- Home

- »

- Medical Devices

- »

-

Orthopedic Devices Market Size, Share, Trends Report, 2030GVR Report cover

![Orthopedic Devices Market Size, Share & Trends Report]()

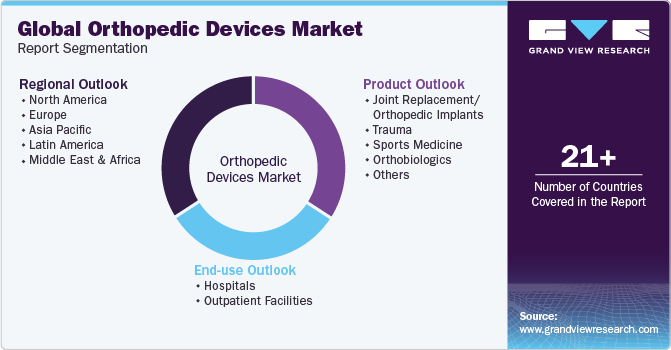

Orthopedic Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Joint Replacement/Orthopedic Implants, Sports Medicine, Orthobiologics), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: 978-1-68038-928-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Devices Market Summary

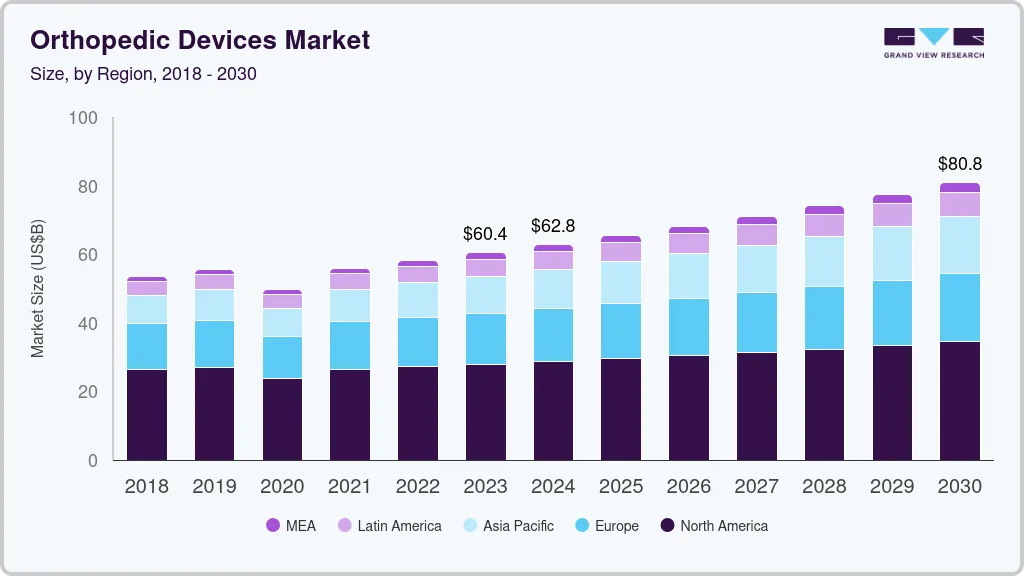

The global orthopedic devices market size was estimated at USD 60.4 billion in 2023 and is anticipated to reach USD 80.8 billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. The market is driven by a high incidence of orthopedic disorders, a growing aging population, an increasing degenerative bone disease, and a growing number of road accidents.

Key Market Trends & Insights

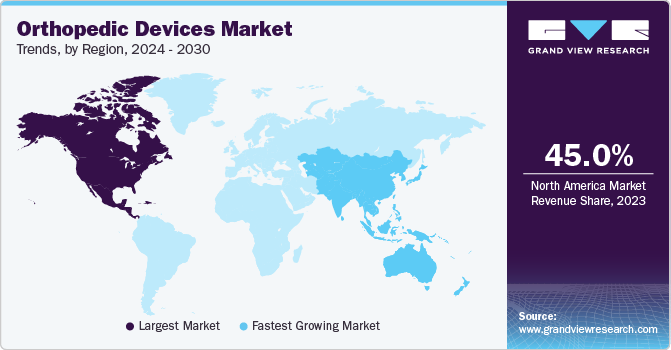

- North America dominated the orthopedic devices market with the largest revenue share of 45% in 2023.

- The U.S. held the largest revenue share of 93.3% in the North American region in 2023.

- By product, the joint replacement/orthopedic implants segment led the market with the largest revenue share of 41.7% in 2023.

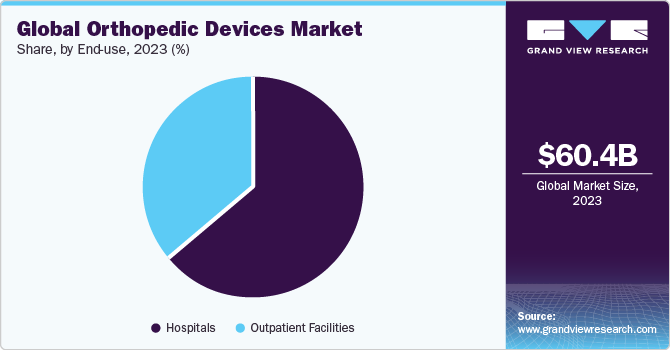

- By end-use, the hospitals segment led the market with the largest revenue share of 64.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 60.4 Billion

- 2030 Projected Market Size: USD 80.8 Billion

- CAGR (2024-2030): 4.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The early onset of musculoskeletal disorders caused by sedentary routines and obesity is projected to fuel market growth. According to a report from the Lancet Rheumatology, the number of people worldwide with other musculoskeletal disorders increased by 123.4% between 1990 and 2020, from 221 million to 494 million. The report predicts that cases of these disorders will rise by 115% from 2020 to 2050, reaching an estimated 1,060 million cases by 2050.

The growing penetration of robots in orthopedic procedures is further supplementing the market growth. For instance, Stryker UK Limited reports that approximately 13,000 patients worldwide receive Mako robotic arm surgery every month. Advanced imaging and real-time feedback in robotics define precision in orthopedic surgery, resulting in less tissue disruption and faster recovery. Robotics are used to create personalized treatment plans that tailor procedures to individual anatomical characteristics, improving outcomes and reducing complications.

Moreover, the availability of advanced orthopedic devices and rapid development in healthcare infrastructure globally are anticipated to influence market growth positively. Increasing awareness and availability of minimally invasive surgical techniques, which offer multiple benefits, is another key driver of market growth. In addition, the rising number of people participating in sports and physical activities is directly linked to an increase in sports-related injuries that require medical attention, which is expected to further spur the market's development. According to the American Academy of Pediatrics and the National SAFE KIDS Campaign, over 3.5 million children aged 14 and under suffer injuries each year while playing sports or engaging in recreational activities. In addition, more than 775,000 children in the same age group are treated in emergency rooms for sports-related injuries annually.

The aging population is impelling the demand for orthopedic solutions globally. As people age, their bones tend to weaken due to excessive loss of bone mass, which is common between the ages of 25 and 54. After the age of 55, the loss of bone density becomes even more significant, thereby boosting market growth. According to the number of individuals aged 60 years or older will increase significantly by 2030. It is estimated that one in every six people globally will be in this age group. By 2050, this figure is expected to double to 2.1 billion.

Furthermore, increasing technological advancement in the field of orthopedic industry is escalating market growth. In November 2023, a team of researchers from UCLA School of Dentistry developed a new dental implant technology that uses ultraviolet (UV) light. The new technique involves exposing titanium implants to a one-minute UV light treatment. The treatment removes hydrocarbons, which significantly lowers the risk of post-treatment complications. Such advanced technologies will boost the adoption of dental implants, thereby supplementing market growth.

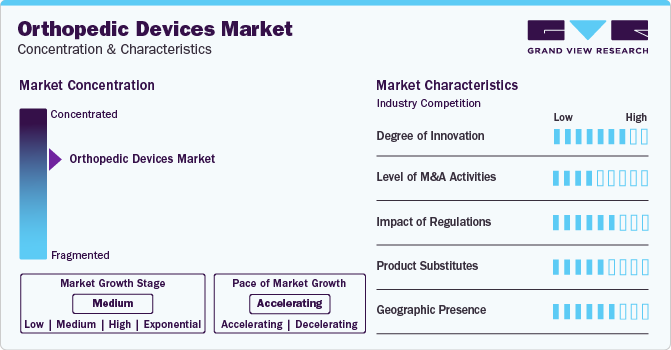

Market Concentration & Characteristics

The treatment of orthopedic conditions and injuries has been significantly transformed by recent advancements in the field of orthopedic devices. Furthermore, market players are investing in innovative technologies and procedures to keep up with the demand. For instance, the BONEZONE report states that in 2019 and 2020, the seven largest public orthopedic companies including DePuy Synthes, Stryker, and Zimmer Biomet collectively dedicated over USD 2.3 billion towards research and development. In addition, in June 2023, Acuitive Technologies launched a new tendon fixation device, Citrelock ACL.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for orthopedic devices and to maintain a competitive edge. In January 2024, Enovis acquired LimaCorporate S.p.A., a globally recognized orthopedic company. This strategic move enhances Enovis' standing in the global orthopedic reconstruction market by integrating Lima's proven surgical solutions and technologies into its portfolio.

Orthopedic devices must meet strict regulatory requirements to ensure that they meet high standards of quality, safety, and effectiveness before they can be introduced to the market. In the U.S., the FDA regulates orthopedic medical devices. There are two pathways for the competent authority to approve new orthopedic devices, the PMA or the 510(k) approval. Most industries use the 510(k) premarket notification because it does not require clinical trials. It can be used for devices that are considered substantially equivalent to an FDA-approved device. However, devices approved through this process are susceptible to recalls by the U.S. FDA.

Physical therapy and rehabilitation equipment can be considered as substitutes for orthopedic devices. Such equipment includes exercise bands, balance boards, and therapy balls that are specifically designed to enhance strength, flexibility, and range of motion. Technological advancements have further led to the development of wearable devices and mobile applications that guide users through customized rehabilitation programs, offering convenience and accessibility.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In January 2024, Tynor Orthotics inaugurated an advanced manufacturing facility in Mohali, Punjab. Similarly, in June 2022, Smith+Nephew expanded its orthopedic business by opening a manufacturing unit in Malaysia. It was an investment of more than USD 100 million.

Product Insights

Based on product, the joint replacement/orthopedic implants segment led the market with the largest revenue share of 41.7% in 2023. Increasing number of joint replacement surgeries across the globe is fostering market growth. According to the American College of Rheumatology, over 450,000 hip replacements and more than 790,000 knee replacements are performed annually in the U.S. alone. Moreover, the adoption of robotic-assisted joint replacement surgeries is also contributing to the market. A study titled “Trends in Computer-Assisted Surgery for Total Knee Arthroplasty in Germany: An Analysis Based on the Operative Procedure Classification System between 2010 to 2021” found that robot-assisted Total Knee Arthroplasty (R-TKA) surgeries have increased significantly between 2018 and 2021, with an average annual increase rate of 84.74%. Furthermore, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are anticipated to influence segment growth positively.

The ortho-biologics segment is anticipated to witness at the fastest CAGR over the forecast period. Increasing adoption of strategic initiatives by key market players to expand their product portfolio and geographic reach is driving segmental growth. In July 2023, Anika Therapeutics Inc. announced that its Tactoset injectable bone substitute has been granted clearance for further use with autologous bone marrow aspirate under FDA 510(k). In addition, in June 2022, Istos Biologics introduced a new product line called Influx Fibrant. These products are made of 100 percent cortical allograft. The Influx Fibrant line includes five different products: the Fibrant anchor, Fibrant pak, Fibrant wrap, Fibrant bullet, and Fibrant boat.

End-use Insights

Based on end-use, the hospitals segment led the market with the largest revenue share of 64.5% in 2023. This can be attributed to significant infrastructure and the availability of various treatment solutions. Moreover, the increasing number of hospital admissions due to bone fractures and injuries caused by road accidents is projected to drive the market growth. Favorable reimbursement policies for patients who choose to visit hospitals over outpatient facilities, coupled with a significant number of hospitals and primary care centers in both developed and developing economies, are key factors that contribute to the high demand for hospital services. The segment is also expected to witness at the fastest CAGR of 4.4% during the forecast period.

The outpatient facilities segment is anticipated to grow at a significant CAGR over the forecast period. This is due to the increasing preference for day care centers and ambulatory surgery centers in surgical procedures. Outpatient facilities offer advantages such as reduced waiting times, quick discharge, lower procedural costs, and improved efficiency. In addition, they provide patients with adequate postoperative pain control, rapid discharge, minimal side effects, and overall cost containment.

Regional Insights

North America dominated the orthopedic devices market with the largest revenue share of 45% in 2023. The market growth is attributed to the growing need for advanced healthcare services, owing to the presence of major industry players, well-established healthcare infrastructure, and comprehensive reimbursement coverage. Moreover, rise in a number of trauma and fracture cases, growth in a number of middle-aged & geriatric patients opting for orthopedic devices, and introduction of biodegradable devices & internal fixation devices are fostering regional growth.

U.S. Orthopedic Devices Market Trends

The orthopedic devices market in the U.S. held the largest revenue share of 93.3% in the North American region in 2023. An increasing number of joint surgical procedures, growing technological developments, and high prevalence of orthopedic disorders drive the market growth in the U.S. Furthermore, a well-established healthcare infrastructure and strong distribution network in the country fuels market growth. For instance, according to the CDC report covering the period from 2019 to 2021, doctor-diagnosed arthritis was prevalent in 17.9% of men and 24.2% of women in the U.S. (NHIS). Companies are increasingly adopting expansion strategies, such as mergers, acquisitions, product launches, collaborations, and partnerships is propelling market growth.

The Canada orthopedic devices market is anticipated to register at the fastest CAGR during the forecast period. Market players are concentrating on boosting R&D efforts to introduce advanced products and maintaining their market position through various strategies. In February 2024, Tyber Medical LLC, an orthopedic device manufacturer, obtained clearance for its anatomical plating system in Canada. This extensive product line had previously obtained FDA 510(k) clearance in the U.S. and has now been approved by Health Canada.

Asia Pacific Orthopedic Devices Market Trends

The orthopedic devices market in Asia Pacific is anticipated to be the fastest-growing region. The rapidly developing healthcare infrastructure in major countries, such as India, China, & Japan, and the booming medical tourism industry are propelling demand for orthopedic devices in the region. The number of orthopedic implantations performed in the region is growing due to the rising incidence of chronic orthopedic ailments and improved diagnostic tools.

The China orthopedic devices market is anticipated to grow at the fastest CAGR during the forecast period. It is driven by the country's increasing middle class and aging population. Medical tourism is booming, the healthcare infrastructure is constantly being improved, and patients are becoming more aware of the commercial availability of orthopedic devices. All of these factors are contributing to market growth in the country. However, the high cost of orthopedic procedures and strict government policies for the approval of devices is hampering market growth to a certain extent.

Europe Orthopedic Devices Market Trends

The orthopedic devices market in Europe is anticipated to register at a significant CAGR during the forecast period. This is attributed to several factors including increased healthcare spending as well as a rise in the number of elderly people suffering from osteoarthritis, osteoporosis, bone injuries, and obesity. According to Eurostat, as of January 2023, the EU population reached 448.8 million, with 21.3% of the population aged 65 or older.

The Germany orthopedic devices market is anticipated to register at a considerable CAGR during the forecast period. Osteoarthritis was the second most common reason for hip surgeries in most of the aged population. According to an Elsevier B.V. article, approximately 1 million patients are diagnosed with knee osteoarthritis every year in Germany, resulting in a total of approximately 5 million people living with knee OA annually.

The orthopedic devices market in UK is anticipated to register at a considerable CAGR during the forecast period. The market can witness new growth prospects over the forecast period, due to an increase in the reconfiguration of supply chain models by medical device manufacturers and a rise in demand for organs for transplantation. In addition, the dental orthopedic implants segment is becoming more popular, and major companies are introducing new products in this area.

Key Orthopedic Devices Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Orthopedic Devices Companies:

The following are the leading companies in the orthopedic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker

- Zimmer Biomet

- DePuy Synthes

- Smith+Nephew

- Aesculap, Inc. - a B. Braun company

- CONMED Corporation

- NuVasive, Inc. (mergerd with Globus Medical)

- Enovis (formerly known as DJO)

Recent Developments

-

In November 2023, Smith+Nephew acquired CartiHeal, the developer of the Agili-C implant, in a deal valued at USD 330 million. This acquisition aligns with Smith+Nephew's strategic focus on investing in its sports medicine business and incorporating innovative technology into its portfolio

-

In October 2023, DePuy Synthes received U.S. FDA 510k clearance for its lower extremity anatomic plating system, TriLEAP. This modular system is specifically designed to meet the complex needs of podiatric medicine doctors, orthopedic surgeons, and specialists in foot & ankle care

-

In September 2023, Enovis (DJO, LLC) opened a new manufacturing facility in the U.S., which is dedicated to manufacturing reconstructive knee, hip, and shoulder implants

-

In September 2023, Stryker launched the PROstep MIS Lapidus, a novel internal fixation system designed for the treatment of bunions. This system facilitates a minimally invasive surgical approach to address hallux valgus deformity and achieve fusion of the first metatarsal cuneiform joint

Orthopedic Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 62.8 billion

Revenue forecast in 2030

USD 80.8 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Stryker; Zimmer Biomet; DePuy Synthes; Smith+Nephew; Aesculap, Inc.- a B. Braun company; CONMED Corporation; NuVasive, Inc. (mergerd with Globus Medical), Enovis (formerly known as DJO)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Devices Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the orthopedic devices market report based on product, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Joint Replacement/ Orthopedic Implants

-

Lower Extremity Implants

-

Knee Implants

-

Hip Implants

-

Foot & Ankle Implants

-

-

Spinal Implants

-

Dental

-

Dental Implants

-

Craniomaxillofacial Implants

-

-

Upper Extremity Implants

-

Elbow Implants

-

Hand & Wrist Implants

-

Shoulder Implants

-

-

-

Trauma

-

Implants

-

Accessories (Plates, Screws, Nails, Pins, Wires)

-

Instruments

-

-

Sports Medicine

-

Body Reconstruction & Repair

-

Accessories

-

Body Monitoring & Evaluation

-

Body Support & Recovery

-

-

Orthobiologics

-

Viscosupplementation

-

Demineralized Bone Matrix

-

Synthetic Bone Substitutes

-

Bone Morphogenetic Protein (BMP)

-

Stem Cell Therapy

-

Allograft

-

-

Others

-

-

End-use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the orthopedic devices market with a share of 46.2% in 2023. This is attributable to high demand for advanced healthcare services owing to the presence of well-developed healthcare infrastructure, industry giants, and reimbursement coverage.

b. Some key players operating in the orthopedic devices market include Medtronic PLC; Stryker Corporation; Zimmer-Biomet Holdings, Inc.; DePuy Synthes; Smith and Nephew PLC; Aesculap Implant Systems, LLC; Conmed Corporation; Donjoy, Inc.; and NuVasive, Inc.

b. Key factors that are driving the orthopedic devices market growth are the high incidence of orthopedic disorders such as degenerative bone disease, as well as the growing aging population and the number of road accidents, the early onset of musculoskeletal disorders caused by sedentary routine and obesity, increase in the number of bone-related disorders.

b. The global orthopedic devices market size was estimated at USD 60.4 billion in 2023 and is expected to reach USD 62.8 billion in 2024.

b. The global orthopedic devices market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 80.8 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.