- Home

- »

- Biotechnology

- »

-

Organoids And Spheroids Market Size, Industry Report, 2030GVR Report cover

![Organoids And Spheroids Market Size, Share & Trends Report]()

Organoids And Spheroids Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Developmental Biology, Personalized Medicine, Regenerative Medicine), By End Use, By Region And Segment Forecasts

- Report ID: GVR-4-68038-843-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Organoids And Spheroids Market Summary

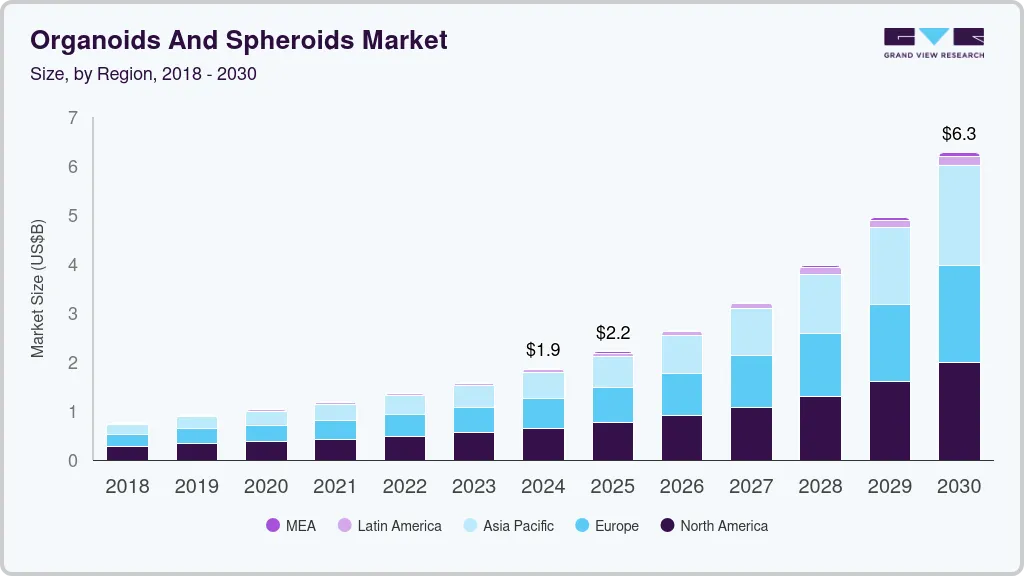

The global organoids and spheroids market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 6.27 billion by 2030, growing at a CAGR of 23.2% from 2025 to 2030. Usage of organoid models to reveal how the COVID-19 virus affects several intestinal cells is expected to drive the adoption of organoids in research.

Key Market Trends & Insights

- North America dominated the organoids and spheroids market with the largest revenue share of 34.72% in 2024.

- The organoids and spheroids market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on type, the organoids segment led the market with the largest revenue share of 59.65% in 2024.

- Based on application, the developmental biology segment led the market with the largest revenue share of 30.17% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billion

- 2030 Projected Market Size: USD 6.27 Billion

- CAGR (2025-2030): 23.2%

- North America: Largest market in 2024

Scientists have been using these systems for the testing and identification of promising medications.

Researchers and companies are working hard to develop organoids that can mimic diseases such as colon cancer, lung cancer, chronic kidney disease, and genetic disorders. Their dedication and innovation are driving a greater need for organoids in the scientific community, as these miniature models hold immense potential for studying and understanding these complex health conditions. For instance, 106 clinical research with organoids are now ongoing as of February 2024, according to ClinicalTrials.gov. In addition, the results of using organoids in pharmaceutical research were being further improved by the most recent technological developments in the creation of organoid models.

Technological innovation in the 3D spheroid technologies

Technological developments in the 3D spheroid technologies are expected to drive the market growth. For instance, the Cultrex Organoid Progenitor Cells provided by AMS Biotechnology (AMSBIO) can be enhanced through the utilization of distinct sets of extracellular matrices, enabling researchers to regulate cellular behavior by manipulating the culture microenvironment. In addition, AMSBIO's Cultrex spheroid proliferation/viability and invasion assays facilitate the creation of cohesive spheroids in low adhesion conditions, promoting the advancement of spheroid development.

Likewise, SCIVAX Corporation’s Nano Culture Plate (NCP) and Nano Culture Dish (NCD) are suitable for high throughput screening applications. Furthermore, spheroids cultivated on NCP are employed for live imaging using both fluorescence microscopes and bright-field microscopes. As a result, these plates have become widely adopted for the development of assays that were previously challenging to develop using other three-dimensional (3D) or monolayer cell culture systems.

Rising demand for tissue engineering & organ transplantation

Organoids and spheroids provide a promising alternative for regenerating or replacing damaged tissues by mimicking the 3D structure and function of real organs. For instance, kidney organoids developed by researchers at Murdoch Children’s Research Institute (2022) have shown potential for future applications in renal tissue regeneration. Similarly, liver spheroids are being utilized in toxicology screening and as precursors to bioengineered liver tissues, reducing the reliance on animal testing and accelerating drug development. These advancements are pushing the market forward by offering scalable, patient-specific solutions for both therapeutic and research applications in regenerative medicine.

Methods for the generation and culture of cancer spheroids and organoids:

Method or Technology

Advantages

Inconvenient

Hanging drop method

• Simple and easy to perform

• Low cost

• Generate small numbers of organoids

• No need for specialized equipment• Can be technically challenging to handle and manipulate the organoids

• Limited scalability and reproducibility

• Takes a long time

• Difficult long-term cultureLow-attachment plate method

• Can be used to generate small or large numbers of organoids

• Simple and easy to perform

• Wide range of cell types and seeding concentrations• Formation of spheroids with irregular and heterogeneous shapes and sizes

• Not provide adequate oxygen and nutrient supply to the center of the spheroids

• Cost of the equipment

• Continuous agitation could be a need to culture spheroids and organoids

• Challenging medium exchangesMicrowell method

• Allows for the formation of multiple organoids in a single well

• Allows for high-throughput screening

• Allows for better control over the microenvironment of the organoids

• Allows for the formation of multiple organoids in a single well• Can be technically challenging to handle and manipulate the organoids

• High cost of the equipment

• Can be technically challenging to handle and manipulate the organoids

• Relatively high cost of the equipmentMagnetic levitation

• Formation of uniform cell aggregates

• Can be used to create dynamic and versatile microenvironments for cells, (ex: mimicking the mechanical forces of blood flow)

• Using magnetic fields to• New technology and more research are needed to fully understand its potential uses in cancer research

• High cost of the specialized equipment and the magnetic beads

• Difficult to scale up toSource: MDPI

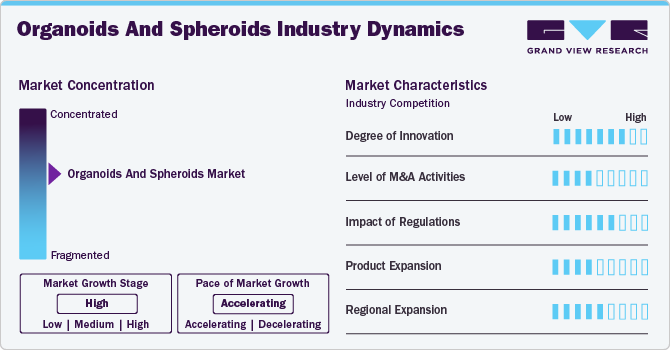

Market Concentration & Characteristics

The organoids and spheroids industry is witnessing significant innovation, driven by advancements in stem cell research, genome editing technologies, microfluidics, and automation. Researchers are exploring the use of organoids for drug discovery applications due to their potential to better mimic the physiological environment of human organs compared to traditional cell culture systems. This has led to the development of new organoid culture media, growth factors, and scaffolds that support the formation of complex organoid structures. Moreover, the use of CRISPR/Cas9 gene editing technology is enabling researchers to generate patient-specific organoids, which can be used for personalized medicine applications. The integration of microfluidics and automation technologies is also facilitating the development of high-throughput organoid screening platforms that can accelerate drug discovery processes.

The level of M&A activities in the organoids and spheroids industry has been moderate in recent years. For instance, In May 2021, Crown Bioscience, a global drug discovery and development services company, announced the acquisition of OcellO B.V., a Netherlands-based company specializing in organoid-based drug discovery services for oncology and immunology indications. The acquisition is aimed at expanding Crown Bioscience's preclinical in vitro drug development service offerings, particularly in the areas of oncology and immunology, and strengthening its position in the growing organoids market. OcellO's expertise in organoid technology and its proprietary organoid platform is expected to complement Crown Bioscience's existing capabilities in cell biology, genetics, and genomics, enabling the company to offer more comprehensive and integrated drug discovery services to its clients in the pharmaceutical and biotechnology industries.

Regulations play a vital role in the organoids and spheroids industry, shaping how these technologies are used and developed. Stem cells, which are essential for creating organoids and spheroids, raise important ethical questions about their source and potential impact on human health. Due to these concerns, a complex regulatory framework has been established to address these issues. However, navigating these regulations can result in delays and increased costs for companies working in this field. Regulatory bodies set standards to ensure the safety and effectiveness of organoids and spheroids, evaluating factors such as culture quality, model validation, and how well they replicate human biology. Adhering to these regulations is key to gaining approval for drug development and preclinical testing, highlighting the importance of compliance in this innovative area of research.

The current product expansion in the organoids and spheroids industry can be considered moderate. While there have been advancements and new product launches in this field, the rate of expansion may not be as high as in some other sectors. Organoids and spheroids are relatively new technologies in the field of life sciences research, and their adoption and understanding are still evolving. For instance, in February 2023, TheWell Bioscience, a provider of innovative solutions for cell culture and tissue engineering, has recently announced the launch of its new product, the VitroGel Organoid Recovery Solution. This solution is designed to facilitate the fast and safe harvesting of organoids and cells, resulting in high yields. With the VitroGel Organoid Recovery Solution, researchers can now efficiently retrieve their organoids and cells from the gel matrix without compromising their viability or functionality. This breakthrough technology is set to significantly enhance the productivity and efficiency of organoid and cell culture workflows, enabling researchers to accelerate their studies and discoveries in the field of regenerative medicine, drug development, and disease modeling.

The regional expansion level in the organoids and spheroids industry refers to the geographical reach and presence of companies operating in this market. As the demand for advanced cell-based models increases, companies in this market are looking to expand their presence in different regions to tap into new markets and opportunities. The regional expansion level in the organoids and spheroid market can vary depending on the company and its strategic goals. Some companies may start by expanding within their home region, gradually moving to neighboring countries or regions, and ultimately expanding to a global level. Others may choose to directly enter multiple regions simultaneously.

Type Insights

Based on type, the organoids segment led the market with the largest revenue share of 59.65% in 2024. The organoid market is primarily driven by the increasing demand for physiologically relevant 3D cell culture models in drug discovery, disease modeling, and personalized medicine. Organoids, derived from stem cells, offer a more accurate representation of human tissues compared to traditional 2D cultures, enabling more predictive preclinical testing and reducing reliance on animal models. Advances in stem cell technologies, CRISPR gene editing, and bioprinting have accelerated organoid research while rising investments from pharmaceutical companies and governments in regenerative medicine and cancer research further propel market growth. For instance, in October 2022, AIM Biotech Pte. Ltd. released the organiX System. Organoids can be given vascularization and immunological competence using this technique, extending their shelf life during the study process.

The spheroid segment is expected to grow at the fastest CAGR over the forecast period. In the past few years, spheroid cultures have been in demand in drug discovery, toxicology, and cancer research. For instance, a June 2022 study conducted by researchers at the University of Padua mapped the use of MCTSs in cancer nanomedicine presents a significant opportunity since it is the first step in bridging the gap between pre-clinical and clinical research, improving the effectiveness and efficiency of the development of nanotechnology-based medicines. Spheroids are commonly generated from cell lines, whereas stem cells are the preferred cell source for culturing organoids. The commercial availability of cell lines for spheroid generation is a major factor in the high revenue share of the segment. LNCaP Cell Line and PC-3 Cell Line are some of the commonly used products for spheroid generation.

Application Insights

Based on application, the developmental biology segment led the market with the largest revenue share of 30.17% in 2024, owing to the rising usage of organoid and spheroid culture systems for developmental biology. Organoid biology presents a great opportunity to test the fundamentals of human developmental biology that have been obtained through classical approaches.

Organoids derived from Induced Pluripotent Stem Cells (iPSCs) and Embryonic Stem Cells (ESCs) have emerged as valuable tools for investigating tissue homeostasis, lineage specification, and embryonic development. This is primarily attributed to the ability of organoids to faithfully retain the developmental features exhibited during their formation. Consequently, researchers have successfully employed these models to gain insights into the developmental biology of various organs, including the stomach, pancreas, and brain, by inducing sequential differentiation via signaling pathways such as Fibroblast Growth Factor (FGF), Bone Morphogenetic Protein (BMP), and Wnt.

The regenerative medicine segment is expected to witness at the fastest CAGR over the forecast period. Transplantation of organoids and spheroids that are derived from adult stem cells helps in the replacement of diseased tissue or organs. For instance, XanoMATRIX surfaces are used for the growth and culturing of mesenchymal stem cells and are also used for regenerative medicine.

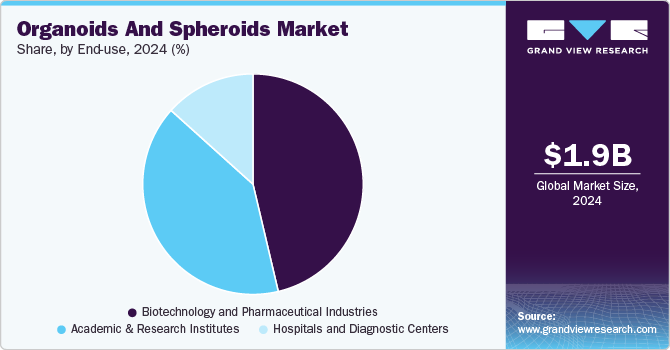

End Use Insights

Based on end use, the biotechnology and pharmaceutical industries segment led the market with the largest revenue share of 46.32% in 2024. Potential clinical applications of organoids and spheroids have encouraged pharmaceutical start-ups to venture into this arena. Moreover, the high utilization rate of organoids and spheroids in pre-clinical drug discovery by pharma entities is expected to propel organoids and spheroids industry growth.

Globally, the prevalence of chronic diseases such as cancer, chronic renal disease, and cardiovascular disease is rising. For instance, according to the American Cancer Society, in the U.S., about 1,918,030 new cancer cases and 609,360 cancer deaths were anticipated in 2022, with lung cancer as the primary cause of death accounting for about 350 of those fatalities daily. The burden of providing healthcare to an expanding number of patients with various chronic diseases is rising, but so are efforts to find new treatments for these diseases through research and development.

The academic & research institutes segment is expected to witness at the fastest CAGR over the forecast period. The use of organoid models for research and development is growing because of an improved understanding of disease conditions and how medications affect actual organs. According to ClinicalTrial.gov, the objective of the "Intestinal Organoids (BIODES)" study, which began in France in September 2022, was to create a bio-collection of organoids from digestive biopsies along with related health information, to test those organoids with potential therapeutic molecules for gastrointestinal disorders. An increase in the number of research initiatives, collaborations, and strategic alliances between major players is expected to boost segment revenue generation.

Regional Insights

North America dominated the organoids and spheroids market with the largest revenue share of 34.72% in 2024. The increase in the utilization of organoid-based research models in the biotechnology sector in the U.S. and Canada can be attributed to the advancements in technology that have enabled the development of 3D organoids and spheroids. These innovative models have proven to be more effective than traditional 2D cell culture platforms, as they provide a more accurate representation of human tissue structures. By creating a microenvironment that closely mimics in vivo conditions, researchers can obtain more reliable and predictive results from their experiments.

U.S. Organoids And Spheroids Market Trends

The organoids and spheroids market in the U.S. accounted for the largest market revenue share in North America in 2024. The local presence of key players, such as Corning, PerkinElmer, and Thermo Fisher Scientific, Inc., is expected to enhance the market growth in the U.S. Moreover, the existence of international funding organizations in this region is also anticipated to drive the demand for organoids and spheroids culture systems. For instance, according to ClinicalTrial.gov, a study titled "Patient-derived Organoid Model and Circulating Tumour Cells for Treatment Response of Lung Cancer" was started in Texas, the U.S., in August 2018, and it is expected to be finished in December 2024. The objective of this work is to create a biobank of lung cancer organoids grown from patients and to assess the ex-vivo responses of the potential organoids to various chemotherapy drugs.

Europe Organoids And Spheroids Market Trends

The organoids and spheroids market in Europe is expected to witness at a significant CAGR over the forecast period, driven by several factors. One of the primary growth drivers is the increasing demand for personalized medicine, which has led to a surge in demand for patient-specific models for drug discovery and development. Organoids and spheroids offer an opportunity to create such models by mimicking human tissue structures in a 3D environment. This technology has the potential to reduce the time and cost associated with traditional drug discovery methods while improving their efficacy and safety.

The Organoids and Spheroids Europe 2024 Conference in Rotterdam, the Netherlands, is an essential event in the field. The conference’s primary objective is to learn about the assembly of cells into functional clusters using microfluidics and lab-on-a-chip technologies. Creating physiologically relevant organoids, such as liver cells for toxicity tests or ex vivo organ sections for biological process studies, is expected to be a key research focus. Given the significant impact of this improvement on disease modeling, drug discovery, and personalized medicine, this conference is crucial for researchers, clinicians, and industry leaders.

The UK organoids and spheroids market is anticipated to grow at a substantial CAGR during the forecast period. Technological advancements have played an important role in driving market growth in the UK. The government in the UK has invested heavily in genomics research, which has led to the development of cutting-edge technologies for creating organoids and spheroids. For instance, in May 2023, Chancellor Jeremy Hunt announced a USD 700.65 million war chest to boost the UK's life sciences sector is expected to have a positive impact on the market growth. The funding will be used to support research and development in various areas of life sciences, including genomics, artificial intelligence (AI), and cell and gene therapies. The funding is also expected to support the establishment of a new National Institute for Health Protection (NIHP), which will focus on improving public health by developing new treatments and vaccines. This initiative is expected to drive demand for organoids and spheroids, as they provide an ideal model for testing new treatments and vaccines in a preclinical setting.

The organoids and spheroids market in France is expected to grow at the fastest CAGR during the forecast period. The French government has made significant investments in stem cell technology, which has contributed to the market in France. Stem cells have the potential to differentiate into various cell types and can be used to create organoids and spheroids that mimic human tissue structures in vitro. The French government has established several research centers and initiatives focused on stem cell research, such as the Institut Clinique de la Souris (ICS) and the Centre de Recherche en Cancérologie de Marseille (CRCM). These centers have contributed to advancements in stem cell technology and have facilitated research into organoids and spheroids for various applications such as drug discovery, disease modeling, and regenerative medicine.

The Germany organoids and spheroids market is projected to grow at a significant CAGR during the forecast period. The government has been actively supporting research and development in the German market through funding initiatives. For instance, the German Research Foundation (DFG) provides funding for research projects focused on organoids and spheroids, including projects focused on disease modeling, drug discovery, and regenerative medicine. Moreover, the German government has established several research centers and initiatives focused on organoids and spheroids, such as the Fraunhofer Institute for Cell Therapy and Immunology (IZI) and the German Center for Neurodegenerative Diseases (DZNE). These centers provide a platform for researchers to collaborate and advance in the field of organoids and spheroid.

Asia Pacific Organoids And Spheroids Market Trends

The organoids and spheroids market in Asia Pacific is expected to witness at the fastest CAGR over the forecast period, owing to constant developments in the field of stem cell research. A rise in partnerships among key market entities is expected to enhance market growth. For instance, in March 2020 Nichirei Biosciences and UPM Biomedicals partnered together to provide UPM culture products in Japan. This enhanced the availability of natural hydrogels for spheroid and organoid culture.

The China organoids and spheroids market has seen significant advancements in 3D cell culture technology, especially with regard to organoids and spheroids. As a result, China's market for these sophisticated cell culture models is expanding. China's 3D cell culture technology has recently advanced thanks to partnerships that promote research in this area. For instance, in October 2020, Merck entered into a collaboration with D1Med to advance the application of three-dimensional (3D) cell culture technology in China, with Merck providing 3D cell culture products and expertise. This collaboration reflects the increasing focus on 3D cell culture techniques, which are gaining traction in cell biology and have the potential for various applications, including tissue engineering, regenerative medicine, drug development, toxicity testing, and organoid formation.

The organoids and spheroids market in Japan has been experiencing significant growth, fueled by advancements in 3D cell culture technology and increasing research activities in the field of advanced cell models. In addition, several key players in Japan are contributing to the market growth. For instance, in March 2020, UPM and Nichirei Biosciences formed a strategic partnership to cater to the growing demand for advanced natural hydrogels in the Japanese 3D cell culture market. This collaboration aims to supply high-quality GrowDex hydrogels developed by UPM to support the research and development efforts of Japanese biotech and pharmaceutical companies. The partnership between UPM and Nichirei Biosciences brings together UPM's expertise in developing innovative natural hydrogels and Nichirei Biosciences' strong presence and deep understanding of the Japanese life sciences market. This collaboration will enable Japanese researchers and scientists to access cutting-edge cell culture technologies such as GrowDex hydrogels, known for their biocompatibility and ability to mimic the native extracellular matrix, providing an ideal environment for growing organoids and spheroids.

Middle East And Africa Organoids And Spheroids Market Trends

The organoids and spheroids market in the Middle East and Africa is driven by a growing focus on advancing healthcare infrastructure, increasing investment in biomedical research, and rising government initiatives to promote precision medicine and biotechnology. Countries such as the United Arab Emirates and Saudi Arabia are prioritizing life sciences as part of their economic diversification strategies, leading to the establishment of research hubs and collaborations with global biotech firms. The region’s rising burden of chronic diseases, including cancer and diabetes, is also fueling demand for more predictive and patient-relevant 3D cell models like organoids and spheroids.

The organoids and spheroids market in Saudi Arabia is anticipated to grow at a significant CAGR during the forecast period.The Saudi Arabian government is investing heavily in research and development in various fields, including healthcare, which is driving the market growth in Saudi Arabia. For instance, the significant investment in healthcare infrastructure under Saudi Arabia's Vision 2030 initiative is expected to provide a major boost to the country's market. This USD 65 billion investments is facilitating the development of new technologies, products, and services in the field of healthcare, including organoids and spheroids, and is leading to their commercialization in the Saudi Arabian market.

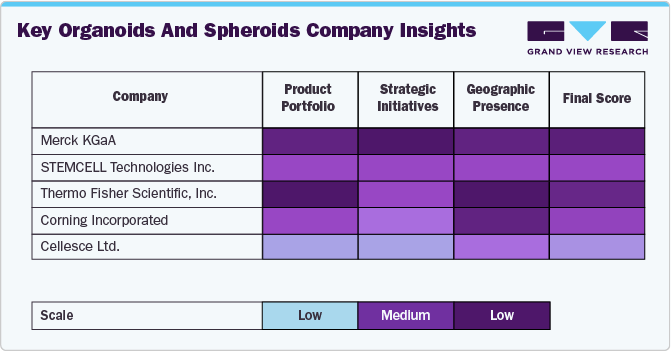

Key Organoids And Spheroids Company Insights

Competition among the existing players has increased owing to developments in technology and its potential applications in the arena of drug discovery. Therefore, key players are continuously involved in the launch of new and improved products. For instance, Perkin Elmer offers a wide portfolio of platforms for the detection, handling, and analysis of spheroids. Researchers have developed mini lungs to study the mechanism of the entry of SARS-CoV-2 and its spread in tissues. Organoids have also been employed to study the defense mechanism of tissues against SARS-CoV-2. This can potentially help in the development of a vaccine for treatment.

Regulatory compliance and ethical considerations play a crucial role in shaping the competitive scenario. Companies that successfully navigate stringent approval processes and develop standardized, scalable organoid models will dominate the market. As the demand for precision medicine grows, firms investing in personalized organoid platforms will likely capture significant market share. The competition is further intensified by emerging startups introducing cost-effective, high-throughput organoid solutions, challenging established players. With continuous advancements and increasing regulatory support, the organoid market is poised for sustained growth, driving new opportunities across the biotech, pharma, and healthcare sectors.

The above analysis highlights the competitive landscape of the companies, with larger firms maintaining a more robust global footprint and strategic engagement. Companies like Merck KGaA, STEMCELL Technologies, and Thermo Fisher Scientific Inc. demonstrate strong positions across all three categories, suggesting a well-rounded market presence. Corning Incorporated and Corning Inc. show moderate strength, particularly in strategic initiatives and geographic reach. Meanwhile, Cellesce Ltd. & others appear to have relatively lower scores, indicating potential areas for growth.

Key Organoids And Spheroids Companies:

The following are the leading companies in the organoids and spheroids market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Biomatrix

- 3D Biotek LLC

- AMS Biotechnology (Europe) Limited

- Cellesce Ltd.

- Corning Incorporated

- Greiner Bio-One

- Hubrecht Organoid Technology (HUB)

- InSphero

- Lonza

- Merck KGaA

- Prellis Biologics

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In March 2024, CHA Biotech signed a CDMO agreement with Cell in Cells, a regenerative medicine company specializing in cell therapies, to develop and manufacture organoid-based treatments for cartilage diseases. This partnership aims to advance regenerative medicine by leveraging organoid technology for innovative therapeutic solutions.

-

In August 2023, InSphero, a company specializing in robotics and intelligent automation, entered into a distribution agreement with Advanced BioMatrix, a provider of biomaterial solutions for cellular assays and regenerative medicine, to expand the use of 3D cell culture techniques beyond traditional suspension-based methods into scaffold-based models.

-

In June 2023, Inventia Life Science partnered with Biotron Healthcare to distribute its RASTRUM miniaturized 3D cell culturing platform in India. This collaboration is expected to benefit the field of organoids and spheroids by making the advanced technology of the RASTRUM platform more accessible to researchers in India.

Organoids And Spheroids Market Report Scopes

Report Attribute

Details

Market size value in 2025

USD 2.21 billion

Revenue forecast in 2030

USD 6.27 billion

Growth rate

CAGR of 23.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3D Biomatrix; 3D Biotek LLC; AMS Biotechnology (Europe) Limited; Cellesce Ltd; Corning Incorporated; Greiner Bio-One; Hubrecht Organoid Technology (HUB); InSphero: Lonza; Merck KGaA; Prellis Biologics; STEMCELL Technologies Inc.; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organoids And Spheroids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organoids and spheroids market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

By Type

-

Organoids

-

By Type

-

Neural Organoids

-

Hepatic Organoids

-

Intestinal Organoids

-

Other Organoids

-

-

By Method

-

General Submerged Method for Organoid Culture

-

Crypt Organoid Culture Techniques

-

Air Liquid Interface (ALI) Method for Organoid Culture

-

Clonal Organoids from Lgr5+ Cells

-

Brain and Retina Organoid Formation Protocol

-

Others

-

-

By Source

-

Primary Tissues

-

Stem Cells

-

-

-

Spheroids

-

By Type

-

Multicellular Tumor Spheroids (MCTS)

-

Neurospheres

-

Mammospheres

-

Hepatospheres

-

Embryoid bodies

-

-

By Method

-

Micropatterned Plates

-

Low Cell Attachment Plates

-

Hanging Drop Method

-

Others

-

-

By Source

-

Cell Line

-

Primary Cell

-

iPSCs Derived Cells

-

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Developmental Biology

-

Personalized Medicine

-

Regenerative Medicine

-

Disease Pathology Studies

-

Drug Toxicity & Efficacy Testing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical Industries

-

Academic & Research Institutes

-

Hospitals and Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors driving the organoids and spheroids market growth include technological developments in 3D spheroid technology, high adoption of organoids & spheroids in drug discovery, and rising demand for cell therapy & tissue engineering.

b. The global organoids and spheroids market size was estimated at USD 1.86 billion in 2024 and is expected to reach USD 2.21 billion in 2025.

b. The global organoids and spheroids market is expected to grow at a compound annual growth rate of 23.23% from 2025 to 2030 to reach USD 6.27 billion by 2030.

b. North America region dominated the organoids and spheroids market with a share of 34.72% in 2024. The region's dominance can be attributed to supportive government regulations, growing demand for innovative therapeutics, and increasing efforts by key market players to advance cell-based therapy products for treating a range of chronic disorders.

b. Some of the key players operating in the organoids and spheroids market include 3D Biomatrix; 3D Biotek LLC; AMS Biotechnology (Europe) Limited; Cellesce Ltd; Corning Incorporated; Greiner Bio-One; Hubrecht Organoid Technology (HUB); InSphero, Lonza; Merck KGaA; Prellis Biologics; STEMCELL Technologies Inc.; Thermo Fisher Scientific, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.