- Home

- »

- Beauty & Personal Care

- »

-

Organic Soap Market Size, Share And Trends Report, 2030GVR Report cover

![Organic Soap Market Size, Share & Trends Report]()

Organic Soap Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Bar, Liquid), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-455-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Soap Market Summary

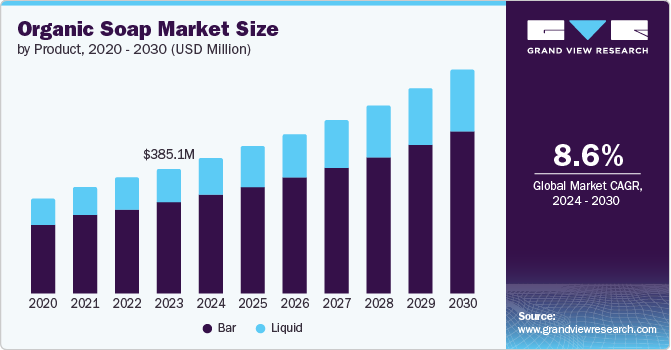

The global organic soap market size was valued at USD 385.1 million in 2023 and is projected to reach USD 686.1 million by 2030, growing at a CAGR of 8.6% from 2024 to 2030. Market growth worldwide can be attributed to the rising awareness about health, increasing demand for eco-friendly and sustainable products, and increase in the distribution channels.

Key Market Trends & Insights

- North America organic soap market dominated the global industry with a share of 32.9% in 2023.

- The U.S. organic soap market held a significant share of the North America in 2023.

- By product, the bars segment dominated the market with a revenue share of 73.0% in 2023.

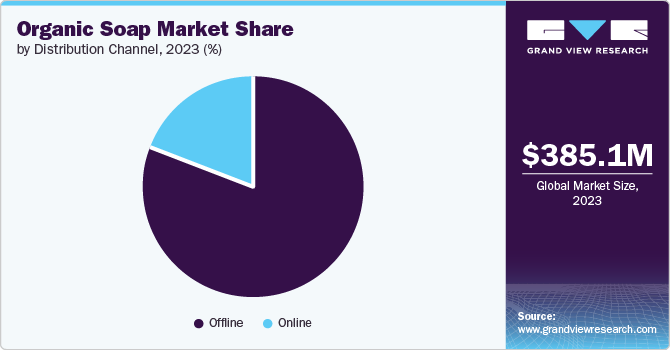

- By distribution channel, the offline distribution segment dominated the market with a share of 80.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 385.1 Million

- 2030 Projected Market Size: USD 686.1 Million

- CAGR (2024-2030): 8.6%

- North America: Largest market in 2023

In addition, influenced by social media and digital marketing as influencers promoting organic products such as skincare on social media driving the market growth. The industry is driven forward by a growing trend towards health and wellness, as consumers become increasingly conscious about the ingredients in their personal care products. Consequently, they are opting for natural and organic soaps that are free from harmful chemicals, parabens, and aluminum. This shift is fueled by the awareness of the potential health issues caused by these chemicals, such as skin rashes, skin allergies, and dry and dull skin. Organic soaps, on the other hand, contain plant extracts and oils that do not have negative implications on the skin.

The demand for natural fragrances is another key driver of the market, with consumers attracted to a wide range of natural fragrances extracted from plants such as citrus fruits, lavender, rosemary, and mint. The shift towards sustainability is also driving growth, as consumers prefer eco-friendly, vegan, and sustainable soaps made from plant-based sources and natural oils. The availability of organic soaps across multiple distribution channels, including online and offline platforms, has also contributed to market expansion.

Government policies supporting organic products, increasing disposable income, and the rise of e-commerce have all contributed to the growth of the organic soaps market. As consumers become more health-conscious and environmentally aware, they are seeking out products that align with their values of purity, authenticity, and sustainability. The recognition of organic products as a key aspect of well-being has propelled the demand for organic soap products. With an emphasis on holistic well-being and herbal remedies, consumers are driving the demand for personal care products that meet these values.

Product Insights

The bars segment dominated the organic soap market with a revenue share of 73.0% in 2023. This can be attributed to its cost-effectiveness, eco-friendly packaging, and long-term durability. Enhanced by natural ingredients such as shea butter, coconut oil, and essential oils, it provides effective cleansing and moisturizing benefits. Consumers prefer bar soaps due to traditional appeal, tactile experience, and reduced environmental impact compared to liquid soaps.

The liquid organic segment is expected to register the fastest growth of CAGR 8.9% in the forecast period. Liquid organic soaps cater to consumers seeking a mess-free washing experience. These formulas incorporate glycerin and natural oils to moisturize and nourish the skin. Widely used in homes, offices, and public spaces via pump bottles or dispensers, liquid organic soaps have gained popularity due to urbanization, flexible lifestyles, and increased awareness of skin health among consumers.

Distribution Channel Insights

The offline distribution segment dominated the organic soap market with a revenue share of 80.5% in 2023. The physical experience of interacting with products and the trust and credibility associated with offline shopping are key factors driving market growth. Consumers can purchase products immediately, without waiting for delivery or shipping, and browse a range of brands under one roof, enhancing their overall shopping experience and contributing to the continued dominance of offline distribution channels.

The online distribution segment is expected to register the fastest growth with a CAGR of 9.0% in the forecast period. E-commerce platforms allow consumers to browse and purchase organic soaps from the comfort of their own homes, with products delivered directly to their doorstep. Global market expansion is facilitated by e-commerce, enabling consumers to access products from diverse regions. As internet usage increases and customers shift towards online shopping, major players are developing e-commerce websites, driving growth in this segment.

Regional Insights

North America organic soap market dominated the global organic soap market with a revenue share of 32.9% in 2023. The dominance of the region can be attributed to factors such as consumer awareness, presence of established brands, regulatory frameworks, and reachable distribution channels. The region’s emphasis on organic elements, sustainability practices, and product efficiency resonates nicely with evolving consumer alternatives for organic products.

U.S. Organic Soap Market Trends

The U.S. organic soap market held a significant share of the North America organic soap market in 2023, driven by the country’s established market, ongoing innovations, and government and influencer advocacy. Strong consumer demand for organic products in the U.S. has fueled market growth, solidifying its position as a key player in the regional market.

Europe Organic Soap Market Trends

Europe organic soap market is expected to register the fastest CAGR of 9.2% over the forecast period. European consumers, particularly in Germany, France, and the UK, are increasingly opting for natural soaps due to concerns over the negative side effects of chemical products and a growing focus on environmental sustainability. Strict regional regulations on cosmetics further drive demand for organic soap products, providing a competitive advantage for companies catering to this market.

Germany organic soap market is poised for growth in the forecast period, driven by the country’s strong cultural emphasis on sustainability and eco-awareness. This alignment with the global trend towards natural and organic products will likely fuel demand for organic soaps, presenting opportunities for companies to capitalize on this growing market segment.

Organic soap market in UK is anticipated to experience significant growth over the forecast period, driven by heightened consumer awareness and a shift in preferences towards natural and organic products. Consequently, demand for organic soaps is expected to surge, driven by the perception that these products are safer and more beneficial for skin health, offering a lucrative opportunity for companies to capitalize on this trend.

Asia Pacific Organic Soap Market Trends

Asia Pacific organic soap market is anticipated to witness rapid growth in the global organic soap market. Rising disposable incomes, urbanization, and increased awareness of personal hygiene and well-being are driving demand for natural and organic personal care products, including organic soaps, in countries such as China, India, and Japan. E-commerce platforms are playing a crucial role in expanding the reach of organic soap manufacturers in the Asia Pacific region, presenting opportunities for growth.

China organic soap market is expected to grow rapidly in the coming years due to a rise in disposable income, an increase in the diversity of products, rise in the importing of products. Moreover, changing consumer preference towards high-quality, and eco-friendly organic soaps drives the market growth.

Organic soap market in India is held a substantial market share in 2023 owing to traditional use and preference for bath soaps amongst Indian consumers. Bath soaps have been a staple personal care product in Indian households for generations. In addition, with strong distribution channels from small shops to supermarkets consumers can easily get organic soaps.

Key Organic Soap Company Insights

Some key companies in the organic soap market include Sundial Brands LLC; Lush Retail Ltd.; Osmia; EO Products; Pangea; and others. Industry participants are leveraging extensive marketing campaigns and retail partnerships to expand their reach and customer base. Key players are enhancing global visibility through retail chain launches in developed countries including Germany, France, Italy, and the UK. Funding from investors is also supporting the expansion of organic product offerings, positioning companies for future growth opportunities.

-

Sundial Brands LLC specializes in shampoo, conditioner, and body wash products under the SheaMoisture brand. Acquired by Unilever in 2017, the company offers a range of products across hair care, bath, body, skin care, baby, and men’s categories, globally distributed and certified as a B Corporation for its sustainable development and eco-friendly practices.

-

Lush Retail Ltd. is renowned for its handmade, fresh, and ethically sourced products. With over 900 stores globally, Lush prioritizes sustainable packaging, ethical sourcing, and anti-animal testing. The company has received numerous awards for its products and business practices, solidifying its reputation as a leader in the industry.

Key Organic Soap Companies:

The following are the leading companies in the organic soap market. These companies collectively hold the largest market share and dictate industry trends.

- Sundial Brands LLC

- Lush Retail Ltd.

- Osmia

- EO Products

- Pangea

- Brittanie’s Thyme

- Davines S.p.A.

- Laverana Digital GmbH & Co. KG

- Truly’s Natural Products

- Beach Organics

Recent Developments

-

In June 2024, Lush launched Bath Bot, a water-resistant device that revolutionized the bathroom experience with synchronized lights and sounds. Conceived by Lush’s in-house tech team, Bath Bot is sustainable, vegan, and designed for reuse. The device was manufactured in the UK and is designed to enhance the bathing experience.

-

In September 2023, EO Naturals launched its premium range in India. The brand offers natural ingredients, essential oils, and eco-friendly packaging, prioritizing both skin care and environmental sustainability. EO Naturals prides itself on its quality, luxury, and commitment to community empowerment.

Organic Soap Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 417.1 million

Revenue forecast in 2030

USD 686.1 million

Growth Rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, New Zealand, Brazil, Argentina, South Arabia, South Africa

Key companies profiled

Sundial Brands LLC; Lush Retail Ltd.; Osmia; EO Products; Pangea; Brittanie’s Thyme; Davines S.p.A.; Laverana Digital GmbH & Co. KG; Truly’s Natural Products; Beach Organics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Soap Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic soap market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bar

-

Liquid

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.