- Home

- »

- Medical Devices

- »

-

Orthopedic Digit Implants Market Size & Share Report, 2030GVR Report cover

![Orthopedic Digit Implants Market Size, Share & Trends Report]()

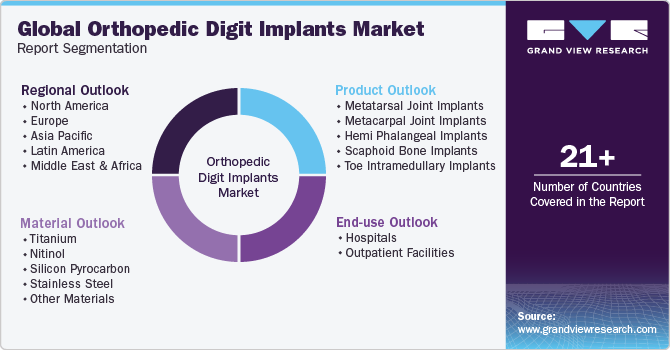

Orthopedic Digit Implants Market Size, Share & Trends Analysis Report By Product (Metatarsal Joint Implants, Metacarpal Joint Implants), By Material (Titanium, Nitinol), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-265-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Orthopedic Digit Implants Market Size & Trends

The global orthopedic digit implants market size was estimated at USD 265.0 million in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. The growing cases of orthopedic diseases such as rheumatoid arthritis and osteoarthritis are anticipated to boost market growth.

According to the 2021 Global RA Network report, there are over 350 million individuals worldwide who have arthritis. In addition, a study published in Lancet Rheumatology indicates that by 2050, almost one billion people will be living with osteoarthritis, which is the most prevalent form of arthritis. Such diseases require the use of orthopedic digit implants, thereby fostering market growth.

Increasing technological advancements in orthopedic implants including, orthopedic digit implants, will accelerate the market growth. Advanced biomaterials with better biocompatibility and durability have improved the quality of implants, leading to an increase in their demand. These biomaterials consist of ceramics and alloys that imitate the properties of natural bone and joints, which has further contributed to market growth. Moreover, the use of computer-aided design and biomechanics studies has also played a significant role in the development of precise implant designs, further boosting the market growth. In addition, advances in 3D printing technology have enabled the production of custom prosthetic digits. In March 2024, OrthoVentions LLC invested in MotioOV, which is an early-stage company that was created in partnership with the Hospital for Special Surgery (HSS). MotioOV's focus is to develop a unique 3D printed implant as well as custom instruments that can help to address issues related to stiffness and pain caused by arthritis of the first metatarsophalangeal (MTP) joint.

Increasing demand for minimally invasive procedures will drive the demand for orthopedic digit implants. In addition, the increasing adoption of organic and inorganic strategies by the key market players is expected to spur market growth. For instance, In January 2024, Extremity Medical LLC, a medical engineering firm, has announced a strategic relationship with Henry Schein, Inc., a global healthcare solutions company. This partnership will help Extremity Medical expand its innovative orthopedic extremity implant systems. In addition, the company completed growth debt financing from June through November, which will help fuel market growth. Such initiatives undertaken by market players will foster market growth.

The orthopedic industry is expected to experience rapid growth due to the increasing number of new players entering the market. In April 2024, Henry Schein, Inc., the largest provider of healthcare solutions for dental and medical practitioners, announced the completion of its acquisition of TriMed, Inc. TriMed is a global developer of orthopedic solutions for the treatment of upper extremities like hands and wrists, and lower extremities like feet and ankles. Henry Schein had announced its intention to acquire a majority interest in TriMed on December 20, 2023. With this acquisition, Henry Schein entered the market for orthopedic extremities.

Increasing government and non-government initiatives will escalate the market growth. For instance, in June 2022, Loci Orthopaedics, a Medtech start-up, received USD 8 million in funding and financial support from the European Commission's European Innovation Council (EIC) Accelerator Programme. The grant and equity investment will be utilized to conduct a clinical trial of the company's implant treatment for thumb arthritis, before proceeding to full-scale commercialization.

Market Concentration & Characteristics

The market has witnessed varying degrees of innovation over the years, driven by advancements in materials science, biomechanics, and surgical techniques. Furthermore, innovations such as custom-made implants and minimally invasive surgical approaches have contributed to better outcomes and faster recovery times for patients.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. These mergers and acquisitions facilitate access to complementary technologies, expertise, and distribution channels, enabling companies to accelerate product development, improve operational efficiency, and capture a larger share of the market. In March 2024, Stryker acquired SERF SAS, a joint replacement company based in France, from Menix. This acquisition enhanced the company’s product portfolio.

Regulations play a crucial role in shaping the global market, ensuring the safety, efficacy, and quality of implants available to patients. Regulatory requirements govern various aspects of implant development, manufacturing, and distribution, imposing standards for materials, design, sterilization, and labeling. While these regulations are essential for safeguarding patient health and promoting innovation, they can also pose challenges for manufacturers, increasing time and cost barriers to market entry.

Product substitutes are alternative methods or technologies that healthcare facilities can use instead of performing orthopedic digit implants surgery. One notable substitute in the market is minimally invasive procedures, along with regenerative medicine. These substitutes provide patients and physicians with options that may moderate certain risks associated with traditional implants, offer tailored solutions for complex cases, and potentially speed up the healing process.Another emerging substitute is regenerative medicine techniques, such as tissue engineering and stem cell therapy, which hold the promise of regrowing or repairing damaged digits without the need for implants.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product launches create more opportunities for market players to enter new regions.In February 2023, Tyber Medical LLC acquired ADSM-Synchro Medical, a French company that specializes in developing and distributing implants for surgical forefoot pathologies. The acquisition was a part of Tyber Medical LLC's strategy to strengthen its global presence.

Product Insights

The metatarsal joint implants segment led the market with the largest revenue share of 47.7% in 2023. Metatarsal joints are more prone to fractures, thereby fostering segmental growth. For instance, according to a study published in the NIH in 2023, metatarsal fractures are a common type of foot injury. They occur about ten times more often than Lisfranc fracture-dislocations. In children, metatarsal fractures account for 61% of all foot fractures. Most of these fractures happen at the fifth (41%) and first (19%) ray. The fifth metatarsal is the most fractured bone (23%), followed by the third metatarsal in cases of industrial injuries. Such increasing cases of metatarsal fractures will accelerate market growth.

The hemi phalangeal implants segment is anticipated to witness at the fastest CAGR over the forecast period. Increasing incidence of fractures among the growing population is expected to boost market growth. For instance, as per an article published in the American Society of Plastic Surgeons in 2022, the incidence of phalangeal fractures varies depending on the digit. The small finger has the highest incidence of fractures at 26%, followed by the ring finger at 24%, the middle finger at 19%, and the index and thumb finger both at 16%. Fractures of the distal and proximal phalanges are the most common, each accounting for 39%, followed by middle phalanges at 22%.

Material Insights

Based on material, the titanium segment led the market with the largest revenue share of 29.8% in 2023. Titanium orthopedic digit implants are expected to experience significant growth due to their superior biocompatibility and strength-to-weight ratio. This makes them perfect for implants requiring durability and compatibility with the human body. For instance , according to an article published in ScienceDirect in 2023, Ti and its alloys are the preferred materials for orthopedic implants. This is due to their lower elastic moduli, which range from 48 to 112 GPa, in comparison to 316L stainless steel, which has a moduli of 210 GPa, and cobalt-chromium alloys, which have a moduli of 240 GPa. In addition, advancements in titanium manufacturing techniques have enabled the production of complex geometries, allowing for a better anatomical fit and long-term performance.

The nitinol segment is anticipated to witness at the fastest CAGR over the forecast period. Nitinol is a shape memory alloy composed of nickel and titanium. It presents unique growth opportunities in the market, due to its unique properties, including super elasticity and shape memory. These properties make it particularly suitable for applications where precise fitting and long-term performance are essential. Nitinol implants can return to their original shape even after undergoing significant deformation. This feature allows for greater flexibility and durability in orthopedic procedures. Such advantages of nitinol-based implants will accelerate market growth.

End-use Insights

Based on end-use, the outpatient facilities segment led the market in 2023 with the revenue share of 55.9%. Outpatient facilities provide a convenient and easily accessible option for patients who require minor orthopedic procedures such as digit implants, without the need for prolonged hospital stays. As the trend towards ambulatory care continues to grow, outpatient facilities are becoming increasingly popular for patients seeking quicker recovery times and reduced healthcare costs associated with inpatient hospital stays. For instance, according to an article published by MJH Life Sciences, outpatient orthopedic volume for typical health systems increased by 29.9% between January 2022 and May 2023, with the number of procedures rising from 373,266 per month to 484,857. Outpatient centers also often offer specialized expertise and streamlined processes to provide efficient orthopedic care, which can attract patients seeking personalized treatment options, thereby fostering market growth.

The hospitals segment is anticipated to register at a significant CAGR over the forecast period. Hospitals are primary centers for orthopedic surgeries, including digit implants, where patients receive comprehensive care from diagnosis to post-operative rehabilitation. Moreover, advancements in minimally invasive techniques for digit implant surgeries have made orthopedic procedures more feasible, further driving demand for these facilities. In addition, the presence of skilled healthcare professionals specializing in orthopedics coupled with the availability of state-of-the-art medical equipment will supplement segmental growth.

Regional Insights

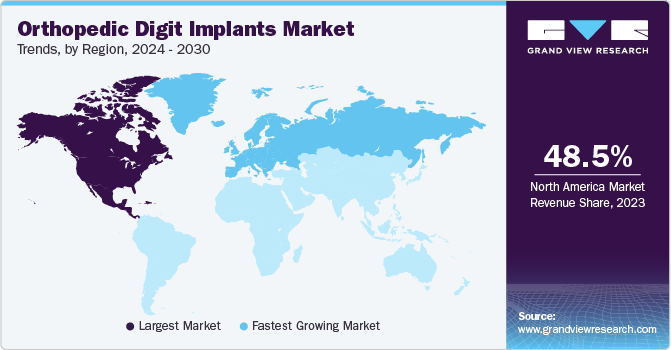

North America dominated the orthopedic digit implants market with the largest revenue share of 48.5% in 2023, owing to a rise in musculoskeletal disorders, such as osteoarthritis and rheumatoid arthritis. In addition, the presence of well-established healthcare infrastructure and reimbursement policies further stimulate market growth. Moreover, growing emphasis on minimally invasive surgeries and the growing adoption of digital healthcare solutions in the region is anticipated to boost market growth.

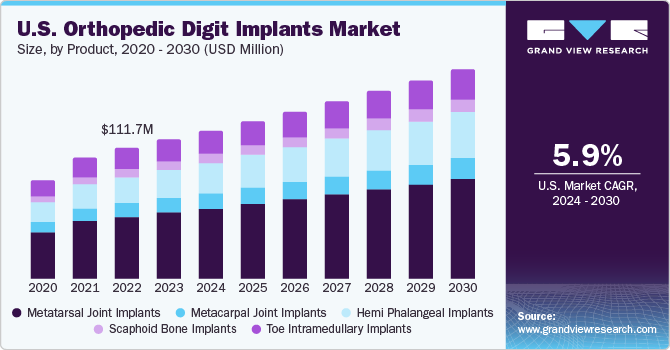

U.S. Orthopedic Digit Implants Market Trends

The orthopedic digit implants market in the U.S. held the largest share of 92.6% in 2023. Growing government initiatives to accelerate the research for arthritis are boosting market growth. For instance, in March 2024, Congress approved a legislative funding package for federal fiscal year 2024 expenditure. President Biden signed the package into law, which includes a provision to allocate USD 685 million for the National Institute of Arthritis, Musculoskeletal and Skin Diseases (NIAMS). This funding is intended to support research aimed at preventing, treating, and understanding the causes of arthritis and other related conditions that affect many patients.

The Canada orthopedic digit implants market is anticipated to register at the fastest CAGR during the forecast period. The country's aging population and increasing prevalence of musculoskeletal disorders contribute to rising demand for orthopedic digit implants. For instance, according to a Springer Nature article, the proportion of seniors (aged 65+) in Canada was projected to increase from 16.3% in 2016 to 25.4% by 2060. These aging populations are more prone to musculoskeletal disorders, thereby supporting market growth.

Europe Orthopedic Digit Implant Market Trends

The orthopedic digit implants market in Europe is anticipated to register at the fastest CAGR during the forecast period. The region's strong focus on research and development fosters continuous innovation in implant technologies, enhancing product efficacy and patient outcomes. Furthermore, favorable healthcare policies and robust regulatory frameworks ensure the safety and quality of orthopedic digit implants, thereby increasing their demands among the population.

The Germany orthopedic digit implants market is anticipated to register at a considerable CAGR during the forecast period. The rising incidence of road accidents in the country contributes to increased demand for orthopedic digit implants. According to the Statistisches Bundesamt (Destatis) report, in February 2023, around 21,600 people were injured in road accidents in Germany.

The orthopedic digit implants market in UK is anticipated to register at a considerable CAGR during the forecast period. The UK's National Health Service (NHS) provides universal healthcare coverage, ensuring access to orthopedic procedures for all residents, which stimulates market growth. In addition, increasing aging population will escalate market growth. According to the Office for National Statistics, the number of people aged 75 and over is expected to double from 5 million to nearly 10 million by 2039 in UK.

Asia Pacific Orthopedic Digit Implant Market Trends

The orthopedic digit implants market in Asia Pacific region is experiencing significant market growth, owing to the rising prevalence of orthopedic conditions such as osteoarthritis and rheumatoid arthritis due to an aging population and lifestyle changes. Moreover, advancements in healthcare infrastructure and increasing healthcare expenditure in countries such as China, India, and Japan are fostering the adoption of orthopedic digit implants. In addition, a surge in sports-related injuries and road accidents is fueling the demand for orthopedic surgeries, including digit implants, across the region.

The China orthopedic digit implants market is anticipated to register at the fastest CAGR during the forecast period.Rapidly expanding healthcare infrastructure and a growing elderly population, presents a significant driver for market growth. According to government statistics, China's population of people aged 60 and above was approximately 297 million in 2023, accounting for 21.1% of the total population.

The orthopedic digit implants market in Japan is anticipated to register at the fastest CAGR during the forecast period. Advanced healthcare systems, with a strong focus on innovation and technological advancements are boosting market growth. Furthermore, with an aging population, there is a growing need for orthopedic treatments, including digit implants, to address age-related conditions, thereby escalating market growth.

Latin America Orthopedic Digit Implant Market Trends

The orthopedic digit implants market in Latin America is witnessing a steady market growth, due to the increasing awareness regarding the availability and benefits of orthopedic implants among both patients and healthcare professionals. Moreover, the region's growing geriatric population and a rise in chronic diseases such as diabetes, which can lead to complications requiring orthopedic interventions, are further driving market growth.

The Brazil orthopedic digit implants market is anticipated to register at the fastest CAGR during the forecast period. Increasing emphasis on sports and physical activity in the country is driving market growth. According to a study published in NIH titled "Injuries and complaints in the Brazilian national men's volleyball team: a case study" in 2023, out of 41 athletes who played for the team during the analyzed period, 12 athletes suffered from 28 injuries, and 38 athletes reported a total of 402 complaints. Such increasing cases of injuries will escalate market growth.

Middle East & Africa Orthopedic Digit Implant Market Trends

The orthopedic digit implants market in Middle East and Africa region are experiencing notable market growth. Increasing incidence of orthopedic conditions such as osteoarthritis and osteoporosis due to factors like sedentary lifestyles, obesity, and an aging population are accelerating market growth. In addition, the region's expanding medical tourism sector, coupled with the presence of skilled healthcare professionals will foster market growth.

The South Africa orthopedic digit implants market is anticipated to register at the fastest CAGR during the forecast period. The country's aging population, coupled with a high prevalence of orthopedic conditions are fostering market growth. Furthermore, South Africa's improving healthcare system, along with increasing investments in medical technology, enables better access to orthopedic treatments, thereby supplementing market growth.

Key Orthopedic Digit Implants Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Orthopedic Digit Implants Companies:

The following are the leading companies in the orthopedic digit implants market. These companies collectively hold the largest market share and dictate industry trends.

- Extremity Medical LLC

- Stryker

- Zimmer

- Smith & Nephew

- Depuy

- Arthrex Inc

- Acumed LLC

- Anika Therapeutics, Inc.

- VILEX, LLC

- Paragon 28

Recent Developments

-

In February 2024, AddUp, a manufacturer of metal components using additive manufacturing, collaborated with Anatomic Implants, a startup that makes medical devices, to file a 510(k) application for the world's first replacement of a toe joint that is 3D printed. Anatomic Implants is the first startup to obtain a patent and develop a first metatarsophalangeal (MTP) joint replacement that closely mimics the human anatomy by using 3D printing technology with titanium

-

In May 2021, BioPoly LLC announced FDA clearance for its Great Toe Implant, making the BioPoly technology available for the first time in the U.S.

-

In March 2021, Accufix SurgicalTM received approval from the US Food and Drug Administration (FDA) for its Accu-Joint Hemi Implant. This implant is designed for the Metatarsophalangeal (MTP) Joint and is a Hemi-arthroplasty Metatarsal Head or Phalangeal Base Implant. Its purpose is to restore arthritic toe joints functionally and accurately, without compromising the original anatomic bone structure

-

In September 2019, Arthrosurface, Inc., a leading company in joint preservation technology received FDA clearance (510K) for its BOSS Toe Fixation System. This new system is designed to provide better stability for the first metatarsal when there is a distal bone void. It is an alternative to toe fusion and helps preserve motion for patients

Orthopedic Digit Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 283.4 million

Revenue forecast in 2030

USD 412.7 million

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Zimmer Biomet; Smith+Nephew; DePuy Synthes; Arthrex Inc.; Acumed LLC; Anika Therapeutics, Inc.; VILEX, LLC; Paragon 28; Extremity Medical LLC

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Digit Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global orthopedic digit implants market report based on product, material, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Metatarsal Joint Implants

-

Metacarpal Joint Implants

-

Hemi Phalangeal Implants

-

Scaphoid Bone Implants

-

Toe Intramedullary Implants

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium

-

Nitinol

-

Silicon Pyrocarbon

-

Stainless Steel

-

Other materials

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic digit implants market size was estimated at USD 265.0 million in 2023 and is expected to reach USD 283.4 million in 2024.

b. The global orthopedic digit implants market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 412.7million by 2030.

b. North America dominated the orthopedic digit implants market with the highest share in 2023. This is attributable to growing preference of minimally invasive surgeries and increased number of patient pool suffering from orthopedic diseases.

b. Some key players operating in the orthopedic digit implants market include Wright Medical Group N.V., Integra LifeSciences Corporation, TEIJIN NAKASHIMA MEDICAL CO., LTD., Stryker Corporation, DePuy Orthopaedics, Inc. (Johnson & Johnson), VILEX IN TENNESSEE, INC., and Merete Medical.

b. Key factors driving the orthopedic digit market growth include growing patient awareness regarding minimally invasive implant options and availability of advanced medical implants mainly in developing regions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."