- Home

- »

- Consumer F&B

- »

-

Organic Fruits And Vegetables Market Size Report, 2030GVR Report cover

![Organic Fruits And Vegetables Market Size, Share & Trends Report]()

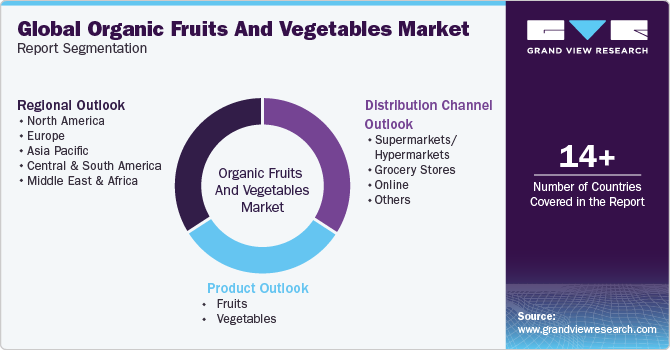

Organic Fruits And Vegetables Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fruits, Vegetables), By Distribution Channel (Supermarkets/Hypermarkets, Grocery Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-262-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Fruits And Vegetables Market Summary

The global organic fruits and vegetables market size was estimated at USD 76.19 billion in 2023 and is anticipated to reach USD 147.31 billion by 2030, growing at a CAGR of 9.9% from 2024 to 2030. The market is mainly driven by increasing consumer awareness regarding the benefits of organic products, concerns over food safety, environmental sustainability, and a growing inclination towards healthy lifestyles.

Key Market Trends & Insights

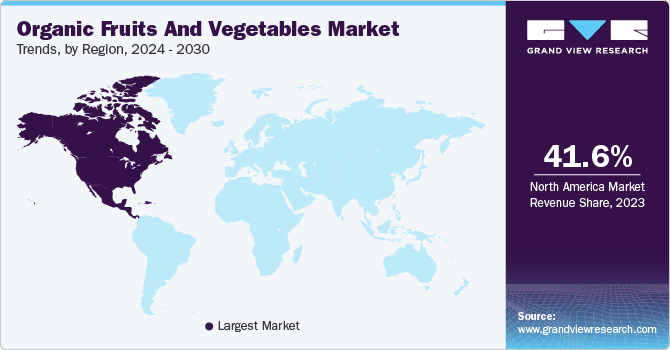

- The North America organic fruits and vegetables market accounted for a share of 41.6% of the global revenue in 2023.

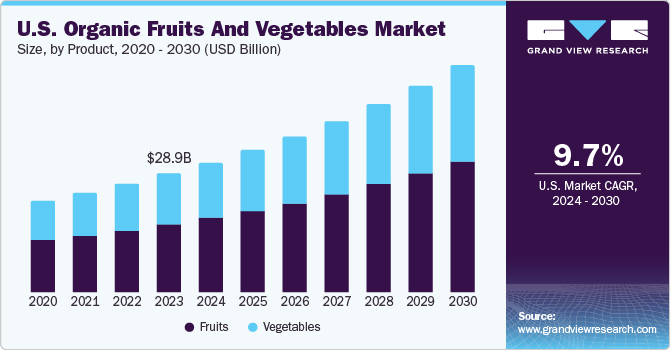

- The organic fruits and vegetables market in the U.S. is projected to grow at a CAGR of 9.7% from 2024 to 2030.

- By product, the organic fruits accounted for a share of 57.0% of the global revenue in 2023.

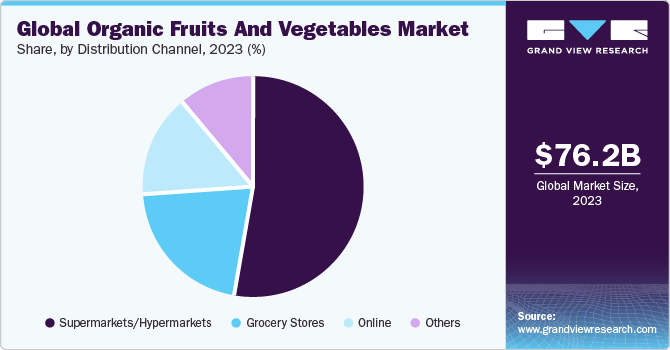

- By distribution channel, the sales through supermarkets and hypermarkets accounted for a share of 52.5% of global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 76.19 Billion

- 2030 Projected Market Size: USD 147.31 Billion

- CAGR (2024-2030): 9.9%

- North America: Largest market in 2023

For instance, according to the FIBL (Forschungsinstitut für biologischen Landbau) survey report, total organic food retail sales accounted for around USD 146 billion (135 euro billion) in 2022. The growing awareness of the potential health risks associated with conventional produce has led to a shift towards organic alternatives. Furthermore, consumers are increasingly seeking out organic produce due to its perceived higher nutritional value and the absence of harmful chemical residues. The rise in demand for organic berries such as blueberries and strawberries is a testament to consumers' health-conscious choices. Research has shown that organic berries have higher levels of antioxidants and phytonutrients compared to their conventionally grown counterparts, driving consumer preference for these organic options.

Environmental sustainability has emerged as a significant driver in the organic fruits and vegetables industry. Consumers are increasingly drawn to organic produce due to its environmentally friendly production practices, including the avoidance of synthetic pesticides and the promotion of soil health. Consumers are exhibiting a greater propensity to support sustainable agricultural practices. This trend is reflected in the increasing demand for organic fruits and vegetables as consumers seek to minimize their environmental impact and support farming methods that prioritize soil health and biodiversity.

The trend of organic fresh fruits and vegetables in the U.S. has been on the rise as more consumers become aware of the benefits of organic produce. According to the Organic Trade Association, sales of fresh organic produce in the U.S. rose by nearly 11% in 2020 to reach USD 18.2 billion. To maintain this trend and attract more customers, a rising number of manufacturers have been growing organic produce. The organic Peruvian table grape winter program was launched by California-based organic produce importer Awe Sum Organics in November 2022. Beginning in early December when the California grape season comes to an end and running through early April, the program aims to cover the winter organic table grape gap.

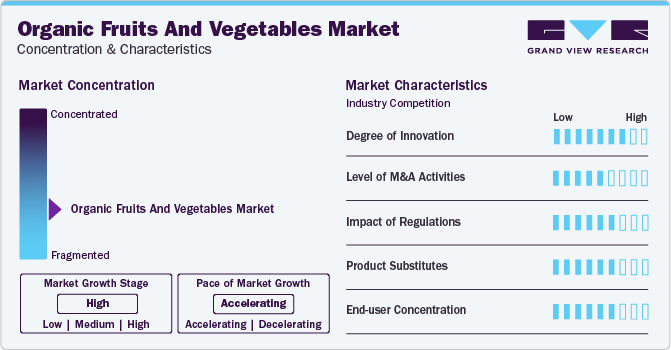

Market Concentration & Characteristics

Players in the market are actively engaged in various initiatives to meet evolving consumer demands and market trends. The degree of innovation in the organic fruits and vegetable industry has shown remarkable strides, encompassing various facets such as sustainable farming practices, technological advancements in production and distribution, and the development of novel organic product lines. Innovative farming techniques, including precision agriculture, vertical farming, and regenerative agriculture, have been instrumental in enhancing yield optimization, reducing environmental impact, and advancing soil health.

The market has witnessed a substantial level of merger and acquisition activities, driven by the demand for market consolidation and strategic expansion. An illustrative example of this trend is the acquisition of Earthbound Farm, a prominent organic salad producer, by WhiteWave Foods, a leading organic food company. This acquisition not only enabled WhiteWave Foods to broaden its organic product portfolio but also facilitated its access to Earthbound Farm's well-established distribution network.

Regulations play a significant role in shaping the market by establishing standards, ensuring compliance, and fostering consumer trust. Stringent regulatory frameworks such as the USDA Organic Certification in the United States, the European Union Organic Regulation, and other regional certifications mandate adherence to organic farming practices, prohibiting the use of synthetic pesticides, GMOs, and chemical fertilizers. These regulations not only provide clarity on what constitutes organic produce but also instill confidence among consumers regarding the authenticity and integrity of organic products.

Potential product substitutes can include conventionally grown fruits and vegetables, as well as processed or preserved alternatives such as canned fruits and frozen vegetables. In addition, specialty produce items and exotic fruits that may not be available organically could serve as substitutes for certain organic products.

The end-user concentration is primarily driven by diverse consumer segments, each with varying preferences and demands. This concentration encompasses health-conscious individuals seeking organic produce for its perceived health benefits, environmentally conscious consumers prioritizing sustainable and ethical agricultural practices, and those with specific dietary requirements, such as vegans and vegetarians who favor plant-based organic options.

Product Insights

Organic fruits accounted for a share of 57.0% of the global revenue in 2023. The increasing consumer awareness regarding health benefits associated with organic fruits has been a significant driver for market growth. Consumers are increasingly opting for organic fruits due to their higher nutritional content, free from synthetic pesticides, and chemicals. The expansion of organic fruit offerings in major grocery chains, including organic berries and stone fruits, meets the increasing consumer demand for convenient access to organic produce.

The organic vegetables segment is projected to grow at a CAGR of 9.6% from 2024 to 2030. The organic sweet potatoes subsegment is experiencing substantial growth due to increased consumer interest in nutritious root vegetables with high levels of vitamins, minerals, and antioxidants. As more consumers prioritize health-conscious food choices, organic sweet potatoes are gaining popularity for their perceived health benefits and superior flavor compared to conventionally grown varieties. Organic exotic vegetables, such as purple cauliflower, purple sweet potatoes, and rainbow carrots, are gaining traction among health-conscious consumers seeking vibrant and nutritious alternatives to traditional produce.

Distribution Channel Insights

The sales through supermarkets and hypermarkets accounted for a share of 52.5% of global revenue in 2023. The major reasons attributed to consumers preferring to shop from hypermarkets and supermarkets are convenience, price, availability, and brand recognition. Hypermarkets and supermarkets often offer a one-stop shopping experience, where consumers can find a wide variety of products, including fruits and vegetables, in one place. Such establishments often have lower prices on fruits and vegetables compared to other retailers due to their immense purchasing power and economies of scale.

The sales of organic fruits and vegetables through online channels are projected to grow at the fastest CAGR of 11.3% from 2024 to 2030. Consumers are drawn to the convenience of purchasing organic fruits and vegetables online, benefiting from doorstep delivery and flexible shopping hours. This convenience factor is driving increased online sales of organic produce, such as pre-cut organic fruits, salad kits, and organic vegetable boxes. The availability of subscription-based services for organic fruits and vegetables encourages recurring purchases and promotes customer retention online. Consumers opting for weekly or monthly organic produce subscriptions are contributing to sustained online sales of staple organic fruits like apples, bananas, and oranges and common organic vegetables such as leafy greens and bell peppers.

Regional Insights

The North America organic fruits and vegetables market accounted for a share of 41.6% of the global revenue in 2023. With the rise in obesity rates in the U.S. and growing awareness of the benefits of a healthy diet, consumers have been steadily shifting toward fresh and organic foods and healthier options over the past ten years. Younger demographics tend to be drawn to trendy diets like raw food and paleo diets that emphasize the health advantages of fresh produce. Furthermore, elderly people are recommended to have good eating habits due to health issues. The demography of baby boomers who buy fresh produce is equally significant.

U.S. Organic Fruits And Vegetables Market Trends

The organic fruits and vegetables market in the U.S. is projected to grow at a CAGR of 9.7% from 2024 to 2030. The rising demand for organic food, including fruits and vegetables, in the country further creates a significant growth opportunity for market growth. According to the FiBL survey report, the U.S. accounted for the highest retail sales of organic food, around USD 63.6 billion (58.6 Euro Billion) in 2022. Consumers are increasingly valuing sustainable farming practices and are drawn to organic vegetables for their environmentally friendly production methods. For example, there is a rising preference for organic broccoli and carrots, emphasizing support for sustainable agriculture and ethical food production.

Key Organic Fruits And Vegetables Company Insights

The organic fruits and vegetables industry is characterized by a diverse mix of global players, regional producers, and specialized organic farming cooperatives. Major agricultural corporations such as Driscoll's, The Hain Celestial Group, SunOpta, and Dole Food Company maintain a significant market presence with extensive product portfolios encompassing both organic and conventional produce.

Key Organic Fruits And Vegetables Companies:

The following are the leading companies in the organic fruits and vegetables market. These companies collectively hold the largest market share and dictate industry trends.

- Amy's Kitchen

- The Hain Celestial Group

- General Mills Inc.

- Conagra Brands

- Danone S.A.

- Driscoll's, Inc.

- SunOpta, Inc.

- Del Monte Foods, Inc

- Organic Valley

- Dole Food Company, Inc.

Recent Developments

-

In January 2023, Dole Food Company, Inc. announced that some of its subsidiaries had agreed to sell Dole’s Fresh Vegetables Division to an affiliate of Fresh Express Incorporated, a wholly-owned subsidiary of Chiquita Holdings. The division comprises operations related to the processing and sale of whole produce like iceberg, romaine, leaf lettuces, cauliflower, broccoli, celery, asparagus, artichokes, green onions, sprouts, radishes, and cabbage, as well as salads

-

In December 2022, Del Monte Produce, Inc. launched the Del Monte Zero pineapple, its first carbon-neutral certified pineapple. The product is available in North American and selective European markets. It is a product line extension from the Del Monte Gold, HoneyGlow, and Del Monte pineapple varieties

Organic Fruits And Vegetables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 83.47 billion

Revenue Forecast in 2030

USD 147.31 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

Amy's Kitchen; The Hain Celestial Group; General Mills Inc.; Conagra Brands; Danone S.A.; Driscoll's, Inc.; SunOpta, Inc.; Del Monte Foods, Inc.; Organic Valley; Dole Food Company, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Fruits And Vegetables Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic fruits and vegetables market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits

-

Apple

-

Bananas

-

Watermelon

-

Grapes

-

Berries

-

Mangoes

-

Oranges

-

Pineapples

-

Others

-

-

Vegetables

-

Leafy Vegetables

-

Carrots

-

Potatoes

-

Tomato

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Grocery Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic fruits and vegetables market size was estimated at USD 76.19 billion in 2023 and is expected to reach USD 83.47 billion in 2024.

b. The global organic fruits and vegetables market is expected to grow at a compounded growth rate of 9.9% from 2024 to 2030 to reach USD 147.31 billion by 2030.

b. The organic fruits market accounted for a share of over 57.0% of the global revenues in 2023. The increasing consumer awareness of the health benefits associated with organic fruits has been a significant driver of market growth

b. Some key players operating in the organic fruits and vegetables market include Amy's Kitchen, The Hain Celestial Group, General Mills Inc., Conagra Brands, Danone S.A., Driscoll's, Inc., SunOpta, Inc.,, Del Monte Foods, Inc., Organic Valley, and Dole Food Company, Inc

b. Key factors that are driving the market growth include increasing consumer awareness regarding the benefits of organic products, concerns over food safety, environmental sustainability, and a growing inclination towards healthy lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.