- Home

- »

- Consumer F&B

- »

-

Organic Edible Nuts And Seeds Market Size Report, 2030GVR Report cover

![Organic Edible Nuts And Seeds Market Size, Share & Trends Report]()

Organic Edible Nuts And Seeds Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Nuts, Seeds), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-061-3

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

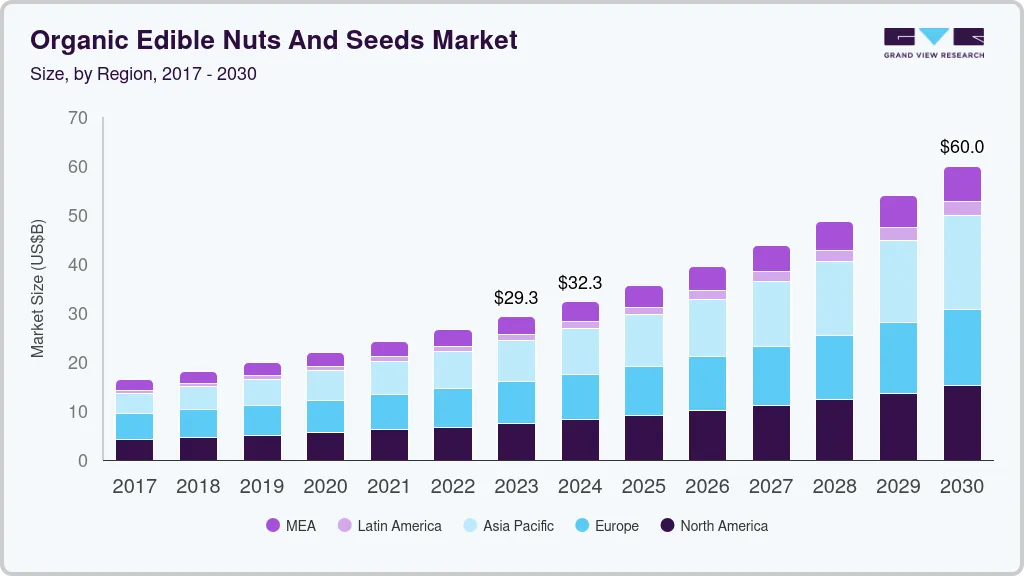

The global organic edible nuts and seeds market size was valued at USD 29.26 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.8% from 2024 to 2030. Rising awareness among consumers about the nutritional and health benefits associated with various types of organic nuts & seeds is boosting product demand. Seeds and nuts are great sources of fiber, fats, vitamins, carbs, proteins, iron, magnesium, phosphorous, essential oils, and antioxidants. Therefore, they are popularly consumed as a convenient and nutritious snack. Furthermore, rising health consciousness is anticipated to remain a primary driving factor over the forecast period. Increasing organic food demand is expected to drive the market over the forecast period. The awareness regarding the negative health impact of hazardous chemicals used in agriculture has grown tremendously over the last few years.

The American Experiences Survey of 2,224 U.S. adults conducted in April 2022 concluded that approximately 43% of the respondents prefer buying organic food and snacks. Additionally, environmental concerns regarding chemical utilization in conventional agriculture are aiding the growth of organic farming, which in turn, is projected to assist the market in the near future. The favorable regulatory framework is another major factor that is expected to support market growth over the next seven years.

Initiatives taken by governments and agencies related to agriculture are expected to play an important role in shaping the global industry over the forecast period. The brisk increase in demand over the recent past is a result of the growing awareness regarding the health benefits of organic nuts and seeds. Furthermore, with the increasing internet penetration, the online market for the purchase of such food products has seen rapid growth globally in the last few years.

These food products have several excellent characteristics such as high antioxidants and other nutritional values. These products are devoid of any exposure to chemicals such as fertilizers, pesticides, and insecticides, and are deemed healthier than their conventional counterparts. Organic nuts and seeds are cultivated in a certified organic environment, right from the sourcing of raw materials. The nuts are completely free from any artificial additives/ingredients and trace amounts of chemical fertilizers.

Product Insights

In terms of product, the almond dominated the global market with a share of 31.6% of total revenues in 2022. Increased consumption and production of almonds in key regions such as Europe and North America are likely to complement the overall segment growth. According to the U.S. Department of Agriculture (USDA), U.S. consumer demand for almonds has increased by over 500% since 1980. In 2021, U.S. people consumed an average of 2.46 pounds (1116 grams) of almonds each, an increase of about 35% from 2016. Such factors are likely to provide more opportunities for organic edible almond manufacturers.

The hazelnut is anticipated to register a CAGR of 12.3% from 2023 to 2030 in terms of revenue. Hazelnuts are very popular and one of the most cultivated and consumed nuts in the world. Furthermore, their easy availability through retail channels is driving the growth of the market.

Distribution Channel Insights

The B2B distribution channel is expected to hold a market share of 51.7% of the market in 2022. Aggressive investments by private equity and venture capital firms in B2B payments are creating new growth opportunities for key players in the market. For instance, in January 2022, Rupifi, an India-based B2B payment application provider, raised USD 25 million in a series-A round of funding, led by Tiger Global Management, LLC and Bessemer Venture Partners.

The B2C segment is expected to accelerate at a CAGR of 11.6% during the forecast period. The increasing share of mobile payments in the e-commerce industry is providing momentum to the abovementioned segment. According to a study conducted by SalesForce, in June 2022, mobile consumers account for 60% of the world’s total e-commerce traffic. Furthermore, the increasing adoption of digital wallets across the globe is expected to drive the B2C segment growth over the forecast period.

Regional Insights

The North America dominated the market with a share of over 51.7% in 2022. The growing inclusion of nuts and seeds in people’s diets across North America is expected to drive the market. Additionally, the growing trend to lower fat from one's diet is augmenting the consumption of organic nuts in North America. According to an article published in Deals on Health, in January 2022, organic food sales made up 5.8% of all U.S. food sales. Such data represents a positive outlook for the market in the years to come. Furthermore, production methods and safety aspects continue to influence purchase decisions. Hence, manufacturers remain on guard to label products to attract more consumers.

Asia Pacific is poised to register the fastest CAGR of about 12.4% during the forecast period. Growing concerns about the impact of conventional farming on biodiversity and the environment, as well as the ethical treatment of cattle, are among the key factors driving the shift toward organic foods. National Organic Program (NOP) in China ensures that organic food industry in the country abides by USDA standards and this is leading to an increase in market size and product scope. This has also led to increased prices and taxes on the same. However, the increasing willingness to pay more for premium organic products is likely to drive key manufacturers to launch new products in the market, thereby supporting market growth.

Key Companies & Market Share Insights

Companies in the market are implementing various expansion strategies such as mergers & acquisitions, capacity expansions, strengthening of online presence, and new product launches to gain a competitive advantage. For instance, in December 2020, Hippie Snacks, a brand of Left Coast Naturals, announced the expansion of its brand presence in the U.S. market by introducing new categories of better-for-you snacks.

-

In July 2022, Olam Food Ingredients (OFI), a part of Olam Group, developed its first public sustainability targets to support the plant-based revolution. The sustainability target aims to cover 50,000 acres of almond orchards and farming operations in the U.S. and Australia markets.

-

In May 2022, Cashew Coast collaborated with Aldi, a supermarket company, to support a sustainable cashew supply chain and empower farmers and female factory workers in the Ivory Coast. The collaboration is part of Aldi’s strategy to improve traceability and transparency in the nut supply chain. As a part of the collaboration, Aldi will be launching African Cashews Specialbuy across its stores in the U.K. with a QR code on the pack to help customers know about Cashew Coast’s journey.

Some prominent players in the global organic edible nuts and seeds market include:

-

Olam Group

-

ADM

-

JIVA ORGANICS

-

NUTSCO

-

Big Tree Organic Farms

-

Left Coast Naturals (Ike Enterprises Inc)

-

Bermar Fruits

-

U-RAAW!

-

Cashew Coast

-

BAUGHER RANCH ORGANICS

Organic Edible Nuts And Seeds Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.28 billion

Revenue forecast in 2030

USD 59.98 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billon, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Olam Group; ADM; JIVA ORGANICS; NUTSCO; Big Tree Organic Farms; Left Coast Naturals (Ike Enterprises Inc); Bermar Fruits; U-RAAW!; Cashew Coast; BAUGHER RANCH ORGANICS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Edible Nuts And Seeds Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global organic edible nuts and seeds market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Nuts

-

Almonds

-

Hazelnuts

-

Walnuts

-

Cashews

-

Others

-

-

Seeds

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Store

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic edible nuts and seeds market size was estimated at USD 26.59 billion in 2022 and is expected to reach USD 29.27 billion in 2023.

b. The global organic edible nuts and seeds market is expected to grow at a compound annual growth rate of 10.7% from 2023 to 2030 to reach USD 60.0 billion by 2030.

b. North America dominated the organic edible nuts and seeds market with a share of 51.7% in 2022. This is attributable to the growing penetration of nuts and seeds in the diets of people across North America. Additionally, the increasing obsession to lower fat from one's diet is augmenting the consumption of organic nuts in North America

b. Some key players operating in the organic edible nuts and seeds market include Olam Group, ADM, JIVA ORGANICS, NUTSCO, Big Tree Organic Farms, Left Coast Naturals (Ike Enterprises Inc), Bermar Fruits, U-RAAW!, Cashew Coast, BAUGHER RANCH ORGANICS

b. Key factors that are driving the organic edible nuts & seeds market growth include rising awareness among consumers pertaining to the nutritional and health benefits associated with various types of organic nuts and seeds is boosting product demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.