- Home

- »

- Medical Devices

- »

-

Orthopedic Power Tools Market Size And Share Report, 2030GVR Report cover

![Orthopedic Power Tools Market Size, Share & Trends Report]()

Orthopedic Power Tools Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Large Bone Orthopedic Power Tools, High-speed Orthopedic Power Tools), By Technology, By Modality (Disposable, Reusable), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-350-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Power Tools Market Trends

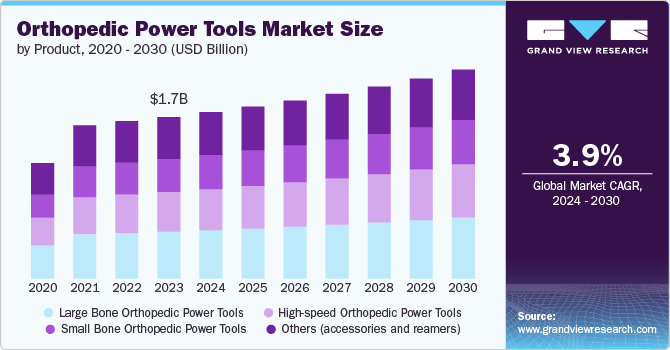

The global orthopedic power tools market size was estimated at USD 1.71 billion in 2023 and is projected to grow at a CAGR of 3.86% from 2024 to 2030. The market is driven by several factors, including the increasing incidence of orthopedic injuries & diseases, the growing geriatric population, advancements in surgical techniques, and the rising demand for minimally invasive procedures. For instance, in January 2024, Paragon 28, Inc. presented the FJ2000 Power Console and Burr System, a solution aimed at revolutionizing ankle and foot surgery. This advanced system enables various non-surgical and open practices in the ankle and foot, leveraging the latest technological advancements to enhance surgical outcomes and patient care.

The orthopedic power tools market is experiencing significant growth due to the increasing volume of orthopedic procedures. The rising incidence of bone deformities & injuries is expected to accelerate the need for diverse surgical interventions, such as kyphoplasty, laminectomies, spinal fusions, spinal decompressions, and discectomy, thereby, driving the need for orthopedic power tools. A study released by the NCBI in May 2022 revealed that approximately half a million individuals worldwide experience spinal cord injuries (SCI) annually, with roughly 17,000 fresh cases documented each year in the U.S. This significant incidence of spinal cord injuries is expected to drive the need for orthopedic instruments capable of delivering precise bone preparation, accurate implant positioning, and effective surgical results.

The orthopedic power tools market is poised for growth, driven by the increasing number of product launches by leading players. These new product introductions are bringing advanced technologies, innovative features, and improved surgical outcomes, attracting healthcare providers' attention and adoption. This trend of continuous innovation and product development is expected to be a key driver for the market during the forecast period. For instance, in March 2023, Arbutus Medical introduced the QuikBow, an advanced wire/pin tensioning device that surpasses traditional Kirschner bows in speed and reliability. The QuikBow is included in Arbutus Medical's TrakPak product, a sterile kit for bedside skeletal traction to enhance the efficiency and dependability of orthopedic procedures.

Product Insights

The large bone power tools segment dominated the market, accounting for 29.03% of the revenue share in 2023. This is driven by the rising incidence of orthopedic disorders, accidents, and sports injuries that necessitate extensive bone procedures, including intramedullary nailing, drilling, total knee/hip replacement, reaming, and driving screws. For instance, the high prevalence of sports-related injuries, with over 3.5 million cases annually among U.S. youth, is a crucial factor contributing to the segment's market leadership.

The high-speed orthopedic power tools segment is the fastest-growing product category within the market. These advanced tools enable surgeons to perform intricate procedures with enhanced precision and efficiency, driving their adoption in complex orthopedic surgeries. The increasing prevalence of sports injuries and the growing demand for minimally invasive surgical techniques are key factors fuelling the growth of this segment.

Technology Insights

The battery-powered systems segment dominated the technology segment of the market with a revenue share of 39.77% in 2023, due to the growing preference among healthcare providers for cordless, portable, and user-friendly power tools. Battery-powered orthopedic tools offer several advantages, including improved mobility during surgical procedures, reduced risk of bacterial contamination compared to pneumatic-powered devices, and lower maintenance costs. For instance, the SPT2100 - Battery Operated Multifunctional System (3G SERIES) from Narang Medical Limited features a hand piece that can drive a variety of quick attachments, easy assembly and disassembly of attachments, 360° rotation, and high-strength stainless steel construction, catering to the needs of healthcare professionals.

The electric-powered systems segment is anticipated to register lucrative growth from 2024 to 2030. These systems are gaining popularity due to their lightweight design, continuous power supply, and lower maintenance costs compared to pneumatic-powered devices. The increasing preference for cordless, portable power tools among healthcare providers is a crucial driver behind the rapid expansion of the electric-powered segment.

Modality Insights

The disposable segment, which holds the largest revenue share under the modality segment in the market and is anticipated to register the fastest growth rate of 3.93% from 2024 to 2030, is driven by several factors. One key driving force responsible for the positive growth of this segment is the increasing demand for single-use devices in orthopedic surgeries due to infection control and patient safety concerns. Disposable tools offer a convenient and hygienic solution that eliminates the need for sterilization between procedures, reducing the risk of cross-contamination. Additionally, advancements in material technology led to the development of disposable tools that are cost-effective, lightweight, and designed for optimal performance, further driving their adoption in orthopedic procedures.

The reusable segment in the orthopedic power tools market refers to a category of power tools designed for multiple uses, offering durability and cost-effectiveness compared to disposable tools. This segment is experiencing rapid growth within the modality segment due to several drivers and instances. One key driver is the increasing demand for sustainable and environment friendly medical devices, leading healthcare facilities to opt for reusable tools that reduce waste generation. Additionally, technological advancements improved the quality and lifespan of reusable orthopedic power tools, making them more attractive to healthcare providers looking for long-term investments.

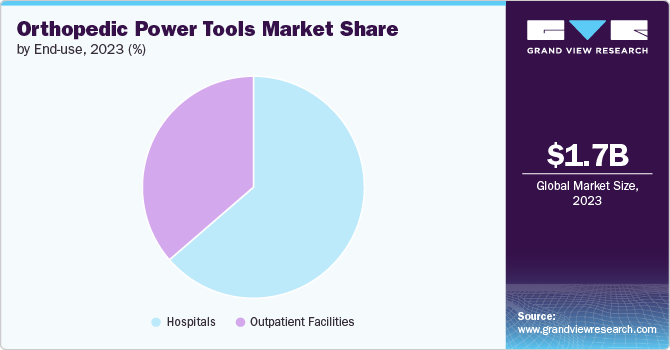

End-use Insights

The hospital segment holds the largest revenue share and is anticipated to register the fastest growth with a CAGR of 4.01% over the forecast period. Firstly, hospitals are major consumers of orthopedic power tools, performing many orthopedic surgeries and procedures daily. Hospital demand for these tools is high because they are essential for various orthopedic interventions such as joint replacements, fracture fixations, and spinal surgeries. Hospitals specialized in orthopedic departments equipped with advanced technologies, including power tools, to provide efficient and precise surgical care to patients.

The outpatient facilities segment is experiencing rapid growth within the market. One significant factor contributing to this growth is the increasing preference for minimally invasive procedures in orthopedic surgeries. Outpatient facilities are well-suited for these procedures as they offer a more convenient and cost-effective alternative to traditional inpatient settings.

Regional Insights

The orthopedic power tools market in North America is driven by the increasing demand for minimally invasive surgeries, which led to the development of advanced power tools that enable surgeons to perform complex procedures with precision and accuracy. The region witnessed significant technological advancements, with companies such as Stryker and DePuy Synthes launching innovative products that cater to the growing demand for orthopedic procedures. For instance, in December 2021, DePuy Synthes, a subsidiary of Johnson & Johnson, introduced the UNIUM System power drill. This new system is designed to cater to the needs of surgeons and medical staff, enhancing their capabilities in performing orthopedic surgeries.

U.S. Orthopedic Power Tools Market Trends

The U.S. orthopaedic power tools holds the largest revenue share in the North American market, driving the demand for advanced power tools that integrate these systems. The region saw significant investments in research and development, with companies such as Medtronic and Johnson & Johnson launching new products that cater to the growing demand for orthopedic procedures.

Europe Orthopedic Power Tools Market Trends

The orthopedic power tools market in Europe is poised for steady growth, driven by the rising geriatric population and the increasing prevalence of orthopedic disorders. The region's focus on developing advanced medical devices and the presence of key players are further contributing to market expansion. For instance, in 2022, Stryker Corporation unveiled its new product, the Pulse Intelligent Delivery Platform, designed to assist in foot & ankle surgeries in ambulatory surgery center (ASC) settings.

Asia Pacific Orthopedic Power Tools Market Trends

The Asia Pacific orthopedic power tools market is driven by the increasing demand for orthopedic procedures in countries such as China and India. This led to development of affordable and innovative power tools that cater to the growing demand. The region witnessed significant growth due to innovations in surgical power tools and a growing senior population; growing preference for battery-powered and electric-operated systems offering advantages such as portability, reduced infection risk, and lower maintenance costs compared to pneumatic tools; focus on developing advanced, user-friendly products.

Key Orthopedic Power Tools Company Insights

Key players hold a significant market share due to their strong presence in the global orthopedic power tools industry. Mergers and acquisitions played a crucial role in shaping the competitive landscape of this market. For instance, in May 2022, ConMed's acquisition of In2Bones Global for USD 245 million aims to strengthen its global orthopedics presence, drive innovation, and expand patient reach. The deal is expected to enhance ConMed's product portfolio and market position in the growing orthopedic power tools market.

Key Orthopedic Power Tools Companies:

The following are the leading companies in the orthopedic power tools market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- CONMED Corporation

- Medtronic

- DepuySynthes (Johnson & Johnson MedTech)

- B. Braun SE

- Zimmer Biomet

- NSK / Nakanishi inc.

- Shanghai Bojin Medical Instrument Co.,Ltd

- Richard Wolf GmbH

- Arthrex, Inc.

- Kaiser Medical Technology Ltd

Recent Developments

-

In January 2024, Arthrex launched a new online platform, NanoExperience.com, to educate people about Nano arthroscopy, a minimally invasive orthopedic procedure. This platform aims to provide information and resources on this innovative surgical technique, which utilizes advanced nanotechnology to enable smaller incisions and faster patient recovery than traditional arthroscopic procedures.

-

In October 2023, DePuy Synthes launched the VELYS Robotic-Assisted Solution for total knee arthroplasty in Europe. The system is designed to enhance procedural efficiency, predictability, and standardization, with a user-friendly interface and streamlined workflow that eliminates the need for costly pre-operative CT scans, improving patient outcomes and reducing resource utilization.

Orthopedic Power Tools Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.76 billion

Revenue forecast in 2030

USD 2.21 billion

Growth rate

CAGR of 3.86% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, modality, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Stryker, CONMED Corporation, Medtronic, DepuySynthes (Johnson & Johnson MedTech), B. Braun SE, Zimmer Biomet, NSK / Nakanishi inc., Shanghai Bojin Medical Instrument Co.,Ltd, Richard Wolf GmbH, Arthrex, Inc., Kaiser Medical Technology Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Power Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthopedic power tools market report based on product, technology, modality, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Bone Orthopedic Power Tools

-

High-speed Orthopedic Power Tools

-

Small Bone Orthopedic Power Tools

-

Others (accessories and reamers)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery-powered Systems

-

Electric-powered Systems

-

Pneumatic-powered Systems

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic power tools market size was estimated at USD 1.71 billion in 2023 and is expected to reach USD 1.76 billion in 2024.

b. The global orthopedic power tools market is expected to grow at a compound annual growth rate of 3.86% from 2024 to 2030 to reach USD 2.21 billion by 2030.

b. The battery-powered systems segment dominates the technology segment of the orthopedic power tools market due to the growing preference among healthcare providers for cordless, portable, and user-friendly power tools.

b. Some key players operating in the market include Stryker, CONMED Corporation, Medtronic, DepuySynthes (Johnson & Johnson MedTech), B. Braun SE, Zimmer Biomet, NSK / Nakanishi inc., Shanghai Bojin Medical Instrument Co.,Ltd, Richard Wolf GmbH, Arthrex, Inc., Kaiser Medical Technology Ltd

b. The market is driven by several factors, including the increasing incidence of orthopedic injuries and diseases, the growing geriatric population, advancements in surgical techniques, and the rising demand for minimally invasive procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.