- Home

- »

- Medical Devices

- »

-

Orthopedic Surgical Robots Market Size, Share Report, 2030GVR Report cover

![Orthopedic Surgical Robots Market Size, Share & Trends Report]()

Orthopedic Surgical Robots Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Hip, Knee, Spine), By End-use (Inpatient, Outpatient), By Region (North America, Europe, APAC, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-240-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Surgical Robots Market Summary

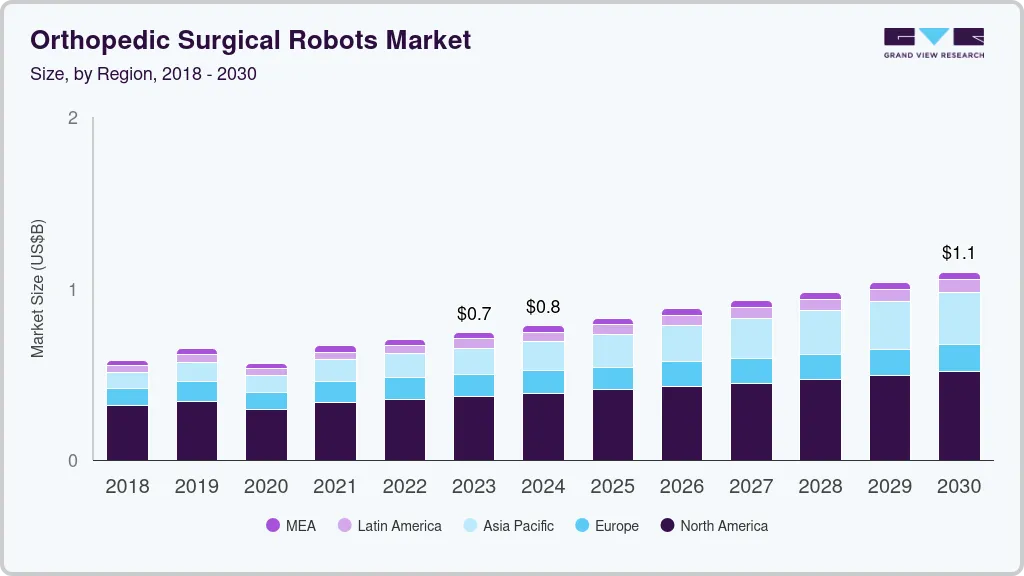

The global orthopedic surgical robots market size was estimated at USD 743.3 million in 2023 and is projected to reach USD 1,093.5 million by 2030, growing at a CAGR of 5.7% from 2024 to 2030. The market growth can be attributed to increasing cases of knee and hip replacement surgeries, new market entrants in the healthcare robotic field, and better improvement in patient outcomes.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2024 to 2030.

- In terms of application, the knee segment accounted for a revenue share of 43.3% in 2023.

- Spine is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 743.3 Million

- 2030 Projected Market Size: USD 1,093.5 Million

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

Moreover, the rising incidence of osteoarthritis in developed countries is leading to a surge in joint replacement surgery. According to data published by the WHO in July 2022, an estimated 1.71 billion people across the globe have musculoskeletal disorders, with 528 million people suffering from osteoarthritis.

Major factors anticipated to drive the market are increasing prevalence of musculoskeletal disorders, such as lower back pain, rheumatoid arthritis, osteoarthritis, & osteoporosis, and increasing market competition. Musculoskeletal disorders account for nearly 70 million physician office visits in the United States annually, and an estimated 130 million total healthcare encounters including outpatient, hospital, and emergency room visits. According to data published by the Australian Bureau of Statistics (ABS) 2020-21 National Health Survey (NHS), around 27.0% people in Australia are estimated to have chronic musculoskeletal conditions including back problems (16%), arthritis (12%), and osteoporosis or osteopenia(3.6).

A recent analysis of Global Burden of Disease (GBD) 2019 data revealed that approximately 1.71 billion people globally live with musculoskeletal conditions, including low back pain, and neck pain. Other factors such as the rising incidence of obesity, leading to increased wear & tear of joints, and a rapidly aging population with increased life expectancy are among factors expected to contribute to the increasing demand for such surgeries, resulting in high demand for surgical robots.

The global orthopedic surgical robots market is expected to witness various changes as major healthcare players are anticipated to enter and challenge the existing market leader. For instance, in November 2023, Monogram Orthopedics announced the first delivery of its mBôs surgical robot to one of the largest global robotics distributors. This step aims to adopt the next wave of robotics in orthopedics by combining ease of use, safety, broad clinical functionality, cost, and novel implant design. Similarly, in June 2021, PROCEPT BioRobitics Corporation raised funding of USD 85 million in a Series G round. The company would utilize the funding in strategizing the global commercial expansion of their product—AquaBeam Robotic System. This latest funding is in addition to the existing USD 348.8 million funding raised by Cambridge Innovation Capital. The financing is aimed at accelerating the availability of Versius in hospitals across the globe while providing full flexibility for achieving its goals

The postoperative functional outcome for patients is one of the significant drivers of orthopedic surgical robots market. Orthopedic robotic surgery supports surgeons in performing complicated procedures with greater flexibility, precision, and control as compared to conventional surgeries. Moreover, according to a study published in Cureus journal, robotic systems such as MAKO, NAVIO, Stryker Mako Total Hip Arthroplasty, and Robotic Arm have transformed the space of orthopedic surgery for patients as well as for surgeons. It provides advanced imaging and real-time feedback assistance to surgeons in precise bone preparation and implant positioning. This results in efficient alignment and joint function

Market Concentration & Characteristics

Market growth stage is medium, and the pace of market growth is accelerating. The orthopedic surgical robot market is highly concentrated due to high degree of innovation, moderate level of merger and acquisition activities, impact of regulations and regional expansion

The orthopedic surgical robot market is characterized by a high degree of innovation owing to advancements in technology and active participation of key companies in competition. For instance, in February 2024, Stryker introduced Triathlon Hinge at American Academy of Orthopedic Surgeons (AAOS) 2024 Annual meeting, Triathlon Hinge is latest and significant advancement for complex cases of bone loss or soft tissue disabilities in revision patients. This innovation will reduce procedural steps, streamline the workflow and instrumentation, thereby providing an efficient surgical suite. Such innovation and technological advances are anticipated to significantly increase the demand for orthopedic surgical robot market over the forecast period.

The merger and acquisition activities are likely to expand the manufacturing capabilities and strategic perspective of the key companies in the orthopedic surgical robot market. For instance, in January 2022, Stryker along with Nephew acquired Engage Surgical, which is involved in the manufacturing of cement-less knee system in the U.S. This acquisition improved its position in meniscal tear solutions and other knee arthroscopy devices. Such acquisition expands product exposure to various regions and consumers, thereby increasing the growth in the market.

Orthopedic surgical robot market key players leverage strategies such as collaborations, partnerships, and acquisitions, to promote the reach of their offerings and increase their product capabilities worldwide For instance, In January 2021, Smith & Nephew completed the acquisition of Extremity Orthopedics business from Integra LifeSciences Holdings Corporation for USD 240 million. This acquisition would strengthen Smith & Nephew’s extremities business and provide the company with a robust product pipeline.

The regulatory approvals play a significant role on the orthopedic surgical market. These regulatory approvals further drive the growth of the market and boost their product expansion. Surgical robots are often referred to as robotic-assisted surgery devices, approved by the U.S. FDA and EU & CEA in Europe. Surgical robots are classified into either Class II or Class III as per the FDA based on the risks possessed to the patient. For instance, in September 2022, Point Robotics Medtech Inc. became the first robotics company which receive U.S. FDA approval for an orthopedic surgical robot.

Orthopedic surgical robot manufacturing companies aim to focus on the expansion of products to extend their consumer engagement and geographical exposure. For instance, in October 2022, Medtronic announced its regional expansion in three global markets as well as indication expansion approvals for its Hugo TM robotic-assisted surgery (RAS) system. This expansion would offer access to RAS to patients across Europe, North America, and Asia.

Applications Insights

The knee segment dominated orthopedic surgical robots market with the largest share of 43.3% in 2023. This growth can be attributed to the increasing prevalence of osteoarthritis and rising patient preference for robotic surgery due to its greater efficiency and availability in the market, which is estimated to accelerate segment growth during the forecast period. For instance, according to a WHO study, around 344 million are suffering from osteoarthritis worldwide. Among them, the knee is the most frequently affected joint followed by the hip and hand due to osteoarthritis.

The spine segment of the orthopedic surgical robot market is anticipated to witness growth with the fastest growth rate from 2024 to 2030. The increasing prevalence of spinal cord is likely to boost the market. According to a study released by NCBI in October 2022, the prevalence of Adult Spinal Deformities (ASD) is approximately 68.0% among the elderly population. Common causes of spinal fusion injury include trauma, falls, collisions, and road traffic accidents. The American Association for the Surgery of Trauma reports that over 3 million nonfatal injuries are documented in the U.S. annually. It is expected that the rise in trauma incidents will fuel market growth throughout the forecast period.

End-use Insights

Based on the end-use, the inpatient facilities dominated the market with the largest revenue share of 53.2% in 2023. Inpatient facilities such as hospitals usually have financial means and a substantial patient flow to invest in expensive surgical robotic systems. Additionally, availability of good infrastructure and proficient staff required for the operation and upkeep of these advanced technologies drive the growth of inpatient segment. The reputation and credibility of hospitals are substantial factors that draw both patients and surgeons towards robotic-assisted surgeries. Additionally, surgeons and healthcare professionals in hospital settings are progressively adopting and incorporating surgical robots into their practices to improve patient care.

The outpatient segment is expected to expand with a faster CAGR from 2024 to 2030 due to efficient and accessible outpatient services. Outpatient settings such as Ambulatory Surgical Centers (ASCs) and surgical centers are witnessing a significant increase in the demand for robotic-assisted procedures. These facilities are leveraging surgical robots to provide patients with minimally invasive and precise surgeries, resulting in faster recovery times and lower healthcare expenses.

Regional Insights

North America orthopedic surgical robots market dominated in 2023 with a revenue share of 49.9% due to its highly efficient healthcare infrastructure and aged population. Major drivers of the market include improvements in surgeries and healthcare facilities for various disorders. Higher favorable outcomes as compared to open surgeries and shorter periods of hospitalization & recovery for children are boosting the demand for robotic-assisted surgeries, which is expectedto boost market growth. Furthermore, improvements in the miniaturization of instruments are likely toallow optimal working conditions in limited space, which is expected to fuel market growth.

U.S. Orthopedic Surgical Robots Market Trends

The orthopedic surgical robots market in U.S. is expected to grow at a CAGR of 5.2% over the forecast period. Increasing disease awareness, rising R&D for novel therapeutics, and the growing prevalence of the orthopedic surgical robot market are some of the key factors propelling market growth. Moreover, the rising adoption of surgical robots in the country can be attributed to increasing awareness of the benefits provided by robotic-assisted surgery, technological advancements in the field, and the growing allocation of funding for medical robot research. These factors collectively contribute to the growth of the market.

Canada orthopedic surgical robots market is projected to grow with the second-fastest CAGR from 2024 to 2030. Various factors contributing to market growth in the country include the presence of key market players in the country and the increasing usage of surgical robots in orthopedics. Canada's proximity to the U.S. and shared regulatory framework have attracted many U.S. players to enter its medical device market. Additionally, the da Vinci System from Intuitive Surgical has garnered widespread adoption in Canada, particularly in orthopedics, establishing a dominant position in the market

Europe Orthopedic Surgical Robots Market Trends

The orthopedic surgical robots market in Europe is expected to expand with a significant CAGR rate over the forecast years. The presence of a well-established healthcare infrastructure and favorable reimbursement policies that alleviate patients' out-of-pocket expenses are significant factors driving market growth. Moreover, continued research on robotics in the region is anticipated to drive further market expansion in the forecast period.

UK orthopedic surgical robots market is estimated to witness the growth in European market from 2024 to 2030. In the UK, healthcare is mainly funded by the government through the National Health Service (NHS), providing comprehensive medical services to all residents at no direct cost to patients. Robotic surgery services in the UK are growing due to technological advancements, rising demand for minimally invasive procedures, and their benefits for patients such as improved outcomes and quicker recovery

The orthopedic surgical robots market in France is projected to expand with the fastest CAGR of 3.3 % over the forecast period. The growth is driven by rising adoption of surgical robots, fueled by awareness of their benefits, technological advancements, and increased funding for medical robot research. Collaborations among key companies further meet market demands. For instance, in April 2022, two French companies namely eCential Robotics and Amplitude Surgical announced a partnership to expand the knee robotic surgery sector. Following this collaboration, eCential robotics will allow the complete utilization of Amplitude Surgical's solutions' specific features in surgical navigation and orthopedic implants, ultimately enhancing the quality of surgery provided to patients.

Germany orthopedic surgical robots market dominated the largest share of the European market in 2023, This is mainly driven by the existence of high-quality healthcare infrastructure, and favorable reimbursement policies are anticipated to be significant drivers for this market. As per World Bank healthcare expenditure as total (% of GDP) estimates, Germany allocates nearly 12.7% of GDP toward healthcare expenditure in 2022.

Asia Pacific Orthopedic Surgical Robots Market Trends

Asia Pacific orthopedic surgical robot market is anticipated to witness significant growth with the fastest CAGR of 10 % during the forecast years owing to high GDP growth over the coming years, mainly led by growth in China and Japan. Government initiatives promoting the adoption of technologically advanced medical devices are a key driver of the orthopedic surgical robot market.

The orthopedic surgical robots market in China is estimated to grow at the fastest CAGR from 2024 to 2030. China's significant demographic of individuals aged 65 or older, comprising 12% of the population, is contributing to a steady rise in daily surgeries within the region. The rising geriatric population, prone to orthopedic ailments, is projected to drive the adoption of robotic-assisted surgeries in the forecast period. Furthermore, regulatory approvals from government bodies are fueling additional growth in the market. For instance, in July 2023, Beijing Tinavi Medical Technologies Co. Ltd.'s surgical robot obtained approval from China's National Medical Products Administration (NMPA). This would help in performing total knee replacement surgeries, broadening its product range to include spine, trauma, and joints in orthopedic surgery.

Japan orthopedic surgical robots market is expected to grow with a CAGR of 9.7% over the forecast period. The growth is driven by notable advancements in surgical robotics aimed at introducing more cost-effective robots in the country. Continued progress in developing highly sophisticated robotic surgical systems has led to increased utilization for medical procedures. For instance, in February 2022, Smith along with Nephew announced the launch of the Cori surgical robot for knee replacements in Japan. Cori comprises 3D intraoperative imaging and a robotic milling tool to sculpt the bone and preserve a patient's anatomy and digitally automate measurements and surgical plans for each patient.

Middle East & Africa Orthopedic Surgical Robots Market Trends

Middle East & Africa orthopedic surgical robot market is growing due to the high economic development and improved healthcare facilities. Economic development and the presence of high unmet medical needs in emerging economies, such as South Africa, are primary factors driving market growth.

The orthopedic surgical robots market in Saudi Arabiais expected to grow at a lucrative rate over the forecast period. Factors such as enhanced healthcare infrastructure, rapid technological advancements, and a rising prevalence of chronic diseases driving an increase in surgical procedures contribute to the growth of the orthopedic surgical robots market in the country. Additionally, increasing awareness, a focus on timely disease management, and rapid technological advancements are driving demand for surgical robots to enhance the quality of surgical procedures. For instance, in February 2024, Sheikh Shakhbout Medical City (SSMC), a collaboration between Abu Dhabi Health Services Company (SEHA) and Mayo Clinic, announced the successful deployment of advanced robotic technology for performing complex surgical procedures in patients. This surgical intervention targeted chronic knee pain and a spectrum of osteoarthritic conditions, taking into account the distinctive motion and structure of the knee.

Key Orthopedic Surgical Robots Company Insights

Some key companies operating in the orthopedic surgical robots market include Medtronic PLC, Stryker Corporation, Smith&Nephew, Intuitive Surgical, Inc., and Zimmer Biomet. These companies are collaborating with regional players to expand their services geographically.

Moreover, several orthopedic surgical robot companies are actively involved in innovation, M&A activities, and strategic initiatives to fulfill the market demand and improve outcomes for patients.

Key Orthopedic Surgical Robots Companies:

The following are the leading companies in the orthopedic surgical robots market. These companies collectively hold the largest market share and dictate industry trends.

- Medrobotics Corporation

- Medtronic

- Renishaw plc

- Smith and Nephew

- Stryker Corporation

- THINK Surgical, Inc.

- Transenterix (Asensus Surgical, Inc.)

- Zimmer Biomet

- Accuray Incorporated

- Globus Medical

- Auris Health Inc.

- Johnson & Johnson Services Inc.

- Nordson Corporation

- OMNILife science Inc.

- Intuitive Surgical

- Wright Medical Group N

- Medrobotics Corporation

Recent Developments

-

In February 2024, THINK Surgical announced the collaboration with Maxx Orthopedics. Under this collaboration, Think Surgical will add Maxx Orthopedic implants with the TMINITM Miniature Robotic system. This collaboration aims to provide an open platform for orthopedic surgical robots to support implants.

-

In November 2023, Monogram Orthopaedics Inc. announced delivery of its first surgical robot to the global market. This Monogram aims to improve orthopedic joint replacement surgery with advanced, next-generation surgical robots.

-

In August 2023, Stryker launched a direct patient marketing campaign. This campaign aimed at enhancing patient engagement and education, reaching patients directly, and providing information about Stryker's innovative medical solutions, with a focus on joint replacement procedures. By fostering better patient understanding & awareness, Stryker aims to empower individuals to make informed decisions about their healthcare, ultimately improving their overall experience and outcomes

-

In May 2022, Medtronic manufactured Hugo's robotic-assisted surgery (RAS) system and won the “Medical Device Innovation Award” in the 2022 MedTech Breakthrough Awards Program. Hugo RAS system is a modern, multi-quadrant platform for soft-tissue procedures.

Orthopedic Surgical Robots Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 782.3 million

Revenue forecast in 2030

USD 1.09 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America: Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medrobotics Corporation; Medtronic; Renishaw plc; Smith and Nephew; Stryker Corporation; THINK Surgical, Inc.; Transenterix (Asensus Surgical, Inc.); Zimmer Biomet; Accuray Incorporated; Globus Medical; Auris Health Inc.; Johnson & Johnson Services Inc.; Nordson Corporation; OMNILife science Inc.; Intuitive Surgical; Wright Medical Group N

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Surgical Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthopedic surgical robots market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hip

-

Knee

-

Spine

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient

-

Outpatient

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia-Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic surgical robots market size was estimated at USD 743.2 million in 2023 and is expected to reach USD 782.3 million in 2024.

b. The global orthopedic surgical robots market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 1.09 billion by 2030.

b. North America dominated the orthopedic surgical robots market with a share of 49.9% in 2023. This is attributable to the increasing number of hospitals that are opting for robot-assisted surgeries, high healthcare spending by the U.S. government, and growing robotic investments in the region.

b. Some key players operating in the orthopedic surgical robots market include Smith & Nephew; Medrobotics; TransEnterix Surgical, Inc.; Intuitive Surgical; Renishaw plc; Medtronic; Stryker Corporation; Zimmer Biomet and THINK Surgical, Inc., and others.

b. Key factors that are driving the market growth include growing prevalence of bone degenerative diseases and rising number of hip & knee replacement surgeries due to increasing cases of arthritis & osteoporosis are anticipated to drive growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.