- Home

- »

- Alcohol & Tobacco

- »

-

Organic Wine Market Size And Share, Industry Report, 2030GVR Report cover

![Organic Wine Market Size, Share & Trends Report]()

Organic Wine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Red Wine, White Wine), By Packaging (Bottles, Cans), By Distribution Channel (On-Trade, Off-Trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-914-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Wine Market Summary

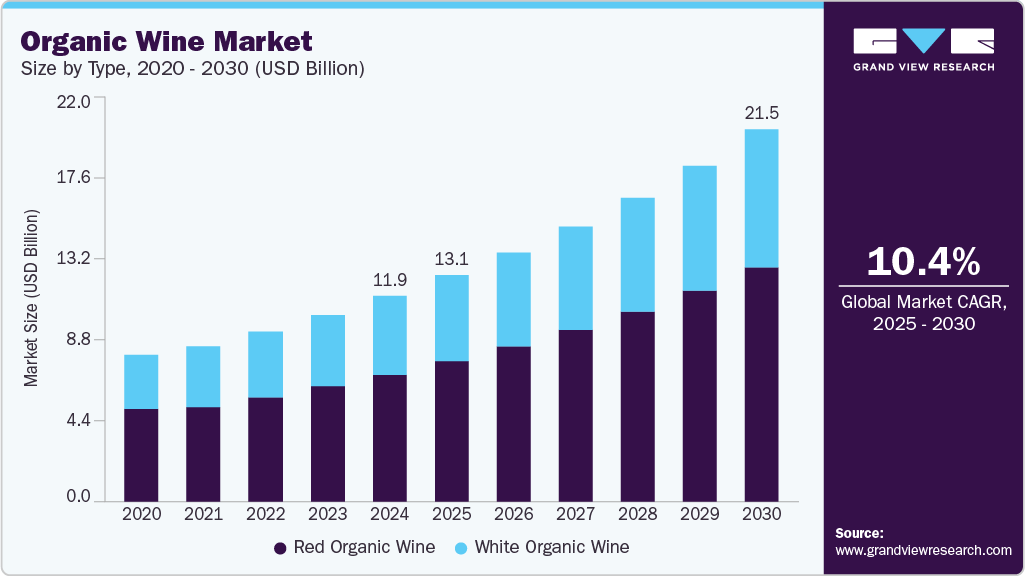

The global organic wine market size was estimated at USD 11.87 billion in 2024 and is projected to reach USD 21.48 billion by 2030, growing at a CAGR of 10.4% from 2025 to 2030. Wine consumption has become a sign of social status, especially among millennials and the young generation, which is driving the market.

Key Market Trends & Insights

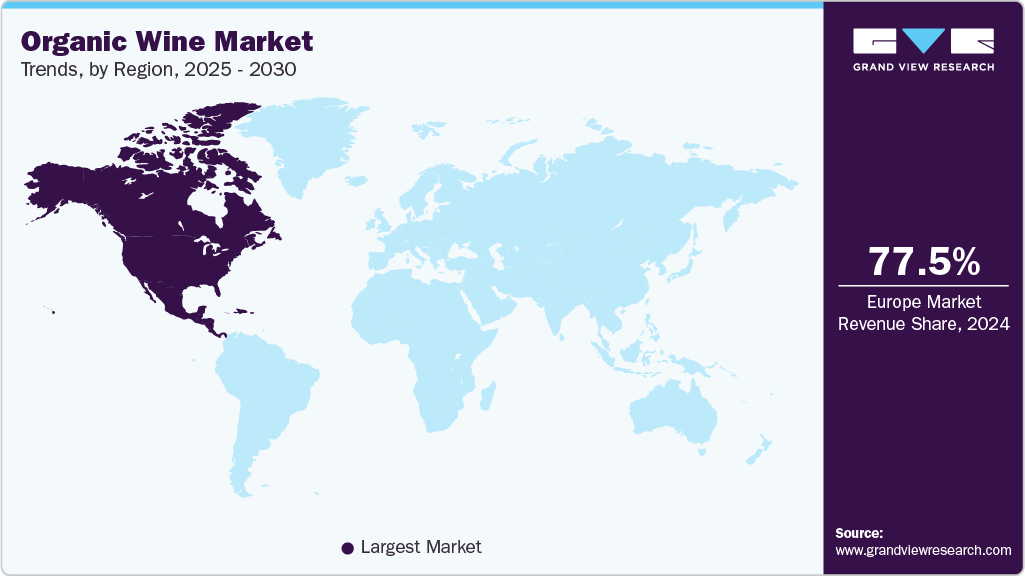

- The organic wine market in Europe accounted for a share of 77.5% of the global market.

- The U.S. commands a significant share of the North American organic wine market and is experiencing consistent growth.

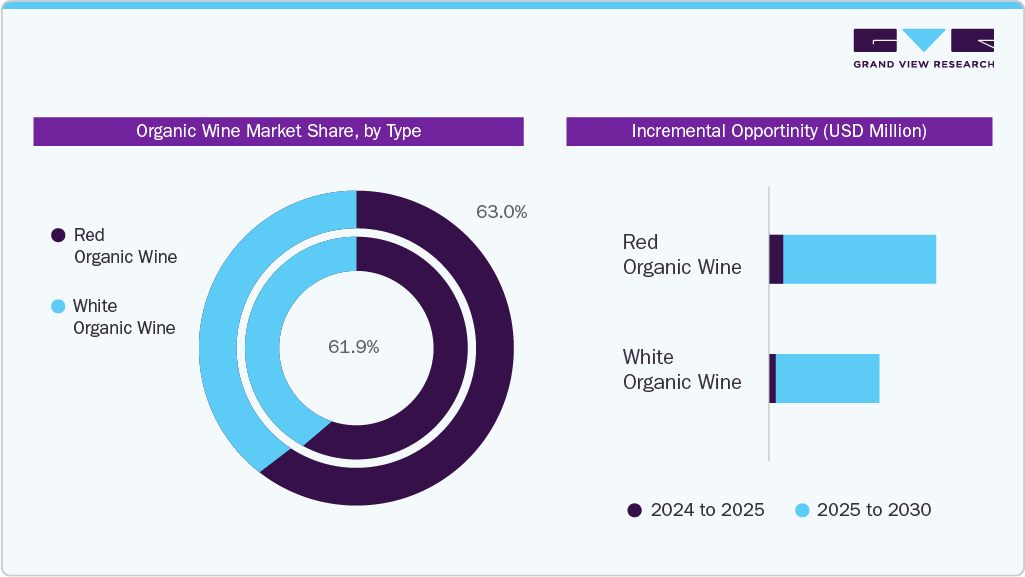

- Based on type, organic red wine accounted for a revenue share of 61.9% in 2024.

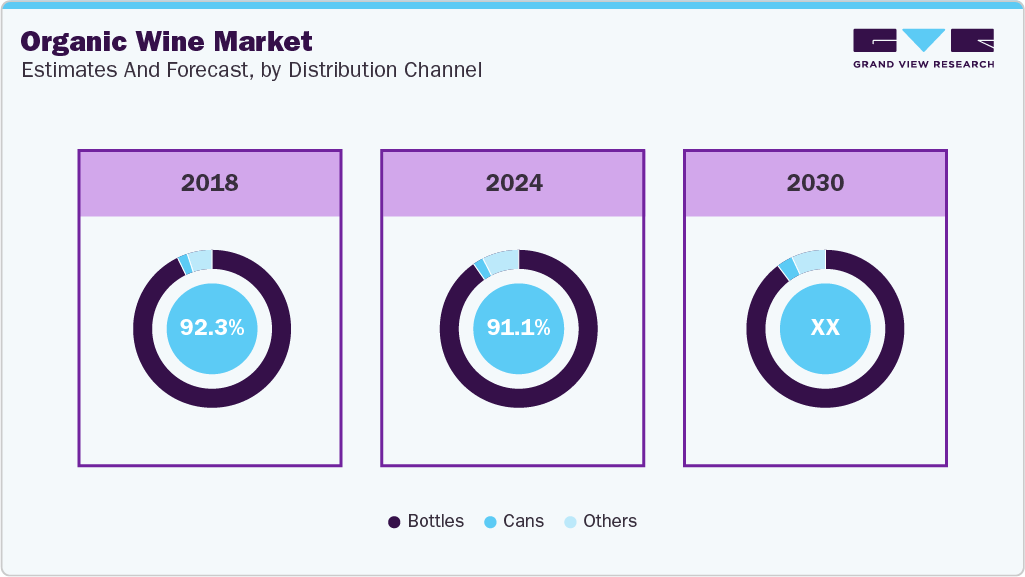

- By packaging, bottled organic wine accounted for a revenue share of 91.1% in 2024.

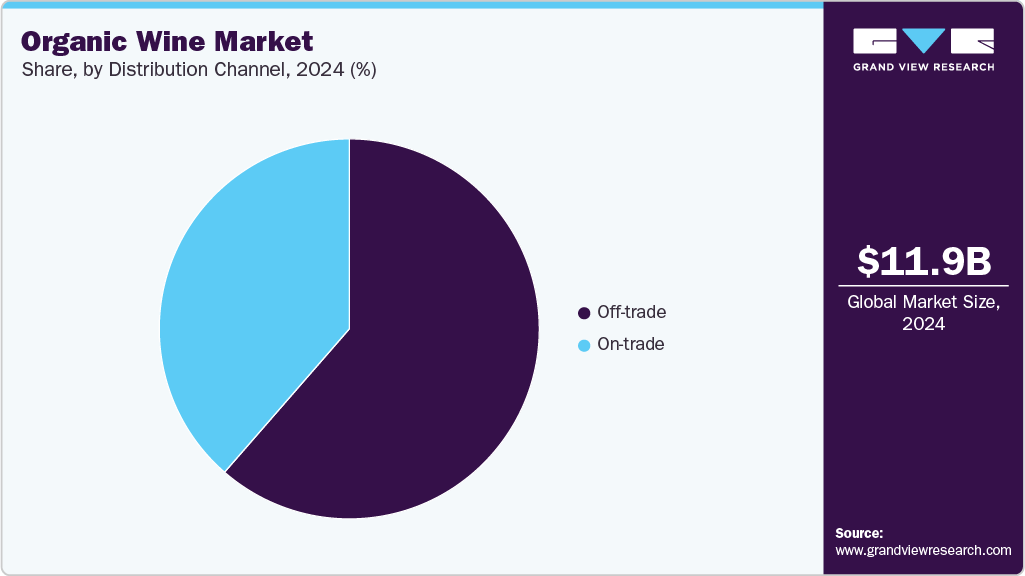

- Based on distribution channel, sales of organic wine through off-trade channels accounted for a revenue share of 61.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.87 Billion

- 2030 Projected Market Size: USD 21.48 Billion

- CAGR (2025-2030): 10.4%

- Europe: Largest market in 2024

- North America: Fastest growing market

Wine sales have surged across the globe owing to innovation in flavor, color, and packaging of the product. Beyond the classics, niche markets and emerging wine regions are gaining prominence. Countries such as Argentina, New Zealand, and South Africa are carving out niches with their distinct offerings. Indigenous grape varieties, innovative winemaking techniques, and unique terroirs are captivating adventurous palates.The market for organic wine is experiencing a significant surge, driven by a growing awareness among consumers about health and wellness. As people become more conscious of what they consume, they are increasingly turning to organic products, including wine, which is seen as a healthier alternative to conventional varieties. Organic wine is produced without synthetic pesticides, herbicides, or chemical fertilizers, and often contains lower levels of sulfites and additives. This makes it appealing to health-conscious consumers who are seeking cleaner, more natural beverage options that align with their lifestyles.

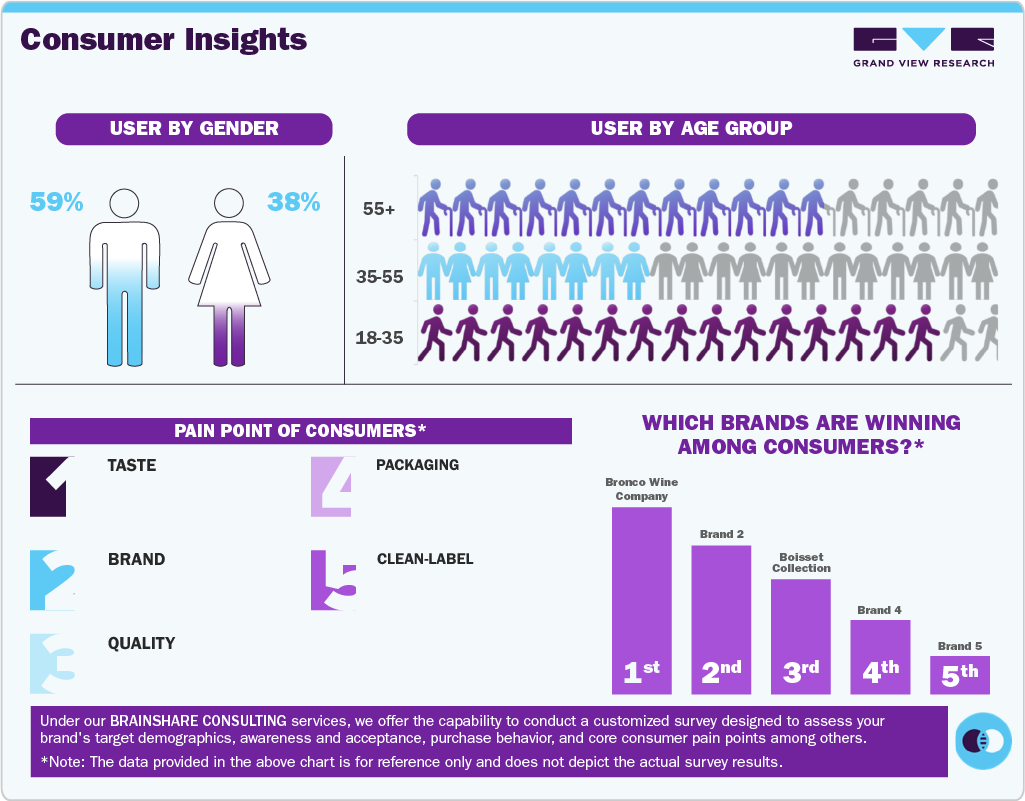

Changing consumer preferences, especially among younger demographics such as Millennials and Gen Z, are also playing a key role in the growth of the organic wine market. These groups tend to favor products that are transparent in their sourcing and production methods. They are more experimental, curious about niche offerings, and willing to try wines that reflect authenticity and craftsmanship. Organic wine fits well into this evolving consumer landscape, where values such as transparency, traceability, and ethical production carry increasing importance.

The premiumization of the wine market is further boosting organic wine sales. Organic wines are often seen as high-quality, artisanal products that offer a unique flavor profile. This perception of superior quality and exclusivity attracts premium wine buyers who are looking for products that stand out. Additionally, organic wine is gaining traction in fine dining establishments, wine bars, and competitions, further enhancing its reputation and appeal.

The rise of wine tourism emerges as a noteworthy factor, with consumers expressing a growing interest in immersive experiences such as vineyard visits, tastings, and insights into the winemaking process. Wine regions, in turn, benefit from the economic impact generated by the influx of tourists.

Many manufacturers prefer to source organic grapes in large quantities from local organic vineyards to reduce production costs while maintaining quality standards. In addition, locally produced organic wine has been gaining popularity due to increasing consumer demand for natural, sustainable, and chemical-free products. Although organic wine still represents a niche within the broader wine market, both its production and consumption have grown steadily in recent years, driven by rising consumer awareness of health, wellness, and environmental sustainability. For instance, in April 2024, Scheid Family Wines launched a certified organic Grandeur Cabernet Sauvignon to celebrate Earth Month. This new wine, certified by California Certified Organic Farmers (CCOF), highlights the winery’s commitment to organic farming, sustainability, and transparency. The label provides detailed ingredient and nutrition information, and the wine is both vegan-friendly and gluten-free. Scheid now farms 667 certified organic acres, making it the largest CCOF-certified organic wine grape grower on California’s Central Coast.

Increased availability and improved distribution channels are making organic wine more accessible than ever. Supermarkets, online retailers, and specialty wine shops are expanding their organic selections, and many vineyards are promoting their offerings directly to consumers through wine clubs and e-commerce platforms. This enhanced accessibility, combined with growing familiarity and trust in organic certifications, is encouraging more consumers to make the switch.

Organic wines are perceived as healthier and of higher quality than regular wine; as a result, they have become increasingly popular across the world. Over the past few years, the demand for these drinks has been rising in countries such as the U.S., France, Italy, Germany, and others. Manufacturers across the globe are increasingly launching new products to meet this surging demand. For instance, in August 2023, LINE 39 launched a new line of organic wines, “Line 39 Organic”, including three new wines, namely Rosé, Chardonnay, and Cabernet Sauvignon. Moreover, in April 2022, Winc, Inc., a winery company in the U.S., launched ‘Wonders,’ a no-sugar, organic, and sustainable wine.

Responsible consumption and sustainability have become key trends in the industry. Consumers look for ethical labels that offer information on distribution and manufacturing methods. It is significant for consumers that grapes used in the production of wines are organically certified grapes or are produced by wineries with sustainable practices. According to a survey conducted by Wine Opinions in March and July 2022, 28% of the U.S. consumers in their 20s and 21% of consumers in their 30s consider wines produced with organically-grown grapes “very important.” Moreover, consumers’ interest in organic wine stems from concerns about the environment, which is often considered to be more pronounced among millennials. Major players such as The Wonderful Wine Co. and Cassa Marrone have also been adopting eco-friendly ingredients to produce wine.

In addition, organic wine is considered healthier than other alcoholic beverages in various regions of the world, including Asia Pacific, and is considered a sign of social distinction. As a result, its consumption is growing among consumers.

Furthermore, the numerous health benefits of organic wine have been attracting consumers, especially highly health-conscious consumers. Resveratrol, a polyphenolic compound present in wine, helps reduce the risk of Alzheimer’s.In addition, the increasing acceptance of organic food & beverages is positively influencing the demand for organic wine. Thus, the nutritional attributes of the product are increasing the consumption of wine around the world.

Type Insights

Organic red wine accounted for a revenue share of 61.9% in 2024. Red wines, including organic red wines, contain high amounts of resveratrol, a powerful antioxidant that helps fight free radicals and toxins that may damage cells and organs. In addition, resveratrol in red wines promotes health and longevity. The consumption of organic red wines has been shown to aid brain health and prevent memory decline and other related conditions, such as dementia and Alzheimer’s.Owing to these benefits, the consumption of organic red wines is increasing among consumers across the globe. To meet this increasing demand, an increasing number of products are offered by market players, which is likely to bode well for the segment’s growth.

The organic white wine market is expected to grow at a CAGR of 9.9% from 2025 to 2030. Organic white wines are high in minerals, such as zinc, which boosts metabolic function. The content of antioxidants and polyphenols, which improve cardiovascular function, is higher in organic white wine than in red wine. In addition, flavonoids are found in white wine. These help reduce inflammation of the airways and protect the lungs, boosting their functioning. Owing to such factors, the consumption of white wine is increasing.

Moreover, players operating in the industry are increasingly launching new products. For instance, in June 2023, Bodega Argento launched ‘Artesano Organic White Malbec’, the first-ever White Malbec in the U.S., which is produced using organic grapes.

Packaging Insights

Bottled organic wine accounted for a revenue share of 91.1% in 2024. Glass bottles are the primary packaging format for organic wines as they are recyclable and reusable. Due to the material’s inert nature, glass bottles can store wines for a long time compared to plastic bottles and cans. Moreover, glass gives the packaging a premium look, which is another factor attributable to the demand for this packaging. Glass is the most adopted packaging material for organic wines.

The canned organic wine market is expected to grow at a CAGR of 14.2% from 2025 to 2030. Aluminum and steel cans are extensively used for the packaging of organic wine. Cans are more convenient and portable than bottles, which, in turn, is driving the growth of canned wines. Aluminum cans weigh less than glass bottles and therefore, lessen the carbon footprint of transporting them from the vineyard to the distributors. The demand for environment-friendly packaging is rising among consumers.

Distribution Channel Insights

Sales of organic wine through off-trade channels accounted for a revenue share of 61.4% in 2024. Organic wine is gaining traction through off-trade channels such as supermarkets, wine shops, and online retailers due to rising consumer interest in health, sustainability, and transparency. As shoppers become more mindful of ingredients and production methods, they are increasingly choosing organic wines for at-home consumption. Retailers are expanding their organic selections to meet this demand, and clear labeling and certifications make it easier for consumers to identify and trust organic options on the shelves.

Sales of organic wine through on-trade channels are expected to grow with a CAGR of 9.6% from 2025 to 2030. The on-trade distribution channel includes bars, clubs, restaurants, hotels, and wineries. Product penetration of organic wine through restaurants and bars is the key factor driving the segment’s growth. Hospitality venues are responding by expanding their organic wine offerings to cater to this growing preference, enhancing their appeal to eco-conscious and health-aware patrons. Additionally, organic wines are often seen as higher quality and more artisanal, aligning well with curated wine lists and elevated dining experiences.

Regional Insights

The organic wine market in Europe accounted for a share of 77.5% of the global market. Europe is a major producer and consumer of organic wine, with a long tradition of organic agriculture and a strong regulatory framework supporting its development. Demand is particularly robust in Western European countries, such as Germany, France, and the UK, where consumers are highly conscious of environmental issues and food safety. The increasing availability of organic wines in supermarkets, specialized wine stores, and online retailers is making them more accessible to a wider consumer base. Moreover, the market growth is also fueled by government subsidies and initiatives that support organic farming and winemaking. Stronger labeling requirements and certification systems in Europe provide consumers with greater assurance about the authenticity and quality of organic wines.

North America Organic Wine Market

The organic wine market in North America is projected to grow at a CAGR of 10.3% from 2025 to 2030, fueled by increasing consumer awareness of health and wellness, and a growing preference for sustainably produced products. Demand is particularly strong among millennials and Gen Z consumers, who are more likely to prioritize eco-friendly and ethical consumption habits. Furthermore, the broadening availability of organic wines in mainstream retail channels, including supermarkets and online platforms, is expanding their accessibility to a wider consumer base. Regulatory support and initiatives promoting organic agriculture also contribute significantly to the market's expansion.

U.S. Organic Wine Market

The U.S. commands a significant share of the North American organic wine market and is experiencing consistent growth. This is propelled by a sophisticated wine culture and a strong demand for premium and artisanal products. Consumers are increasingly willing to pay a premium for organic wines, driven by concerns about pesticide residues and a desire to support sustainable farming practices. The burgeoning organic food industry in the US is naturally spilling over into the beverage sector, creating a favorable environment for organic wine. Several key factors are amplifying demand in the US. Firstly, the expansion of organic vineyards and wine production across California and other states is increasing the supply of domestically produced organic wines, reducing reliance on imports.

Asia Pacific Organic Wine Market

The organic wine market in Asia Pacific is projected to grow at a CAGR of 10.0% from 2025 to 2030. driven by increasing disposable incomes, rising health consciousness, and a growing appreciation for wine culture, particularly in countries like China, Japan, and Australia. As consumers become more aware of the potential health benefits and environmental advantages of organic products, they are increasingly willing to pay a premium for organic wines. The expansion of retail distribution channels, including supermarkets, wine shops, and online platforms, is also making organic wines more accessible to consumers across the region. Additionally, growing awareness of food safety and concerns about pesticide residues in conventionally produced wines are also fueling demand for organic alternatives. The rising popularity of wine as a status symbol and a beverage for social occasions is creating new opportunities for organic wine producers.

Key Organic Wine Company

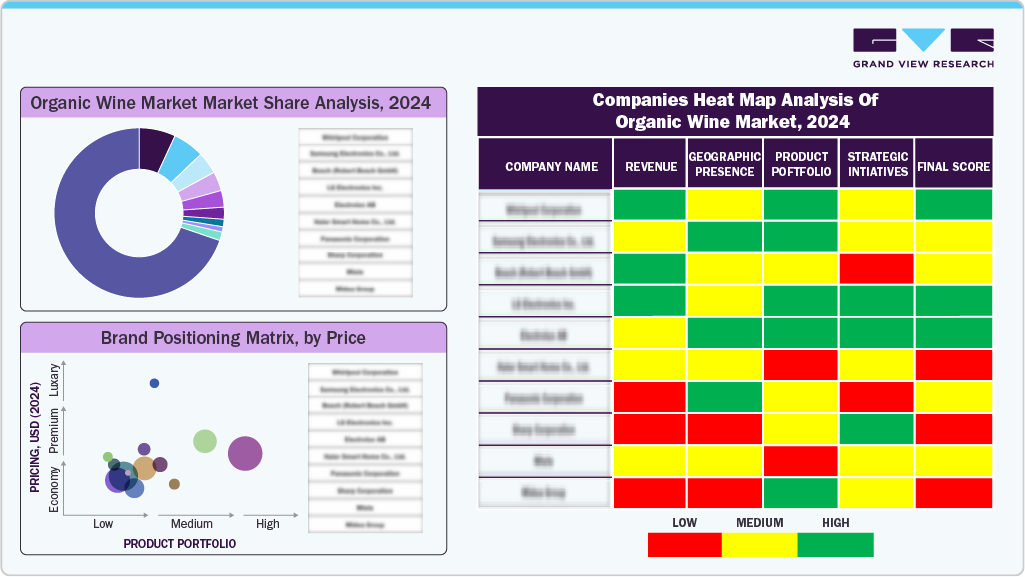

The organic wine market is characterized by the presence of several key companies with well-established brand recognition and extensive distribution networks.

Leading players have developed broad product portfolios and achieved significant penetration across mainstream retail channels. These companies continuously introduce new flavors and formats to appeal to a wide range of consumers, supported by strategic marketing initiatives and investments in production and distribution capabilities that enhance their competitive positioning.

Alongside the major participants, the market includes numerous smaller craft and regional brands contributing to type innovation and category diversification. The growing segment of wine producers is also influencing the market dynamics by bridging the gap between functional beverages and alcoholic drinks.

Overall, the organic wine market remains competitive, with companies focusing on innovation, expanded retail presence, and targeted marketing to respond to evolving consumer preferences and sustain growth.

Key Organic Wine Companies:

The following are the leading companies in the organic wine market. These companies collectively hold the largest market share and dictate industry trends.

- Bronco Wine Company

- Kendall-Jackson Winery

- King Estate Winery

- Boisset Collection - JCB (Jean-Charles Boisset)

- Emiliana Organic Vineyards

- Societa Agricola QuerciabellaSpA

- Grgich Hills Estate

- Avondale

- Frey Vineyards

- The Organic Wine Company

Recent Developments

-

In February 2025, Kind of Wild Wines launched a new Grenache Blanc "Orange Wine" made from organic grapes. This release marks the brand’s first orange wine, crafted by fermenting Grenache Blanc grapes with their skins to achieve a unique color and flavor profile. The wine is certified organic, vegan, and made with minimal intervention, aligning with Kind of Wild’s commitment to sustainability and natural winemaking.

-

In January 2024, Melea launched its first orange wine, Melea Organic Orange, made from organic and Demeter biodynamic-certified Verdejo grapes in La Mancha, Spain. The wine gets its amber color from 5-7 days of skin contact during fermentation in clay amphorae and French oak vats, followed by 2-5 months of aging on lees. It features complex aromas of orange blossom, vanilla pastries, and herbs, with a dry, fresh palate and notes of orange blossom and sourdough bread.

-

In October 2023, Los Vascos, owned by Domaines Barons de Rothschild (Lafite), launched its first organic wine range in Asia. The debut includes two organic wines: a Cabernet Sauvignon and a Sauvignon Blanc, both certified organic and produced at the Los Vascos estate in Chile’s Colchagua Valley. This move reflects the growing demand for organic and sustainable wines in the Asian market. The new organic range highlights Los Vascos’ commitment to sustainability and environmentally friendly viticulture, aligning with global trends toward organic wine consumption.

Organic Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.07 billion

Revenue forecast in 2030

USD 21.48 billion

Growth rate (Revenue)

CAGR of 10.4% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/ billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, distribution channel, region

Key companies profiled

Bronco Wine Company; Kendall-Jackson Winery; King Estate Winery; Boisset Collection - JCB (Jean-Charles Boisset); Emiliana Organic Vineyards; Societa Agricola Querciabella SpA; Grgich Hills Estate; Avondale; Frey Vineyards; The Organic Wine Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Wine Market Report Segmentation

This report forecasts revenue growth at the global, regional and country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the organic wine market report on the basis of type, packaging, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic Red Wine

-

Organic White Wine

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic wine market size was estimated at USD 11.87 billion in 2024 and is expected to reach USD 13.07 billion in 2025.

b. The global organic wine market is expected to grow at a compounded growth rate of 10.4% from 2024 to 2030 to reach USD 21.48 billion by 2030.

b. In 2024, the organic wine market in Europe captured a revenue share of 77.5%. European wine-producing regions, such as France, Italy, Spain, and Germany, have been at the forefront of the organic wine movement. These countries boast centuries-old vineyards and a deep-rooted culture of winemaking, making them ideal environments for organic viticulture. Many wineries in these regions have transitioned to organic farming practices, focusing on soil health, biodiversity, and the preservation of traditional grape varieties.

b. Some key players operating in the organic wine market include Avondale, Elgin Ridge Wines, Kendall-Jackon Winery, The Organic Wine Company, Bronco Wine Company, King Estate Winery, Grgich Hills Estate, Emiliana Organic Vineyards, Societa Agricola Querciabella SpA, Frey Vineyards

b. Consumers are becoming more mindful of what they consume, seeking products that align with their health and wellness goals. In the context of the organic wine market, this health-conscious mindset is a key driver for the rising demand. Organic wines are perceived as a healthier alternative due to the specific cultivation practices involved in their production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.