- Home

- »

- Medical Devices

- »

-

Orthobiologics Market Size, Share & Trends Report, 2030GVR Report cover

![Orthobiologics Market Size, Share & Trends Report]()

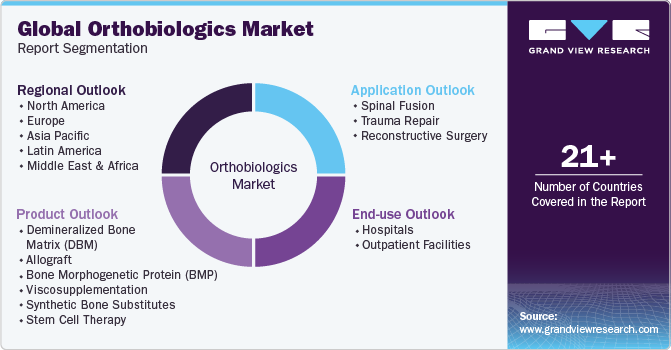

Orthobiologics Market Size, Share & Trends Analysis Report By Product (DBM, Allograft, BMP, Viscosupplementation), By Application (Spinal Fusion, Trauma Repair), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-360-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Orthobiologics Market Size & Trends

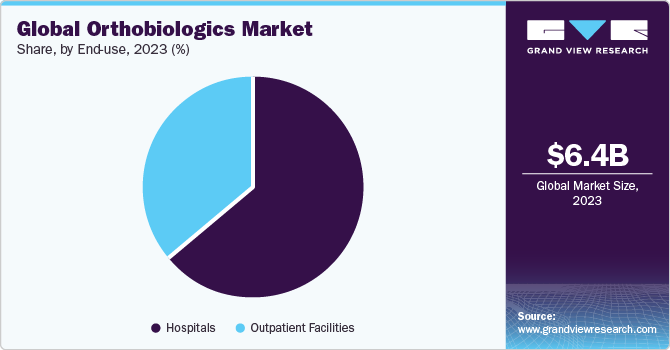

The global orthobiologics market size was estimated at USD 6.4 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. Increasing prevalence of orthopedic procedures coupled with growing geriatric population are the major factors fostering market growth. As per the McLeod Health report, in 2022, the number of orthopedic procedures performed in the U.S. was 18,577,953.

Moreover, increasing cases of road accidents will drive the demand for orthobiologics. As per the “Road Accidents in India-2022” report, a total of 461,312 road accidents were reported by states and union territories (UTs) in the calendar year 2022. These accidents resulted in the loss of 168,491 lives and caused injuries to 443,366 individuals. This represents an 11.9% increase in accidents, a 9.4% increase in fatalities, and a 15.3% increase in injuries compared to the previous year.

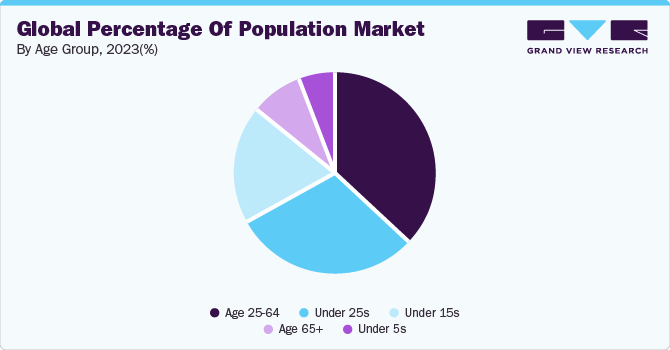

The number of spinal and orthopedic procedures is on the rise due to the increasing population of older adults who are highly susceptible to orthopedic disorders. This can be attributed to the United Nations (UN) report, which predicts that the number of people aged 65 or older worldwide will double in the next 30 years. By 2050, it is expected that the elderly population will reach 1.6 billion, which is over 16% of the world's total population. Moreover, a recent survey conducted by NIHS revealed that almost half (47.3%) of U.S. adults aged 65 or above have been diagnosed with arthritis by a doctor. Such increasing orthopedic disorder cases among the senior population will foster market growth.

Increasing patient satisfaction for the orthobiologics procedure further is fueling the market growth. Professor Mark Slevin, a Professor of Cell Pathology at Manchester Metropolitan University, conducted an analysis that revealed, orthobiologic treatments have a favorable outcome for around 70% of the patients who undergo them. The overall results indicate that over 70% of the treated individuals experience significant improvements such as less pain and increased mobility.

Obesity is a significant contributor to orthopedic disorders. As per the 2022 World Obesity Atlas by the World Obesity Federation, it is predicted that by 2030, one billion people globally will be living with obesity, including 1 in 7 men and 1 in 5 women. Moreover, according to the NIHS survey conducted between 2019 and 2021, adults who were overweight or obese were more likely to report arthritis than those who had a healthy weight or were underweight. Out of the adults who had a healthy weight or were underweight, 15.5% reported being diagnosed with arthritis by a doctor. Meanwhile, 20.5% of adults with overweight and 27.5% of those with obesity reported being diagnosed with arthritis by a doctor.

The market for orthobiologics is expected to grow due to increased investment in research and development and funding from leading medical device and biotechnology companies. In September 2021, Locate Bio, a company specializing in regenerative medicine and orthobiologics, recently raised USD 12.7 million in an equity investment round. Existing shareholder Mercia Asset Management and new investor BGF contributed to the funding, which Locate Bio plans to use to develop its portfolio of regenerative orthobiologics products for patients.

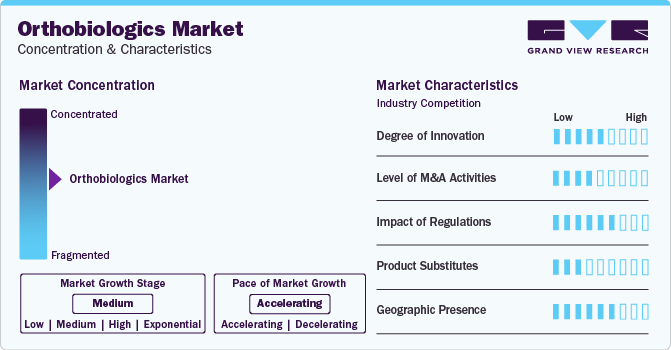

Market Concentration & Characteristics

Recent advancements in the field of orthobiologics have brought about a significant transformation in the way orthopedic conditions and injuries are treated. The use of bone graft substitutes, platelet-rich plasma (PRP) therapy, and stem cell treatments, among other innovative technologies, are leading to a revolution in orthobiologics. Advanced imaging techniques such as MRI and CT scans provide precise and accurate diagnosis and planning. With 3D printing, it is possible to create customized implants and scaffolds that are tailored to individual patients. Additionally, biotechnology and genetic engineering are opening new avenues to improve the regenerative potential of orthobiologics, which can lead to faster healing and better outcomes for patients.

The orthobiologics market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for DBM. In February 2023, Zimmer Biomet acquired Embody, an orthobiologics company primarily focusing on soft tissue healing for USD 155 million. The company’s portfolio includes the Tapestry RC implant that is used for rotator cuff repair and the Tapestry biointegrative implant that is used for tendon healing.

Orthobiologic products are subject to strict regulatory requirements to ensure that they meet high standards of quality, safety, and efficacy before they can be introduced to the market. This helps protect the health of patients and promotes trust among healthcare professionals and consumers. Regulatory agencies, such as the Food and Drug Administration (FDA) in the U.S. and the European Medicines Agency (EMA) in Europe, set guidelines and frameworks for the development, testing, and approval of orthobiologic therapies.

Traditional surgical procedures, although they involve invasive methods, are still a feasible option for some patients who might not qualify for orthobiologics or for those who prefer more established techniques. In addition to this, pharmaceutical therapies, such as pain medications and anti-inflammatory drugs, offer non-invasive alternatives for managing symptoms associated with musculoskeletal disorders. Moreover, medical devices, such as joint implants, provide long-lasting solutions for severe cases of joint degeneration.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising research and development activities create more opportunities for market players to enter new regions. In October 2023, Orthofix Medical Inc received 510(k) clearance and fully launched OsteoCove, an advanced bioactive synthetic graft.

Product Insights

By product, the viscosupplementation segment dominated the orthobiologics market in 2023 and accounted for the largest revenue share of over 40%. Rising patient pool suffering from osteoarthritis and the increasing product launch is anticipated to boost market growth. According to a study titled "According to a recent study titled "Global, regional, and national burden of osteoarthritis, 1990-2020 and projections to 2050", the number of people diagnosed with osteoarthritis has increased by 132.2% since 1990, with around 595 million globally diagnosed with the condition in 2020. The study also predicts that by 2050, cases of osteoarthritis for the knee, hand, hip, and other types of osteoarthritis will increase by significant percentages of 74.9%, 48.6%, 78.6%, and 95.1%, respectively. Viscosupplementation using hyaluronic acid injections is commonly used to treat osteoarthritis due to its ease of use and good tolerance, thus contributing to market growth.

The stem cell therapy segment is anticipated to witness the fastest CAGR over the forecast period. The rising healthcare expenditure globally and growing emphasis on personalized medicine, has created a favorable environment for the expansion of the stem cell therapy market. Furthermore, advancements in biotechnology and regenerative medicine have led to the development of innovative techniques and products for the stem cell therapy market.

Application Insights

The spinal fusion segment held the largest revenue share of over 50% in 2023, owing to the increasing prevalence of spine disorders worldwide. According to theScienceDirect report, over 400,000 spinal fusion surgeries are performed in the U.S. annually. Moreover, consistent penetration of bone morphogenetic proteins, demineralized bone matrices, autografts and allografts in spinal fusion surgeries owing to its ability to provide high bone stability and rapid bone healing is fostering segmental growth. Furthermore, increasing focus of key market players for the launch of novel products for bone healing is escalating market growth. In November 2023, OssDsign AB undertake a strategic shift to focus on the U.S. orthobiologics business. This change makes OssDsign AB a pure play orthobiologics company. The company will concentrate its efforts on OssDsign Catalyst, a nanosynthetic bone graft product that can be easily scaled up and has high gross margins of 90% or more. OssDsign Catalyst is an off-the-shelf product that is used to stimulate healthy bone tissue formation in spinal fusion surgeries.

Reconstructive surgery segment in the market is anticipated to register a significant growth rate over the forecast period. Growing reconstructive surgery demand due to an aging population and an increase in musculoskeletal disorders is fostering segment growth. According to the ISAPS Global Survey, the number of procedures performed by plastic surgeons increased by 11.2% in 2022. About 18.8 million non-surgical and 14.9 million surgical procedures were performed worldwide, continuing the trend of a 41.3% increase over the last four years.Orthobiologics are a promising solution for enhancing bone healing, promoting soft tissue repair, and restoring joint function, driving their adoption in reconstructive procedures.

End-use Insights

Hospitals segment dominated the orthobiologics market in 2023 with a revenue share of over 60%. Hospitals play a crucial role in the utilization of orthobiologics due to their advanced medical infrastructure and comprehensive healthcare services. One of the primary factors driving the growth of orthobiologics in hospitals is the increasing demand for minimally invasive procedures. Orthobiologics provide an alternative to traditional surgical interventions by utilizing the body's natural healing processes. This reduces the need for extensive surgeries and lengthy hospital stays. Moreover, the integration of advanced imaging technologies and surgical techniques in hospitals makes it possible for orthopedic surgeons to administer orthobiologics agents with precision, thereby facilitating tissue regeneration and accelerating recovery.

The outpatient facilities segment in orthobiologics market is anticipated to register a significant growth rate over the forecast period due to due to the increasing trend towards ambulatory care and same-day surgeries. These facilities provide a convenient and cost-effective option for patients seeking minor orthopedic procedures or treatments for sports injuries. As per the Definitive Healthcare report, Specialists One-Day Surgery Centers performed the highest number of knee replacement surgeries in 2022, accounting for 1.6% of the total knee replacement procedures.

Regional Insights

North America dominated the orthobiologics market in 2023 and accounted for the largest revenue share of 46.2% owing to the technological advancements and a robust healthcare infrastructure. Furthermore, favorable reimbursement policies and supportive regulatory frameworks facilitate market growth. Moreover, growing aging population in the region will escalate the market growth. For instance, the U.S. Census Bureau has released the Vintage 2022 Population Estimates, which show an increase of 0.2 years in the nation's median age from 2021 to 2022. Median age is the age at which 50% of the population is younger and the other 50% is older.

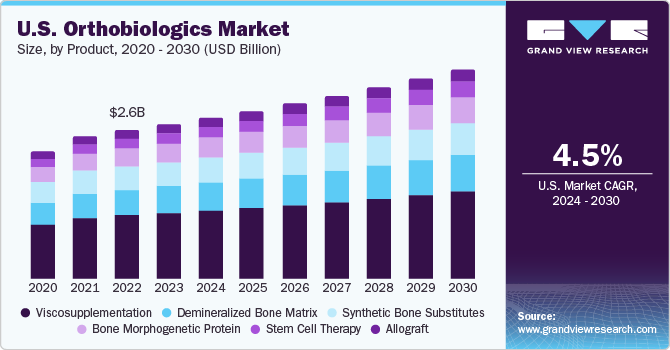

U.S. Orthobiologics Market Trends

The orthobiologics market in the U.S. held the largest share of near to 90% in the North American region in 2023. The region's emphasis on technological innovation and research results in a continuous flow of improved orthobiologic products. In July 2021, Dr. Scott A. Rodeo from Hospital for Special Surgery was granted USD 50,000 from the Orthopaedic Research and Education Foundation to conduct research on an injectable biologic for knees.

Canada orthobiologics market is anticipated to register the fastest growth rate during the forecast period. Increasing government and private funding for the innovation of novel products is anticipated to boost market growth. In February 2023, ChitogenX Inc., a clinical stage orthobiologics company, collaborated with Polytechnique Montréal to secure a grant of USD 3,472,000 from The Natural Sciences and Engineering Research Council of Canada ("NSERC") and Prima Québec.

Europe Orthobiologics Market Trends

Europe orthobiologics market is anticipated to register the fastest growth rate during the forecast period. With an aging population and rising life expectancy, the prevalence of age-related musculoskeletal conditions such as osteoarthritis fuels demand for orthobiologic interventions. Furthermore, presence of various key market players in the region is boosting the market growth.

Germany orthobiologics market is anticipated to register a considerable growth rate during the forecast period. Growing participation of people in sports is expected to propel market growth. As per the deutschland.de report published din 2024,Germany has almost 90,000 sports clubs which have approximately 28 million members.

The orthobiologics market in the UK is anticipated to register a considerable growth rate during the forecast period. Rising acceptance of orthobiologics as effective treatment options is driving market growth. Increasing joint replacement surgeries in the country is contributing to the rise in demand for orthobiologics. As per the NHS report, each year, over 70,000 knee replacements are performed in England and Wales, with the number increasing each year. The majority of total knee replacement patients are aged 65 or older.

Spain orthobiologics market is anticipated to register a significant growth rate during the forecast period. Increased prevalence of musculoskeletal disorders such as osteoarthritis and fractures are boosting market growth. According to the International Osteoporosis Foundation published in 2023, in Spain, a fragility fracture caused by osteoporosis takes place every two minutes, leading to 330,000 fractures annually. The incidence of such fractures has been observed to be increasing due to the gradual aging of the population. It is predicted that the number of fragility fractures will rise by approximately 30% by 2034, resulting in 370,000 cases every year.

Key Orthobiologics Company Insights

Key participants in the orthobiologics industry are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Orthobiologics Companies:

The following are the leading companies in the orthobiologics market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic Plc

- DePuy Synthes

- Zimmer Biomet

- Stryker Corporation

- Bioventus LLC

- Anika Therapeutics, Inc.

- Orthofix, Inc.

- Globus Medical

- Arthrex, Inc.

- Bone Biologics Corp.

Recent Developments

-

In September 2023, NuVasive, Inc. merged with Globus Medical, Inc. This merger aims to offer a wide range of musculoskeletal procedural solutions and enabling technologies to surgeons and patients.

-

in February 2022, Orthofix Medical Inc. introduced Opus BA, a synthetic bone graft solution for lumbar and cervical spine fusion procedures. Opus BA is available in both strip and putty formulations and is designed to fill bone gaps or voids that are not part of the bony structure's stability in the skeletal system.

-

.In August 2021, Seikagaku Corporation launched a new product named HyLink. It is a single injection viscosupplement designed for the treatment of knee osteoarthritis. The product has been launched in Taiwan and is being distributed through TCM Biotech International Corp., which is based in New Taipei City.

Orthobiologics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.8 billion

Revenue forecast in 2030

USD 9.3 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic Plc; DePuy Synthes; Zimmer Biomet; Stryker Corporation; Bioventus LLC; Anika Therapeutics, Inc.; Orthofix, Inc.; Globus Medical; Arthrex, Inc.; Bone Biologics Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Orthobiologics Market Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the orthobiologics market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue USD Billion, 2018 - 2030)

-

Demineralized Bone Matrix (DBM)

-

Allograft

-

Bone Morphogenetic Protein (BMP)

-

Viscosupplementation

-

Synthetic Bone Substitutes

-

Stem Cell Therapy

-

-

Application Outlook (Revenue USD Billion, 2018 - 2030)

-

Spinal Fusion

-

Trauma Repair

-

Reconstructive Surgery

-

-

End-use Outlook (Revenue USD Billion, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook Revenue USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthobiologics market size was estimated at USD 6.4 billion in 2023 and is expected to reach USD 6.8 billion in 2024.

b. The global orthobiologics market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 9.3 billion by 2030.

b. North America dominated the orthobiologics market with a share of 47.07% in 2023. This is attributable to the presence of a majority of the prominent players involved in promoting quality care and undertaking new product development strategies.

b. Some key players operating in the orthobiologics market include Medtronic, MTF Biologics, DePuy Synthes, Bioventus, Stryker, Sanofi, LifeNet Health, Heraeus, Zimmer Biomet, and Arthrex, among others.

b. Key factors that are driving the market growth increasing number of orthopedic procedures globally as a consequence of an upsurge in accidents and obesity and rising geriatric population base.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."