- Home

- »

- Food Additives & Nutricosmetics

- »

-

Organic Personal Care Ingredients Market Size Report, 2030GVR Report cover

![Organic Personal Care Ingredients Market Size, Share & Trends Report]()

Organic Personal Care Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Product (Natural Surfactants, Emollients), By Application (Skin Care, Hair Care), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-496-03

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

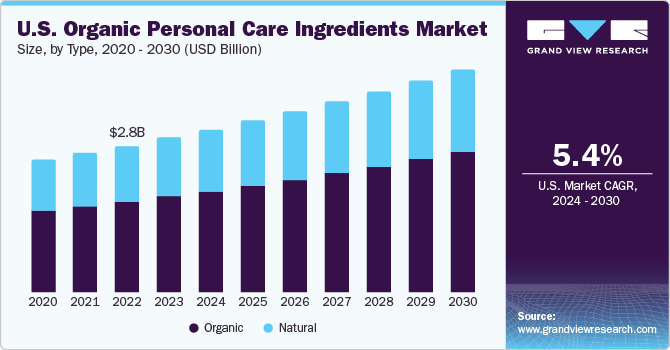

The global organic personal care ingredients market size was estimated at USD 9.95 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. This is attributed to the growing green consciousness among people and organizations. Organic products, including body, facial, body lotions, and sun care products, are manufactured from natural ingredients of plants extracted under eco-friendly conditions. These products do not contain synthetic chemicals such as parabens, phthalates, petrochemicals, and aluminum salts.

In recent years, the sales of organic products have increased significantly due to heightened consumer awareness of their potential positive impact on personal health and environmental sustainability. This trend is driven by a growing desire to reduce the use of harmful chemicals such as phthalates, aluminum salts, and parabens, as well as the efforts of many multinational corporations to prioritize sustainable products.

Changing consumer perceptions of organic products, along with increasing demand for environmentally sustainable options, has led to a rise in the popularity of natural products. Both organic substance suppliers and product manufacturers are dedicating more resources to the research and development of organic products, contributing to the growth of green chemistry and the overall green sector.

A study by EcoFocus found that 85% of consumers are categorized as “consumers who care,” meaning they consider the environmental impact of their purchasing decisions. Additionally, 33% of consumers prefer green personal care products over synthetic ones, and 48% prefer green toiletries. Another survey conducted by NSF International revealed that 87% of consumers fall into the “consumers who care” category, with 76% expressing a preference for independently certified and tested products.

Consumers are increasingly mindful of potential allergens in synthetic ingredients, and the production of organic or naturally derived products can help reduce pollution by efficiently utilizing natural resources. This can be achieved through improved plant growing methods and a focus on better manufacturing practices.

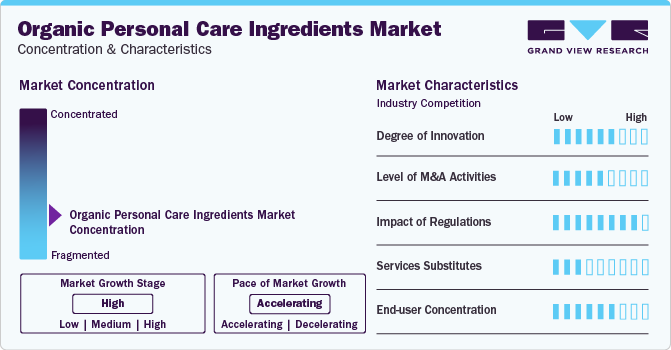

Market Concentration & Characteristics

Global organic personal care ingredients market is fragmented in nature, with key players such as Cargill, Incorporated; BASF SE; The Lubrizol Corporation; Croda International Plc; Huntsman International LLC.; Jarrow Formulas, Inc.; AEP Colloids; Grain Millers, Inc.; PRIDE SEEDS; and SG Ceresco Inc., dominating the industry. This fragmentation is driven by factors such as rising demand for organic or natural products. Advantages such as it avoids irritation; it is earth-friendly and has no strange side effects.

Growing consumer awareness about synthetic chemicals used in products and toiletries is expected to propel the market for organic materials over the forecast years. Changing consumer perception toward artificially manufactured chemicals will strengthen organic ingredients market in near future. However, animal-derived products have witnessed a downward trend owing to changing consumer attitude towards the production process of these substances. Organic products are formulated using ingredients that are obtained without using synthetic pesticides, petro-based fertilizers, and are non-GMO.

Consumers, particularly in the UK, the U.S., and Australia, prefer certified organic products that employ organically grown products as they are produced with no herbicides or pesticides, and do not contain any kind of artificial or synthetic colors, preservatives, or chemicals such as parabens and sulphates.

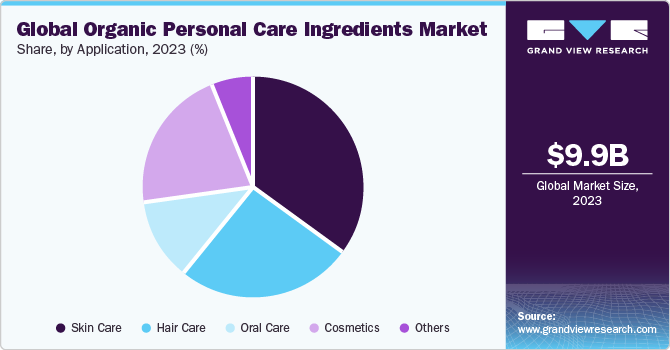

Applications Insights

The skin care segment held the largest revenue share in 2023 due to its rising demand. The segment encompasses a variety of natural products, including sunscreens, body lotions, and face creams, among others. The increasing concerns about products and the rising demand for anti-aging products among consumers are the primary drivers of the skin care products market. Growing awareness about the role of natural ingredients in providing UV protection is anticipated to drive the demand for ingredients used in natural skin care products in the foreseeable future.

The increase in demand for organic oral care products is due to the growing awareness of maintaining oral hygiene and fresh breath. Recent advancements in the field have led to the introduction of innovative oral care products that cater to multiple hygiene needs. The global demand is expected to be driven by heightened awareness, consistent use of oral products, and the availability of new and appealing products. The introduction of natural and effective products such as flosses and mouthwashes is projected to further boost the demand for natural oral care products in the forecast period.

The hair care product segment includes a wide range of products such as shampoos, conditioners, and oils. Evolving hair styling trends in the fashion industry and the increasing number of individuals concerned about grey hair and hair fall are major drivers in the hair care products market. Additionally, the growing prevalence of hair damage and hair fall due to rising pollution and stress is expected to further drive the demand for natural hair care products. With an increasing population of youth and middle-aged individuals experiencing hair-related issues like discoloration, thinning, and dandruff, the demand for natural hair care products is forecasted to experience significant growth in the coming years.

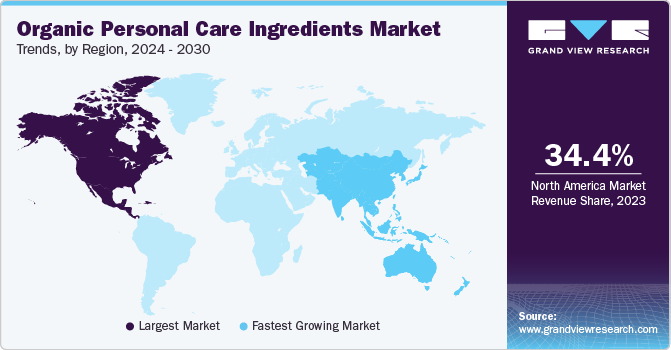

Regional Insights

North America dominated the market and accounted for a 34.4% revenue share in 2023. This high share is attributable to the presence of various small- and large-scale producers and suppliers of the ingredients that characterize the North American organic personal care ingredients market. Huntsman Corporation; Dow Chemical Company; and Stepan Company along with various other small and medium-scale companies are players operating in the market.

Asia Pacific is anticipated to witness significant growth in the product ingredients market. The Asia Pacific region is poised for substantial growth in the market for personal care ingredients. The rising consumer adoption of moisturizing and nourishment creams in Asia Pacific is projected to drive the demand for natural skin care products in the coming years. Market players have been focusing on the production of natural skin care products incorporating authentic plant extracts, indicating a growing trend in the industry.

The presence of a robust product-manufacturing base in the UK, France, and Germany is expected to be favorable for market growth. The European Commission has established the Horizon 2021 Strategy with the prime intention of promoting the consumption and production of natural ingredients in the chemical, personal care, automotive, and energy sectors.

Type Insights

The organic segment held a major revenue share of 61.8% in 2023. This is attributable to the shift in consumer demand towards environment-friendly green products over the past few years. To meet the changing demands of consumers in the product sector and comply with regulatory standards, manufacturers have implemented new and enhanced technologies. The increasing popularity of multi-functional products in recent years can be attributed to their various benefits, and this pattern of consumer demand is expected to persist in the coming years. Nevertheless, stringent regulatory frameworks in different regions may pose challenges to investments in this industry.

The NSF/ANSI sets forth marketing and labeling guidelines for personal care products containing natural ingredients. This standard permits the “contains organic ingredients” label for products with 70% or more natural content, provided they meet all other standard requirements. Furthermore, compliance with NSF/ANSI 305 necessitates companies to accurately disclose the percentage of natural content under the standard's specifications.

Natural products are made with substances sourced from nature and devoid of synthetic chemicals such as parabens, sodium lauryl and laureth sulfates, phthalates, synthetic dyes, and synthetic colors. These products encompass mineral, animal, or plant derivatives directly obtained from agricultural production, harvesting, farming, and mining, and are transformed. In cases where natural alternatives are unavailable, natural ingredients may be combined with synthetic ones. Synthetic ingredients are utilized as substitutes for natural ingredients when the safety and effectiveness of natural products are unsatisfactory based on requirements, and the procurement and manufacturing costs are prohibitively high.

Product Insights

Sugar polymer products dominated the market in 2023. This high percentage can be attributed to sugar polymers being widely used in the manufacturing of organic products. The widespread use of sugar polymers is a direct result of their significant role in the manufacture of luxury brand skin care products, such as Lancome, Dior, Clarins, Guerlain, Clinique, Shiseido, and Estee Lauder, which have experienced escalating demand in emerging markets like India, China, and Brazil. This surge in demand can be attributed to the increasing affluence of consumers in Brazil, Mexico, Australia, Japan, New Zealand, and certain regions of China, leading to a greater propensity to invest in products that enhance one’s appearance.

Active ingredients play a crucial role in skin care products by facilitating skin absorption and combating acne. These ingredients are integral components of various skin care products, including natural alternatives, and their potency varies based on the product type, whether over-the-counter or prescription-based. The selection of active ingredients is contingent upon the specific functions of the end products. For example, acne-fighting ingredients like salicylic acid or benzoyl peroxide are commonly used, while natural anti-aging products may feature antioxidants, such as vitamins C and E, as well as alpha hydroxy acids, to diminish fine lines and wrinkles. Furthermore, specific deep moisturizers may contain dimethicone and petrolatum to enhance skin hydration by trapping moisture.

Surfactants are blended with water, oils, or other liquids to reduce surface tension and facilitate foaming, wetting, emulsification, and spreading of the product. Through the process of adsorption, surfactants modify the properties of the final product by forming a condensed layer and creating a film. Natural surfactants are extensively utilized in the production of natural cosmetics and skin care products due to their diverse properties, such as cleansing, emulsification, solubilization, conditioning, and special effects. The formation of foam, which involves trapping air in liquids, is maintained by the alignment of surfactant molecules. While cleansing cosmetics are designed to eliminate oils, other cosmetic products focus on moisturizing the skin and hair. However, these substances are typically not directly applied in concentrated forms due to their undesirable aesthetic characteristics, leading cosmetic chemists to create emulsions using surfactants.

Key Companies & Market Share Insights

Some key players operating in the market include Cargill, Incorporated; BASF SE; CLARIANT; and Huntsman International LLC.

-

Cargill Beauty, the personal care division of Cargill, provides a wide range of naturally derived ingredients, an integrated and sustainable supply chain, advanced research and application services, and extensive opportunities to facilitate the sustainable development of personal care brands.

-

CLARIANT’s personal care sub-segment operates under the industrial & consumer specialties segment and manufactures active ingredients, emulsifiers & solubilizers, rheology modifiers, surfactants, UB filters, preservatives, pearlizers, and hair conditioning agents. These ingredients are used in skin care, hair, care, oral care, and cosmetic applications.

Some emerging participants in the organic personal care ingredients market are the Lubrizol Corporation, Agrana Beteiligungs-AG, Solabia Group, and Lucas Meyer Cosmetics.

-

Lubrizol Life Science Beauty collaborates with clients to create, produce, and promote a diverse array of distinctive ingredients and formulations for skin care, hair care, and skin cleansing.

-

Lucas Meyer Cosmetics is operating as a subsidiary of International Flavors & Fragrances (IFF), Inc. The company provides premium, distinctive cosmetic active and functional ingredients designed to augment the skin’s inherent natural resilience and beauty.

Key Organic Personal Care Ingredients Companies:

- BASF SE

- AkzoNobel

- CLARIANT

- Evonik Industries

- Agrana Beteiligungs-AG

- Cargill, Inc.

- Croda International plc

- Galaxy Surfactants Ltd.

- GatteFosse SAS

- The Lubrizol Corporation

- Ashland, Inc.

- Silab

- Solvay

- Symrise AG

- Vivimed Labs Ltd

- Rita McQueen Products

- Alban Muller International SAS

- Lucas Meyer Cosmetics

Recent Developments

-

In August 2023, Croda International Plc (‘Croda’) announced the acquisition of Solus Biotech, of biotechnology-derived active ingredients for beauty care.

-

In July 2023, BASF SE Personal Care is launching an updated iteration of its active ingredient Laricyl, which incorporates a sustainable sourcing of the raw material.

-

In October 2023, Clariant, a specialty chemical publicly disclosed its acquisition agreement with Lucas Meyer Cosmetics, a supplier of high-value ingredients for the cosmetics and personal care sector, from International Flavors & Fragrances.

Organic Personal Care Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.51 billion

Revenue forecast in 2030

USD 15.18 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; Canada; Japan; China; India; Brazil

Key companies profiled

Cargill, Incorporated; BASF SE; The Lubrizol Corporation; Croda International Plc; Huntsman International LLC.; Jarrow Formulas, Inc.; AEP Colloids; Grain Millers, Inc.; PRIDE SEEDS; and SG Ceresco Inc; Jedwards International, Inc.; Solvay Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Personal Care Ingredients Market Report Segmentation

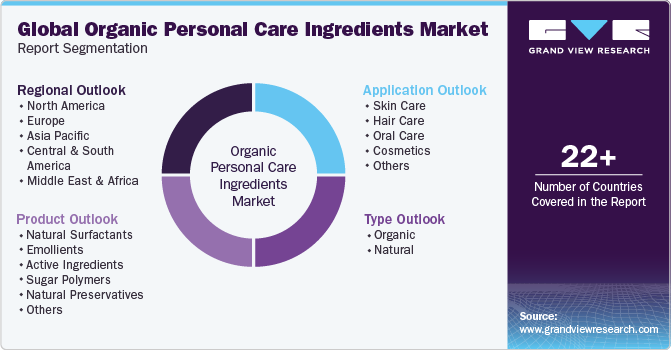

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic personal care ingredients market report based on type, product, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Natural

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural Surfactants

-

Emollients

-

Active Ingredients

-

Sugar Polymers

-

Natural Preservatives

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

Oral Care

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global organic personal care ingredients market size was estimated at USD 9.95 billion in 2023 and is expected to reach USD 10.51 billion in 2024.

b. The global organic personal care ingredients market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 15.18 billion by 2030.

b. North America dominated the organic personal care ingredients market with a share of 34.40% in 2023. This is attributable to promote the incorporation of natural components in products, favoring market growth over the forecast period in the region.

b. Some key players operating in the organic personal care ingredients market include AkzoNobel N.V.; Cargill, Inc.; BASF SE; The Lubrizol Corporation; Croda International Plc; Huntsman International LLC.; Ingredion Incorporated; Clariant International Ltd.; and Evonik Industries.

b. Key factors that are driving the market growth include increasing inclination toward natural and user-friendly ingredients based products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.