Orthokeratology Lens Market Size, Share & Trends Analysis Report By Product, By Distribution Channel (Hospitals, Optometry Clinics), By Indication (myopia, Presbyopia, Hypermetropia, Astigmatism), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-953-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Orthokeratology Lens Market Size & Trends

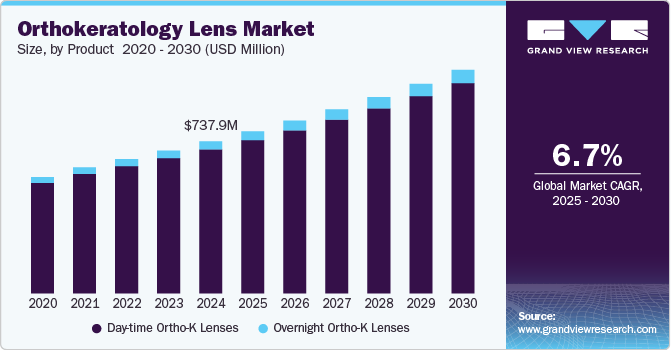

The global orthokeratology lens market size was valued at USD 737.9 million in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The global market for orthokeratology lens is rapidly growing, fueled by rising awareness of myopia management and increasing refractive errors. The introduction of advanced overnight ortho-K lenses, along with more FDA approvals, is driving demand. Additionally, an aging population and the prevalence of digital eye strain are increasing interest in these non-surgical options. Advances in lens technology enhance comfort and effectiveness, further boosting market growth across both developed and emerging economies, creating significant opportunities for industry players.

Orthokeratology lenses, also known as ortho-K lenses, are specialized gas-permeable contact lenses designed to reshape the cornea overnight, allowing individuals to enjoy clear vision throughout the day without the need for glasses or contact lenses. One of the key factors propelling the growth of the ortho-K lens market is the alarming rise in myopia cases worldwide. According to the World Health Organization (WHO), approximately 2.7 billion people globally are affected by myopia, with projections suggesting that this number could soar to 5 billion by 2050. This increasing prevalence, particularly among children and young adults, has made ortho-K lenses an attractive solution for parents seeking effective ways to manage their children's vision. A study published in the journal Ophthalmology indicated that ortho-K can reduce the progression of myopia in children by up to 50%, further solidifying its role in myopia control.

Advancements in lens technology are also contributing significantly to the growth of the market. Recent innovations in lens design and materials have greatly enhanced both comfort and effectiveness. For instance, the development of overnight ortho-K lenses utilizing advanced gas-permeable materials allows for better oxygen transmission, significantly reducing the risk of complications and improving patient satisfaction. Moreover, the integration of digital technology, such as wavefront analysis, enables eye care professionals to create highly customized lenses that enhance the overall efficacy of treatment.

The increase in screen time due to digital devices also plays a crucial role in market growth. A study by the Vision Council reported that over 60% of adults experience symptoms of digital eye strain, leading to heightened awareness regarding eye care and the importance of effective vision correction methods. This trend is driving more individuals to consider ortho-K lenses as a viable solution.

In addition, the young generation prefers the trendy look and has different eyewear based on the occasion. Consumers demand newer designs and technologies, which forces companies to consistently focus on R&D to develop innovative products. An increasing number of awareness programs in developing economies for eye disease diagnosis is estimated to boost the demand for orthokeratology lenses during the forecast period. Vision correction in kids has resulted in better academic performance, which, in turn, results in higher demand for overnight ortho-K-lens.

Orthokeratology lenses are safe, specifically among children, owing to their easy usage. The capability to improve patients’ visualization and quality of life with the use of orthokeratology is one of the most stimulating developments in the ophthalmic industry. With advancements in diagnostic technology and lens materials, orthokeratology is a possible alternative to invasive surgery. In addition, companies working in the market are expanding their output product capacities including orthokeratology lenses to resolve various corneal disorders including myopia and astigmatism.

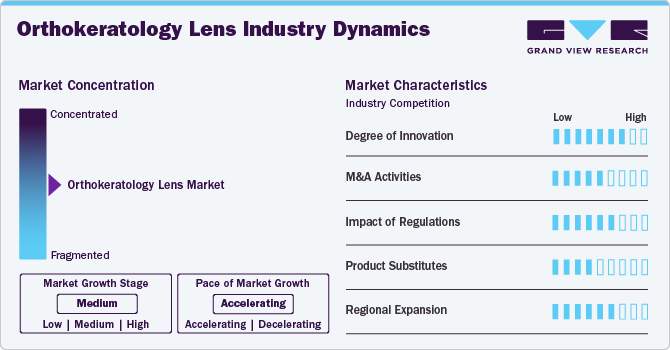

Market Concentration & Characteristics

The market is characterized by moderate concentration, with a mix of established players and emerging companies. Major manufacturers dominate with advanced technologies and extensive distribution networks, driving innovation and market share. The industry focuses on research and development to enhance lens comfort and efficacy, catering to the growing demand for myopia management. Additionally, increased awareness and adoption of ortho-K lenses among eye care professionals and consumers are fueling competition, leading to a wider variety of products and solutions tailored to different patient needs, particularly among children and young adults.

The orthokeratology lens industry exhibits high innovation, driven by technological advancements and a growing understanding of retinal diseases. For instance, in October 2022, advancements in smart medicine were highlighted as technology transforms eye care. Tailor-made orthokeratology lenses, designed using digital technology that analyzes nearly 10,000 data points, offer personalized solutions for refractive errors. This innovation enhances comfort and effectiveness, particularly benefiting children, while improving surgical precision through real-time imaging technology, ensuring safer procedures.

Regulations significantly impact the market by ensuring safety, efficacy, and quality standards for products. Regulatory bodies, such as the FDA and European Medicines Agency, mandate rigorous testing and approval processes, which can influence market entry and innovation. Compliance with these regulations fosters consumer confidence and promotes market growth. Additionally, regulations surrounding marketing and distribution ensure that information about the lenses is accurate and transparent, helping to educate both healthcare providers and patients. As the market evolves, regulatory updates will play a crucial role in shaping product development and ensuring that advancements meet health and safety standards.

Strategic partnerships enhance innovation and allow firms to combine resources for research and development. For instance, the acquisition of Visionary Optics by Euclid Vision Corp. in April 2022 exemplifies this trend, enabling the integration of specialty scleral lens technology with advanced orthokeratology solutions. Such M&A activities not only strengthen competitive positioning but also foster collaboration among industry leaders, driving advancements in myopia management and tailored vision correction solutions to meet rising global demand.

In the market, several product substitutes exist that cater to similar vision correction needs. Traditional soft contact lenses and daily disposable lenses offer alternatives for individuals seeking comfort and convenience, while glasses remain a common choice for those preferring non-invasive options. Additionally, refractive surgical procedures, such as LASIK, provide a permanent solution for myopia and other refractive errors. However, unlike ortho-K lenses, these substitutes may not offer the same reversible effects or be suitable for younger patients. The diversity of options emphasizes the importance of tailored solutions for varying patient preferences and visual requirements.

The market is witnessing significant regional expansion, highlighted by Menicon Co., Ltd.'s announcement of launching the "Menicon Z Night" lens in China in May 2023. This strategic move aims to address the growing demand for myopia management solutions in the region, where the prevalence of refractive errors is increasing. By introducing advanced orthokeratology lenses, Menicon seeks to capture market share in China, furthering its global presence. This expansion reflects the industry's focus on innovative products tailored to specific regional needs, ultimately enhancing vision correction options for consumers worldwide.

Product Insights

The overnight ortho-K lenses segment accounted for the largest revenue share of 94.6% in 2024. This growth is driven by the high adoption rates and effectiveness of overnight ortho-K lenses. These lenses significantly alleviate discomfort often associated with conventional contact lenses, making them an attractive option for individuals who prefer not to wear glasses or contacts during the day, especially during sports. Their convenience particularly appeals to children and young adults, providing an effective solution for myopia management. As myopia prevalence rises and awareness of non-surgical alternatives increases, these lenses gain popularity. Additionally, improvements in lens materials and design enhance comfort and effectiveness, fostering continued growth in this segment as more consumers seek innovative vision correction options.

The daytime ortho-K lenses segment in the orthokeratology lens market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. Daytime ortho-K lenses, typically worn at night, can cause discomfort and symptoms like dry eye when worn during the day, potentially hindering market growth. However, they attract a wide consumer base, especially children and young adults seeking non-surgical myopia solutions. Increased awareness of myopia’s long-term effects and advancements in lens technology enhance comfort and visual clarity, driving demand. As more eye care professionals recommend these lenses, this segment is likely to maintain a leading position in market revenues.

Indication Insights

The myopia segment held largest share of 41.1% in 2024. The rising prevalence of myopia is expected to drive growth in the orthokeratology lenses market during the study period. As reported in the journal Investigative Ophthalmology and Visual Science, around 1.9 billion people, or about 27% of the global population, are affected by myopia. The International Myopia Institute indicates that myopia is on the rise globally, with recent estimates suggesting that 30% of the population is currently myopic, potentially increasing to nearly 50%-about 5 billion people-by 2050. This condition poses significant risks of ocular complications and high healthcare costs, making it a leading cause of permanent blindness worldwide during the forecast period.

The astigmatism segment is expected to grow at a fastest CAGR during the forecast period. The rising prevalence of astigmatism is expected to significantly increase the demand for orthokeratology lenses. According to the American Optometric Association, many individuals with astigmatism prefer corrective eyeglasses over surgery for vision improvement. Currently, about one in three people in the U.S. experiences astigmatism, a figure anticipated to grow. A recent systematic review published by NCBI in February 2023 identified astigmatism as the most common refractive error, with an estimated prevalence of 40% among adults across various World Health Organization regions, including Africa, the Americas, Southeast Asia, Europe, the Eastern Mediterranean, and the West Pacific.

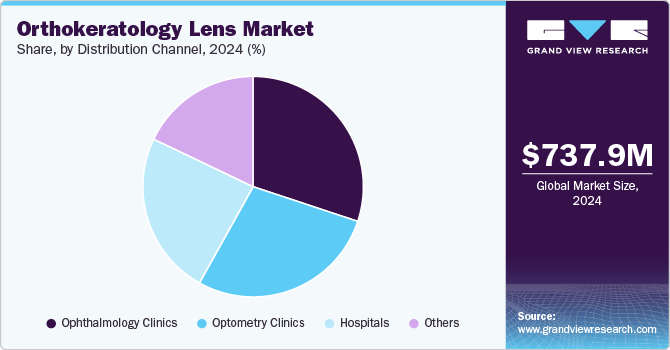

Distribution Channel Insights

The ophthalmology clinics segment accounted for the largest revenue share of 30.1% in 2024. This growth can be attributed to the increasing number of specialized clinics offering advanced myopia management solutions. These clinics provide comprehensive eye care, including personalized consultations and fitting of orthokeratology lenses, enhancing patient experiences. Additionally, the rising awareness of myopia and its associated risks has led more individuals to seek professional care. With the continued emphasis on non-surgical vision correction options and innovative treatment strategies, ophthalmology clinics are well-positioned to drive further market expansion in the orthokeratology lens sector.

The optometry clinics segment of the market is expected to experience a notable increase in compound annual growth rate (CAGR) over the forecast period. This growth is driven by the rising demand for personalized eye care services, as more patients seek effective myopia management solutions. Optometry clinics play a crucial role in educating patients about the benefits of orthokeratology lenses, facilitating their adoption. Additionally, advancements in lens technology and fitting techniques enhance patient outcomes, further encouraging visits to these clinics. As awareness of vision health continues to grow, optometry clinics are expected to become key players in the market.

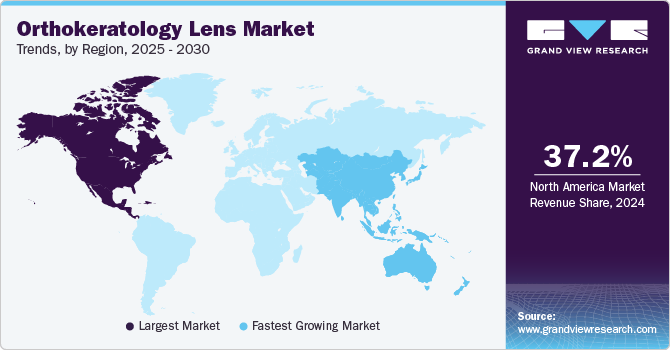

Regional Insights

North America orthokeratology lens market dominated the overall global market and accounted for the 37.2% revenue share in 2024. The strong need for quality assurance measures for ophthalmic devices arises from the well-established healthcare infrastructure. Moreover, ongoing technological advancements, increasing awareness among end users regarding eye health, and strict regulatory standards are anticipated to drive market expansion in the future.

U.S. Orthokeratology Lens Market Trends

The U.S.orthokeratology lens market held a significant share of North America's orthokeratology lens market in 2024. High awareness of retinal disorders and an established healthcare infrastructure facilitate the adoption of advanced diagnostic technologies. A recent paper published in Optometry & Vision Science highlights key trends and insights regarding the current state of orthokeratology in the U.S. The findings from the Fitting of Orthokeratology in the United States (FOKUS) survey, conducted with over 500 eye care professionals (ECPs), reveal that 56% of those actively fitting ortho-k lenses expect market growth in the coming year. Additionally, 46% of ECPs not currently fitting these lenses plan to begin prescribing them within the next two years.

Europe Orthokeratology Lens Market Trends

The European orthokeratology lens market is experiencing growth, driven by rising awareness of myopia management and the increasing prevalence of refractive errors. Innovative lens technologies and materials are enhancing comfort and effectiveness, attracting both consumers and eye care professionals. Additionally, the expansion of specialized clinics offering orthokeratology services is contributing to market development. Growing interest in non-surgical vision correction options among children and young adults’ further fuels demand.

UK orthokeratology lens market is experiencing notable growth, driven by increasing screen time among the population. According to data from Independent UK published in June 2024, Brits spend an average of 1 hour and 52 minutes daily on social media. This prolonged exposure to screens raises concerns about eye strain and exacerbates existing vision issues. As a result, there is a growing demand for effective diagnostic tools like orthokeratology lens to assess and address these vision-related problems.

The orthokeratology lens market in France is expanding, driven by a rising awareness of retinal disorders and the aging population. Increasing incidence of conditions like diabetic retinopathy and macular degeneration is fueling demand for advanced diagnostic tools. Enhanced research initiatives and improved healthcare infrastructure further support market growth in the country. According to World Bank data, France’s healthcare expenditure was around 12.31% of its GDP in 2021.

The orthokeratology lens market in Germany is experiencing robust growth, primarily driven by increasing awareness of retinal health and a significant rise in eye disorders. Notably, Staar Surgical reports that the EuroEyes clinic group performed the highest number of ICL surgeries in Germany in 2021. The aging population, coupled with a high prevalence of conditions such as diabetic retinopathy and macular degeneration, intensifies the demand for precise diagnostic tools. Germany's well-established healthcare system, supported by advanced research and technological innovations, facilitates the adoption of orthokeratology lens devices in clinical settings.

Asia Pacific Orthokeratology Lens Market Trends

The Asia Pacific orthokeratology lens market is experiencing robust growth, primarily driven by the rising prevalence of myopia, particularly among children and adolescents. According to the World Health Organization, myopia affects approximately 50% of the population in some Asian countries, such as Singapore and Taiwan. This has spurred demand for non-surgical vision correction solutions like orthokeratology lenses. Additionally, advancements in lens technology, such as the introduction of customizable lenses, are enhancing comfort and effectiveness. The growth of specialized eye care clinics and increased awareness among parents further contribute to the market expansion, making it a dynamic sector within the ophthalmic industry.

The orthokeratology lens market in Japan is set for significant growth, primarily driven by the country's aging population. As of 2023, approximately 30% of the population is aged 65 and older, making them more susceptible to eye disorders. This demographic shift is anticipated to boost demand for orthokeratology lens in the coming years.

The China orthokeratology lens market is expected to grow, driven by technological advancements and heightened research and development in the field of orthokeratology. The China National Medical Products Administration (NMPA) is responsible for overseeing medical devices, including orthokeratology lens, to guarantee their safety, effectiveness, and adherence to regulatory requirements.

The orthokeratology lens market in India is poised for substantial growth, driven by rising contact lens usage and growing awareness of eye health. With an annual growth rate of 15% to 20%, this trend reflects shifting preferences among Indians toward contact lenses for vision correction. Factors like increasing disposable incomes, urbanization, and evolving attitudes toward eyewear contribute to this surge. Consequently, the demand for orthokeratology lens is projected to increase in India.

Latin America Orthokeratology Lens Trends

The Latin American orthokeratology lens market is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for refractive surgery devices as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Saudi Arabia Orthokeratology Lens Market Trends

The orthokeratology lens market in Saudi Arabia is anticipated to expand in the forecast period. This is attributed to the government's encouragement of private sector involvement in healthcare, as outlined in the National Transformation Plan (NTP). Additionally, the projected rise in disposable income from economic expansion and urban development is expected to generate favorable growth prospects.

Key Orthokeratology Lens Company Insights

The competitive scenario in the market is highly competitive, with key players such as Bausch & Lomb Inc., CooperVision; and Johnson & Johnson Vision Care, Inc.. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Orthokeratology Lens Companies:

The following are the leading companies in the orthokeratology lens market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch & Lomb Inc.

- Euclid Systems Corp.

- CooperVision

- Johnson & Johnson Vision Care, Inc.

- Alpha Corporation (Menicon Group)

- Brighten Optix, Co.

- GP Specialists

- TruForm Optics, Inc.

- Art Optical Contact Lens, Inc.

- MiracLens L.L.C.

Recent Developments

-

In April 2024,a study focused on comparing the effectiveness of various myopia control methods, including orthokeratology (ortho-k) and low-density red-light therapy, particularly in children up to age 13 with low to moderate myopia. The study highlighted ortho-k's efficacy in slowing axial elongation by 30% to 56%, establishing it as a leading optical treatment option. Other methods like myopia control soft contact lenses and spectacles also showed significant effects, emphasizing the importance of tailored approaches in managing myopia among children.

-

In September 2023, AccuLens introduced its NewVision SC orthokeratology lens, a corneo-scleral design recently cleared by the FDA. Crafted from Contamac Infinite material, it features a large diameter for enhanced comfort and wear-time flexibility. The lens incorporates four distinct zones for optimal myopia reduction, including customized base curves and alignment curves tailored to individual patients, ensuring effective treatment and comfort during daily wear.

-

In February 2021, Toray Industries, Inc. announced the establishment of a dedicated production line at its Shiga Plant for the Breath-O Correct orthokeratology lens, approved in Japan. Set to commence full-scale production in April 2021, this move aims to ensure stable supply and enhance competitiveness in the growing orthokeratology market.

Orthokeratology Lens Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 786.1 million |

|

Revenue forecast in 2030 |

USD 1,084.7 million |

|

Growth Rate |

CAGR of 6.7% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product , indication, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Bausch & Lomb Inc.; Euclid Systems Corp.; CooperVision; Johnson & Johnson Vision Care, Inc.; Alpha Corporation (Menicon Group); Brighten Optix, Co.; GP Specialists; TruForm Optics, Inc.; Art Optical Contact Lens, Inc.; MiracLens L.L.C. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Orthokeratology Lens Market Report Segmentation

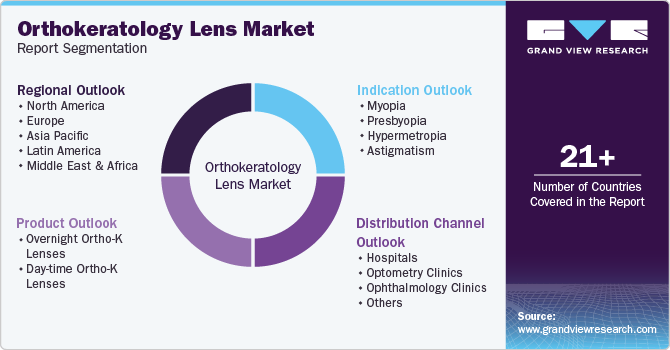

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global orthokeratology lens market report on the basis of product, indication, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Overnight Ortho-K lenses

-

Day-time Ortho-K lenses

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Myopia

-

Presbyopia

-

Hypermetropia

-

Astigmatism

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Optometry Clinics

-

Ophthalmology Clinics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthokeratology lens market size was estimated at USD 737.86 million in 2024 and is expected to reach USD 786.1 million in 2025

b. The global orthokeratology lens market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 1,084.7 million by 2030.

b. North America dominated the orthokeratology lens market with a share of 37.2% in 2024. This is attributable to increasing prevalence of refractive errors, significant number of new product launches in the market and rise in awareness programs by government and private organizations.

b. Some of the key players operating in the orthokeratology lens market include Bausch & Lomb Inc., Euclid Systems Corp., CooperVision, Johnson & Johnson Vision Care, Inc., Alpha Corporation (Menicon Group), Brighten Optix, Co., GP Specialists, TruForm Optics, Inc., Art Optical Contact Lens, Inc. and MiracLens L.L.C.

b. Key factors that are driving the orthokeratology lens market growth include the rise in the prevalence of refractive errors and initiatives, such as acquisitions and partnerships, product launches, and regulatory approvals undertaken by key companies for product development and distribution activities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."