Orthopedic Contract Manufacturing Market Size, Share & Trends Analysis Report By Type (Implants, Instruments), By Services, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-183-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

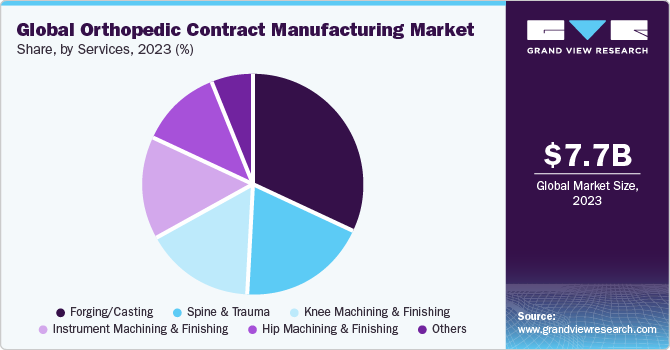

The global orthopedic contract manufacturing market size was estimated at USD 7.71 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. Advancements in technology, rising incidence of orthopedic disorders, increased orthopedic surgeries, and cost-efficiencies associated with outsourcing are a few of the factors driving the market growth.

Furthermore, collaborations between orthopedic device companies and contract manufacturers allow for shared expertise, accelerated product development, and risk mitigation fostering market growth.

High market growth is primarily due to increasing pressure on OEMs to reduce costs and enhance timeline for taking an orthopedic product to market. Moreover, macroeconomic considerations such as growing incidence of bone injuries due to road accidents and sports injuries are boosting demand for orthopedic implants and other products, thus augmenting robust growth for global market.

In addition, rising patient demand for personalized and customized implants tailored to individual requirements and anatomy is significantly boosting demand for contract manufacturers with specialized expertise in developing patient-specific products. Furthermore, rise in medical tourism, with individuals seeking bone health treatments abroad, is another considerable factor amplifying demand for outsourced manufacturing of orthopedic implants, encouraging adoption of contract manufacturing services.

However, the COVID-19 pandemic had a devastating impact on orthopedic OEMs and contract manufacturers specialized in the orthopedic field. Major OEMs such as Stryker, DePuy Synthes, and Zimmer Biomet have witnessed lower demand for orthopedic products due to a temporary halt in elective procedures and treatments, thus negatively impacting their sales revenues in 2020. The market for contract manufacturing also witnessed same scenario, thus impacting overall year-on-year growth. However, relaxation in restriction and an increased backlog of orthopedic procedures and treatments have curated demand for bone health products, thus helping the market to recover from negative to a certain extent.

Market Concentration & Characteristics

Market growth stage is high and pace is accelerating. The market is characterized by high degree of innovation, regulatory considerations, stable merger and acquisition activities, market fragmentation, and increasing regional expansion of manufacturing processes to leverage cost advantages and specialized capabilities.

A high degree of innovation has been witnessed in global market by transformative advancements in design, materials, and manufacturing technologies. Advancements in biocompatible materials, such as advanced ceramics and alloys, considerably enhances compatibility and durability of implants. Furthermore, rise in adoption of 3D printing technologies supports development of highly customized and patient-specific products.

Stringent regulatory norms and quality protocols govern the global market, and contract manufacturers must follow regulatory guidelines to ensure efficacy and safety of their products.

M&A activities in the global market are stable and have seen periodic activities as companies seek to expand product portfolios, strengthen their market positions, and enhance capabilities.

The orthopedic contract manufacturing industry was characterized by a high degree of market fragmentation. Specialization in specific technologies and products has led to a fragmented market scenario.

Rising trend of outsourcing and globalization to leverage cost efficiencies and specialized capabilities is another considerable market characteristic supporting industry growth. OEMs are promoting regional expansion by partnering with contract manufacturers across the globe to penetrate maximum economies and augment their market positions.

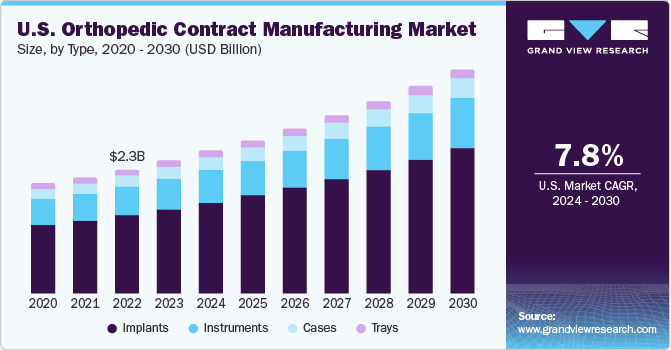

Type Insights

Based on type, the implants segment led the market in 2023 with the largest revenue share of 63.5%. This high percentage can be attributed to increasing demand for orthopedic implants, driven by increasing incidence of orthopedic conditions and technological innovations in implant materials and designs. In response to increasing demand for orthopedic products, several companies are focusing on developing and commercializing novel orthopedic implants, witnessing a notable increase in product launches. Moreover, increasing demand for patient-centric products or customized implants per individual is another factor boosting segmental growth. For instance, in February 2023, CurvaFix, Inc., announced the launch of a 7.5mm CurvaFix IM Implant to streamline surgical procedures catering to patients with smaller bone structures. Companies are leveraging innovative technologies such as enhanced biomaterials and 3D printing to manufacture implants that offer enhanced biocompatibility, durability, and modifications.

The cases segment is anticipated to witness a stable CAGR during the analysis timeframe. Increasing incidence of bone health conditions such as osteoarthritis is one of the major factors supporting demand for high-quality orthopedic implants, devices, cases and other related solutions. For instance, as per World Health Organization, more than 550 million people worldwide are suffering from osteoarthritis, reflecting a surge of 113% from 1990. Several orthopedic OEMs are turning to contract manufacturers to leverage their advanced technologies, specialized expertise, and cost-effective solutions to meet this demand efficiently. Hence, the aforementioned factors are anticipated to support segmental growth.

Services Insights

Based on service, the forging/casting segment held the largest market revenue share of 32.5% in 2023. Increasing number of contract manufacturers penetrating the landscape of orthopedic industry is one of the prominent factors supporting segmental growth. Growing focus of contract manufacturers in expanding their services is boosting demand for orthopedic contract manufacturing for services such as forging and casting of orthopedic products. In addition, several contract manufacturers are investing in development of advanced materials for novel orthopedic products. For instance, in June 2022, Tecomet, Inc.a prominent contract manufacturer within orthopedic sector, announced a strategic investment of USD 4 million in its facility in Cork, Ireland. This initiative aims to enhance facility's plastic and polyethylene machining capabilities, solidifying its position as a global center of excellence for polymeric materials used in orthopedic products.

The spine & trauma segment is anticipated to witness a lucrative CAGR during the forecast period. High growth of the segment is majorly due to increasing demand for spine and trauma products globally. Moreover, increasing incidence of sports injury is another factor augmenting demand for trauma devices. For instance, in September 2023, Orthofix Medical Inc., a prominent global company specializing in trauma and spine solutions, announced the launch of Galaxy Fixation Gemini system in the U.S., used for an external fixation in trauma settings. Increasing launch of spine and trauma devices simultaneously boost demand for contract manufacturing services, thus supporting segmental growth.

Regional Insights

North America dominated the market with a revenue share of 36.4% in 2023. North America is one of the major contributors to the market growth. This region is home to numerous medical device companies, which are outsourcing part of their manufacturing functions to contract service providers, thereby contributing towards the market growth. High cost of manufacturing is a major challenge, encouraging several medical device companies in North America to outsource functions to third-party vendors with high level of expertise in the domain.

The U.S. held the largest market share in North America. Large medical device companies are outsourcing part of their manufacturing services to CMOs, owing to usage of advance technologies and specialized capabilities thereby contributing to the market growth in the U.S. These companies are also increasingly inclined toward medical device outsourcing due to requirement of high maintenance and efficient systems for management of raw materials that results in minimizing overall setup costs. Moreover, manufacturing service outsourcing also facilitates the company’s focus on core capabilities, sharing of associated risks, and improved service delivery, which are pertinent to gaining competitive advantages.

Asia Pacific is anticipated to witness a significant CAGR over the forecast period. Pricing pressure, budget scrutiny in developed economies, and fluctuations in reimbursement schemes are some of the major factors that are anticipated to increase adoption of cost-containment measures by OEM. This trend is expected to boost orthopedic device outsourcing to emerging countries like India and China. Some of the benefits provided by contract manufacturers in emerging countries include export infrastructure, artificially low currency value, low cost labor, government incentives for local manufacturers, especially in China. Hence, the aforementioned factors are anticipated to support the market growth in the Asia Pacific region.

Key Companies & Market Share Insights

Key players operating in the market include Tecomet, Inc, Orchid Orthopedic Solutions, ARCH Medical Solutions Corp., and Cretex companies.

-

Tecomet, Inc provides comprehensive manufacturing solutions, overseeing entire process from engineering to final delivery for a diverse array of forged applications. This encompasses production of implants and components for hips, knees, trauma, and extremities

-

Orchid provides contract manufacturing services tailored to orthopedic procedures, catering to both established original equipment manufacturers and emerging companies within orthopedic and medical device industry. The executive team at Orchid is dedicated to supporting professionals in orthopedic sector

-

Viant, Paragon Medical, Avalign Technologies, LISI Medical are some of the emerging market participants in the global market.

-

Paragon Medical specializes in products and components tailored for the global orthopedic market. Collaborating closely with OEMs and contract manufacturing organizations, the company engages in the development of innovative products that not only meet rigorous regulatory requirements but also addresses the ever-changing dynamics of the market

-

Avalign IMS provided turnkey manufacturing processes for spine, orthopedic, trauma, complex assemblies, and maxiofacial implants

Key Orthopedic Contract Manufacturing Companies:

- Tecomet, Inc

- Orchid Orthopedic Solutions

- Cretex companies

- Viant

- ARCH Medical Solutions Corp.

- Avalign Technologies

- LISI Medical

- Paragon Medical

- Norman Noble, Inc.

- Autocam Medical

Recent Developments

-

In October 2023, Orthofix Medical Inc., a prominent global company specializing in spine and orthopedics, announced the 510k clearance of OsteoCove, an innovative bioactive synthetic graft for orthopedic treatments. This approval shall provide opportunities for contract manufacturers to offer bulk manufacturing services

-

In June 2023, four medical device companies namely EOS, Tecomet Inc, Orthopaedic Innovation Centre (OIC), and Precision ADM announced a collaborative alliance, presenting a comprehensive solution for medical device additive manufacturing (AM). This partnership encompasses a complete array of services, incorporating front-end design and engineering services, device and machine validation, 510k approval pathways, pre-clinical testing, and commercialization for all sorts of medical devices including orthopedic devices

-

In November 2022, Marle Group completed the acquisition of Elite Medical, a top-tier vertically integrated orthopedic implants and precision instruments contract manufacturer headquartered in Tennessee

Orthopedic Contract Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.28 billion |

|

Revenue forecast in 2030 |

USD 12.96 billion |

|

Growth rate |

CAGR of 7.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, services, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Tecomet, Inc; Orchid Orthopedic Solutions; Cretex companies; Viant; ARCH Medical Solutions Corp.; Avalign Technologies; LISI Medical; Paragon Medical; Norman Noble, Inc.; Autocam Medical |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Orthopedic Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthopedic contract manufacturing market report based on type, services, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Implants

-

Instruments

-

Cases

-

Trays

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Forging/Casting

-

Hip Machining & Finishing

-

Knee Machining & Finishing

-

Spine & Trauma

-

Instrument Machining & Finishing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic contract manufacturing market size was valued at USD 7.71 billion in 2023 and is anticipated to reach USD 8.28 billion by 2024.

b. The global orthopedic contract manufacturing market is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030 to reach USD 12.96 billion by 2033.

b. Implants led the market and accounted for 63.5% of the global revenue in 2023. This high percentage can be attributed to increasing demand for orthopedic implants, driven by increasing incidence of orthopedic conditions and technological innovations in implant materials and designs.

b. A few of the key players operating in the market include Tecomet, Inc, Orchid Orthopedic Solutions, Cretex companies, Viant, ARCH Medical Solutions Corp., Avalign Technologies, LISI Medical, and others.

b. Advancements in technology, rising incidence of orthopedic disorders, increased orthopedic surgeries, and cost-efficiencies associated with outsourcing are a few of the factors driving orthopedic contract manufacturing market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."