Orthopedic Splints Market Size, Share & Trends Analysis Report By Product (Fiberglass Splints, Plastic Splints), By Application (Lower Extremity, Upper Extremity), By End-use (Hospitals), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-585-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Orthopedic Splints Market Size & Trends

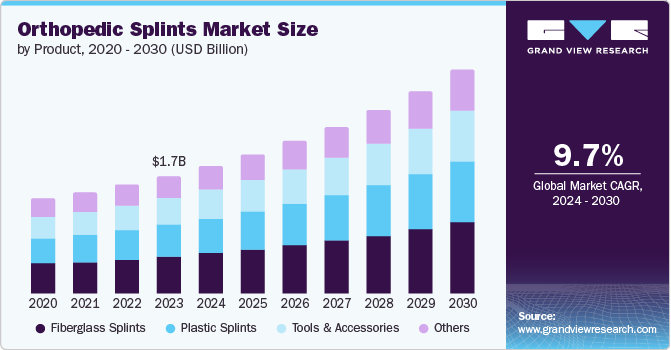

The global orthopedic splints market size was valued at USD 1.69 billion in 2023 and is expected to grow at a CAGR of 9.7% from 2024 to 2030. The aging population and an increase in bone fracture cases are predicted to fuel market expansion. Moreover, an increase in the prevalence of musculoskeletal illnesses is also expected to fuel market expansion. The emergence of new innovations used to make splints in the form of devices such as 3D-printed splints offers an effective and comfortable fit for patients. These high-technology splints fit well, offer support, and allows the limbs to be put through the correct range of motion that speeds up the healing process. Furthermore, lightweight and durable materials such as carbon fiber and thermoplastics are having a positive effect on the overall patient care experience, which is anticipated to drive the market growth.

There is a substantial rise in the healthcare infrastructure particularly in the emerging economies. The government and private organizations in countries such as India, China and Brazil are investing in healthcare infrastructures. This development comprises the construction of new hospitals, clinics, and rehabilitation centers; which helps in the demand of orthopedic splints.

The growth in sports injuries is another major driver of the orthopedic splints market. Increased participation in sports and physical activity worldwide has led to an increase in fractures, strains and stress injuries. Professional athletes, as well as fitness enthusiasts, are more responsive to such injuries, requiring the use of orthopedic splints for effective healing and recovery.

Product Insights

The fiberglass splints segment accounted for the largest market revenue share of 31.7% in 2023 owing to the clear advantages of fiberglass splints compared to other types of splints. They weigh less, are more porous and durable, and are therefore easy to use. In addition, they are the preferred choice when the injured area needs X-rays during the healing process. Moreover, it is available in several colors, which makes it popular among the younger population.

The plastic splint segment is anticipated to witness a significant CAGR over the forecast period. This is attributable as it is considered as a cheaper option compared to fiberglass and other types of splints. It can also be easily molded into different shapes. Various technological advances and high popularity, especially in rural areas of developing countries, contribute to the growth of the segment.

Application Insights

The lower extremity segment dominated the market and accounted for a share of 55.0% in 2023. This is pertaining to easy availability of these devices and the increase in knee and hip fractures. The lower limb segment is further divided into the hip, knee and ankle and foot. The ankle and foot segment is expected to account for the largest share, while the knee segment is expected to grow at the fastest CAGR during the forecast period.

The upper extremity segment is expected to grow at the fastest CAGR of 9.8% from 2024 to 2030 owing to technological advancements in this segment and the rising incidences of shoulder and neck injuries. The upper limb segment is further divided into the elbow, hand and wrist, shoulder, and neck. The hand and wrist segment is expected to hold the dominant market share due to increasing incidence of wrist fractures.

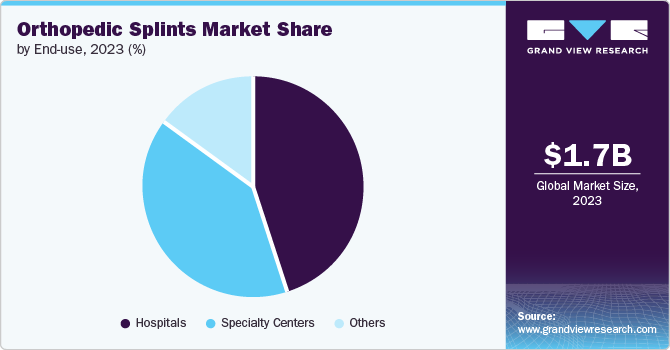

End Use Insights

The hospitals segment dominated the market in 2023 with a revenue share of 44.5%. The growth of the market is driven by the preference of hospitals for potential injuries. This trend is particularly evident in developing economies. Additionally, increasing hospitalizations due to fractures and road traffic injuries are estimated to boost the market growth.

The specialty centers is projected to grow at the fastest CAGR over the forecast period. This is attributable to increased awareness of specialty centers treating fractures and other similar injuries. Other segments include outpatient centers, clinics, trauma centers and sports academies. Also, this segment is expected to grow significantly during the forecast period.

Regional Insights

North America orthopedic splints market dominated the market and accounted for a revenue share of 41.0% in 2023. This is attributable to the increasing prevalence of orthopedic diseases, obesity and geriatric population. According to the Centers for Disease Control and Prevention (CDC), about 26% (or 78 million) of U.S. adults are estimated to suffer from arthritis by 2040.

U.S.Orthopedic Splints MarketTrends

The orthopedic splints market in the U.S. dominated the market with a share of 85.7% in 2023 due to rising sports injuries, a growing elderly population with bone issues, broad healthcare professional and patient adoption, and advancements in splint technology within a strong U.S. healthcare system.

Europe Orthopedic Splints Market Trends

Europe orthopedic splintswas identified as a lucrative region in this industry. Europe's aging population and rising sports injuries mirror the U.S. trends, driving demand for splints. Strong healthcare systems receptive to new technologies make Europe a lucrative market.

Asia Pacific Orthopedic Splints Market Trends

The Asia Pacific region is expected to grow at the fastest CAGR of 11.3% from 2024 to 2030 owing to the high geriatric population in countries, such as China. As a result, there are more incidences of bone fractures, which raises the need for orthopaedic splints. Moreover, Japan makes a substantial contribution because of the country's growing uptake of high-tech products.

Key Orthopedic Splints Company Insights

There is intense competition and market fragmentation on a worldwide scale. Product development and launches, distribution network expansion, and worldwide footprint expansion through partnerships and subsidiaries are just a few of the strategic efforts that market participants carry out.

-

SAM Medical is a company specializing in medical supplies for emergency and pre-hospital situations. Their product line includes splints, slings, tourniquets, and bleeding control kits designed to address fractures, hemorrhaging, and other injuries.

-

Essity Aktiebolag (publ), is a Swedish hygiene and health company. They focus on developing and selling disposable products like tissue paper, baby diapers, and feminine care items. The company also offers wound care and incontinence products under various brands.

Key Orthopedic Splints Companies:

The following are the leading companies in the orthopedic splints market. These companies collectively hold the largest market share and dictate industry trends.

- Essity

- Sam Medical

- 3M

- Otto Bock Healthcare

- DeRoyal Industries Inc.

- Medi GmbH & Co. KG

- Zimmer Biomet

- Stryker Corporation

- Orthosys

- United MedicareBreg, Inc

- Ossur

Recent Developments

-

In June 2024, Zimmer Biomet and THINK Surgical signed a deal to distribute TMINI, a handheld robotic system for knee replacement surgery. This complements Zimmer Biomet's existing ROSA robotic arm system and offers surgeons more choices for knee replacement procedures. Zimmer Biomet plans to launch the customized TMINI system in selected U.S. markets in the latter half of 2024.

-

In April 2024 Zimmer Biomet announced the world's first successful robotic-assisted shoulder replacement surgery using their ROSA Shoulder System. This system is designed to give surgeons more flexibility and precision during shoulder replacements. The ROSA Shoulder System aims to improve patient outcomes and satisfaction.

Orthopedic Splints Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.83 billion |

|

Revenue forecast in 2030 |

USD 3.20 billion |

|

Growth rate |

CAGR of 9.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regions covered |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Essity Aktiebolag (publ).; 3M; Otto Bock Healthcare; DeRoyal Industries Inc.; Zimmer Biomet; Stryker; Orthosys; United Medicare; SAM MEDICAL |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Global Orthopedic Splints Market Report Segmentation

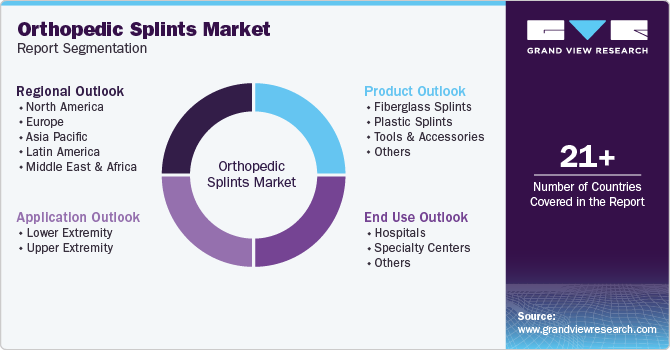

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global orthopedic splints market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiberglass Splints

-

Plastic Splints

-

Tools & Accessories

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Lower Extremity

-

Hip

-

Knee

-

Ankle & Foot

-

-

Upper Extremity

-

Elbow

-

Hand & Wrist

-

Shoulder

-

Neck

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."