopedic products, and more.

-

Dentsply Sirona is a manufacturer of professional dental products and technologies. The company specializes in the manufacturing and sale of laboratory and specialty products related to dental supplies.

Key Osseointegration Implants Companies:

The following are the leading companies in the osseointegration implants market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker

- Smith+Nephew

- Zimmer Biomet

- Institut Straumann AG

- CONMED Corporation

- Integrum Energy Pvt. Ltd.

- Dentsply Sirona.

- CAMLOG Biotechnologies GmbH

- OSSTEM IMPLANT CO., LTD.

Recent Developments

-

In November 2023, Keystone Dental Holdings introduced the GENESIS ACTIVE Implant System. This cutting-edge surgical solution is anticipated to revolutionize the approach to dental implant placement and restoration within the industry.

-

In March 2023, Dentsply Sirona introduced the DS OmniTaper Implant System, a versatile solution designed for broad clinical applications. The system incorporates an intuitive drilling protocol to optimize procedural efficiency and a pre-mounted TempBase component to facilitate immediate restoration, streamlining overall workflow.

-

In May 2023, Zimmer Biomet Holdings Inc. completed the acquisition of Ossis, a medical device company specializing in personalized 3D-printed hip replacement implants. This strategic move follows a previous partnership where Ossis served as Zimmer Biomet's Asia Pacific collaborator for hip and pelvic replacement solutions.

Osseointegration Implants Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.76 billion |

|

Revenue forecast in 2030 |

USD 14.24 billion |

|

Growth Rate |

CAGR of 8.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, Material, End Use, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Medtronic, Stryker, Smith+Nephew, Zimmer Biomet, Institut Straumann AG, CONMED Corporation, Integrum Energy Pvt. Ltd., Dentsply Sirona., CAMLOG Biotechnologies GmbH, OSSTEM IMPLANT CO., LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Osseointegration Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Osseointegration implants market report based on product, material, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Implants

-

Hip Implants

-

Knee Implants

-

Spinal Implants

-

Others

-

-

Material (Revenue, USD Million, 2018 - 2030)

-

Ceramic Implants

-

Zirconia Implants

-

Stainless Steel Implants

-

Titanium Implants

-

Metallic Implants

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."