Orthopedic Navigation Systems Market Size, Share & Trends Analysis Report By Application (Knee, Hip, Spine), By Technology (Electromagnetic, Optical), By End-use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-780-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The global orthopedic navigation systems market size was estimated at USD 2.85 billion in 2024 and is expected to grow at a CAGR of 13.9% from 2025 to 2030. The market is primarily driven by increased adoption of minimally invasive surgeries, technological advancements, initiatives by key market players, and a high prevalence of orthopedic disorders. Furthermore, high awareness levels among patients & healthcare professionals are expected to drive the market growth over the forecast period. For instance, in March 2023, Caira Surgical, an innovator in radar surgical tracking, introduced the Caira TKA Radar Navigation System for advanced joint replacement at the CG 2023 Musculoskeletal Conference presentation.

The rise in the prevalence of minimally invasive surgeries is expected to drive market demand. There is a rise in orthopedic conditions such as ligamentous knee injuries, osteoarthritis, rheumatoid arthritis, and osteoporosis. These ailments affect the body's musculoskeletal system, which comprises muscles, bones, joints, nerves, ligaments, cartilage, and tendons. This reduces the range of motion, stiffness, swelling, and muscle pain that later requires surgical treatment. For instance, according to the Australian Institute of Health and Welfare, rheumatoid arthritis accounted for 2.0% of the total disease burden and 16% for all musculoskeletal conditions in 2023 in the country.

Osteoarthritis is the major cause of pain and disability, especially in the elderly. Owing to the growing geriatric population, the number of hip replacement surgeries in the UK is anticipated to increase by at least 40% by 2026. Knee, hip, and other joint replacement procedures are among the most common elective surgeries in the U.S. The number of younger patients is expected to grow owing to lifestyle changes and improved access to care. For instance, a law firm, according to the JMW Solicitors LLP, 68,335 hip replacement procedures were performed in the UK between April 2021 and March 2022.

Moreover, according to the Centers for Disease Control and Prevention (CDC), the prevalence of arthritis is expected to increase in the upcoming decades. According to the CDC, 53.2 million (or 1 in 5) U.S. adults have some form of arthritis, expected to reach 78 million by 2040. Among them, two-thirds are expected to be women. In addition, by 2040, the estimated number of adults reporting arthritis is expected to be 34.6 million, 43.2% of adults with arthritis. This indicates the potential need for navigation systems for orthopedic surgeries over the forecast period. This indicates the potential need for navigation systems for orthopedic surgeries in the near future.

Associated advantages of Computer-assisted Surgeries (CAS), such as low blood loss, shorter hospital stays, and easier rehabilitation, are other factors expected to drive the market growth. CAS is instrumental in delivering accurate implant alignment, provides improved End Useality, improves quality-adjusted life year, and causes less pain & tissue damage and fewer complications. Due to the above-mentioned factors, the demand for minimally invasive surgery is increasing rapidly. Furthermore, technological advancements in orthopedic surgical navigation procedures and increased R&D activities are other factors expected to boost demand.

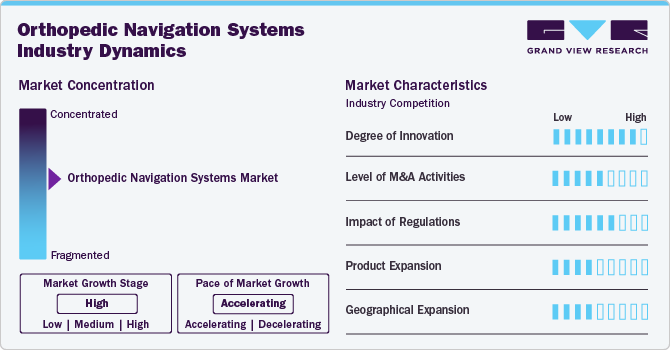

Market Concentration & Characteristics

The market is characterized by a high degree of innovation owing to the rise in funding for R&D and technological advancements. For instance, in March 2023, Caira Surgical raised USD 10M in a Series A funding round to develop its advanced radar surgical tracking technologies.

The market is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary technologies and distribution channels to capture a larger market share. For instance, in January 2023, Orthofix Medical Inc., a manufacturer of orthopedics medical devices company, completed its merger with SeaSpine, a spinal surgical solutions company. This supported Orthofix Medical Inc.’s objective to become a leading spine and orthopedics company. This is owing to a complementary portfolio of innovative spinal hardware solutions, biologics, and a leading surgical navigation system.

Regulations significantly impact the market by ensuring patient safety, product quality, and efficacy. Market players invest substantial resources in developing technologically advanced products and regulatory submissions to obtain regulatory approval for pipeline products. For instance, in June 2022, Stryker received U.S. FDA 510(k) clearance for its Q Guidance System, providing surgical spine planning and navigation capability through multiple tracking options.

Several market players are expanding their business by launching new solutions to expand their product portfolio. For instance, in March 2023, Augmedics, an augmented reality (AR) surgical navigation specialist, introduced advanced and FDA-approved features, such as the xvision Spine System, which offers AI image enhancement End Useality and new customizable views.

Companies are implementing various strategies, such as distribution agreements, geographic expansion, and new product development, to improve their market penetration. For instance, in January 2022, B. Braun SE planned to expand its footprint in Vietnam with a new factory, enabling the company to consistently serve the regional market.

Application Insights

By application, the knee segment dominated the market with a revenue share of 45.9% in 2024. An increasing number of total knee replacement procedures and rising awareness regarding associated benefits contribute to its dominance. In addition, wider applications in multiple surgical conditions, such as total knee arthroplasty, uni-compartmental (partial) knee replacement, kneecap replacement (patellofemoral arthroplasty), and revision knee replacement, further support segment growth. Increasing technological advancements, such as minimally invasive surgeries, accompanied by the availability of improved implant materials, are anticipated to boost knee surgery procedure volumes, thereby supporting segment growth. For instance, in March 2022, Pixee Medical, an augmented surgical guidance company, launched the ‘Knee+’ first augmented reality (AG) guidance system for total knee arthroplasty. It helps the orthopedic surgeon in real-time 3D positioning of instruments with the help of augmented reality glasses without using disposable and bulky capital equipment.

The spine segment in the market is anticipated to witness the fastest CAGR growth over the forecast period. This growth is attributed to the increasing volume of spine surgeries as the prevalence of spinal disorders increases. Spinal injuries are the main reason for mortality and morbidity resulting from either weakening of the neurological injury or bony spine to the spinal nerves or spinal cord. Moreover, launching technologically advanced products fuels the segment growth over the forecast period. For instance, in June 2023, PathKeeper Surgical, an Israel-based MedTech company, commercialized using the PathKeeper, a 3D optical spine navigation system in the U.S.

Technology Insights

By technology, the optical segment dominated the market with a revenue share of 41.9% in 2024. An optical surgical navigation system is built on the principle of stereo vision with high precision. These systems find application in medical procedures requiring high precision and demanding major access paths. Some optical navigation systems, such as optical coherence tomography (OCT) and Raman Spectroscopy, are used to sense the inheritance capability of bone, and surgeons benefit from the visual images of bone. For example, Stryker offers a NAV3i Platform, an optical surgical navigation system, for the spine, cranial, ENT, and orthopedic procedures. Such advantages associated with the technology are attributed to segment growth.

The electromagnetic segment in the market is anticipated to witness the fastest CAGR growth over the forecast period. Electromagnetic navigation systems involve electromagnetic techniques comprising magnetic field producers and magnetic field detectors to create a live image of the body. This navigation system is essential for elderly people, who are highly vulnerable to numerous physical conditions. According to the National Cancer Institute, electromagnetic external shock wave therapy (ESWT) systems are designed for orthopedic procedures. Orthopedic ESWT systems are used for orthopedic procedures to alleviate pain; moreover, they are intended for treating chronic orthopedic diseases such as plantar fasciitis, lateral epicondylitis, and calcifying tendonitis of the rotator cuff. This is expected to support the segment growth over the forecast period.

End-use Insights

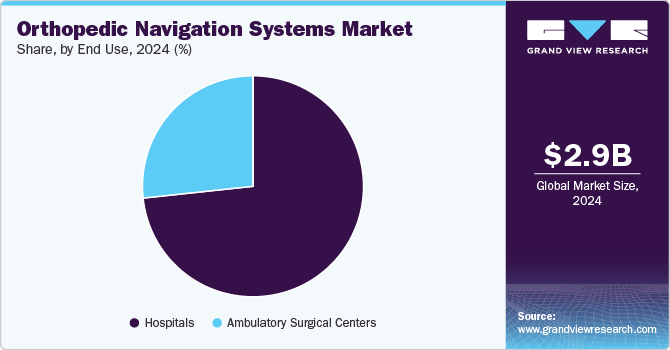

By end use, the hospitals segment dominated the market with a share of over 70% in 2024. Hospitals offer a large array of treatment options relating to pain management and orthopedic procedures. Moreover, the presence of technologically advanced medical devices and the increased patient footfall under these facilities further drive segment growth. Moreover, in December 2022, SeaSpine Holdings Corporation reported installing its 7D FLASH Navigation System at the Inova Fairfax Hospital in the U.S. This marked the 100th installation of the company’s 7D system across the globe.

Ambulatory surgical centers (ASCs) is anticipated to witness the fastest CAGR growth over the forecast period, owing to the growing number of ASCs, adoption of enabling technologies for orthopedic surgeries, and cost-effectiveness. For instance, the Ambulatory Surgery Center Association states that more than 6,300 Medicare-certified ASCs are in the U.S. Moreover, factors such as reduced wait times, personalized care, and shorter stay duration have increased the demand for these centers. Innovative surgical methods in such settings allow tests and procedures to be performed without hospital admission. This is expected to support segment growth.

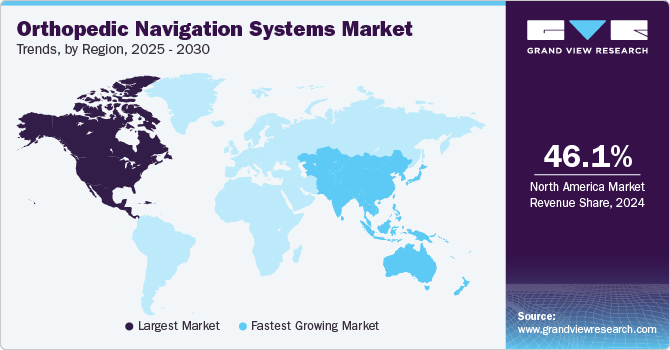

Regional Insights

North America orthopedic navigation systems market dominated with a revenue share of 46.1% in 2024. The availability of improved healthcare infrastructure, high awareness levels, and favorable government initiatives about promoting orthopedic navigation systems are some factors contributing to the growth of this region. In addition, factors such as the increasing geriatric population, high government spending on healthcare, well-developed reimbursement structure, presence of established manufacturers, and launch of new products in the region contribute to the regional market growth. For instance, in 2024, DePuy Synthes introduced and received the U.S. FDA 510(k) clearance for its VELYS Active Robotic-Assisted System (VELYS SPINE) for use in instrumenting and planning spinal fusion procedures in the thoracolumbar, cervical, and sacroiliac spine.

U.S. Orthopedic Navigation Systems Market Trends

The U.S. orthopedic navigation systems industry held the largest market share in 2024. Total joint replacement is one of the country's most-performed elective surgical procedures. The number of primary and revision total joint replacement procedures has continuously increased in recent years. According to the American Academy of Orthopaedic Surgeons, in the U.S., over 450,000 total hip replacement and 700,000 total knee replacement procedures are performed each year. Thus, the demand for orthopedic navigation systems has increased recently.

Europe Orthopedic Navigation Systems Market Trends

The Europe orthopedic navigation systems industry is anticipated to register a significant growth rate during the forecast period. The growing incidence of osteoarthritis and rising demand for minimally invasive surgeries for joint replacement surgery are expected to boost the demand for orthopedic navigation systems over the forecast period in this region. Moreover, rising expenditure on healthcare, growing awareness regarding computer-assisted orthopedic navigation systems, and rising adoption of these techniques are some factors responsible for market growth in this region.

Germany orthopedic navigation systems market is anticipated to register a considerable growth rate during the forecast period. Germany market is anticipated to register a considerable growth rate during the forecast period. Favorable reimbursement policies and growing incidence of road accidents in the country fuel market growth. For instance, as per data published by Statistisches Bundesamt (Destatis) in February 2023, around 21,600 people were injured in road accidents in Germany.

The orthopedic navigation systems market in the UK is anticipated to register a considerable growth rate during the forecast period.Key strategic initiatives, such as mergers & acquisitions, by market players in the country, propel market growth. For instance, in January 2021, Smith & Nephew acquired the Extremity Orthopedics business of Integra LifeSciences Holdings Corporation for USD 240 million. This acquisition is expected to significantly strengthen the company’s business by adding a sales channel, upper & lower extremities portfolio, and new product pipeline.

Asia Pacific Orthopedic Navigation Systems Market Trends

The orthopedic navigation systems industry in Asia Pacific is anticipated to grow fastest over the forecast period, owing to the rising prevalence of orthopedic conditions such as rheumatoid arthritis and osteoarthritis due to lifestyle changes and the aging population. Moreover, increasing healthcare expenditure and advancements in healthcare infrastructure in countries such as India, China, and Japan promote the adoption of the navigation systems market.

Australia orthopedic navigation systems market is anticipated to register a considerable growth rate during the forecast period.Increasing incidence of obesity & sports-related injuries, growing product launches, and distribution strategies among the market players are expected to boost market growth in the country. For instance, in June 2021, DePuy Synthes entered into an exclusive agreement with Navbit, an Australian start-up, to launch Navbit Sprint into operating rooms across Australia. This novel navigation system utilizes smart sensor technology to support specialists in aligning the acetabular cup.

Latin America Orthopedic Navigation Systems Market Trends

The orthopedic navigation systems industry in Latin America is witnessing steady growth over the forecast period. Factors such as increasing awareness among patients and healthcare professionals regarding the benefits of orthopedic navigation systems and the rising prevalence of osteoporosis propel market growth. For instance, according to the International Osteoporosis Foundation, approximately 655,645 cases of hip fractures are expected to be registered in Latin America by 2050.

Brazil orthopedic navigation systems market is anticipated to register considerable growth during the forecast period. One major factor boosting the market is the increasing prevalence of osteoporosis in the country. For instance, according to an article published by Scientific Electronic Library Online (SciELO), osteoporosis and associated fractures are very common in Brazil, owing to a growing geriatric population affected with musculoskeletal disorders and an active youth attracted toward high-intensity sports.

Middle East & Africa Orthopedic Navigation Systems Market Trends

The orthopedic navigation systems market in the Middle East and Africa is experiencing lucrative growth. A significant increase in the prevalence of arthritis and chronic disorders in the geriatric population in the region is anticipated to drive the market over the forecast period. There are various risk factors of chronic orthopedic diseases, such as obesity, overweight, chronic back pain, arthritis, and osteoporosis. Furthermore, the increasing incidence of sports injuries and road accidents is a key factor for market growth.

The UAE orthopedic navigation systems market is anticipated to grow considerably during the forecast period. The increase in amputations due to age-related diseases such as rheumatoid arthritis, osteoarthritis, bursitis, and tendinitis and the acquisition of privately developed models accelerate market growth. Moreover, the rise in the incidence of co-morbidities, including obesity and diabetes, leads to an increase in the risk of degenerative joint diseases, especially in the elderly population, fueling the market growth.

Key Orthopedic Navigation Systems Company Insights

Key market participants focus on developing innovative business growth strategies in product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Orthopedic Navigation Systems Companies:

The following are the leading companies in the orthopedic navigation systems market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Stryker

- Medtronic

- Smith+Nephew

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson Services, Inc.)

- Kinamed Incorporated

- Amplitude Surgical

- Globus Medical

- OrthAlign

- Exactech, Inc.

- Pixee Medical

Recent Developments

-

In August 2024, DePuy Synthes introduced a unique dual-use robotics and standalone navigation platform created in partnership with eCential Robotics. The platform, known as the VELYS SPINE (VELYS Active Robotic-Assisted System), recently received 510(k) clearance from the U.S. Food and Drug Administration (FDA).

-

In April 2024, DePuy Synthes (Johnson & Johnson Services, Inc.) showcased new innovations and technological advancements across its comprehensive Spine portfolio, such as the TriALTIS Spine System. It is combined with TriALTIS Navigation Enabled Instruments.

-

In May 2023, Stryker launched the Ortho Q Guidance system, which supports advanced planning and guidance for hip and knee surgeries. This system integrates new optical tracking capabilities through a redesigned, high-tech camera and advanced algorithms in the newly launched Ortho Guidance software.

Orthopedic Navigation Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.26 billion |

|

Revenue forecast in 2030 |

USD 6.24 billion |

|

Growth rate |

CAGR of 13.9% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

B. Braun SE; Stryker; Medtronic; Smith+Nephew; Zimmer Biomet; DePuy Synthes (Johnson & Johnson Services, Inc.); Kinamed Incorporated; Amplitude Surgical; Globus Medical; OrthAlign; Exactech, Inc.; Pixee Medical |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Orthopedic Navigation Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research, Inc. has segmented the global orthopedic navigation systems market report based on application, technology, end-use, and region:

-

Application Outlook (Revenue USD Million, 2018 - 2030)

-

Knee

-

Hip

-

Spine

-

-

Technology Outlook (Revenue USD Million, 2018 - 2030)

-

Optical

-

Electromagnetic

-

Fluoroscopy-based

-

Image-guided navigation

-

Others

-

-

End-use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic navigation systems market size was estimated at USD 2.85 billion in 2024 and is expected to reach USD 3.26 billion in 2025.

b. The global orthopedic navigation systems market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2030 to reach USD 6.24 billion by 2030.

b. North America dominated the market with a share of 46.1% in 2024. This is attributable to the availability of improved infrastructure, high awareness levels, and favorable government initiatives pertaining to the promotion of orthopedic navigation systems.

b. Some key players operating in the orthopedic navigation systems market include B. Braun SE, Stryker, Medtronic, Smith+Nephew, Zimmer Biomet, DePuy Synthes (Johnson & Johnson Services, Inc.), Kinamed Incorporated, Amplitude Surgical, and Globus Medical.

b. Key factors driving the orthopedic navigation systems market growth include increased adoption of minimally invasive surgeries, technological advancements, initiatives by key market players, and a high prevalence of orthopedic disorders.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."